Bull Market, A Pipe Dream for A-share Retail Investors? | Pay to Win

Author|Wang Hanyu Huang Yida

Editor|Zheng Huaizhou

On January 23, the Shanghai Composite Index closed at 3230.16 points once again.

Since October last year, the market index has been fluctuating around the closing price of 3336.50 on September 30, digesting a huge amount of trapped positions. Those who rushed into the market during the Golden Week holiday, just like those who entered the market at the turn of the bull and bear market 10 years ago, are waiting for the opportunity to increase and cash out.

The experience of the two bull markets in 2007 and 2015 shows that whenever the stock market becomes a money-making tool that is talked about on the streets and everyone rushes to enter the market, a crash will follow. But in the stage of the crazy rise of the market index, few people can not be influenced by the market sentiment and maintain true rationality.

Looking back at historical experience, the current shock may be fortunate. At least no one is shouting "The bull market is coming" anymore, and the stock market is safer instead.

The Bull Market Makes Everyone a Stock God, "Fundamentally Looking Down on Buffett"

"Starting tomorrow, short-term risks can come at any time." On October 8, investor Zhu Jiu wrote such a sentence on his social networking site. On that day, he began to withdraw. Before September 24, Zhu Jiu's securities account had been fully filled.

On October 9, the main indexes of A-shares fell across the board, with more than 5000 stocks in the market falling and more than 900 stocks hitting the daily limit. The ups and downs were staged again.

While Zhu Jiu was withdrawing, most of the people who just reacted during the Golden Week holiday were almost blindly rushing into the stock market, and many of them even bought at the daily limit price. "Being smashed as soon as entering the market" has become the reality that this batch of investors have to face instantly.

Before this, new investors opened accounts frantically, crowded out the brokerage trading platform, and the brokerage APP operation was stuck. Talking about stocks on the streets and alleys became a lively scene that suddenly emerged before the Golden Week last year.

The last time A-shares showed such an unprecedented heat was nearly 10 years ago. After the long bear market after 2008, A-shares finally reversed in May 2014.

On May 9 of that year, the State Council issued the "Several Opinions of the State Council on Further Promoting the Healthy Development of the Capital Market", namely the "New Nine National Policies", aiming to promote the reform of the capital market.

The introduction of the "New Nine National Policies" is usually regarded as the starting point and key driving event of that round of bull market. The loose and standardized policy core of this document has laid a policy foundation for this round of bull market.

The so-called looseness mainly refers to measures such as guiding and increasing the proportion of direct financing and developing a multi-level capital market, aiming to make the equity financing market cake bigger; while policies such as standardizing market behavior and strengthening supervision have significantly enhanced investor confidence and attracted a large amount of incremental funds to participate in the capital market.

Reflected in the market trend of A-shares, from May after the introduction of the "New Nine National Policies" to the end of October of the same year, the Shanghai Composite Index accumulated a rise of nearly 20%. Looking back, that stage can be regarded as the starting stage of the bull market from 2014 to 2015.

Chart: The trend of the Shanghai Composite Index from May to October 2014; Source: wind, 36Kr

After entering November, there have been continuous good news. Driven by a series of events such as the launch of the Shanghai-Hong Kong Stock Connect, the central bank's interest rate cut, and the interest rate marketization reform, the "Reform Bull" market was ignited, and the bull market entered the second stage. The A-share market quickly rose, and the Shanghai Composite Index soared 34% between November and December.

