Zhike | The DeepSeek transaction is booming. Can the AI concept still be chased at a high price?

Author | Huang Yida

Editor | Zheng Huaizhou

This week (February 3 - February 7), due to the Spring Festival factor, there were only three trading days for A-shares. The Shanghai Composite Index increased by 1.63% during the week and closed at 3304 points on February 7; the Wind All-A Index rose by 3.57% this week.

In terms of sectors, 28 of the 31 first-level industries in Shenwan rose this week, and 3 declined. Among them, the computer, media, automotive, mechanical equipment and other sectors led the gains, while the banking, building materials, and food and beverage sectors decreased this week.

From a style perspective, the STAR Market performed significantly better than value this week. Reflecting on the performance of style indices and broad-based indices, the Beijing Stock Exchange 50, STAR 200, STAR 100, Wind Innovation and Entrepreneurship 50 and other indices had the largest increases, while the Dividend Index, CSI Dividend, Shenzhen Dividend, CSI 300, CSI A50 and other indices had smaller gains or declines during the same period.

The Hong Kong stock market trading was not affected by the Spring Festival. The Hang Seng Index increased by 4.49% during the week; the Hang Seng TECH Index rose by 9.03% this week. In terms of sectors, among the 12 Hang Seng Industry Indices, 10 sectors rose and 2 declined. The information technology, non-essential consumer, raw materials, and healthcare sectors led the gains, while the utilities and conglomerates sectors decreased.

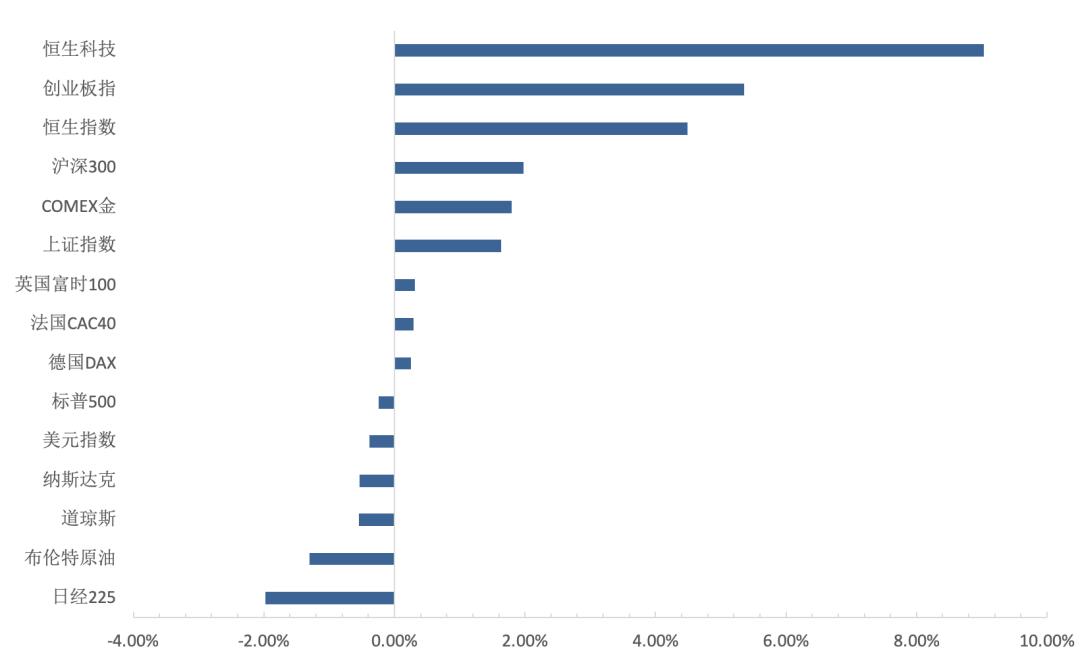

In terms of overseas major assets, the three major US stock indices all closed lower this week. The technology sector represented by the Nasdaq performed poorly. Most major European stock indices closed higher, and most major stock indices in the Asia-Pacific region except for the Nikkei closed higher. In terms of commodities, crude oil decreased significantly this week; most base metals closed higher; precious metals increased significantly this week; among agricultural products, except for cotton and sugar, most other varieties closed higher. The US Dollar Index decreased slightly overall this week.

Chart: Weekly changes in major global asset classes; Source: Wind, 36Kr

01 The Essence of DeepSeek Trading is the Return to Fundamentals

The A-share market rose positively after the Spring Festival, with AI being the core trading theme, followed closely by robots. The re-emergence of AI is mainly driven by DeepSeek, with related sectors experiencing active trading and a rapid market evolution. The CSI Artificial Intelligence Industry Index increased by 9.39% in just three trading days after the festival, reflecting the market's recognition of China's AI technology. Also affected by DeepSeek, the US stock technology sector adjusted during the same period. The market performance also reflects the expectation that the gap between the Chinese and US model ends is narrowing, which has led to a revaluation of related sectors in the US stock market.

