"BLUK" listed on the Hong Kong Stock Exchange today, becoming the hottest new stock in 2025 | Focus Analysis

On January 10, Bu Lu Ke officially rang the bell and listed on the Hong Kong Stock Exchange. The IPO was priced at the upper limit of HK$60.35 (raising HK$16.74 billion), and the opening price increased by 75.64% to HK$106, with a market value exceeding HK$25.5 billion.

Bell-ringing Ceremony

The information on the last round of equity transfer before the listing shows that the share price of Bu Lu Ke was RMB 32.27 at that time, equivalent to a 73% increase compared to the IPO pricing. It was only a 9-month gap.

In fact, the poor liquidity of the Hong Kong stock market has always been criticized, but the consumer sector of the Hong Kong stock market rose against the trend in 2024. For example, Pop Mart and Lao Pu Gold have both increased several times. This has also raised the expectations of investors, bringing back the new share subscription trend.

For Bu Lu Ke, it caught a good listing timing. On the one hand, the capital market is in an active period, and on the other hand, the entire industry sector is booming. Eventually, its subscription was extremely popular, with a subscription ratio of over 10,000 times. The total margin subscription amount in the entire market reached HK$877.496 billion, and the margin subscription multiple was 6,027.58 times. It successfully entered the top three in the Hong Kong stock market, second only to Ant Financial and Kuaishou.

Greenwoods Asset Management, UBS, and Fullgoal Fund also became cornerstone investors, subscribing for US$20 million, US$20 million, and US$10 million respectively.

In fact, to understand Bu Lu Ke, you only need to know these three points:

How does it make money? How well does it perform?

