智氪丨歌尔微,能否帮歌尔股份摆脱代工印象?

Author | Fan Liang

Editor | Ding Mao

As early as the end of 2020, Goertek released an announcement to plan the spin-off and listing of Goertek Microelectronics.

After one year of preparation, at the end of 2021, Goertek Microelectronics officially submitted the prospectus to the ChiNext. After two rounds of inquiries, it was already 2023. Coincidentally, the IPO policy tightened, and Goertek Microelectronics had no choice but to withdraw the listing application in May 2024, announcing to switch to the Hong Kong Stock Exchange, and officially submitted the prospectus in January 2025 to start the Hong Kong IPO process.

After nearly 5 years, Goertek insists on listing Goertek Microelectronics. An important reason is that The company intends to eliminate the "OEM" impression in the capital market through Goertek Microelectronics and establish a more technology-innovative listed platform.

So, can Goertek Microelectronics truly achieve this?

Goertek's Sensor Business

The relationship between Goertek Microelectronics and Goertek can be simply understood as follows.

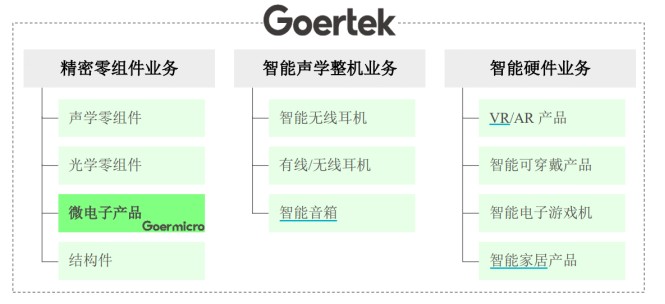

Goertek has three major businesses: precision components, intelligent acoustic whole machines, and intelligent hardware. Goertek Microelectronics is a business division of Goertek's precision component business that mainly manufactures microelectronic products (various sensors).

In 2023, Goertek's total revenue was 98.574 billion yuan, of which the revenue of the precision component business was 12.992 billion yuan, and the revenue of Goertek Microelectronics was 3.001 billion yuan. Judging only from the revenue volume, Goertek Microelectronics is only 1/30 of Goertek, with a strong technological attribute but not very prominent.

Figure: Goertek's Business Structure Source: Company Announcement, 36Kr Collation

Specifically for Goertek Microelectronics, its products mainly include MEMS sensors (acoustic, pressure, inertial, etc.), SIP packaging, and sensor interaction modules.

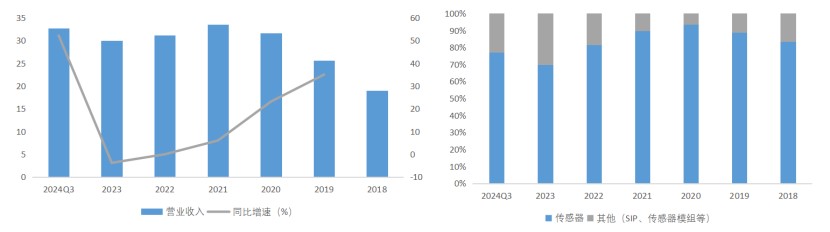

The company's prospectus shows that From 2021 to 2023, Goertek Microelectronics' operating income was in a slightly declining state, dropping from 3.348 billion yuan to 3.001 billion yuan, but the company re-entered the growth track in 2024, with operating income reaching 3.266 billion yuan in the first three quarters, an increase of 52.17% year-on-year. In terms of profit, from 2021 to the first three quarters of 2024, Goertek Microelectronics' net profits were 329 million yuan, 326 million yuan, 289 million yuan, and 243 million yuan, respectively.

By product, MEMS sensors account for the majority of the company's revenue, in 2021, Goertek Microelectronics' sensor business was approximately 2.999 billion yuan, accounting for approximately 90% of the total revenue; in 2023, the sensor business revenue was 2.092 billion yuan, accounting for 69.7%; in the first three quarters of 2024, Goertek Microelectronics' sensor revenue increased by 66.89% to 2.515 billion yuan, accounting for 77% of the total revenue.

