Zhike | Profitable yet losing money, Blue may not be the next "Pop Mart".

Author | Fan Liang

Editor | Ding Mao

Since 2024, the share price of Pop Mart, the leading blind box company, has continuously reached new highs, with an interval increase of more than three times, and its market value once exceeded HK$120 billion. Behind the soaring share price, on the one hand, it benefits from the doubling growth of profits in the first half of 2024, and on the other hand, it is the enthusiastic pursuit of the concept of "Grain Economy" by the capital market.

At the right time, on December 15, The building block toy brand Bloco passed the hearing of the Hong Kong Stock Exchange and is only one step away from the IPO.

There is no doubt that Bloco just caught up with this wave of "Grain Economy". According to the prospectus, after Bloco completed the Series A financing in April 2021, its valuation reached RMB 7.2 billion. After the company's IPO ended, it finally issued 27.7383 million shares at the price of HK$60.35 per share, and finally raised HK$1.674 billion. The corresponding issue valuation is about HK$15 billion, nearly doubling compared with the previous round of valuation.

On January 10, 2025, Bloco successfully landed on the Hong Kong Stock Exchange. Up to now, the increase has exceeded 50%, and the market value has reached HK$22 billion. The highest increase is 80%, and the market value exceeds HK$26 billion. Then, what kind of company is Bloco? Can its valuation go further with the "Grain Economy" boom after listing?

Revenue close to that of Pop Mart in 2020

According to the product line division, Bloco mainly has building block character toys and building block toys two product lines, both of which belong to the building block category of toys. The raw materials and production processes are similar. The main difference is that building block character toys generally have a definite shape and are smaller in size, with a low difficulty in assembly; while building block toys can be matched arbitrarily.

From 2016 to 2021, Bloco's products were mainly building block toys. In 2022, building block character toys were launched and mainly sold in blind boxes. Since then, the company's performance has officially entered an explosive period.

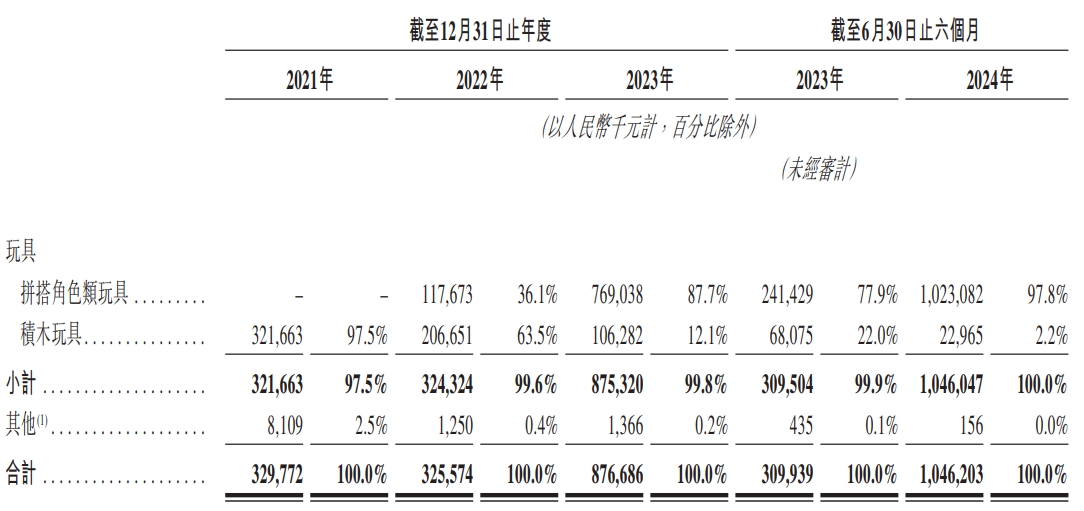

According to the prospectus, from 2021 to 2023, Bloco's revenues were 330 million yuan, 326 million yuan, and 877 million yuan, respectively. Among them, the revenue proportion of building block character toys was 0%, 36%, and 88%. In the first half of 2024, Bloco's revenue was 1.046 billion yuan, with a year-on-year growth of more than 200%. Among them, the year-on-year growth of building block character toys was more than three times, and the revenue proportion was as high as 98%. In terms of product form, from 2022 to the first half of 2024, Bloco the proportion of blind box sales in the total sales increased from 73% to 88.3%, and the proportion in the total revenue increased from 34.8% to 73.9%.

