Office rents in Beijing have dropped to the 2011 level, and the vacancy rates in CBD, Financial Street, and Yansha are still rising.

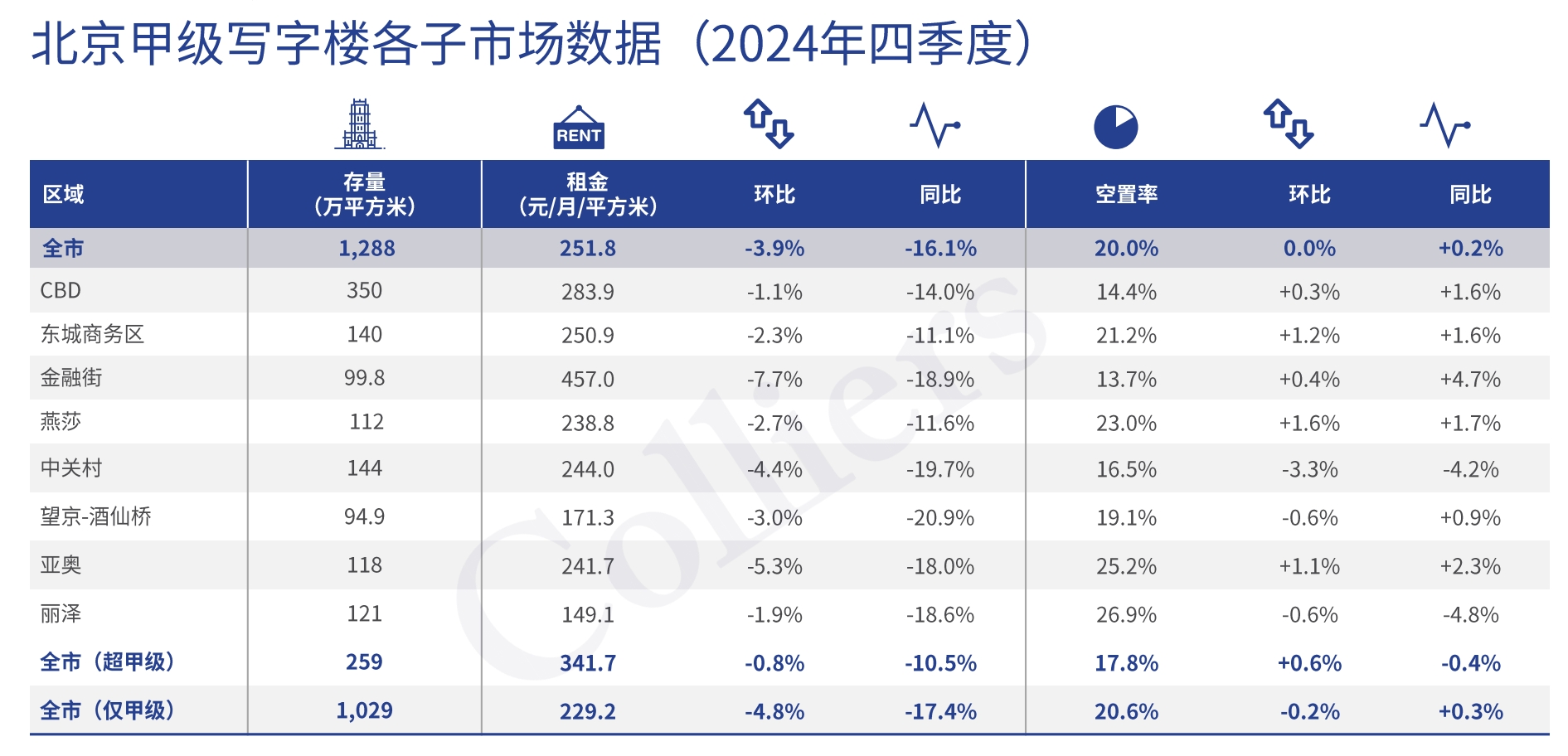

By the end of 2024, the stock of office buildings in Beijing is close to 23 million square meters. Among them, Grade A office buildings are approximately 12.882 million square meters, and Grade B office buildings are 9.877 million square meters.

The proportion of the stock of the Beijing office building market. Data source: Colliers International

In terms of rent, the latest report released by Colliers International shows that the market has continued to "trade price for quantity" throughout the year. The year-end rent of Grade A office buildings has decreased by 16.1% year-on-year, the largest decline since the historical record, and has dropped to the market level in 2011.

The good news is that the rent decline in the fourth quarter of last year narrowed quarter-on-quarter. With the support of enterprise relocation and integration and the demand of state-owned enterprises and central enterprises, the annual market demand reached 300,000 square meters, an increase of 244% compared with 2023.