Figure: Goertek Microelectronics' Revenue and Structural Changes Source: Wind, 36Kr Collation

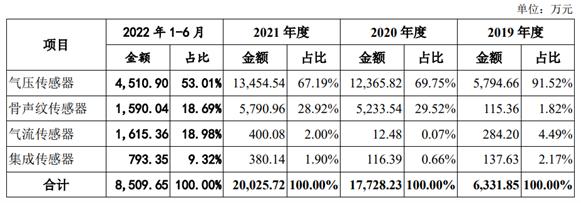

Among MEMS sensors, acoustic sensors are the main ones. In the latest prospectus, Goertek Microelectronics did not disclose the revenue composition of different types of sensors, but from the A-share prospectus of Goertek Microelectronics, it can be seen that the company's acoustic sensor business was 2.799 billion yuan in 2021, and other types of sensors (pressure, inertial) were 200 million yuan, so it is speculated that the company's current sensor revenue is still mainly derived from acoustic sensors.

Figure: Goertek Microelectronics' Other Types of Sensors Source: A-share Prospectus, 36Kr Collation

From the development status of Goertek Microelectronics' other types of sensors, its Hong Kong stock prospectus shows that in terms of shipment volume, Goertek Microelectronics has been the largest domestic pressure sensor (air pressure, altitude, blood pressure, water depth) supplier in 2023; in terms of inertial sensors, Goertek Microelectronics is the only company in Asia that applies bone acoustic sensors with more than 70db to high-end smart headphones and realizes commercialization. In addition, Goertek Microelectronics disclosed that the company has achieved mass production and delivery of ToF sensors in optical sensors since 2024.

In terms of customers, similar to Goertek, Goertek Microelectronics' major customer is still primarily Apple. In the first three quarters of 2022/2023/2024, Goertek Microelectronics' revenue from Apple accounted for 56.1%, 49.4%, and 61.8% of the total revenue, respectively. In terms of products, the products that Goertek Microelectronics sells to Apple mainly include sensors and SIP packaging.

Since MEMS sensors are mainly used in consumer electronic products such as mobile phones and headphones, and Goertek is the OEM of Apple Airpods, many investors may have doubts about The business flow relationship among Goertek Microelectronics' MEMS sensor manufacturing, Goertek's OEM, and Apple, here is a simple introduction.

Taking Goertek's OEM of Airpods containing its own MEMS sensors as an example, Apple will adopt the "buy and sell" model to first purchase MEMS sensors from Goertek Microelectronics, and then sell the MEMS sensors to Goertek for whole machine OEM. In this chain, Goertek Microelectronics' direct customer is Apple, and its sales revenue is the sales amount to Apple. When Apple sells MEMS sensors to Goertek, Goertek's purchase price is one of the operating costs of its OEM Airpods. Through this transaction setup, Goertek Microelectronics and Goertek can to a certain extent eliminate the interference of related party transactions.

However, related party transactions are still inevitable, for example, in the first three quarters of 2024, Goertek Microelectronics' second largest customer is Goertek, with a revenue accounting ratio of 7.8%, because Goertek also needs to purchase sensors for the production of other businesses.

In fact, in order to reduce related party transactions with Goertek, Goertek Microelectronics has made unremitting efforts for several years. In terms of the timeline, in 2019 and 2020, Goertek Microelectronics' products were mainly sold through Goertek, but after 2021, through Apple's "buy and sell" model, Goertek Microelectronics gradually changed to direct sales. Overall, the related party transactions between Goertek Microelectronics and Goertek have basically been clarified, and the impact on Goertek Microelectronics is relatively small.

Figure: Goertek Microelectronics' Latest Customer Structure Source: Hong Kong Stock Prospectus, 36Kr Collation

Where is the Technological Content?

As mentioned earlier, Goertek wants to establish a more technology-innovative listed platform through Goertek Microelectronics to eliminate the "OEM" impression in the capital market. So, how strong is the technological attribute of Goertek Microelectronics?

Taking the MEMS sensor with the highest revenue proportion as an example, according to the disclosure of Goertek Microelectronics, the MEMS sensor is composed of MEMS chip and ASIC chip packaging, and its working principle is: The MEMS chip converts the external physical, chemical, biological and other signals into electrical signals, and the ASIC chip reads the above electrical signals and processes and outputs them to realize the function of obtaining external information. Therefore, the barriers of the MEMS sensor at the hardware level are mainly reflected in material development, MEMS chip, ASIC chip and packaging technology, and at the software level, it is reflected in the algorithms related to signal processing integrated in the chip.

