Zhao Ming exits, Honor steps into the storm | Focus Analysis

Written by Wang Fangyu

Edited by Su Jianxun

The top-level personnel changes at Honor, a mobile phone manufacturer, have finally been settled.

On January 17, Honor officially announced that Mr. Zhao Ming resigned from his positions as the company's director, CEO, and other related positions for personal reasons. The board of directors decided that Mr. Li Jian would replace Mr. Zhao Ming to carry out the work.

Public information shows that Li Jian joined New Honor in 2021 and has successively served as a core member of the management team, vice chairman, director, and president of the Human Resources Department.

Intelligent Emergence notes that before the official announcement, there were rumors about Honor's personnel adjustments. There were rumors that Honor CEO Zhao Ming and the team of the Magic series mobile phone products left the company, but Honor officially denied the news at that time.

The adjustment of important personnel is only one aspect of the current situation of this mobile phone manufacturer.

In 2024, the competition in the domestic mobile phone market is intense. With Huawei's "return" and the reclamation of the market, the market competition pattern is being redefined. Honor's market share in the Chinese mobile phone market is being squeezed, and it is facing an adverse situation.

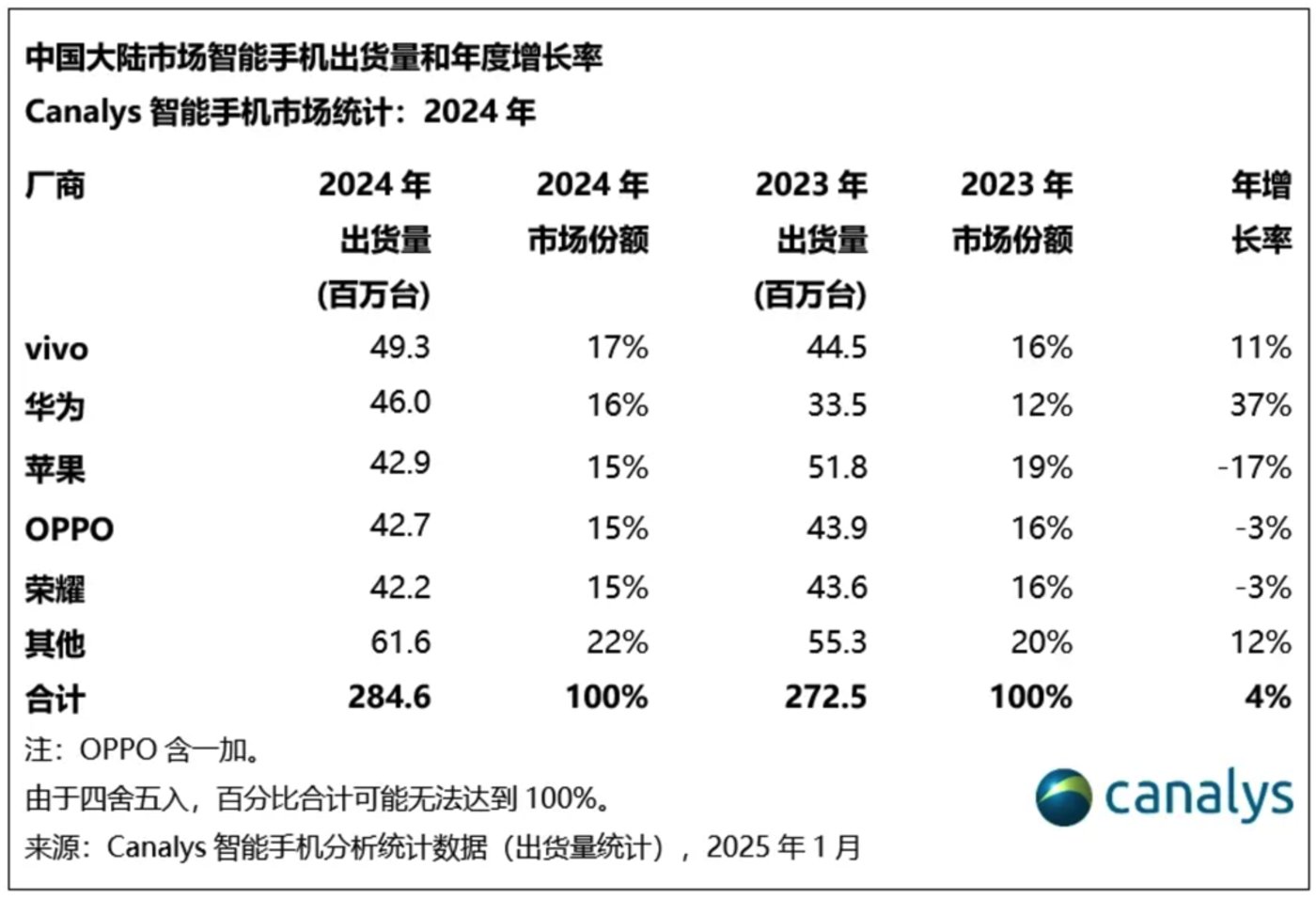

The latest annual statistics from Canalys show that the annual shipment of smartphones in mainland China in 2024 reached 285 million units, of which Honor's market share was 15%, with a negative growth of 3% compared to 2023.

