Vivo's Hu Baishan: AI has a limited short-term improvement on the user experience, while imaging remains the biggest selling point | An exclusive interview with 36Kr.

Written by Wang Fangyu

Edited by Su Jianxun

The smartphone industry has developed to the present, and it has already evolved into a ranking competition among top manufacturers, with the competitive pattern tending to be relatively stable. However, in the just-passed 2024, the domestic smartphone market has once again caused waves.

With the strong return of Huawei, the pattern of domestic top mobile phone manufacturers has changed from 5 to 6, and the market share changes of manufacturers have become more prominent.

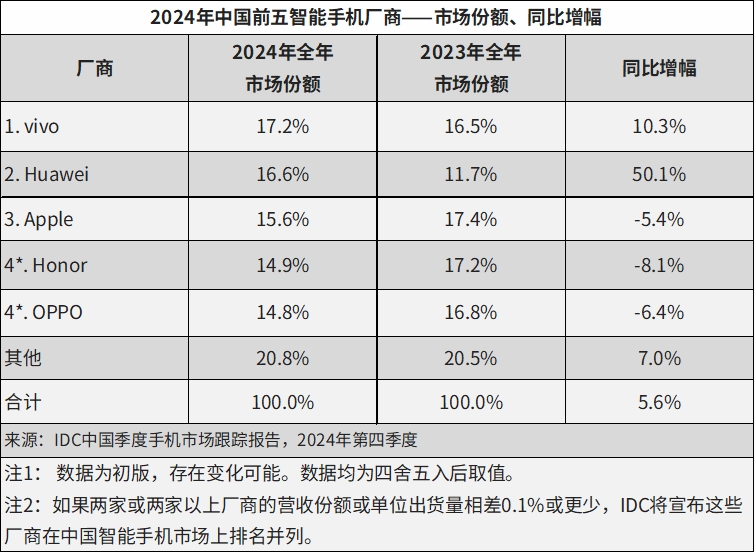

The latest annual statistics from IDC show that in 2024, the annual shipment of the smart phone market in mainland China was 286 million units, with a slight increase of 5.6% year-on-year. Among the TOP5 camps, the market share of Huawei phones in the Chinese market has increased from 12% in 2023 to 16.6% in 2024, while Apple, OPPO, and Honor have shown a negative growth.

Data source: IDC report

However, the market share of mobile phone manufacturer vivo has steadily increased and continues to rank first. This is also the fourth consecutive year that vivo has ranked first in the domestic smart phone market in terms of domestic mobile phone sales.

In 2024, the Chinese mobile phone market has undergone new changes: large models have been installed in smart phones and have begun to become a selling point; the mobile phone market has slowly recovered and has shown growth again; Huawei has made a strong return and has become the number one in the Chinese market share in 2024Q4.

Under these changes, can the methodology that vivo has long adhered to continue to be effective? Recently, Hu Baishan, Executive Vice President and Chief Operating Officer of vivo, accepted media interviews including 36Kr, and exchanged views on the development direction and planning of vivo in 2025.

The following is the actual record of the communication between 36Kr and Hu Baishan (edited):

Q: The pattern of the domestic mobile phone market has changed significantly this year, and some well-known companies have even dropped out of the top five. Has the mobile phone market emerged a new pattern and new competitive trend?

Hu Baishan: The entire Chinese mobile phone market, including the next two or three years, is still in a rather intense state. Because no brand is willing to lose the Chinese market, everyone is still going all out, and each is looking for a development goal or path that suits them.

For vivo, the two brands are vivo and its sub-brand iQOO. Our positioning for these two brands is very simple. According to the target audience, the vivo audience likes imaging and a better sense of humanistic design; iQOO is for extreme gaming performance. From the perspective of channels, these two brands also have their own focuses. Vivo is more offline-oriented, while iQOO is more online-oriented. In Q3 of 2024, our growth rate was relatively fast, which also lies in the relatively good coordination of the two brands.

