After surging by 140%, can Megmeet, Nvidia's new favorite, rise by another 80%? | Zhike

Author | Author: Ding Mao

Editor | Editor: Zheng Huaizhou

On January 15, Megmeet, the new favorite of NVIDIA, once triggered a limit-down during the trading session.

The main reason is the market rumor on that day that the quality problem of Lite-On, the second supplier of NVIDIA AI server power supplies, has been improved, and it is expected to resume large-scale supply. Affected by this, investors are worried that Megmeet's future market share will decline. Under the panic effect, some investors took profits and settled, and the intensified selling pressure triggered significant fluctuations in the stock price during the trading session.

Looking back at 2024, the NVIDIA concept is undoubtedly one of the investment mainlines with higher certainty in the A-share market. Especially the new suppliers represented by Wall Nuclear Materials, Megmeet, Chunzhong Technology, and Xinyisheng, after boarding the NVIDIA train in 2024, they have achieved remarkable results in the capital market. Taking the above four companies as an example, the average increase in their stock prices last year reached 168%.

As one of the new favorites, Megmeet is an outstanding enterprise in the domestic electronic and electrical field. Although the company's performance has maintained a steady growth in recent years with the expansion of its business territory, it has always been unknown in the capital market. In October last year, after the announcement of being promoted to the list of NVIDIA power supply suppliers, the company's stock price started to rise continuously. As of the close on January 17, 2025, the cumulative increase in three months was as high as 136%.

So, after holding the thigh of NVIDIA, what positive changes will occur in the fundamentals of Megmeet in the future? How much incremental space is there? After the rapid rise in the early stage, is there still room for the future stock price?

Steady Growth in Traditional Business, NVIDIA Brings Performance Elasticity

Megmeet was established in 2003 and listed on the Shenzhen Small and Medium-sized Board in 2017. Its main business is power electronics and precision connections. It is an electrical automation company based on power electronics and related control technologies, focusing on the transformation, automatic control, and application of electrical energy.

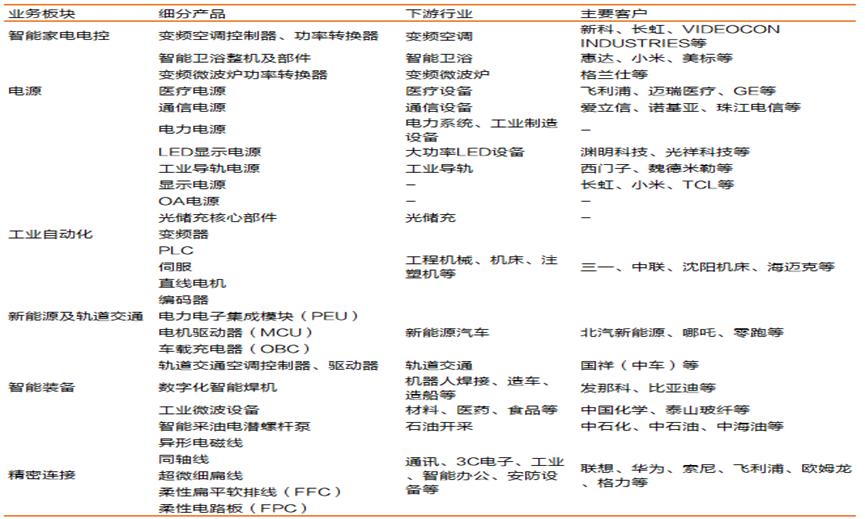

Over the past 20 years since its establishment, Megmeet has continuously expanded its business territory by adopting the methods of endogenous growth and exogenous expansion. Its main business has gradually expanded from industrial display power supplies to six categories: intelligent home appliance electronic control products, power supplies, new energy & rail transit components, industrial automation, intelligent equipment, and precision connections. Its product matrix is rich and covers many industries.

