Focus Analysis | Another Price War, Don't Underestimate Tesla

Written by | Han Yongchang Edited by | Zhang Bowen

The first price reduction of the year unexpectedly came from Tesla.

The limited-time insurance subsidy of 8,000 yuan for Model 3 and the 5-year 0-interest offer made the market boil instantly. Automakers such as Xiaopeng, Li Auto, and IM Motors followed suit. On the first working day of 2025, the auto market is so lively.

After the silence in 2024, Tesla seems to be announcing its return to the center of the stage.

In the past year, this global leader in pure electric vehicles has not had an easy time. There were no new cars, no new stories, and even the launch of Cybercab was lackluster, leaving more disappointment than hope.

This also doomed that Tesla's financial performance will not be too good.

In 2024, Tesla's total revenue was 97.69 billion US dollars (about 708.4 billion yuan), an increase of 1% year-on-year. A total of 1.7892 million vehicles were delivered throughout the year, a decrease of 1% year-on-year.

2023 was the first profit decline for Tesla in seven years, and 2024 was the first sales decline for Tesla in 10 years.

Sales declined, and profits were even worse. Tesla's full-year net profit in 2024 was only 7.09 billion US dollars, a 53% decrease year-on-year.

However, despite the dismal financial report and unsatisfactory deliveries, Tesla's stock price still closed up 2.9% on the day after the financial data was released.

This is attributed to Musk's "big promises". Building cars is obviously no longer Musk's top concern. He has already focused his work on AI, autonomous driving, and the robot Optimus.

At the fourth-quarter earnings conference, Musk announced that an unsupervised fully autonomous driving service will be launched in Austin, USA in June this year; Optimus will also be put into use within Tesla this year. His these promises are the reasons why the stock price did not fall but rose instead.

2025 is obviously a turning year for Tesla to return to the growth range.

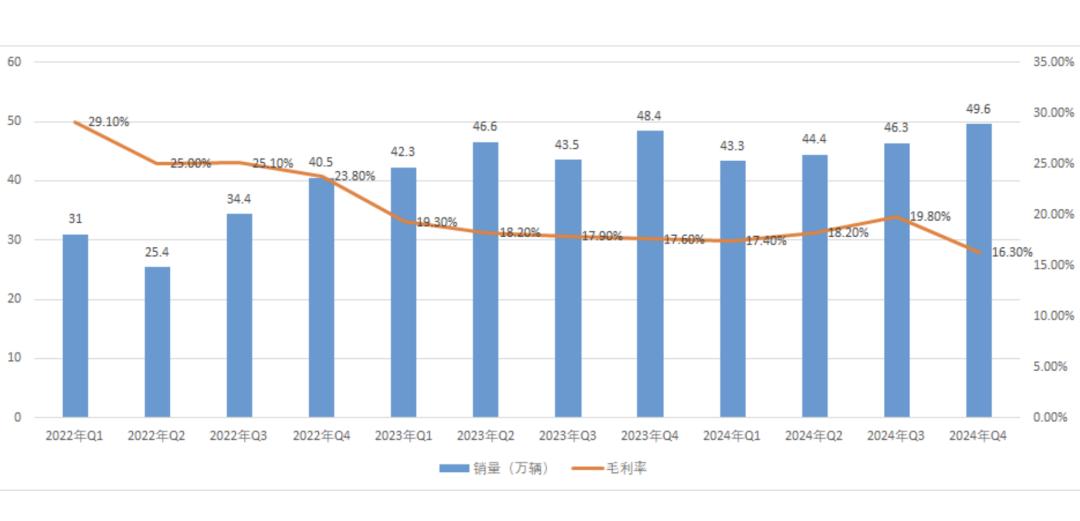

"Gross margin is further declining, but the trough period has been passed"

After the significant increase in net profit in the third quarter of 2024, Tesla's profit returned to the declining range in the fourth quarter.

In this quarter, Tesla's gross margin was 16.3%, far lower than the analyst's expectation of 18.9%. Despite selling the highest 496,000 vehicles in a single quarter, it still couldn't hide the weakness of profits.