Q: Now many manufacturers in the Chinese mobile phone market are facing a challenge, that is, the consumption structure of the Chinese mobile phone market is now showing a dumbbell shape. The sales volume of entry-level, high-end, and ultra-high-end prices is considerable, but the middle range has been relatively weak in recent years. How does vivo respond to this trend?

Hu Baishan: In the early years, the domestic mobile phone consumption market was in a positive pyramid shape, with the larger part at the bottom; then it began to evolve into a spindle shape, with the middle part becoming larger; now the market has begun to evolve into a dumbbell shape, which is a normal evolutionary state.

We found that 60%-70% of domestic smart phone users have a large base number, but the replacement cycle is long; about 20%-30% of users have extreme requirements for imaging and gaming performance, and the replacement cycle is short. These factors constitute the entire Chinese market from the original pyramid and spindle shape to the current dumbbell shape. Currently, in all developed countries, including Europe and the United States, the entire market is actually also in a dumbbell shape.

Q: Two years ago, you said that you expected vivo's NPS (Net Promoter Score, one of the most popular indicators to measure customer satisfaction) to increase by 20% every year. Two years later, what is the current situation of NPS?

Hu Baishan: We started to establish the NPS system four years ago. We will monitor the NPS of each product in three stages: one month, six months, and seven or eight months after its launch. We hope that the NPS will continue to increase every year.

In the past few years, the growth of vivo's NPS mainly relied on reducing the detractors, and now the proportion of negative feedback is very low. In the future, the improvement of NPS mainly depends on increasing the recommendation rate. Therefore, internally, for the definition and design of our products, including various tracks, we have always emphasized continuously extending the strong points, so as to improve the NPS value. For example, the battery life of our mobile phones has improved in the past two years, and this has become a strong point this year; including the system OS, making the OS more and more smooth. Therefore, the improvement of NPS is mainly through these strong points that users really care about to increase user recommendations.

Q: There is a voice in the current market that the Chinese mobile phone market is ushering in a replacement wave. Since the fourth quarter of 2024, the consumption of the Chinese mobile phone market has also been gradually recovering, including the demand for the high-end mobile phone market is also expanding. Is this a manifestation of the replacement wave?

Hu Baishan: The domestic smart phone has already met the needs of most consumers relatively well. Therefore, the replacement wave will definitely not occur again. The period of the domestic replacement wave is probably from 2016 to the first half of 2019, approximately more than three years.

The positive aspect of the current market development is that the proportion of high-end phones is continuously increasing, and the market capacity is continuously increasing. Most of the users of high-end phones are young people. For them, replacing a flagship phone every two years or even once a year is not a big expense. Young people have a great demand for various scenarios, such as concerts, travel, and tourism. Among high-end mobile phone consumers, the proportion of young people is also increasing. This series of circumstances constitute the continuous increase in the absolute number and relative share of high-end phones, and young people have made a great contribution.

Q: In the current environment, facing fierce competition, how do you define vivo's core competitiveness?

Hu Baishan: We believe that vivo's core competitiveness lies in two points. The first is user orientation, based on the orientation of the target users. We need to figure out who the target users are, and what their various scenarios, including usage scenarios, purchase scenarios, and life scenarios, are like. The second is the continuous investment in long tracks. Vivo has four core long tracks, including design, imaging, system, and performance.

Q: In the past many years, the "competition" of mobile phone manufacturers in photography has been the top priority; after the emergence of the AI large model, many views believe that AI is the future competitive focus of mobile phone manufacturers. How do you view the position of AI for mobile phone manufacturers? Will it replace imaging as the core of competition in the future?

Hu Baishan: Let's talk about imaging first. Vivo's ultimate goal for itself is to replace most of the DSLR camera scenarios, so the ceiling of the imaging competition is still very high. Assuming that the regular focal length of a DSLR is 100 points, our main camera is now close to 80 to 85 points. However, in terms of telephoto and video, the gap between mobile phones and DSLRs is still relatively large. Therefore, the technology itself still has a lot of room for development, and imaging is still the focus of future flagship phones.