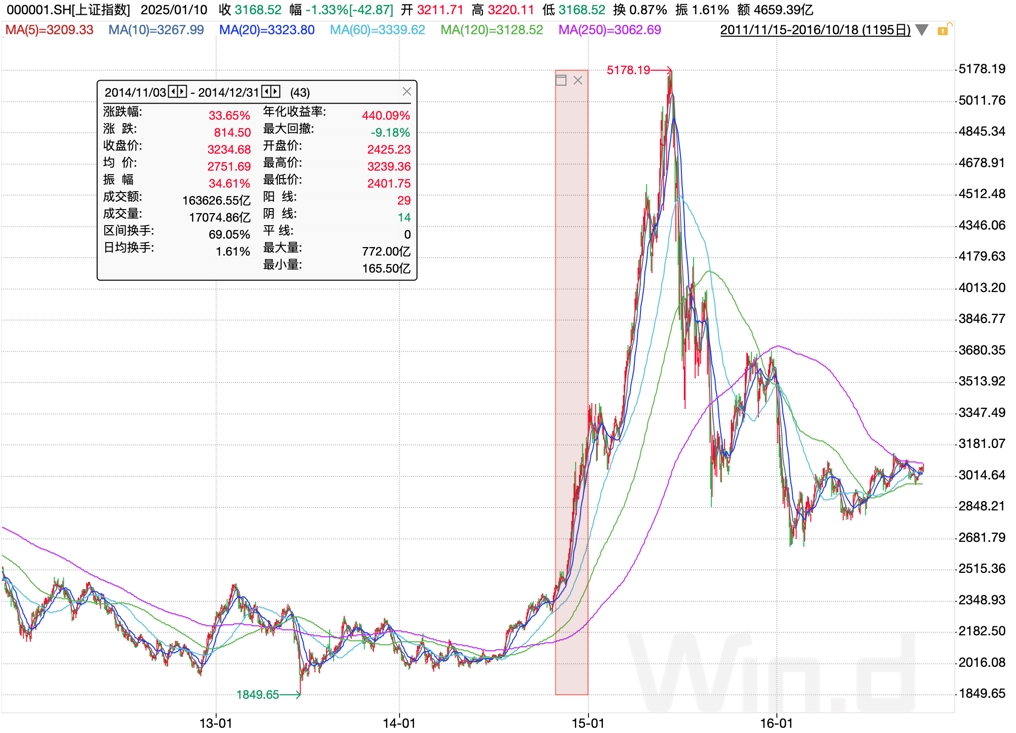

Chart: The trend of the Shanghai Composite Index from November to December 2014; Source: wind, 36Kr

During this period, brokerages have always been the leading sector, especially the leveraged funds represented by margin trading and off-exchange financing, which have made the entire large asset management industry expand by trillions - this kind of madness has brought a painful lesson for the big crash half a year later. But at that time, no one cared about the leverage, and the carnival was moving towards a higher climax.

In 2015, the A-share bull market entered the third stage. The Shanghai Composite Index rose all the way from around 3300 points at the beginning of the year, and reached the high of 5178.19 points in mid-June as the end of this round of bull market.

Chart: The trend of the Shanghai Composite Index from January to June 2015; Source: wind, 36Kr

"5178" is the watershed of that round of A-share bull and bear market, and it can also be regarded as the turning point for Zhu Jiu from a "playing around" mentality to seriously considering becoming a professional investor.

At that time, with the bull market established, the market risk appetite rose rapidly in the first half of 2015, driving investors to buy high-risk growth sectors. At the same time, the emerging industries represented by Internet + and information technology also developed rapidly during this period. Relevant star stocks have accumulated a large amount of funds due to their high performance expectations. Letv and East Money are both very popular stocks.

For example, Letv's opening price was less than 50 yuan per share at the beginning of February 2015, and it had risen to nearly 180 yuan per share by May 12; East Money was less than 4 yuan per share at the beginning of February, and it had risen to nearly 16 yuan by the beginning of June.

Zhu Jiu, who bought these two stocks, described himself at that time as "making a lot of money". He recalled that this kind of situation was very common at that time, "Almost as long as you bought it, if you put it (in the account) and don't look at it for two days, you will be surprised that 'how come you have made so much money again'."

Before that, Zhu Jiu practiced in the A-share market with a learning mentality for 6 years, and the capital invested was "one month's salary". And the starting point for him to enter the market, July 2009, was the beginning of the long bear market of A-shares. After 6 years, the bull market finally arrived, and he found that "this matter (investing in the stock market) can increase the position to make money."

Sun Qian, who entered the market a few years earlier than Zhu Jiu, because he experienced the glorious moment in 2007, now looking back on the situation of 2015, his mentality is relatively calm.

Sun Qian entered the futures industry after graduating in 2003, mainly engaged in commodity trading in the non-ferrous and chemical industries. When the copper price broke through the historical high of 3000 US dollars, the non-ferrous metal represented by copper started a magnificent bull market. Sun Qian, who was close to the water, bought Chihong Zinc & Germanium at about 9 yuan per share in 2004, and then encountered the big bull market from 2005 to 2007 - the Shanghai Composite Index rose from about 1100 points at the end of 2005 to the historical high of 6124 in 2007.

During this period, Sun Qian sold Chihong Zinc & Germanium at about 25 yuan and 26 yuan respectively, and then bought China Merchants Bank and Urban Co., Ltd. at about 9 yuan, and sold them at about 27 yuan and 50 yuan respectively.

Although Chihong Zinc & Germanium, which Sun Qian sold earlier for less than 30 yuan, once rose to about 150 yuan per share, Sun Qian, who experienced the 6124 point, still firmly made the first pot of gold in the stock market.

Recalling this bull market, Sun Qian said that it was an era of "Everyone is a stock god", "During that period (2005 - 2007), it was almost buying and holding with eyes closed, and it was a market with double or even several times of increase. Those who have experienced it know that Buffett's investment return is fundamentally looked down upon."

The soaring market index stimulated the emotions of shareholders. When the Shanghai Composite Index stood at the high point of 6124, the market shouted the slogan of "Breaking 10,000 by the end of the year", and the enthusiasm of shareholders was like a kite with a broken string.

