Who is the most profitable merchant on Xiaohongshu?

Author | Yang Qi

In the past two years, when it comes to Xiaohongshu, the e-commerce business has become an unavoidable focus. In 2023, Xiaohongshu E-commerce proposed the role of buyers, and in 2024, it put forward the definition of "lifestyle e-commerce" and introduced the role of "curator". New roles are emerging, but in the vortex of competition, what the business world is more concerned about is how Xiaohongshu E-commerce makes money and who makes money in it?

Not long ago, according to the business development situation, Xiaohongshu E-commerce officially released a rise100 e-commerce annual list, selecting the 100 most worthy of attention merchants and 100 buyers in the Xiaohongshu E-commerce ecosystem in 2024.

As one of the business segments of Xiaohongshu that attracts the most attention from the outside world, this list is also an ecological sample submitted by Xiaohongshu E-commerce. This list implies the appearance of the roles encouraged by the platform and is also an overall profile of the e-commerce ecosystem.

Why are they called the top 100 merchants and top 100 buyers? What are their commonalities and characteristics? Where are the new opportunities? Dissecting these details can give a glimpse of the tendencies and changes of Xiaohongshu E-commerce business in the past year, and also represents their future direction.

Those Changes: Explicit and Implicit

Explicit and implicit, rise100 is like a fuse that connects all the merchant and buyer groups in 2024.

First, let's look at the explicit changes. New faces, growth, and young people are the most intuitive characteristics of the 2024 rise100 e-commerce annual list.

Compared with the 2023 list, we will find that 90% of the listed in 2024 are new faces. This also reflects the growth of the ecological roles of Xiaohongshu. Data shows that in 2024, the number of new merchants and buyers entering into Xiaohongshu E-commerce increased by 8.1 times year-on-year, and the number of merchants with an annual sales of more than 50 million increased by 4.6 times.

Younger age is also one of the obvious trends. Among the top 100 buyers, 30% are post-95s; among the top 100 merchants, 15% of the curators are post-95s. This can be understood as a signal that Xiaohongshu E-commerce is further integrating with the community population. After all, among the 300 million monthly active users of Xiaohongshu, post-95s account for 50%.

Leaving aside the conventional transaction scale and growth rate, some implicit changes are more worthy of attention.

36Kr learned that in the rise100 list of 2023, most of the listed merchants relied on the way of cooperation with buyers to operate, but in 2024, more than 90% of the listed merchants received traffic through store broadcasts and had a stable daily sales. Some store broadcasts even exceeded the volume of buyer live broadcasts. For example, the merchant UMAMIISM started to build a buyer cooperation matrix in March 2024, later explored the store broadcast path, and had more than 500 store broadcasts throughout the year, achieving a 12-fold increase in performance compared to the previous year.

In June last year, Xiaohongshu E-commerce stated that it would focus on store broadcasts. The fact that 90% of the listed merchants are doing store broadcasts also proves the importance Xiaohongshu attaches to this path. In the process of all platforms, this is almost a necessary step to allow more merchants to use the platform as a deep management position and attract more merchant investment.

In addition, detailed categories and niche tracks are beginning to emerge opportunities on Xiaohongshu. Compared with 2023, the number of list categories in the 2024 rise100 list has increased from 6 to 9. Among them, the fashion trend is divided into three sections: women's clothing, clothing and shoes, and trendy sports. In addition, a new category of "hobbies" has also emerged, such as CRAZY GUGU, which makes stress-relieving kneading toys, and Flower and Pearl Box, which specializes in Lolita clothing.

This also means that personalized demand has become a good business. Bobo Nuts, which is on the list this time, is a brand that specializes in making plush toys for "big kids". In a fast-paced society, plush toys not only belong to children, but adults also have a strong need for healing and companionship. After seizing this segmented demand, Bobo Nuts, which started operating on Xiaohongshu in 2024, gained 24,000 followers on Xiaohongshu in just one year and became one of the fastest-growing brands in the trendy toy industry.

36Kr also learned that the average customer unit price of the top 100 listed merchants has decreased significantly. Especially in some fashion categories, the decline has exceeded 50% - compared with 2023, the women's bag category of the top 100 listed in 2024 has dropped from 1,044 yuan to 301 yuan, and the women's shoe category has dropped from 651 yuan to 316 yuan.

This seems to be quite different from the high customer unit price impression of Xiaohongshu in the past. According to the data of Xin Hong, from September 10 to December 10, 2024, among the top 10 live-streaming rooms with the most followers on Xiaohongshu, 6 are mainly promoting affordable clothing and bedding with a price of about 100 yuan. The live-streaming rooms of these products are almost live 24 hours a day, and the large items with cost performance in the store are also extremely popular. For example, a 138-yuan camellia knitted top wholesaled by the Shenzhen Nanyou stall has sold nearly 30,000 orders.