Figure: Megmeet Product Matrix Data Source: Tianfeng Securities, 36Kr Collation

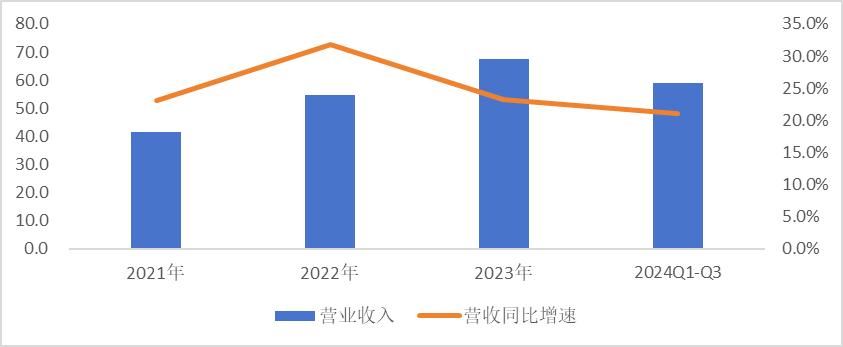

From the perspective of revenue, from 2021 to 2023, Megmeet's revenue expanded from 4.16 billion yuan to 6.75 billion yuan, with a CAGR of 27.4%. In the first three quarters of 2024, the company achieved operating revenue of 5.90 billion yuan, with a year-on-year growth rate of 21.1%. It can be seen that thanks to the company's multi-field coordinated expansion, the company has maintained a rapid and stable growth in recent years, reflecting a high growth potential.

Figure: Megmeet Revenue and Growth Rate Data Source: Wind, 36Kr Collation

From the perspective of revenue proportion, in 2023, the revenue proportions of the company's six business segments were: intelligent home appliance electronic control 38.8%, power supply 31.4%, industrial automation 8.7%, new energy & rail transit components 10.5%, intelligent equipment 5.4%, precision connection 4.7%, and other businesses 0.6%. Intelligent home appliance electronic control and power supply products are the company's most core sources of income. From the perspective of changes, the industrial automation and new energy & rail transit products have achieved rapid expansion in the past two years, and the business proportion has been continuously increasing.

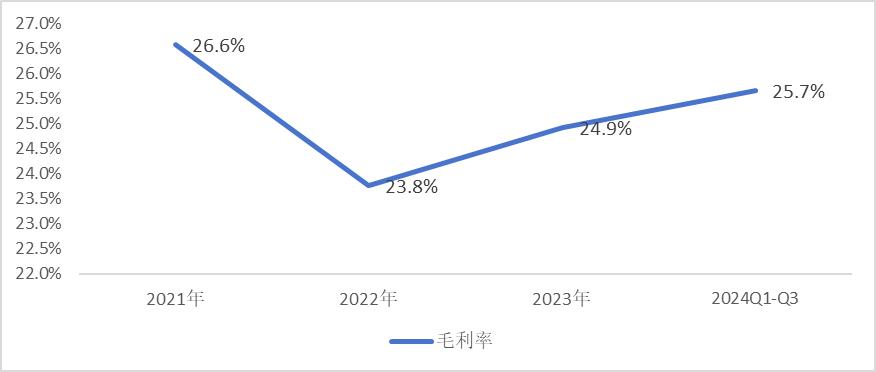

From the perspective of the profit end, from 2021 to the first three quarters of 2024, Megmeet's gross profit margins were 26.6%, 23.8%, 24.9%, and 25.7%, respectively. The fluctuation in the gross profit margin is mainly due to the cost increase caused by the price increase of IGBT from 2021 to 2022. Since 2023, the company's gross profit margin has shown signs of recovery.

