A post - 1970s returnee doctor from Tsinghua University ushers in an IPO with a market value exceeding 10 billion yuan | Specialized and Sophisticated Express

Author | Zhou Qinbing

Editor | Peng Xiaoqiu

Recently, Hyperstrong (688411.SH) successfully listed on the Science and Technology Innovation Board. As of the close on February 21st, its stock price was reported at 63.90 yuan, with a total market value of 1.1357 billion yuan. It is also known as the "first stock in energy storage integration".

Hyperstrong was founded on November 4th, 2011, and its headquarters is located in Beijing. The company focuses on the R & D, production, and sales of electrochemical energy storage systems. It provides a full range of energy storage system products and one - stop overall solutions for energy storage systems to customers in the entire "source - grid - load" chain industries, such as traditional power generation, new energy power generation, smart grids, and end - power users. After years of development, it has become a national specialized, refined, distinctive, and innovative "little giant" enterprise.

From 2020 to 2023, the company's revenue grew rapidly, reaching 370 million yuan, 838 million yuan, 2.626 billion yuan, and 6.982 billion yuan respectively. The expected revenue in 2024 is 8.266 billion yuan to 8.701 billion yuan. Among them, the growth rate in 2022 was the most significant, with a year - on - year increase of 213.37% compared to 2021. The growth rate in 2023 remained strong, with a year - on - year increase of 165.89% compared to 2022. However, the growth in 2024 slowed down significantly, with an expected growth rate of 18.39% to 24.62%.

Meanwhile, the company's non - recurring profit after deduction also went through a process of turning losses into profits. From 2020 to 2023, the company's non - recurring profit after deduction was - 42 million yuan, - 6 million yuan, 127 million yuan, and 561 million yuan respectively.

From the perspective of the development process, Hyperstrong had a major transformation.

As early as 2017, the company was engaged in the new - energy vehicle leasing business. However, by 2019, the subsidy for new - energy vehicles was reduced by about 50%, and the company's main business was severely hit. The high vehicle purchase cost and operation and maintenance cost, combined with the large proportion of accounts receivable and slow capital return, posed huge challenges to the company's operation, and it was at a critical node of difficult transformation.

In 2020, due to high R & D expenses in the early stage of transformation and compressed market profits, the company was still in a loss state. It resolutely divested non - core businesses, sold most of its new - energy vehicle leasing business to the joint - venture company Dongfeng Hyperstrong, and instead focused on the energy storage system integration field. In 2021, the revenue proportion of the company's new - energy vehicle leasing business decreased from 27.83% to 10.34%, and further decreased to 2.43% in 2022.

In 2021, the energy storage industry received favorable policies from all parties, and the results of the company's transformation began to show. Safer batteries and real - time monitoring battery management systems (BMS) improved the safety and service life of the products; the energy conversion rate of over 95% and the rapid charging and discharging performance further enhanced the response speed and flexibility of the energy storage system. The product advantages became the main driving force for performance growth. In addition, the company actively laid out the overseas market, reached cooperation with international enterprises such as Schneider Electric, and initially built a sales network covering Europe, America, Australia, and the Middle East. This expansion also provided new impetus for revenue growth.

Compared with the previous year, the company's main business revenue increased by about 2.3 times, and the loss margin was also significantly narrowed. Among them, the revenue from the energy storage system business was 653 million yuan, accounting for 78.52% of the main business revenue, and it had become the core driving force for the company's business growth.

In 2022, the company's performance achieved a major breakthrough. The revenue soared to 2.626 billion yuan, and the non - recurring profit after deduction successfully turned from loss to profit, with a rapid upward trend. The revenue from the energy storage system business reached 2.456 billion yuan, accounting for 94.61%, further consolidating its dominant position in the company's business.

In 2023, Hyperstrong continued to maintain a strong growth trend. The revenue from the energy storage system business reached 6.927 billion yuan, accounting for as high as 99.30%, almost becoming the entire source of the company's revenue. At this stage, the company's market share in the energy storage system field continued to expand. In 2023, it became one of the world's top five energy storage system integrators and ranked second in the Asia - Pacific region.

In the first three quarters of 2024, the company achieved a revenue of 5.198 billion yuan, a year - on - year increase of 20.40%; the net profit attributable to the parent company was 313 million yuan, a year - on - year increase of 77.36%. The company expects to achieve an operating revenue of 8.266 billion yuan to 8.701 billion yuan in 2024, a year - on - year increase of 18.39% to 24.62%; it is expected to achieve a net profit of 614 million yuan to 647 million yuan, a year - on - year increase of 6.25% to 11.84%.

There are mainly three reasons for the significant slowdown in the performance growth rate in 2024.

The fierce competition in the energy storage system market has led to a decline in market prices

From 2022 to the first half of 2024, the year - on - year changes in the unit price of Hyperstrong's energy storage systems were 8.41%, - 4.31%, and - 27.03% respectively. However, the cost reduction was relatively small, resulting in a decline in the gross profit margin and affecting profit growth.