Tesla's sales and gross margin

Tesla's automotive business revenue in the fourth quarter was only 19.8 billion US dollars, a 8% year-on-year decrease. This also includes 692 million US dollars in income from carbon credits. After deduction, the gross margin of the automotive business in this quarter is only 13.6%.

Although Tesla announced in its financial report that its vehicle cost has dropped below 35,000 US dollars, it is obvious that the cost reduction is not enough to offset the significant decline in the vehicle price.

Profits are declining, while expenses are increasing. Tesla's R & D investment in AI and other areas continued to increase in the fourth quarter, and operating expenses began to increase quarter-on-quarter. Under this situation, Tesla's operating profit in the fourth quarter was 1.583 billion US dollars, a 23% decrease from 2.064 billion US dollars in the same period of the previous year.

In the previous quarter, Musk gave the growth range of car sales in 2025 at the earnings conference: 20% - 30%. But in the fourth quarter, this indicator was not reiterated, only saying that "sales will return to positive growth in 2025".

This means that the uncertainty of Tesla's automotive business in 2025 is still very large. Even the always bold Musk did not "make bold claims".

Since 2023, Tesla's single-quarter sales have remained stable between 400,000 and 500,000. Even with multiple price cuts and promotions, and even the launch of the refreshed Model 3, it has not broken through the 500,000 mark.

Therefore, to return to positive growth, the new Model Y is obviously the main force.

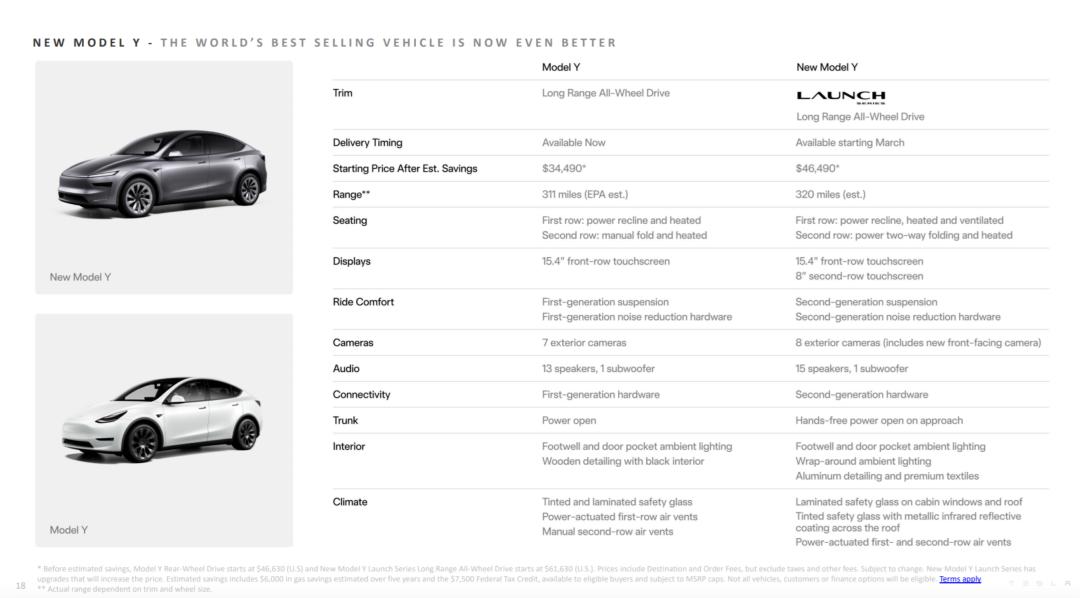

In 2024, Model Y once again became the best-selling model in the world. Even though this car has not been refreshed for five years, its competitiveness is still strong. In the Chinese market, in 2024, there was even a "six major sects besieging Model Y" hot scene, but they all failed to shake Model Y's market position.

The new Model Y was launched on January 10. Industry sources said that the number of orders reached 50,000 on the same day. When the new Model Y starts to be delivered in March, it is natural for Tesla's sales to return to the positive growth range.