Behind this is the influx of industrial belt merchants. 36Kr noticed that more than 50% of the merchants in the 2024 list are industrial belt merchants. In addition, according to incomplete statistics from Xin Bang, among the top 10 live-streaming rooms with a customer unit price of less than 100 yuan in GMV in the past three months on Xiaohongshu, 6 are from "source factories".

In the past, the industrial belts of e-commerce platforms mostly competed with "low prices", but even for the industrial belts, Xiaohongshu E-commerce takes an unconventional path. The relevant business head of Xiaohongshu E-commerce once told 36Kr that what Xiaohongshu E-commerce wants to do is to have a rich price range and a diverse supply of price ranges.

The Opportunities That Are Stirred

If you observe carefully, many people may find that the number of second-generation factory managers on Xiaohongshu has suddenly increased.

These second-generation factory managers either share their daily lives, or tell the story of taking over the business, and some even directly shoot videos of inspecting the factory. In this 2024 rise100 list, 9 second-generation factory entrepreneurs are also on the list.

In the traditional source industrial belt, inheriting the family business is almost the only option for local merchants. 36Kr once interviewed many traditional factory merchants in Yiwu and found that the older generation of merchants are eager to transform but unable to keep up with the times. The young second-generation factory managers have become their only hope. A second-generation factory manager of a leggings factory who recently transformed into Xiaohongshu E-commerce told 36Kr, "We make basic leggings with a low unit price. We once thought that the style of Xiaohongshu was not very suitable for our product style, but it turned out that the user demand on this platform is actually not small."

In fact, there have always been a large number of users on Xiaohongshu who have a demand for cost performance. The college student group is a typical example. They also have a high demand for aesthetics, style and taste, but due to insufficient budget, they can only be deterred by high-priced products. On Xiaohongshu, it is not uncommon to see posts where student parties directly ask "Where to find the most cost-effective products in the 100-yuan price range".

From the perspective of the platform, after making a name for itself with Zhang Xiaohui and Dong Jie to create a buyer model with high aesthetics and high quality, Xiaohongshu can only expand the e-commerce ecosystem by doing business for more people. 36Kr learned that at the end of 2024, all industry operation heads and products of Xiaohongshu started an internal interview on key business opportunities. At that time, the consensus formed within Xiaohongshu was that a large number of user needs were not met by the supply of Xiaohongshu - that is, how to meet the needs of being good-looking, good-quality and good-price at the same time.

In this regard, Xiaohongshu's idea is to find merchants in the industrial belt, but unlike other platforms, Xiaohongshu needs high-quality industrial belt merchants that are in line with the platform's style. This can also be seen from its search trajectory. Xiaohongshu first went to first-tier cities such as Shanghai and Shenzhen to find supplies, and then went to industrial belts in Dongguan and other places to continuously discover more high-quality sources of goods. Up to today, Xiaohongshu has traveled to more than 50 cities, covering categories such as fashion, home furnishing, cultural and entertainment, food and health care, etc.

Pursuing low prices is not the strength of Xiaohongshu E-commerce, nor is it the original intention of Xiaohongshu E-commerce to find industrial belt merchants. Many factory merchants said that Xiaohongshu is obviously taking a differentiated route from other platforms. The mentality it conveys is to sell products with high quality-price ratio and high appearance-price ratio, and to impress users with "good prices" rather than "low prices".