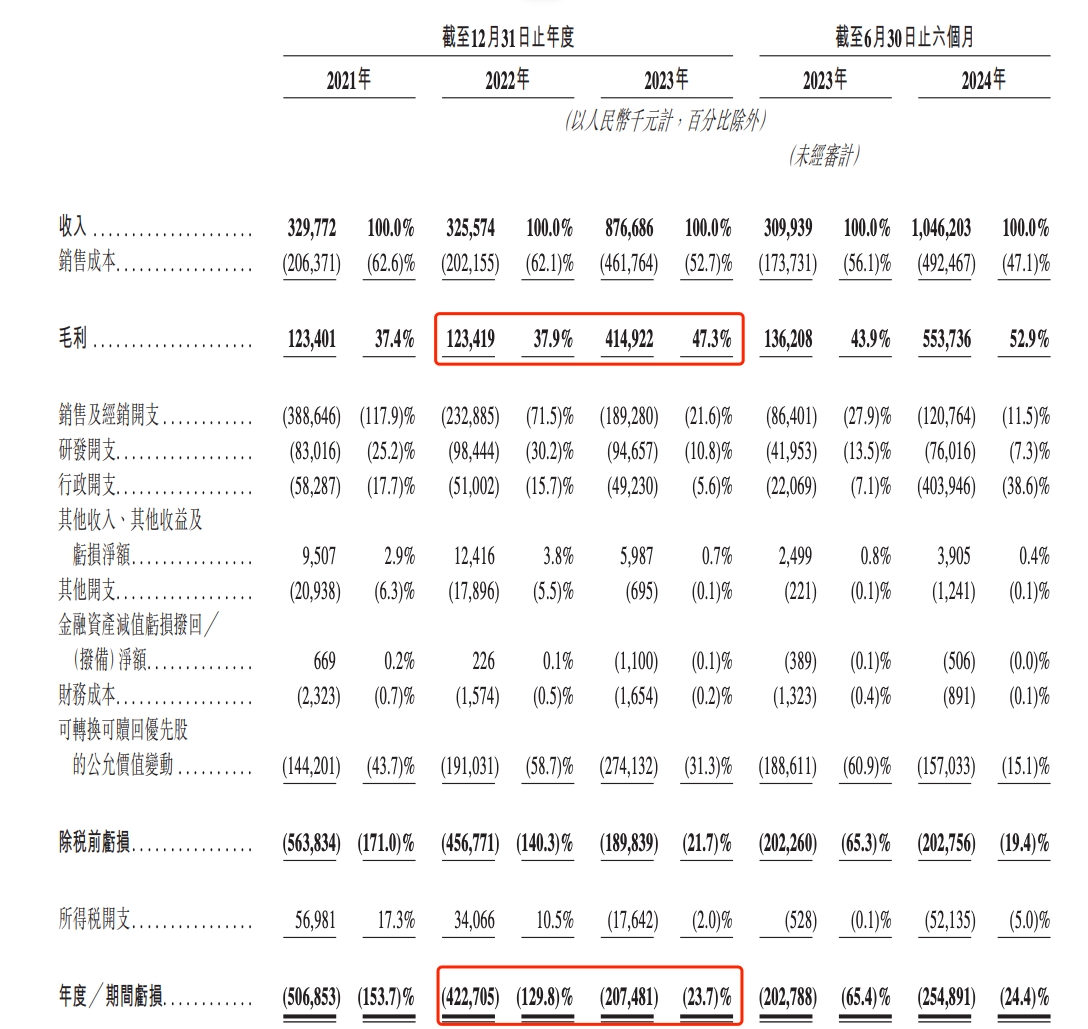

Let's first look at the overall revenue situation. Bu Lu Ke's revenues in 2021, 2022, and 2023 were RMB 330 million, RMB 326 million, and RMB 877 million respectively; gross profits were RMB 123 million, RMB 123 million, and RMB 415 million respectively; gross profit margins were 37.4%, 37.9%, and 47.3% respectively; and corresponding profits were -RMB 507 million, -RMB 423 million, and -RMB 207 million respectively.

Performance Overview

Bu Lu Ke is still in a loss-making state, with a total loss of over RMB 1.1 billion in three years. However, the narrowing of losses and the maintenance of high revenue growth are good signs, which are much more optimistic than the situation where revenue increases but losses also expand. It can be clearly seen that Bu Lu Ke's performance really took off in 2023, with a growth of 169.3% compared to 2022. Why is it 2023?