Figure: Changes in Megmeet's Gross Profit Margin Data Source: Wind, 36Kr Collation

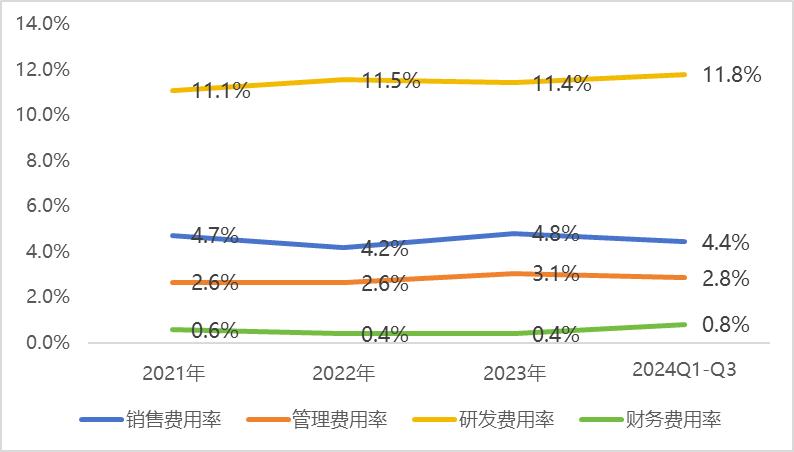

From 2021 to the first three quarters of 2024, the company's period expense rates were 19.1%, 18.8%, 19.7%, and 19.9%, respectively. The slight increase in the expense rate is mainly due to the continuous growth of R & D investment. During this period, the company's R & D expense rates were 11.1%, 11.6%, 11.4%, and 11.8%, respectively, while the other three expense rates were 8.0%, 7.2%, 8.3%, and 8.1%, respectively, which are relatively stable as a whole.