Chart: Recent trends of the CSI Artificial Intelligence Industry Index; Source: Wind, 36Kr

From technological evolution to capital market investment decisions, this round of AI market is significantly different in driving factors from the previous ones. In the previous AI market, except for the part of concept speculation, the细分 sectors driven by fundamentals or policies were more biased towards hardware and infrastructure, typically such as chips, optical modules, computing power, and AI products. However, in the AI market after the Spring Festival, with DeepSeek trading as the core main line, investors are more concerned about the technological progress and performance realization at the application end. Thus, it can be seen that the investment logic of the AI concept has gradually evolved from a grand narrative to fundamental investment, and the proportion of fundamentals will continue to increase in the future.

The reasons why investors would give high premiums to related targets in the short term are as follows: On the one hand, after entering 2025, the AI sector experienced a short-term sharp decline, and the subsequent recovery was also weak, so it already had a certain elasticity in valuation; on the other hand, it is trading the breakthrough of AI technology. According to public information, DeepSeek's low-cost open-source model has reduced the training cost of AI by more than 10 times. Based on this, The combination of reducing training costs and improving training efficiency can offset the impact of insufficient computing power, which is the main reason for narrowing the technical gap between Chinese and US large models. It is not difficult to understand why the market has such a rapid response when a good expectation becomes a reality.

After a short-term surge, investors naturally concern about the cost-effectiveness. The concept index increased by about 10% in three trading days. Can it be chased after? To answer this question, it can be viewed from the dimension of risk management:

1. Even though the AI concept has risen sharply in the short term, the short-term increase is far less than the 924 market, and the position of the CSI Artificial Intelligence Industry Index has not exceeded the high point in November last year. More importantly, behind the hot DeepSeek trading is the switch of the driving logic, and fundamentals have begun to gradually dominate. Subsequently, individual stocks with performance support will be the focus of investors' attention;

2. From the perspective of style comparison, the short-term sharp rise of the AI concept has made the growth style proud, while the value style is relatively lonely. However, after comparing the valuation positions of the two, and looking at the cost-effectiveness, it can be seen that the growth and value are still relatively balanced, which means that growth still has space relative to value, which is conducive to the continuous fermentation of the subsequent market.

02 Investment Strategy

Following the previous question, based on the point of the AI concept, the mainstream market view believes that it can be chased, but the short-term surge combined with the current investors' uncertainty about the entire economic outlook, the thinking of taking profits will also greatly affect investor behavior. Therefore, even though the AI concept can be chased, it will not be a smooth process, and psychological preparations for short-term fluctuations and adjustments should be made. From a medium and long-term perspective, based on the current technical judgment of domestic AI application ends and related policy expectations, The AI sector has shown the potential to become a long-term trading main line in the A-share market.

From the perspective of medium and long-term investment opportunities, the AI boom triggered by DeepSeek indicates that computing power is no longer the biggest constraint for the development of AI. At the same time, China has a huge base of Internet users, the Chinese network also has a huge amount of text data, the payment system in the consumer field is convenient, and the logistics facilities are complete. The commercial realization of AI applications has huge potential. In the future, with the accelerated iteration of domestic large models and the accelerated development of AI application ends, it also contains a large number of investment opportunities for Chinese technology enterprises.

It has to be said that as an important carrier of AI applications, robots make the market of these two sectors highly correlated. The future technological development path of the two is roughly as follows: Technological breakthroughs drive breakthroughs at the application level, the demand for related software and hardware increases significantly, the penetration rate rapidly improves, and at the same time, immature business models begin to be acceleratedly eliminated. In this series of processes, through the establishment of a technological lead to a business model, it is very likely to produce a new leader. Therefore, paying attention to both technology and business models is the main idea for investing in the AI and robot sectors.

In the short term, the return of funds to the market after the Spring Festival, combined with the DeepSeek theme market, with only the current macro expectations, there is still a certain upward momentum in the A-share market. In the next stage, the focus is on the Two Sessions and related policy expectations; in terms of fundamentals, the first-quarter report should be paid attention to, and enterprises with the first improvement in supply and demand may have relatively clear investment opportunities. In terms of sectors, in addition to technology growth, consumption is also worthy of attention. With the continued promotion of national subsidies, the investment opportunities in sectors such as home appliances, automobiles, and e-commerce are promising.

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment requires caution. Under no circumstances does the information in this article or the opinions expressed constitute investment advice to anyone. Before making an investment decision, if necessary, investors must consult a professional and make a cautious decision. We do not intend to provide underwriting services or any services that require a specific qualification or license for trading parties.