Risks then emerged, and the vast majority of stocks had risen to extremely unreasonable prices.

At that time, Sun Qian was still looking for targets in the market, and bought Western Mining at the daily limit price when it was the last daily limit, and then the market went down all the way, and finally almost exhausted his profits in this round of bull market.

In retrospect, Sun Qian sighed to 36Kr: In fact, it is the opportunity given by the market, not his own ability at all. It is almost the same for any stock.

10x Leverage Margin Financing, One Daily Limit to Clear

The ups and downs from 2007 to 2008 made countless investors climb to the peak and return to the starting point, but in another round of bull and bear, most people still find it difficult to be truly calm.

In 2015, the market staged a similar market to 2007. This time, Sun Qian did not frequently switch hotspots, but chose to firmly hold China First Heavy Industries, which he had been heavily holding since 2014.

As a typical representative of cyclical stocks, China First Heavy Industries had accumulated a gain of about 200% in the first two stages of the bull market in 2014. Sun Qian's logic for continuing to hold China First Heavy Industries in 2015 is to be optimistic about the policy-driven of the reform of state-owned enterprises. In addition, after the bull market is established, the market risk appetite rises rapidly, and investors have a higher tolerance for high valuations.

Chart: The stock trend of China First Heavy Industries from 2014 to 2015; Source: wind, 36Kr

"At that time, I bought it all the way after (the stock price of China First Heavy Industries) fell below 3 yuan. In 2015, the market began to ferment and skyrocket. (China First Heavy Industries) reached a maximum of 21 yuan. I reduced my position above 10 yuan, reduced half of it at 12 yuan, and cleared all positions at 20 yuan." Sun Qian said.

And at that moment, the market index has once again reached a high point like 6124 in 2007. How many people can resist the temptation to exit and not enter?

At least, Sun Qian and Zhu Jiu, who have already obtained a good return at that time, have re-entered the market.

Sun Qian bought Aluminum Corporation of China at about 9 yuan per share. Shortly after, the China Securities Regulatory Commission issued a statement on Saturday, June 13, during the rest period, requiring brokerages to investigate off-exchange margin financing. When the market opened on Monday, A-shares fell in response. In the chaos, a stampede followed, and a large number of highly leveraged accounts were forced to be liquidated or required to add margin. These investors had to reduce their holdings of stocks to obtain liquidity. Therefore, while deleveraging, it further accelerated the market decline.

The market index plummeted from more than 5000 points to more than 3000 points. Fortunately, the liquidity of Aluminum Corporation of China was better at that time. Sun Qian decisively stopped the loss and sold it at about 8.5 yuan.

After Zhu Jiu withdrew in May 2015, he avoided the crash in June. But with the confidence of 5178 points, he bought Shanghai Pudong Development Bank again in July, but still underestimated the strength of the "sell-off". In the three months before and after this, A-shares staged more than ten "thousands of stocks hitting the daily limit", and the market fluctuated repeatedly, and finally retreated significantly compared to the first half of the year.

Recalling this round of reversal, Zhu Jiu sighed: "In the transition of bull and bear markets, it is difficult to avoid both the beginning and the end. You cannot always outperform the market, and you always have to pay some price."

Sun Qian also mentioned that if he chose other stocks, he might be like most shareholders, directly falling back to the starting point. Or if a relatively large leverage is used, it is also possible to retract a lot.

"Looking back, it is actually a matter of luck. Even if Aluminum Corporation of China only falls from 9 yuan to 8.5 yuan, if the leverage is high, my loss will also be very large." He said.

In this round of bull market, the operation of 10x leverage margin financing to invest in stocks is very common.

In fact, a major driver of this round of bull market is the large amount of leveraged funds that are rushing into the market, and the "Reform Bull" has gradually evolved into the "Leverage Bull". At that time, as the optimistic expectations of investors continued, the balance of margin trading and short selling was constantly refreshed. At the market high in mid-June 2015, the balance of margin trading and short selling reached a historical peak of 2.27 trillion yuan.

Off-exchange margin financing is another important source of leveraged funds. Publicly available information shows that the scale of off-exchange margin financing at that time was as high as 4 - 5 trillion yuan. Although the margin financing channels are different, they generally have the characteristics of high interest rates, which also planted a time bomb for the subsequent bear market of the bull market.

And when Zhu Jiu decided to withdraw when the Shanghai Composite Index rose to more than 5000 points in May 2015, it was also because he detected the horror of the crazy addition of leverage.

At that time, he went to the client's place to negotiate business and found that the K-lines were all on a row of computers outside the office. The client explained that this was "convenient for watching the market" and said that it provided lending funds to the outside and often provided 10x leverage off-exchange margin financing for stock traders.