In terms of selling price, the average price of Bloco's building block character toys in the first half of 2024 is 18 yuan per piece, and the building blocks are 97 yuan per piece. The price composition is mainly the wholesale price for distributors.

Figure: Bloco's Revenue (Divided by Product Structure) Source: Company Announcement, Compiled by 36Kr

An obvious trend is that after 2022, Bloco has focused its business on building block character toys with greater growth potential. Currently, this is a wise choice. This is also supported by the company's gross margin, expense ratio and other data after 2022. The financial data performance of building block character toys is far better than that of building block toys.

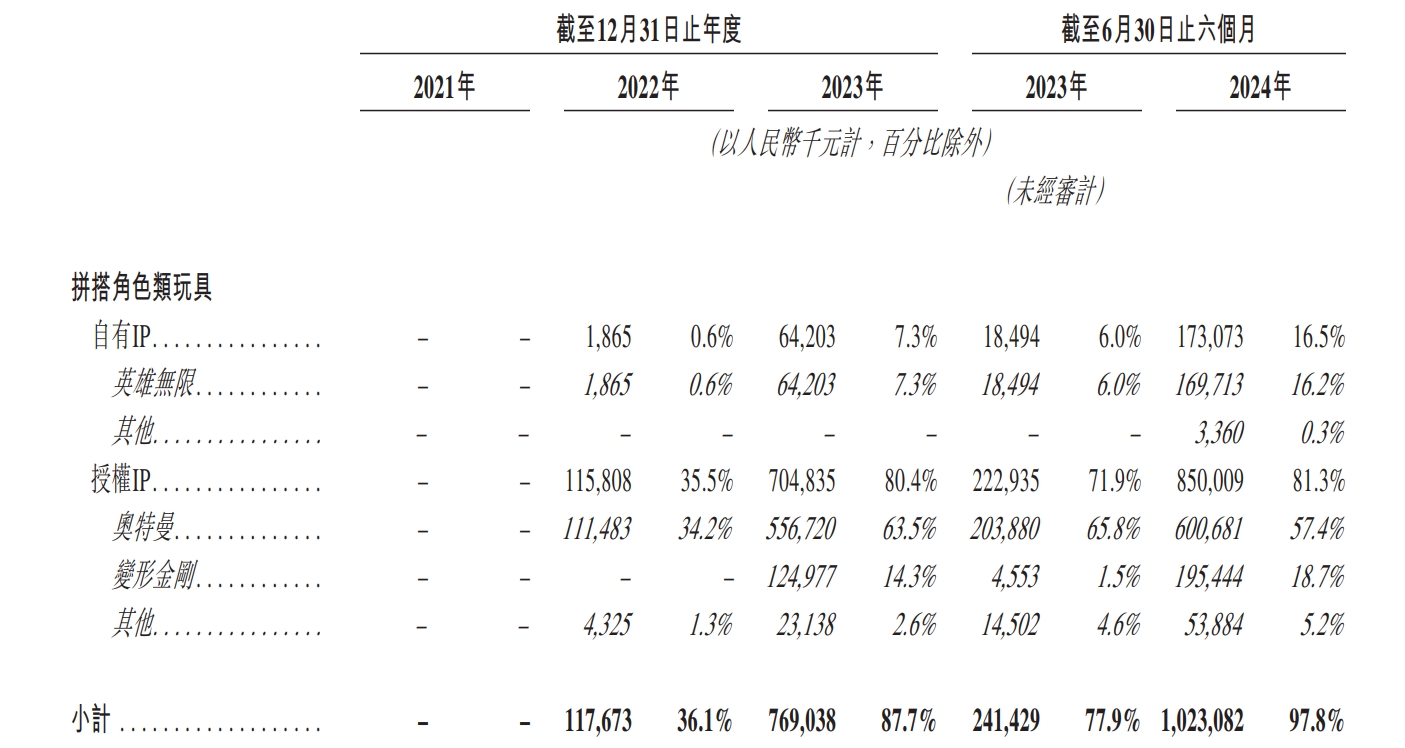

In terms of the composition of building block character toys, Bloco mainly uses licensed IPs (such as Ultraman, Transformers, etc.) and supplements with its own IP (Hero Infinity), and gradually increases the sales proportion of its own IP products. In terms of the audience, the core licensed IP of Bloco mainly targets the youth group, and the majority are male.

In terms of the construction of its own IP, Bloco has successively launched animated cartoons such as Transformable Bloco and Hero Infinity in recent years to strengthen the recognition of its own IP. In 2023, among Bloco's building block character toys, the revenue of licensed IP toys accounted for 92% (Ultraman IP accounted for 72%), and the revenue of its own IP toys accounted for only 8%. By the first half of 2024, the proportion of its own IP revenue reached 17%, and the proportion of licensed IP decreased to 83%.