The impact of industrial chain fluctuations

Looking upstream, the company's procurement proportion from its largest supplier, CATL and its subsidiaries, decreased significantly, while the procurement amount from EVE Energy increased significantly. The uncertainty in the development and cooperation of new suppliers may affect raw material supply and cost control. Looking downstream, the company is highly dependent on large customers. From 2021 to the first half of 2024, the proportion of Hyperstrong's sales revenue from the top five customers to the current operating revenue was 78.16%, 83.70%, 74.37%, and 58.43% respectively. Although it decreased in 2024, the proportion was still relatively high. It is worth mentioning that the company's customers include the "Five Big and Six Small" power generation groups and the two major power grid groups, and the customer resources are of high quality.

The relatively high proportion of the company's accounts receivable but low collection ratio still restricts the company's development

In the first half of 2024, the net operating cash flow of Hyperstrong dropped significantly to a negative value. The funds may limit the company's business expansion and daily operations, affecting performance growth.

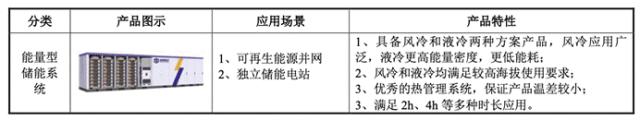

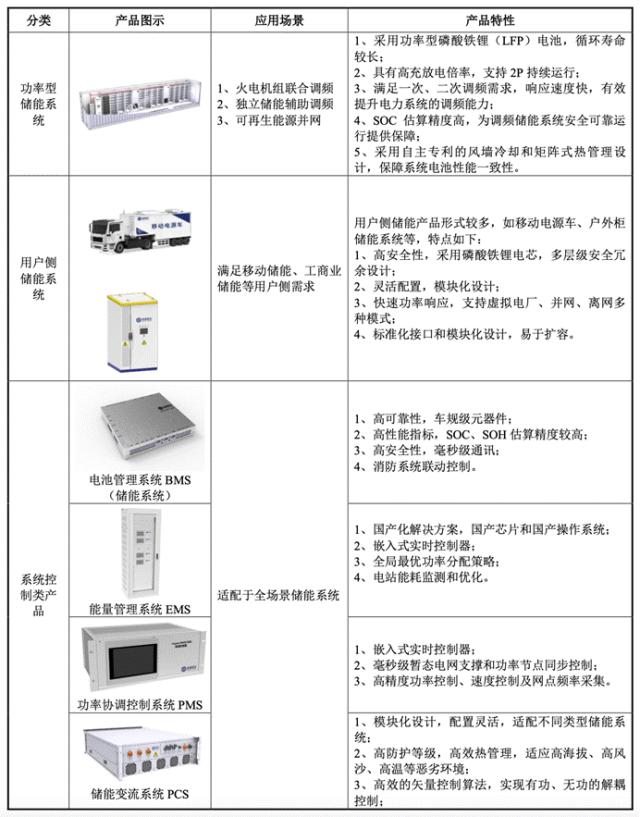

Specifically for the products, the company's energy storage system products include four categories, namely power - type, energy - type, user - side, and system control types, covering multiple application scenarios. On the power generation side, it can help new - energy power generation achieve smooth output, track the planned power generation curve, and improve power generation efficiency and stability; on the power grid side, it can participate in auxiliary services such as peak shaving, frequency regulation, and voltage regulation of the power grid, enhancing the stability and reliability of the power grid; on the user side, it can help users achieve arbitrage from peak - valley electricity price differences and improve power quality.

Image source: Prospectus

In the industry, Hyperstrong occupies an important position. According to the statistics of CNESA, Hyperstrong ranked first in the domestic market energy storage system shipment list in 2022 and 2021; it ranked second in the 2023 China energy storage system integrator shipment list.

The experience of the founder, Zhang Jianhui, is also full of highlights. Zhang Jianhui, from Shenyang, Liaoning, was born in 1978. He both studied in the Department of Electrical Engineering of Tsinghua University majoring in power system automation for his undergraduate and master's degrees. His master's research focused on high - power power electronics, covering the development from the system side to the power electronics equipment end. In 2001, Zhang Jianhui went to the University of California, Berkeley, in the United States to pursue a doctorate. His major changed from high - voltage electricity to microelectronics, that is, IC design (integrated circuit design). After graduation, he joined National Semiconductor. During this period, his team successfully developed two mass - produced chips. One was the control chip Solar Magic for panel - level power optimization of solar panels, and the other was the battery system chip. His profound academic background and rich experience laid a solid foundation for him to found Hyperstrong.

The company raised a total of 861 million yuan this time. After deducting the issuance fees, it was about 766 million yuan. It is mainly used for the annual production project of a 2GWh energy storage system, the R & D and industrialization project of the energy storage system, the digital intelligent laboratory project, and the marketing and after - sales service network project. The investment of the raised funds is expected to promote innovation in energy storage technology and accelerate industrial upgrading.