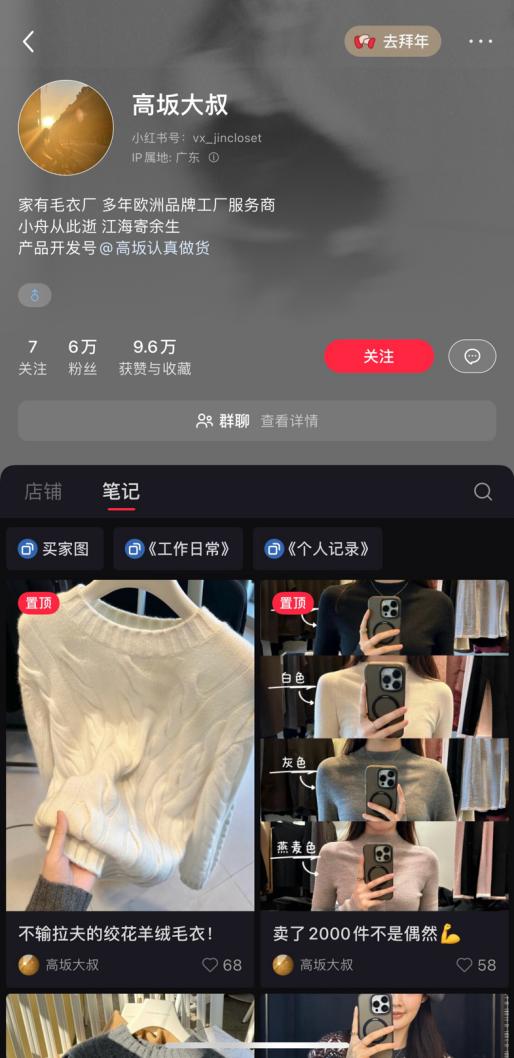

Regarding "good prices", Uncle Takasaka on this list may have the right to speak. Seven months ago, Uncle Takasaka began to look for new entrepreneurial opportunities. He has opened a sweater factory and has many years of experience in the wholesale of women's clothing supply chain. He knows that his strengths are in the source of goods and quality control, rather than relying on low prices to stimulate users to obtain short-term traffic.

Behind this recognition is the reality that small and medium-sized merchants have been suffering from the involution of low prices for a long time. When the e-commerce industry has rolled to the extreme low prices, the "victory of low prices" only leads to the expulsion of good money by bad money, the traffic cost remains high, and the return rate is also getting higher and higher. A large number of popular women's clothing stores have fallen before 2025.

A white-label merchant once told 36Kr that the algorithm logic of many mainstream e-commerce platforms will be more inclined to low-priced products, and the phenomenon of shoddy goods passing off as high-quality ones occurs from time to time. Over the years, many colleagues, including himself, have been deeply tired and powerless of the involution of low prices.

Only a business with low prices is doomed to be short-term and boring. Uncle Takasaka quickly chose Xiaohongshu as his first stop in e-commerce. He cuts in from the pure cashmere category and shares in detail the production process of each cashmere sweater in the notes, including gram weight, material selection and design, to make high-quality and good-price women's clothing. Uncle Takasaka found that compared with the label of being cheap enough, what Xiaohongshu users really care about is whether this product is worth this price. Once the demand for "good prices" can be met, the purchasing power of users will be astonishing - less than half a year after the new entry, Uncle Takasaka broke through the monthly sales of 10 million, and the annual sales in 2024 are expected to exceed 40 million.

Consumption has never disappeared, but has been flowing. When everyone actively or passively rushes to low-price competition, on the other end of the scale, the opportunities to build brands, make repeat purchases, and accumulate user groups have instead been stirred.

Is It a Long-Term Business or a Short-Term Sweetness?

A rather realistic question is that the scale of Xiaohongshu E-commerce is still in its infancy. Behind the short-term growth sweetness, can merchants see certainty on Xiaohongshu E-commerce?

Before discussing this issue, let's look at a big background. Since the second half of last year, due to the excessive negative impact of low-price competition, several mainstream platforms have successively adjusted their business strategies and weakened the weight of prices, but the long-term accumulated problems are difficult to eliminate, and merchants are still unable to get out of the low-price situation in the short term.

This also means that on other platforms, to stand out, you have to rely on traffic.

For merchants who seriously make products and services, Xiaohongshu may be a rare fertile ground. Starting from the community, the equalization of traffic on Xiaohongshu is no secret. It is not the influence of big Vs that determines the traffic. Instead, the platform is more inclined to distribute traffic to content that is practical and unique. So, an interesting phenomenon is that in this rise100 list, 67% of the buyers have less than 500,000 followers, and 19 have less than 100,000 followers. Some merchants, such as Uncle Takasaka, even have less than 70,000 followers. Merchants who have been entered for less than 1 year have become the mainstream roles on the list.

On Xiaohongshu, no matter which price range, as long as you make products with cost performance and appearance-price ratio, you can find your own opportunities. For example, "This Pear Pear Is Not Too Thin", who started to be a Xiaohongshu buyer in April 2024, focuses on items with a customer unit price of around 300. There are countless competitors in this price range, but Pear Pear combines her pear-shaped figure and locks the shared products on the keywords of "practical to wear", "slimming", "affordable" and "ordinary people's commuting". Since the start of the broadcast in May 2024, Pear Pear has increased her monthly sales from 500,000 to 5 million.

More importantly, different from other platforms, more and more merchants have found an emotional connection with users on Xiaohongshu. Q21 is a typical example. As a brand specializing in children's underwear, the founder, Zhao Xiaoling, initially had the entrepreneurial idea because her son has sensitive skin and could not find suitable underwear. On Xiaohongshu, Zhao Xiaoling found that there are actually a large number of parents like her who are worried about their children's healthy clothing.