The performance differences of different business sub-markets are widening. Among them, the vacancy rates of Grade A office buildings in CBD, Dongcheng Business District, Financial Street, and Lufthansa Area continue to rise quarter-on-quarter. The overall vacancy rates in Dongcheng Business District, Lufthansa, Ya'ao, and Lize have exceeded 20%.

Data source: Colliers International

Affected by the continuous rise in the vacancy rate and the continuous narrowing of the rent gap between Grade A and Grade B office building projects, the competition among sub-markets and across asset classes is increasing. This has also led to a significant reduction in office building rents in business districts with strong market demand such as Zhongguancun and Financial Street, and the prices of some projects with a high rental rate have begun to loosen.

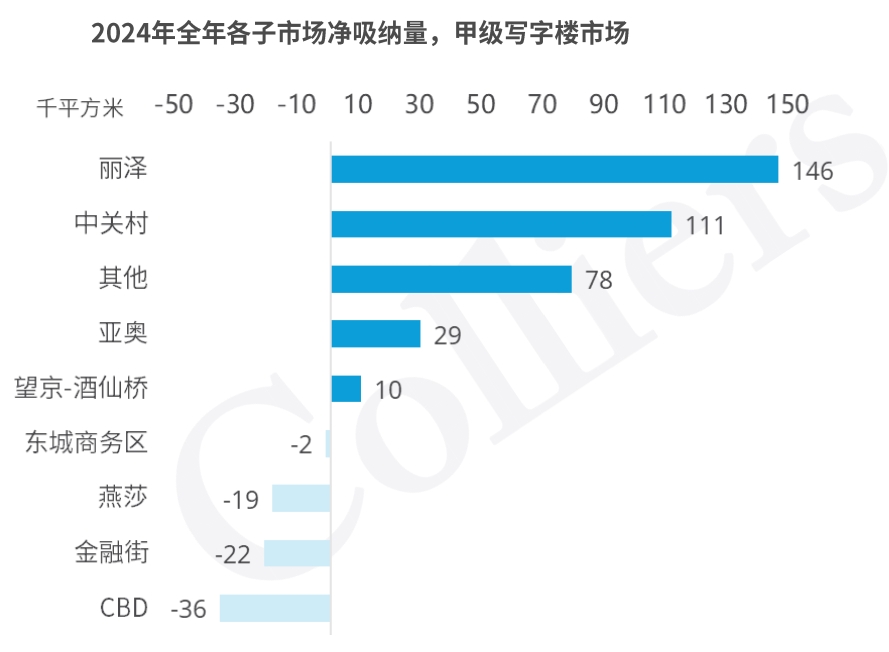

From the perspective of sub-markets, the market digestion volume of the two business districts of Lize and Zhongguancun accounts for nearly 80% of the city's total for the whole year.

Among them, Lize maintains the average digestion rate of the past five years. Benefiting from the advantages of the aggregation of the science and innovation industry in the region, the Zhongguancun market has been the first to benefit from the development dividend of new-quality productive force-related enterprises, with an annual digestion of 110,000 square meters.