Figure: Changes in Megmeet's Expense Rate Data Source: Wind, 36Kr Collation

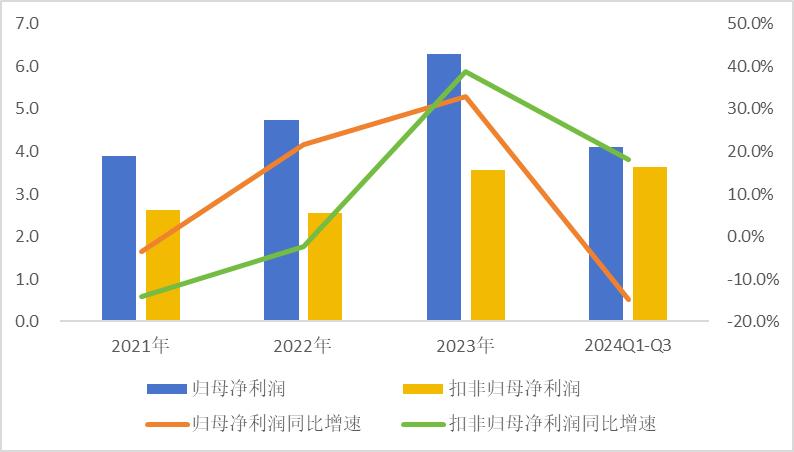

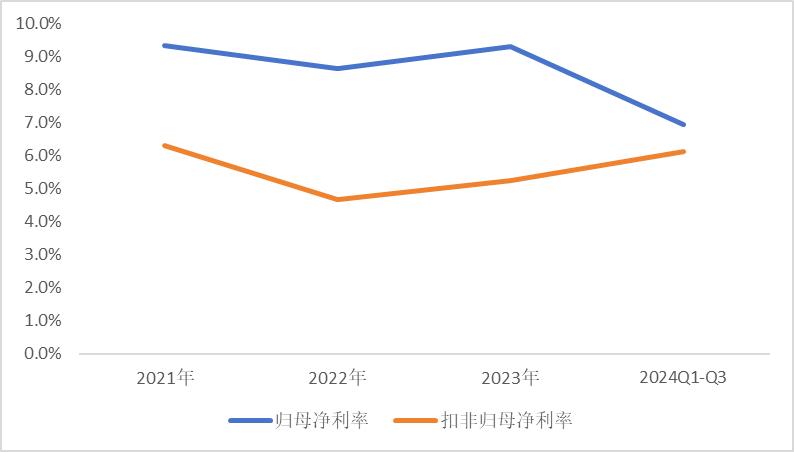

From 2021 to the first three quarters of 2024, the company's net profits attributable to shareholders were 390 million yuan, 470 million yuan, 630 million yuan, and 410 million yuan, with year-on-year growth rates of 21.6%, 33.0%, and -14.8%, corresponding to net profit margins attributable to shareholders of 9.4%, 8.6%, 9.3%, and 7.0%; during the same period, the non-recurring profits and losses attributable to shareholders were 260 million yuan, 260 million yuan, 360 million yuan, and 360 million yuan, with year-on-year growth rates of -2.3%, 38.9%, and 18.1%, corresponding to non-recurring net profit margins of 6.3%, 4.7%, 5.3%, and 6.1%. Overall, in the first three quarters of 2024, due to the decrease in the net gain from changes in the fair value of investments, the company's net profit attributable to shareholders declined, but the non-recurring net profit and net profit margin after deduction both increased.

Figure: Changes in Megmeet's Net Profit Data Source: Wind, 36Kr Collation

Figure: Megmeet's Net Profit Margin Data Source: Wind, 36Kr Collation

Overall, under the strategy of "multi-polar growth to balance risks", the company not only realizes a diversified layout in the business field and product breadth but also completes the global development in both domestic and overseas markets. Currently, the company has diverse and decentralized income sources, with a relatively fast and stable overall growth and a strong ability to resist cyclical fluctuations. In terms of profitability, after the risk of price increase of upstream raw materials is lifted, the profitability of the company's business in 2024 has obviously recovered, but the fair value change income related to investments has decreased, which has to some extent dragged down the profit performance. However, in the medium and long term, the investment-related income has brought a better smoothing effect to the company's profits.

Through the previous analysis, it can be seen that although the fundamentals of Megmeet are currently acceptable, it is obviously unable to support a price-earnings ratio of 65 times. Therefore, it can be affirmed that The key reason why the market is optimistic about Megmeet is the imagination space of the company's revenue and profit in the next few years after it cuts into the NVIDIA supply chain.

The cause of the Megmeet and NVIDIA incident was on October 15, 2024, when NVIDIA announced the design and project progress news of the NVIDIA GB200 NVL72 rack product on its official website. It was mentioned in the article that Megmeet, as one of the more than 40 designated data center component providers, is participating in the innovative design and cooperative construction of its Blackwell GB200 system. The power supply suppliers it displayed included Delta, Lite-On, and Megmeet. Then on October 17, Megmeet officially announced its partnership with NVIDIA, indicating that as a designated server power supply supplier, it is participating in the GB200 system design and construction.

Since Megmeet is currently the only mainland power supply partner that has announced its entry into the NVIDIA supply chain, the market has fully recognized its future business development prospects and performance growth space. Since October 16, the company's stock price has shown an exponential growth, with four consecutive daily limit-ups. In just three months, the maximum increase in the company's stock price once exceeded 170%, and the cumulative increase is still more than 130% as of now.

How Big is the Imagination Space of the AI Business?

As mentioned above, the core reason why the current market is optimistic about Megmeet is that after the company cuts into the NVIDIA supply chain, the performance increment and broader imagination space brought by the AI business under stable supply in the future. So, how big is the current market space related to the AI business? And how much performance elasticity will it bring to Megmeet?

In recent years, the rapid development of artificial intelligence has promoted the growth of global data centers. With the expansion of the AI server market, the performance and power consumption levels of its core CPU, GPU, as well as memory, network communication and other chip components are all improving, which puts forward higher requirements for the power supply system of AI servers and also brings a broader imagination space.

Specifically, compared with the power supply system of ordinary servers, The value increment of the AI server power supply system is reflected in two aspects: First, in terms of energy efficiency, the AI server power supply is more efficient, the general server power supply is generally 95 - 96%, and the AI server power supply can currently reach 97.5 - 98%; Second, in terms of power density, the power density of ordinary servers is twenty to thirty watts per cubic inch, and the AI server can reach 100 watts per square inch or even higher. In other words, higher energy efficiency requirements and higher power density will jointly promote the increase in the value of the AI server battery system from both the price and quantity aspects.