In the past two years, due to the birth of the large model, AI has developed rapidly. Returning to the mobile phone itself, AI still has its limitations, and the biggest problem is insufficient computing power.

I divide AI into three stages. The first stage is to strengthen some of the past functions through AI capabilities, such as the elimination function of AI image editing, such as the ability of voice recognition and conversation; the second stage is to combine the OS system with the large model to make the mobile phone more intelligent and the interactive experience better, such as vivo's Atomic Island. The user experience at this stage can barely be satisfied by the current computing power.

The third stage is PhoneGPT mentioned at our VDC conference this year. The function we demonstrated at that time was to order takeout. It is said that it can be ordered, but in fact, when the success rate of each step is only 85%, it cannot move, and the time is also very long. Currently, the user experience is not good, and it is still in the model stage. To truly achieve the requirements of PhoneGPT, the computing power requirement is not a little increase, but many times increase. The current integrated architecture, packaging architecture, and computing power and hardware such as bandwidth are still not enough.

The real PhoneGPT requires that the entire capability requires the high-speed storage, server-side capability, bandwidth capability, and SoC architecture to be close to the server-side to have a chance to be implemented in the terminal. This is the same as the imaging ceiling. We can see that the user demand has already emerged, but I estimate that it will take more than five years to reach a requirement that you can feel and experience.

Inside vivo, we have purchased nearly 10,000 computing power cards. We found that many models can run in the cloud, but they simply cannot run on the mobile phone. On the mobile phone, only 2B and 3B parameters can be run. Of course, PhoneGPT can be connected to the cloud, but the cloud model also has problems. One is that the network transmission speed is not fast enough, and the other is related to user privacy and data security.

Therefore, from the perspective of user experience, the ability of the AI large model for smart phones is a gradual improvement, not from 0 to 1. AI has little driving force for the entire replacement wave, and it cannot drive users to improve the experience from 0 to 1.

Q: The domestic mobile phone market in 2024 has slightly increased year-on-year. Has it emerged from the trough? Where is the focus of market competition next year?

Hu Baishan: The national subsidy is a big variable in the mobile phone market in 2025, but vivo still has a relatively controlled expectation of this matter. Although the subsidy rules in each province are different, with an average of about 500 yuan with a 10% subsidy, this method is equivalent to a unified price reduction for each brand. The driving force for the core users to replace their mobile phones is not strong.

Most mobile phone users are relatively satisfied with their current phones. Only some users will replace their phones in advance due to the subsidy. The Chinese e-commerce platforms will carry out a 10-billion-yuan subsidy every June and November each year, and this subsidy intensity is also not small. Therefore, the national subsidy only changes the user's purchase curve for the next year, and the total market volume may not change much, or it may increase slightly. This is our view on the national subsidy.

Q: This year, flagship phones have generally increased in price. In the future, with the development of AI, the performance requirements may be higher. Will the price increase continue next year? How does vivo balance the cost and price?

Hu Baishan: We judge that the price increase may still continue. There are two factors behind the price increase. One is that the flagship SOC chip is increasing in price. With the upgrade of the semiconductor manufacturing process and the reduction of the chip area, the continuous price increase is certain; the second is like imaging, which is still relatively far from 80 points and still requires continuous investment every year; although the hardware space of the mobile phone remains unchanged, the implementation method of imaging, such as the arrangement of the lenses and the implementation method of the module, will change greatly, which will lead to a decrease in the yield rate and an increase in the cost of each product.

In the long term, it is an inevitable trend for the price of flagship phones to go up. For consumers, there will be some products with suitable price ranges and good experience to meet the needs of users. However, to pursue the ultimate user experience, such as the ultimate experience of imaging, AI, and gaming, more money needs to be spent.