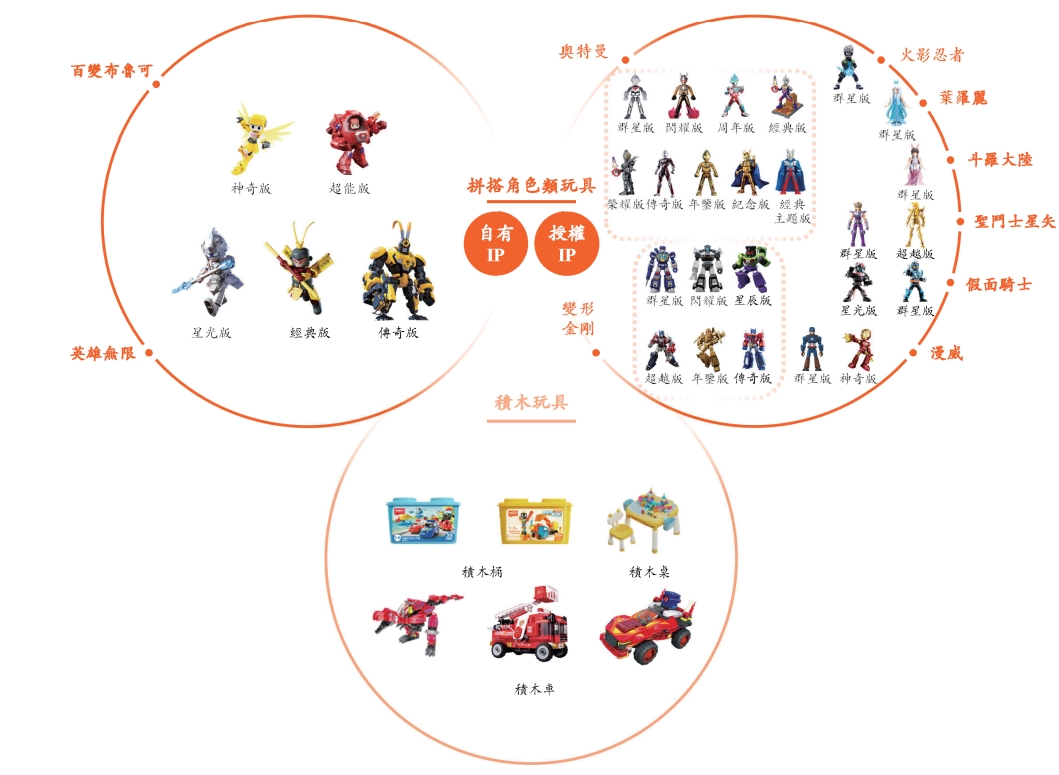

The answer lies in the large volume of the Ultraman IP toys. Bu Lu Ke first obtained the Ultraman licensing agreement in 2021, started selling it in Q1 of 2022 with 140,000 pieces sold, and the Ultraman IP contributed RMB 110 million in revenue throughout the year, accounting for one-third. At the beginning of 2023, Bu Lu Ke's Ultraman IP sales exceeded one million pieces (in a single quarter) for the first time, and at the end of Q4, it once exceeded 4 million pieces. Therefore, the Ultraman IP contributed RMB 557 million in revenue throughout 2023, accounting for 63.5%.

Looking at it in detail, the average price of Bu Lu Ke's Ultraman toys in 2023 was RMB 21, an increase of RMB 2. The sales volume was 26.62 million pieces, more than four times that of the previous year.

Besides Ultraman, Bu Lu Ke also started selling Transformers IP toys in 2023, contributing RMB 125 million in revenue that year. The average price of Transformers is RMB 2 more expensive than Ultraman, at RMB 23, with a sales volume of 5.38 million pieces. Equivalently, the Ultraman and Transformers IPs contributed 80% of Bu Lu Ke's revenue.

Bu Lu Ke also has its own IP, Hero Infinity. Its revenue was RMB 1.87 million in 2022 and increased to RMB 64.2 million in 2023. Therefore, nearly 90% of Bu Lu Ke's revenue is contributed by building-block character toys, and 80% of that is contributed by licensed IPs.

In the first half of 2024, Bu Lu Ke's building-block toys contributed RMB 1.02 billion in revenue, which is more than RMB 200 million higher than the entire year of 2023, continuing the high growth. Among them, the licensed IPs of Ultraman and Transformers are also higher than the entire year of 2023, and the own IP Hero Infinity is more than twice that of the entire year of 2023 (with a small base).

In terms of total revenue, Bu Lu Ke's revenue in the first half of 2024 was RMB 1.046 billion, compared with RMB 310 million in the same period of the previous year; the gross profit was RMB 554 million, compared with RMB 136 million in the same period of the previous year; and the loss during the period was RMB 255 million, compared with RMB 203 million in the same period of the previous year.

As of September 30, 2024, Bu Lu Ke's revenue was RMB 1.69 billion, an increase of 177.2% year-on-year. It recorded a gross profit of RMB 870 million, an increase of 220.7% year-on-year.

How is the future growth potential?

If estimated based on the half-year data, Bu Lu Ke's full-year revenue in 2024 is approximately RMB 2.09 billion, compared with RMB 880 million in the previous year, a doubling growth. In terms of losses, both in 2023 and the first half of 2024, they are around 24% of the revenue. Similarly calculated, Bu Lu Ke is expected to lose RMB 500 million in the full year of 2024. Including the listing expenses, the number may be even larger.

For the future growth potential, in addition to continuing to focus on the increment of the licensed IPs Ultraman (expiring in 2027) and Transformers (expiring in 2028), as well as the own IP Hero Infinity. What is more worthy of attention is that Bu Lu Ke has obtained the commercialization process of 50 well-known IPs, including Naruto, Marvel, Infinity Saga and Spider-Man and His Amazing Friends, Minions, Pokémon, Kamen Rider, Detective Conan, Hatsune Miku, Saint Seiya, Neon Genesis Evangelion, Hello Kitty, Sesame Street, Super Sentai, DC Superman, DC Batman, Harry Potter and Star Wars, etc.