From the price aspect, due to the continuous increase in server power consumption, the power of a single battery is continuously increasing, which promotes the increase in the unit price of the AI server battery system.

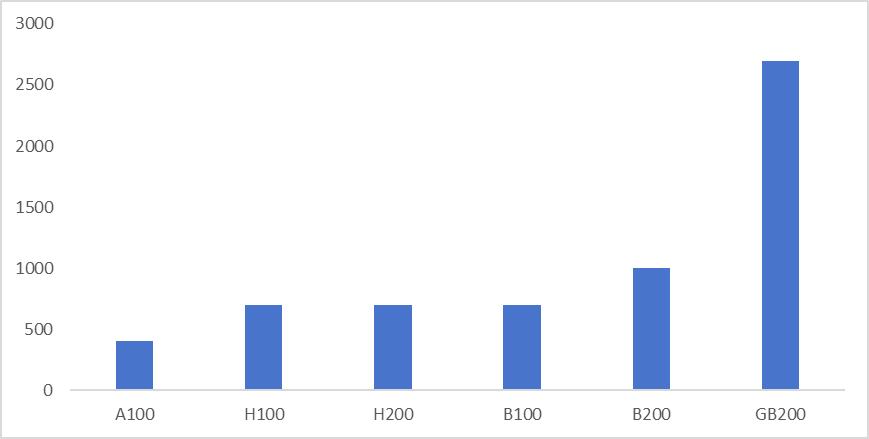

At the GTC in 2024, the NVIDIA B200 GPU based on the Blackwell architecture has a power of 1000W. It is calculated that the superchip GB200 composed of two B200 GPUs and one Grace CPU has a maximum power of 2700W. In contrast, the earlier B100 GPU has a power of 700W, and the even earlier A100 has a power of 400W.

Figure: Changes in NVIDIA GPU Power Data Source: Tianfeng Securities, 36Kr Collation

According to the disclosure, the peak power consumption of the GB200 NVL72 architecture server based on the GB200 GPU can reach 120kW. In this context, the GB200 server needs to use a 5.5kW power supply, far exceeding the 300 - 1200W of ordinary servers. In the future, it is expected that with the further increase in power consumption, a larger power supply will be required, and the power of the PSU (Power Supply Unit) may be further increased from 5.5kW to 8kW.

The upgrade of battery performance leads to a synchronous increase in battery prices. According to Delta's disclosure, the unit watt price of power supplies with low downstream demand such as the A series and V series may be 0.5 - 0.6 yuan/watt and 0.7 - 0.8 yuan/watt; the unit watt price of the H series power supply is about 1 yuan/watt; while the unit watt price of the GB series is higher, such as 5.5 kilowatts at 5 - 7 yuan/watt.

From the quantity aspect, the increase in the peak power consumption of the server also brings the demand for more power supplies. At the same time, in order to improve the conversion efficiency, the battery of the AI server rack will use the N + 1 or N + N redundant design, which further increases the actual usage quantity.

Since the computing system is a complex load that operates at full power, the system must maintain the highest possible efficiency throughout the entire power demand. Every watt of energy wasted is dissipated as heat and translates into a higher requirement for the cooling system in the data center, which increases operating costs and carbon footprint. Therefore, data centers prefer power supplies with advanced level certifications such as 80 PLUS Platinum or Titanium.

Generally speaking, the efficiency (Efficiency) of the PSU with the change of the load (Load) is not linear, and usually presents an "efficiency curve", reaching a higher or the highest conversion efficiency in a certain load range. According to the common power supply design and the requirements of the 80 PLUS certification standard, in the 40% - 60% load range, the working states of the circuits and components of the power supply are relatively balanced