Currently, Goertek Microelectronics has the full-stack technical capability from material development, to MEMS chip and ASIC chip design, to algorithm software development, to MEMS sensor packaging. According to the disclosure of Goertek Microelectronics, in the first three quarters of 2024, the shipment volume of the company's sensors with self-developed chips was 447 million, accounting for 29.7% of the total shipment volume. And the A-share prospectus of Goertek Microelectronics discloses that in 2021, 2022, and the first half of 2023, the shipment volumes of various sensor products with self-developed chips of Goertek Microelectronics were 192 million, 157 million, and 149 million respectively, and the estimated proportion in the sensor business revenue was approximately 5%, 4%, and 7% respectively, and the estimated proportion in the sensor shipment volume was approximately 10%, 10%, and 20% respectively, The income proportion of self-developed chip sensors is much lower than the sales volume proportion.

However, on the whole, in Goertek Microelectronics' sensor products, The proportion of self-developed chips is in a continuous upward trend, which has also become the greatest reliance of Goertek Microelectronics' IPO.

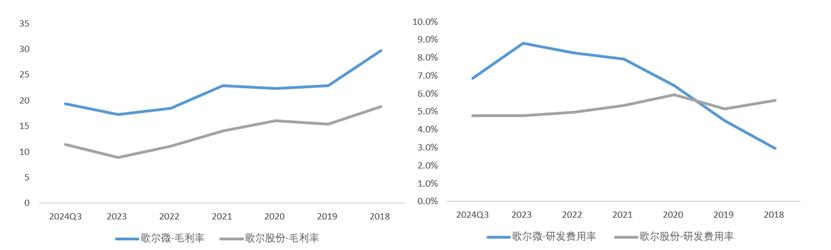

In addition, from the perspective of profitability, in the first three quarters of 2024 Goertek Microelectronics' comprehensive gross profit margin was 19.41%, higher than Goertek's gross profit margin of 11.44%. From the perspective of R & D, in the first three quarters of 2024 Goertek Microelectronics' R & D expense ratio was 6.9%, also higher than Goertek's R & D expense ratio of 4.8%. In terms of patents, as of the third quarter of 2024, Goertek Microelectronics had a total of 704 invention patents, while as of the end of 2023, Goertek had a total of 6,809 authorized invention patents.

It can be said that Goertek Microelectronics is an asset with strong profitability and high R & D investment within Goertek's territory. But if Goertek Microelectronics is compared in the semiconductor industry, it does not have a distinct advantage.

In 2022/2023/2024Q3, Goertek Microelectronics' gross profit margins were 18.5%, 17.23%, and 19.41%, respectively, and have been below 20% for a long time, although it is higher than the average gross profit margin of the Shenwan Consumer Electronics Index of 11.95% and the average gross profit margin of domestic manufacturing enterprises above designated size of about 15%, but it is lower than the average gross profit margin of the Shenwan Semiconductor Index of 26.53%.

Figure: Comparison of Goertek Microelectronics and Goertek's Gross Profit Margin and R & D Expense Ratio Source: Wind, 36Kr Collation

Why is the Gross Profit Margin Low?

It is not difficult to find from the above comparison of gross profit margins that Although Goertek Microelectronics' gross profit margin has exceeded that of ordinary manufacturing industries, it is still not in line with the high-tech impression it attempts to convey to the capital market. The reasons are mainly from the following two aspects.

First, Goertek Microelectronics' self-developed chips have not yet had a positive impact on the company's gross profit margin.

The Hong Kong stock prospectus of Goertek did not disclose the gross profit margin of sensors with self-developed chips, but according to the A-share prospectus, As of the first half of 2023, the overall gross profit margin of Goertek Microelectronics' self-developed chip sensors was lower than that of non-self-developed sensors.

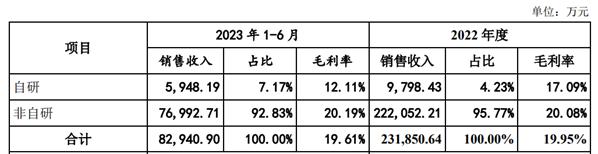

In the first half of 2023, The gross profit margin of Goertek Microelectronics' acoustic sensors with self-developed chips was only 12.11%, while that of non-self-developed chips was 20.19%; the gross profit margin of Goertek Microelectronics' other sensors (pressure, inertial) with self-developed chips was 27.16%, and that of non-self-developed chips was 20.56%. Although the gross profit margin of other sensors with self-developed chips is higher than that of non-self-developed chips, due to the low revenue proportion, the boosting effect on the company's gross profit margin is low.

Figure: Goertek Microelectronics' Acoustic Sensor Gross Profit Margin Source: Company Announcement, 36Kr Collation