Figure: Bloco's Revenue (Divided by IP Structure) Source: Company Announcement, Compiled by 36Kr

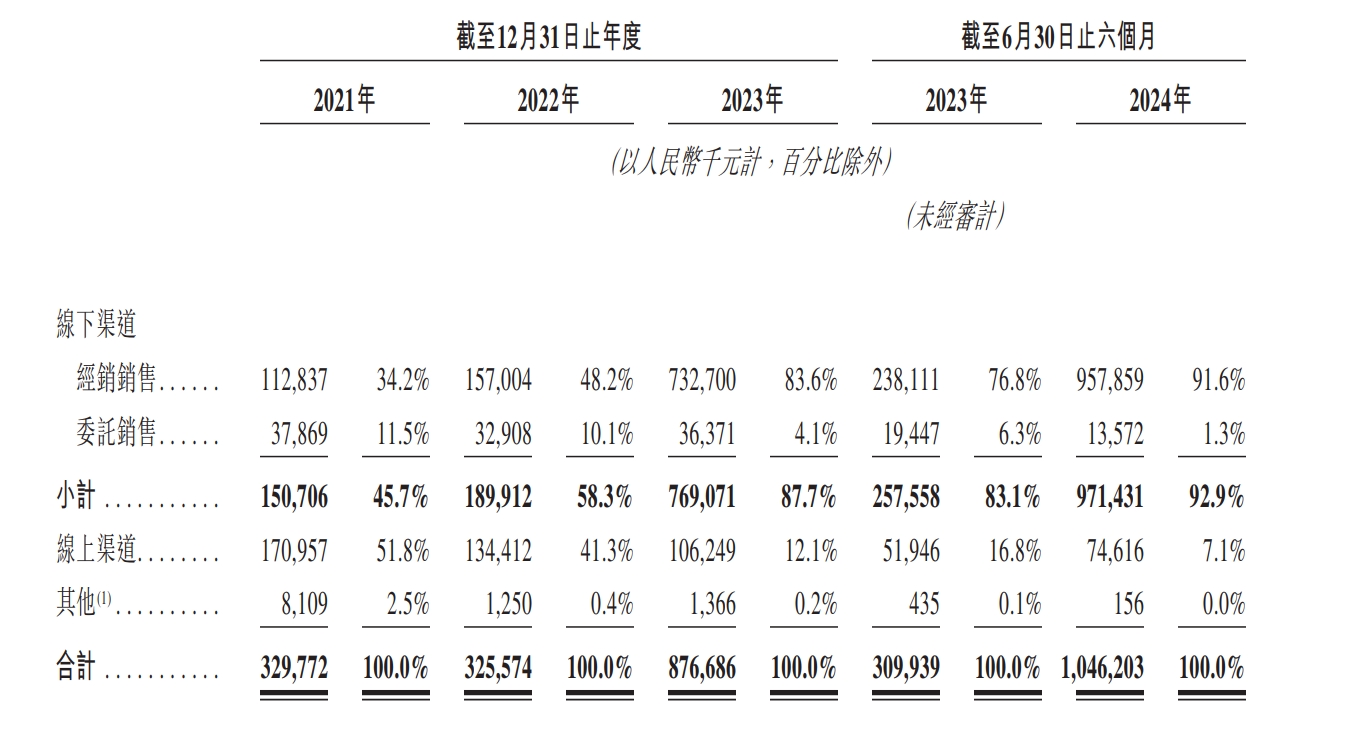

In terms of the business model, Bloco has mainly experienced a transformation from online direct sales to offline distribution, which is related to the change of the company's main products.

From 2021 to the first half of 2024, the proportion of the company's offline distributor revenue increased from 34.2% to more than 90%, and the number of distributors increased from 225 to 511, with about 70% distributed in second-tier cities and above. From the perspective of performance contribution, the number of Bloco's distributors increased by 84% from 2021 to 2023, but the corresponding revenue increase of the company was 166%. Therefore, Bloco's performance expansion is not simply relying on the expansion of the number of distributors. Its average sales to a single distributor increased from 501,400 yuan in 2021 to 1.4339 million yuan in 2023. In terms of the management and control of distributors, Bloco is in a strong position overall, such as setting a minimum purchase quantity for distributors and requiring ordinary distributors to pay before the goods arrive.