Comparison between the new Model Y and the old model

In addition to the main automotive business, Tesla's energy business has also begun to enter a period of rapid growth.

The financial report shows that its energy generation and storage business revenue in the fourth quarter was 3.061 billion US dollars, a 113% year-on-year increase; accounting for 11.9% of the total revenue in the fourth quarter.

In addition, Tesla's Shanghai Energy Storage Super Factory was completed at the end of December 2024, and the commissioning ceremony will be held on the morning of February 11. Production capacity will begin to climb in the first quarter of this year.

This means that the energy business is also steadily growing into a new growth pole for Tesla. Tesla also expects that the energy business will increase by at least 50% in 2025.

In general, after a very plain 2024, the explosion of orders for the new Model Y and the continuous expansion of energy storage and other businesses have allowed this company to gradually emerge from the trough period and begin to regain vitality.

In 2025, Tesla has three trump cards to play.

"There are three more cards to start a new stage of the company"

The automotive business is still Tesla's fundamental business, and the first card is the tortuous Model Q.

This 25,000 US dollar model that has been rumored in the market for several years is finally ready to be launched this year. Tesla clearly pointed out at the earnings conference that it will launch a more affordable model in the first half of 2025 to continue to expand the product line.

Not long ago, an overseas blogger also leaked that Model Q will be released on June 25, 2025, with an expected price of less than 30,000 US dollars.

The price of this car in China may be around 150,000 yuan, and it is very possible to be set at 140,000 yuan. For Tesla, this is a new sales explosion point.

However, in the current price war situation, models such as Xiaopeng MONA M03 and Aion RT have already lowered the price of A-class pure electric sedans to the 120,000 yuan level. Even if Model Q has Tesla's unique brand appeal, it is very difficult to become a phenomenon-level product in the market.

Of course, Tesla's six-seat Model Y has not yet been released, but the market response to this model is not strong. At most, it is an embellishment in terms of sales, and it is difficult to provide timely help.

In addition to new cars, Tesla's second card is FSD that consumers outside the United States have not been able to experience.

FSD is Tesla's core autonomous driving technology, spanning from L2 to L4 levels of intelligent driving capabilities. Both the already sold Model 3/Y series products and the driverless taxi Cybercab rely on FSD.

Tesla is very confident at the earnings conference and officially announced that it will launch an unsupervised fully autonomous driving service in Austin, USA in June 2025.

Musk once gave a data: Once fully autonomous driving is achieved, the utilization rate of the car will increase from the current 10 hours per week to 50 hours or more, thereby bringing a huge increase in asset value.

When FSD can be commercially used in driverless driving, the piloting capability of the already sold vehicles will also have a huge leap.

At the earnings conference, Musk also acknowledged that he is discussing the matter of FSD authorization with other car companies. Tesla has invested a lot in training FSD and will begin to get a return in 2025.

The third card is the focus of Tesla's next stage of work and also the business that Musk is most concerned about, that is, the robot Optimus.

Musk disclosed the latest progress of Optimus at the earnings conference. He said that the design of Optimus has not been locked, the prototype design is simple, and production is the difficulty.

"We expect that Optimus will mainly be put into use within Tesla this year. Optimus will be responsible for completing the boring and repetitive work in the factory."

Currently, Tesla's robot production line has a monthly production capacity of about 1,000 units. Its goal is to design the next-generation production line to have a monthly capacity of 10,000 units, and the next-generation production line after that to be 100,000 units per month.

Musk believes that producing 1 million robots per year is a stable production state, and at that time, the production cost of Optimus will be less than 20,000 US dollars. As for the price of Optimus, it will be determined by market demand.

Musk also gave the commercialization time point of Optimus: Starting from the second half of next year, Tesla may start to deliver Optimus externally.

The new car, FSD, and the robot Optimus are the three most powerful cards of Tesla at present. If everything goes smoothly in 2025, then Tesla will start a new development stage.

As Musk said, 2025 may become Tesla's "most important year in history".