Product System

According to the prospectus, Bu Lu Ke has more than 500 patent layouts, strengthening the ability of the original IP matrix. In terms of users, it has completed the layout of all age groups. As of the first half of 2024, Bu Lu Ke has 431 SKUs on sale, including 116 SKUs mainly for children under 6 years old, 295 SKUs mainly for people aged 6 to 16, and 20 SKUs mainly for people over 16 years old.

That is to say, with global IPs and all age groups, Bu Lu Ke has built a global layout.

Currently, the global building-block character toy company with the highest market share is Bandai in Japan. Its revenue in 2023 was RMB 48.8 billion, with a profit of RMB 3.17 billion, and a market share of 39.5%; the second is Lego in Denmark. Its revenue in 2023 was RMB 69.2 billion, with a profit of RMB 13.76 billion, and a market share of 35.9%.

In comparison, Bu Lu Ke's current size is really too small. The future expectations lie in the high growth of the industry on the one hand. According to Sullivan's data, the global penetration rate is only 8%, but the average annual compound growth rate is 20.5%; among them, China's growth is the fastest, which is twice that of the global average; on the other hand, it may be to seize the market of Bandai and Lego. As for how much it can seize, it can only be continuously tracked.

In addition, Bu Lu Ke is also regarded as "the next Pop Mart". In fact, Pop Mart's stock price first took off in October 2022, but its revenue growth in the last year was only 2%, affected by the epidemic. In 2023, its revenue growth was 36%, and its profit doubled, but the stock price did not rise.

It was not until February 2024 that the stock price began to soar, increasing more than three times throughout the year. The catalyst lies in the increase in overseas business. In Q1 of 2024, its domestic growth was only 20%, but its overseas growth was 240%. In the first three quarters of 2024, the overseas growth was even 440%, directly shocking the capital market. Currently, Pop Mart's market value is RMB 110 billion, with a dynamic PE of 70 times. However, Bu Lu Ke has no profit yet and cannot be valued by PE, and can only be referred to by PS.

However, the increasing cost of licensing fees is also worthy of attention. In 2023, the expenditure was RMB 72.979 million, accounting for 8.3% of the total revenue.

3. Team Background

The founder, Zhu Weisong, is 42 years old and is a serial entrepreneur. Previously, he co-founded the game company YOOZOO Games in 2009 and served as the CTO. After YOOZOO Games was listed on the A-share market in 2014, he began to gradually withdraw and start a new business.

Therefore, Zhu Weisong has a strong capital appeal. From 2018 to February 2020, Bu Lu Ke raised RMB 887 million in the angel round alone, attracting institutions such as Legend Capital and CTV Golden Bridge. At this time, the share price was RMB 22.79.

In the second half of 2020, Bu Lu Ke conducted the Pre-A round of financing, attracting RMB 330 million, and Source Code Capital entered.

In 2021, Bu Lu Ke raised RMB 600 million in the A round of financing, and Yunfeng Capital entered and invested RMB 330 million. Yunfeng Capital also successfully became the third largest shareholder. At this time, the share price rose to RMB 31.17.

Since then, Bu Lu Ke has not received any new financing until this Hong Kong IPO. After the IPO, Zhu Weisong's equity decreased to 49.47%, and President Sheng Xiaofeng holds 1.81%.

As of 2024, Bu Lu Ke has 519 employees, of which 64% are R & D personnel. This also conforms to the genes of Zhu Weisong, who is born in technology. As he said in an interview in 2019, "The Chinese (toy market) is basically dominated by most foreign brands. Chinese brands are relatively low-end, and most (products) are knockoffs, which is quite sad. I have also talked with many Chinese toy bosses, and most of them do not think that knockoffs are bad. This is the current situation."