Regarding the reasons why Bloco changed its sales channels, there may be the following several aspects: First, the main product has shifted from building blocks to building block character toys, and the direct payer may shift from "parents" to "teenagers". Therefore, it is necessary to increase exposure through offline channels to reduce the difficulty of reaching a transaction. Opening up offline channels is equivalent to opening up the offline market; Second, the building block character products have added the attribute of blind boxes. Compared with online, consumers can get an immersive experience more easily through offline purchases, such as Pop Mart's offline revenue accounting for more than 80% in 2020 and still more than 60% in 2023.

In general, If Bloco's revenue in the first half of 2024 is simply multiplied by two, then its total revenue in 2024 is approximately close to that of Pop Mart in 2020. If the GMV is used as the accounting standard, Bloco is approximately equivalent to Pop Mart in 2021.

Finally, in terms of industry status, according to Frost & Sullivan data, taking the retail GMV of building block character toys in 2023 as an example, the global GMV of Bloco products is 1.8 billion, with a global market share of 6.3%, ranking third. The first and second are Bandai and Lego, both with a market share of more than 30%. The domestic market GMV is 1.7 billion, ranking first, with a market share of 30.3%, exceeding 20% of Bandai and 15% of Lego in China.

Figure: Bloco's Revenue (Divided by Sales Channel) Source: Company Announcement, Compiled by 36Kr

How to plan the IPO funds?

From the investment direction of Bloco's IPO funds, the company's future strategic planning can also be seen. According to the prospectus, among the funds that Bloco expects to raise net, the investment is mainly in five directions:

(1) 25% is used for product research and development.

(2) 25% is used for mold procurement and own capacity building.

(3) 20% is used for own and licensed IP construction.

(4) 20% is used for marketing.

(5) 10% is used for daily operations.

Bloco puts research and development at the top of the investment direction of the raised funds, because its blind box products need to continuously launch new products to meet the downstream market demand. After all, the key to the rapid expansion of blind boxes lies in the continuous repurchase of consumers. Moreover, since Bloco's licensed IP is not exclusively owned, it is also necessary to increase SKUs to form product differences. According to Bloco's disclosure, as of June 30, 2024, Bloco has 431 SKUs on sale, including 116 SKUs mainly for children under 6 years old, 295 SKUs for people aged 6 to 16, and 20 SKUs for people over 16.

Own capacity building and mold procurement rank second because Bloco currently has no production capacity, and its building block toy products mainly rely on outsourcing. With the expansion of the company's sales scale, Bloco naturally does not want to be "controlled by others" in the production end. According to Bloco's disclosure, the company's average monthly sales volume in the first half of 2024 is about 9.3 million pieces, and the monthly production capacity of its own factory after completion is 9 million pieces. Therefore, after the completion of its own factory, the production capacity can already meet the demand in 2024.

Ranked third is the expenditure related to IP. Bloco expects to use HK$65 million for its own IP construction, and the capital investment related to the third-party licensed IP is about HK$179 million. It can be seen that currently, Bloco is not promoting the construction of its own IP in an aggressive manner, and it still places the licensed IP in a relatively important position.

This is different from Pop Mart's strategy of strongly promoting its own IP through direct sales. Under the direct sales channel, after the own IP is displayed in the core position in the store, it can gather consumers' attention and strengthen the IP recognition. However, under the distribution channel, the own IP products are often displayed at the same time as other popular IP products. The attention of consumers entering the store will be dispersed by the popular IP, making it difficult to achieve sales and also affecting the inventory turnover of distributors.

Therefore, under the background of channel constraints and insufficient potential of its own IP, we judge that Bloco's toy products will be mainly licensed IP in the next few years, while promoting the construction of its own IP in a gradual manner. Naturally, the stability of the licensed IP is crucial to Bloco's operation, which is also the main reason why Bloco is willing to invest a large amount of funds in the third-party IP. It is expected that in the future, Bloco will focus on balancing the contribution of each IP to the company's revenue to thereby diversify the renewal risk of the licensed IP.

In general, Bloco's fundraising investment plan relatively clearly reflects the company's future strategic planning. From the balance sheet data, as of the first half of 2024, Bloco has about 550 million yuan in cash on its books, and a considerable part of it comes from extending the payment period of suppliers. Therefore, the IPO funds can be said to be a "huge sum" for Bloco, which is very important for the company to rapidly expand its business scale.