At a critical juncture when Honor has just completed the shareholding reform and is planning for an IPO, such a huge personnel change and performance are obviously very unfavorable.

An investment banker told Intelligent Emergence that in the current context of the tightened A-share IPO, the stability of the performance of IPO companies is a key issue that the regulatory authorities focus on. "During the queuing period after the application, the performance of the enterprise will have a greater impact on whether it can pass the review."

Continuous Quarterly Decline in Market Share

Behind the adjustment of important personnel, Honor's market performance in 2024 is not optimistic, and its market share has declined for several consecutive quarters.

Data from Canalys shows that from Q1 to Q3 in 2024, Honor's market share in mainland China was 16%, 15%, and 15% respectively. In the fourth quarter, it dropped out of the top five positions, with a market share of less than 14%.

In contrast, the entire Chinese mobile phone market is in a state of positive growth. Data shows that the annual shipment of smartphones in mainland China in 2024 reached 285 million units, with a mild year-on-year growth of 4% in shipments.

Image Source: Canalys Report

The total market is still growing, but Honor's market share is declining. An important variable behind this is the return of Huawei mobile phones.

Hu Baishan, Executive Vice President and Chief Operating Officer of vivo, said in an interview with Intelligent Emergence and other media at the end of last year that the biggest change in the Chinese mobile phone market pattern in 2024 comes from Huawei's strong return. Many users have chosen Huawei again, and the mobile phone market pattern has changed from five to six. "There is nothing to avoid. Essentially, Huawei needs to regain its market share."

It can be seen that with the "return" of Huawei mobile phones, Huawei's market share in the Chinese market has increased from 12% in 2023 to 16% in 2024, ranking second in the Chinese market share.

Behind Huawei's 37% annual growth in mobile phone shipments is the negative growth of manufacturers Apple, OPPO, and Honor.

Although Zhao Ming has repeatedly stated in public that Honor is not afraid of the return of Huawei mobile phones. "Huawei's return has made the industry full of vitality, competitiveness, and challenges. The best tribute for Honor is to compete with Huawei with the strongest products and the best state."

But in fact, as Huawei's former sub-brand, Honor and Huawei mobile phones have a certain degree of overlap in the target customer group. Even some consumers have formed a fixed brand perception that Honor is a "budget alternative" to Huawei. For a long time after Honor's independence, the mobile phone UI and design styles of the two manufacturers were highly similar.

When Huawei was cornered due to the chip problem and its mobile phone business shrank rapidly, Honor once ranked first in the domestic Android mobile phone market share. Now, Huawei, which has returned to the mobile phone market, is cutting into the market share of other competitors, and the former sub-brand Honor is the first to be affected.

Personnel Changes at the IPO Threshold

After entering 2024, Honor has successively completed several important rounds of pre-IPO financing, with investors including a group of state-owned capitals such as China Mobile, China Telecom, and CICC Capital.

In December last year, Honor Terminal Co., Ltd. completed the name change and was legally transformed into a joint-stock limited company. Honor disclosed to the media that after the completion of the shareholding reform, the IPO process will be initiated in due course.

At the same time, Honor's management has also experienced a series of changes. Deng Bin, the former president of Honor's R & D Management Department, was removed for violating business conduct guidelines; Wan Biao, Honor's vice chairman, also resigned from his position as vice chairman and other related positions in September.

The departure of the "soul figure" CEO Zhao Ming undoubtedly adds new variables to the IPO path of this mobile phone manufacturer.

Public information shows that Zhao Ming joined Huawei in 1998 and held important positions in Huawei's core business positions. In 2015, he succeeded as the president of Huawei Honor. In November 2020, Huawei sold Honor, and Honor became independent officially, with Zhao Ming serving as the CEO of Honor Terminal Co., Ltd.

As the company's top leader, Zhao Ming has experienced the entire process of Honor from within the Huawei system to independence. After its independence from Huawei, he led Honor to carry out brand adjustments and strategic reconstructions, enabling Honor to emerge from the predicament of only 3% of the domestic market share (data from the first quarter of 2022) and even once achieving the first place in the domestic mobile phone market share.

At a critical juncture of planning for an IPO, the departure of CEO Zhao Ming has a significant impact on Honor's listing process.

The above-mentioned investment banker told Intelligent Emergence that whether the performance of IPO companies can withstand the reporting period and the period after the reporting period will be the focus of regulatory attention. This requires Honor to maintain the stability of its performance within one to two years before and after the listing, and there should be no significant decline.

Zhao Ming's successor, Li Jian, has served as vice chairman, director, and president of the Human Resources Department, but whether he has the comprehensive business management and strategic decision-making capabilities required for a CEO to steer Honor smoothly towards an IPO remains to be verified over time.

In 2025, the pattern of the top mobile phone manufacturers in the domestic market has changed from five to six, and the competition is becoming increasingly fierce. Hu Baishan, Executive Vice President of vivo, judges that the domestic competition in the next 2-3 years will be in a more intense state.

For CEO successor Li Jian and Honor, it will be the core task and a difficult battle to maintain the existing market position in the fierce competition while ensuring the stability of the company's performance to escort the IPO.