Data source: Colliers International

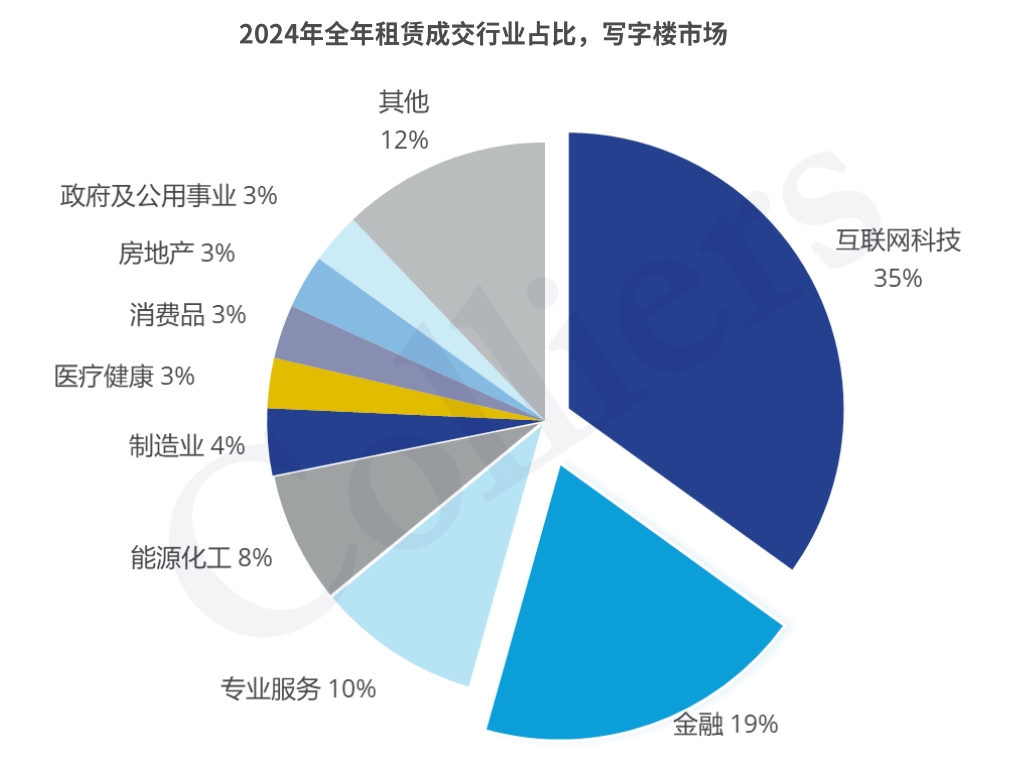

From the perspective of industry demand, Internet technology, finance, and professional services are still the top three main sources of demand throughout the year.

Data source: Colliers International

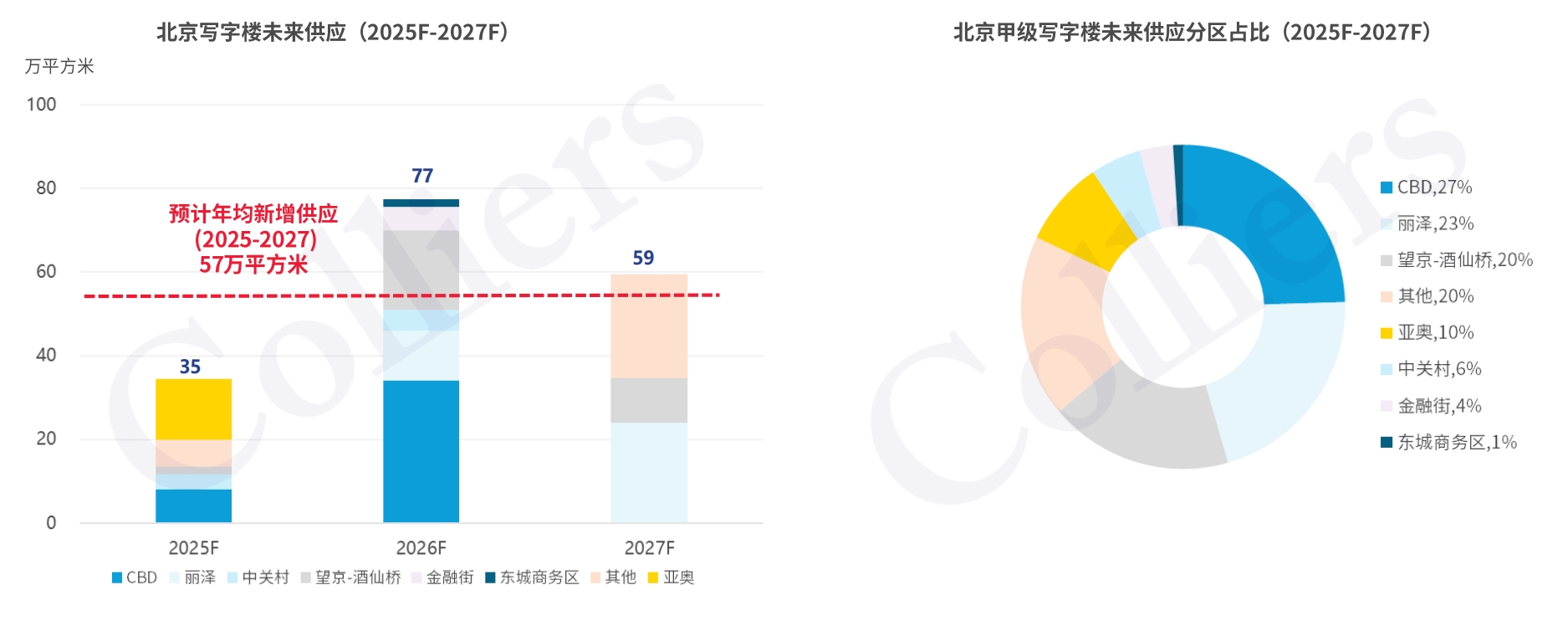

Colliers International predicts that due to the increase in supply in the next two years and the continued uncertainty on the demand side, the market vacancy rate will still rise in fluctuations. Therefore, the rent will also be in a downward channel. The market opportunities mainly lie in the different industrial characteristics of each sub-market, resulting in structural and regional bottom opportunities.

Data source: Colliers International