Large book losses, but actually has the ability to generate blood

Bloco focuses on building block character toys and increases the construction of its own IP. On the one hand, it is able to expand in scale in the form of blind boxes at a low unit price, and on the other hand, the relevant products have a higher profit ability after reaching a certain scale.

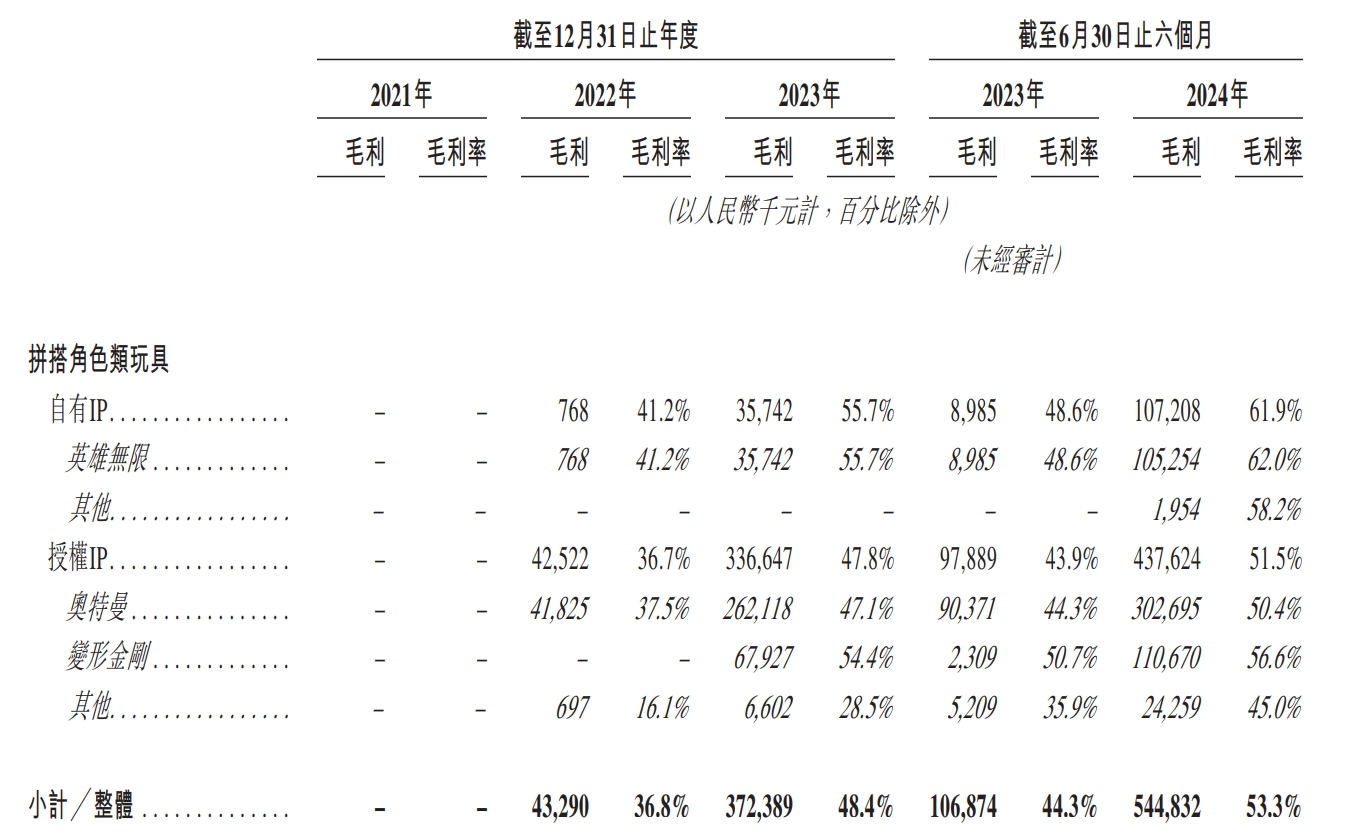

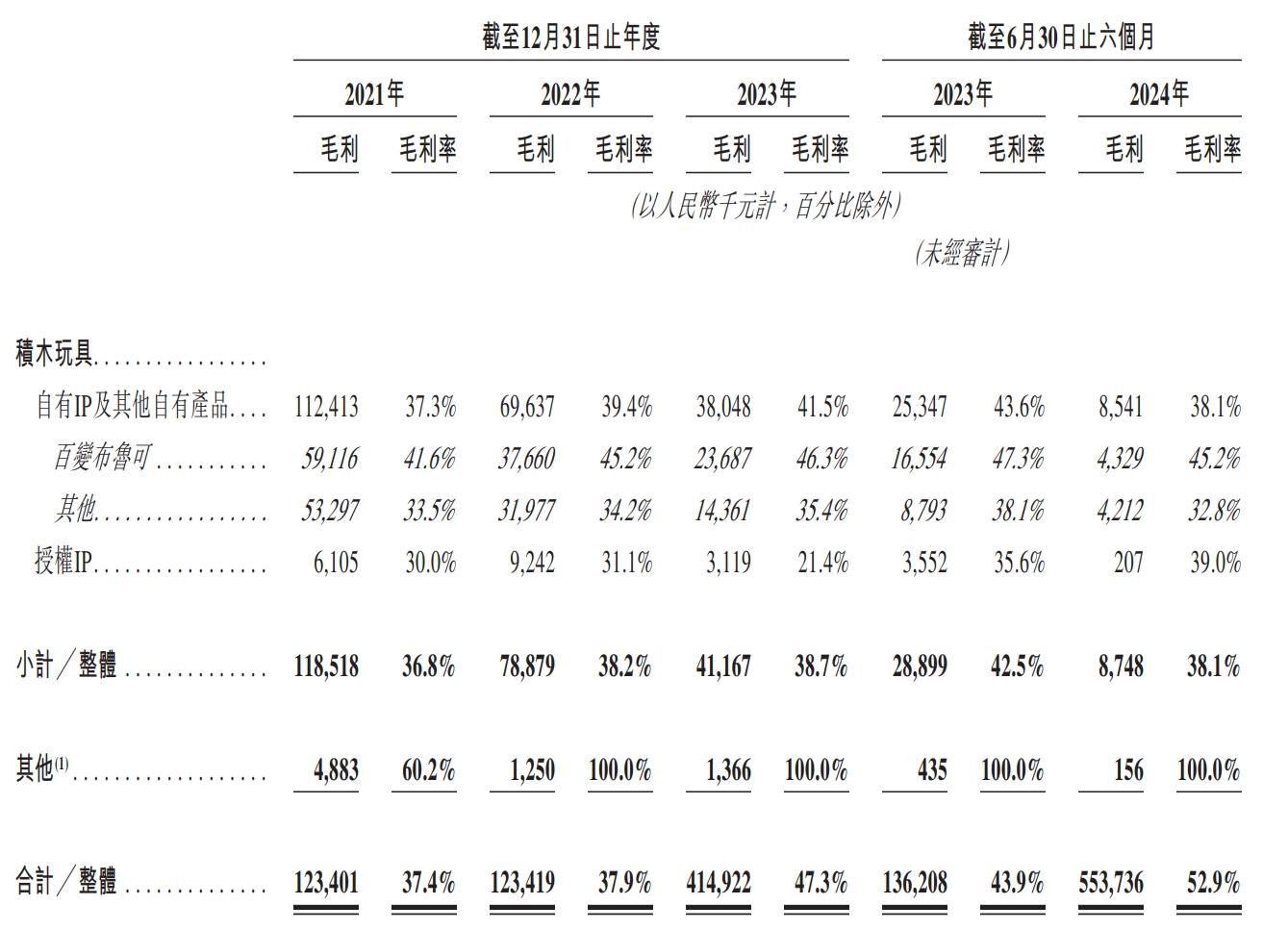

The data in the prospectus shows that the overall gross margin of building block character toys in the first half of 2024 is 53.3%, showing a continuous upward trend, while the building block toys are only 38.1%. According to the IP classification, among the building block character toys, the gross margin of licensed IP products is 51.5%, and the gross margin of its own IP is 61.9%. The reason is also very simple. The own IP does not need to pay the licensing fee, so the cost is also lower. In addition, Bloco disclosed that the calculation method of the IP fee it pays is the higher of the fixed amount or the settlement according to the sales proportion. The increase in the sales volume of the company's related products cannot amortize the IP expenditure.

Regarding why the gross margin of building block character toys is much higher than that of building block toys, the main reason is the aforementioned scale effect. As mentioned earlier, Bloco currently has almost no own production capacity, and its related products are mainly outsourced. After the increase in the purchase volume, the company's bargaining power can also be enhanced.

Figure: Bloco's Gross Margin of Building Block Character Toys Source: Company Announcement, Compiled by 36Kr

Figure: Bloco's Gross Margin of Building Block Toys Source: Company Announcement, Compiled by 36Kr

Looking at the expense structure. In 2021, Bloco's business was mainly building block