Institutional data: The pressure of buying a house continues to decline, and the house price-to-income ratio in second-tier cities has dropped by more than 10%.

According to the latest data on the price-to-income ratio of 100 cities released by Linping Residential Big Data Research Institute, the distribution of the price-to-income ratio in 100 cities across the country continued to "decline" in 2024. More than 70% of the cities had a ratio lower than 10, and only 5 cities maintained a high price-to-income ratio of above 20.

The five cities are: Shenzhen, Beijing, and Shanghai among the first-tier cities, as well as Sanya and Xiamen.

The average price-to-income ratio of these 100 cities in 2024 decreased by 9.7% year-on-year to 10.3. Among them, the second-tier cities had the largest decline, at 10.8%. The price-to-income ratio in first-tier cities is also accelerating its decline.

The price-to-income ratio refers to the ratio of the total housing price per household of urban residents to the annual total household income, which is generally used to measure the difficulty of buying a house.

It is generally believed that a ratio of around 7 in China can be considered a reasonable range.

Source: Linping Residential Big Data Research Institute

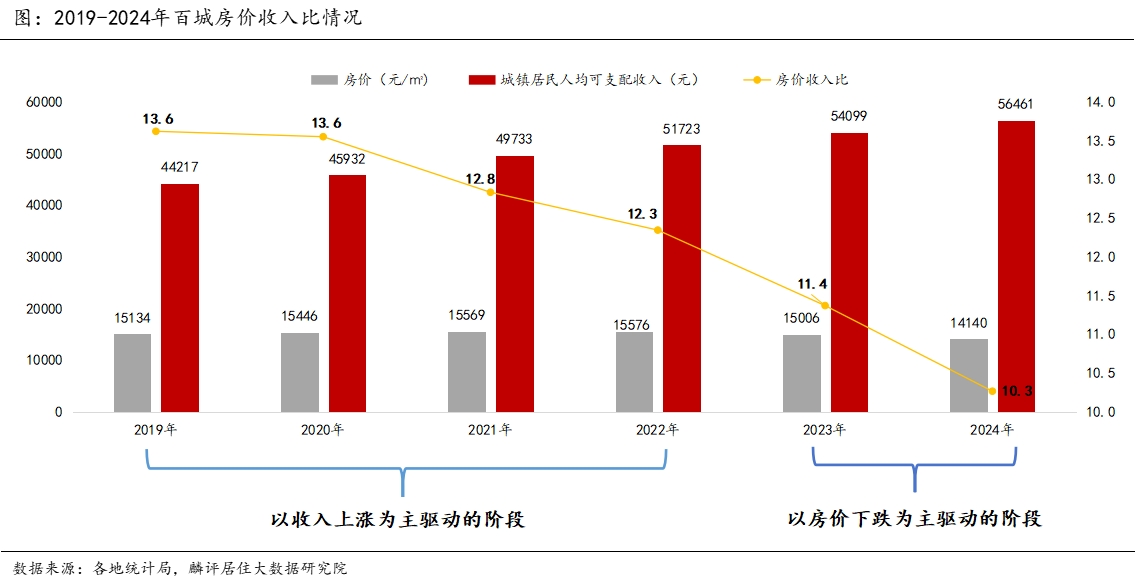

Linping Residential Big Data Research Institute analyzed that although the pressure to buy a house seems to be continuously decreasing on the surface, the reasons for the decline in the price-to-income ratio in the past two years are completely different from those before 2022. The decline in the past two years is due to the continuous decline in house prices rather than a significant increase in residents' income, while before 2022, the decline in the price-to-income ratio was due to the growth rate of residents' income being much higher than the increase in house prices. Although the pressure to buy a house has eased, it still exists.

Source: Linping Residential Big Data Research Institute

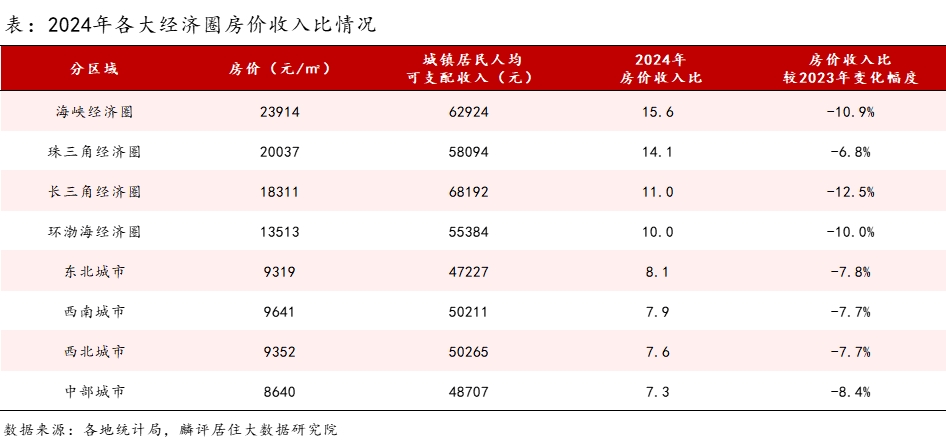

From a regional perspective, the Strait Economic Circle, the Pearl River Delta Economic Circle, and the Yangtze River Delta Economic Circle rank in the top three, with price-to-income ratios of 15.6, 14.1, and 11 respectively in 2024. These economic circles are regions with more active economic development in China, concentrating a large number of high-end industries and high-quality resources.

For example, the Yangtze River Delta Economic Circle covers core cities such as Shanghai, Hangzhou, and Nanjing, the Pearl River Delta Economic Circle has first-tier cities such as Shenzhen and Guangzhou, and the Strait Economic Circle is represented by key second-tier cities such as Xiamen and Fuzhou. The relatively strong demand for buying houses has pushed up the housing prices in these cities, while the steady growth of residents' income cannot quickly make up the gap, resulting in greater pressure to buy houses. The price-to-income ratios in cities in the Northeast, Southwest, and Northwest are between 7 and 8, and the pressure for residents to buy houses is relatively smaller than in other economic circles.

Source: Linping Residential Big Data Research Institute