Zhike | Once the top AI "monster stock", how many cards does ChineseAll Digital Publishing Group still have left?

Author | Ding Mao

Editor | Zheng Huaizhou

In the A-share market, ChineseAll is a unique existence.

As the pioneer of online literature websites, what makes ChineseAll most renowned in the secondary market is not its online literature business, but its fluctuating stock price performance and the support of over 30 concepts behind it.

Figure: Stock price performance of ChineseAll since its listing Data source: Wind, 36Kr

In 2015, ChineseAll entered the A-share market with the title of "the first digital publishing stock". Subsequently, with the support of concepts such as new shares and online education, the stock price experienced an explosive growth. It rose from around 1.6 yuan to a historical high of over 50 yuan in just 10 months, with a cumulative increase of more than 2600%. However, the good times did not last long. As the valuation bubble burst, the company's stock price began to plummet at the end of 2015, once falling to the freezing point of 3.2 yuan in 2020, and has long hovered around ten yuan.

However, in the past two years, driven by popular concepts such as short dramas, AI, and Guzi Economy, ChineseAll has once again stood at the forefront.

Since the end of October 2022, the company's stock price has rebounded from around 7 yuan, reaching a maximum of around 36 yuan. Then, at the end of December, it experienced a correction as the Guzi Economy concept cooled down, but it is still maintained at around 23 yuan. The cumulative increase since October 2022 is more than 230%, with an annualized return of up to 75%.

But it is thought-provoking that, from the perspective of the company's performance, regardless of the stock price carnival in 2015 or 2022, the fundamentals of ChineseAll have not shown a significant improvement. From 2015 to 2023, the company's operating income increased from 390 million yuan to 1.41 billion yuan, with an annualized growth rate of about 15%; during the same period, the net profit attributable to the parent company expanded from 31 million yuan to 89 million yuan, with an annualized growth rate of less than 13%. And as of the third quarter of 2024, the company's accumulated net loss attributable to the parent is nearly 2.3 billion. If viewed from the quarterly financial statements, the net profit attributable to the parent in its single quarter in the past two years has been in a continuous loss state. At the same time, the content platform business, which has mainly been the company's own platform reading and distribution business for many years, is still the company's largest source of income, currently accounting for more than 50%.

Figure: Revenue and net profit performance of ChineseAll since its listing Data source: Wind, 36Kr

These signs indicate that although there are many concepts to support it, ChineseAll has actually not obtained substantial business support from them. The popular concepts have mostly only brought emotional restlessness to it, boosting the high volatility performance of the secondary market.

So, what kind of company is ChineseAll? What is the driving force behind this round of stock price increase? Is it still worth investing in the future?

The Overseas "Domineering President" Helps the Stock Price Rise

Looking back at this round of increase that began in 2022, a very important driving force behind it is the expansion of ChineseAll's short drama business, especially the rapid growth of its short drama overseas business in 2023.

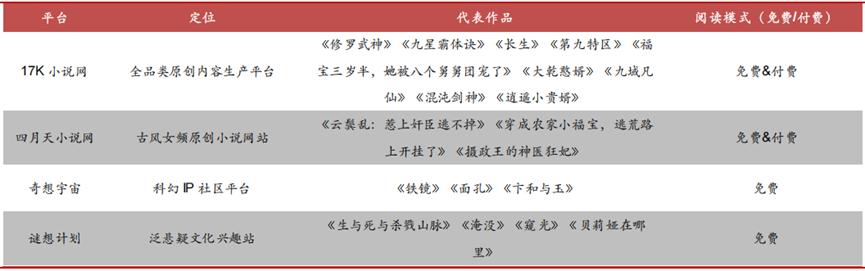

For investors, the most familiar identity of ChineseAll is the pioneer of domestic online literature websites. Its 17k Novel Website, April Day, Wonder Universe, Mystery Plan, and other original platforms are well-known to many online literature enthusiasts. With these original platforms, 4.5 million online original resident authors, and more than 2,000 signed well-known writers and best-selling authors, the company has accumulated more than 5.6 million kinds of digital content resources. It charges C-end users through its own original platform, and at the same time, it is distributed and realized to the B-end by being delivered to top Internet reading platforms such as WeChat Reading, QQ Reading, Baidu Mobile, and major operator platforms.

Figure: Layout of ChineseAll's online literature platforms Data source: Zhongtai Securities, 36Kr

However, with the rise of short videos in the past two years, the scale of the domestic online literature market has continued to shrink. In 2023, the market scale of online literature reading in China was 40.43 billion yuan, with a year-on-year growth of only 3.8%. Affected by this, the main business of ChineseAll's online content has also entered a bottleneck period. In 2023, its digital content business revenue was 712 million yuan, a year-on-year decrease of 12.19%, and in the first half of 2024, this business still showed a 10.3% decline.

In order to seek new growth momentum, after 2020, the company began to continuously exert efforts in the IP derivative business, with the expectation of upgrading from a single online literature production and operation to the full life cycle operation of literary IP. The so-called IP derivative business is to take the literary IP as the core and extend downstream to conduct the full-modal development of derivative forms such as audio, comics, animation, short dramas, film and television, games, and cultural and creative peripheral products.

For ChineseAll, the film and television adaptation of literary IP is a very important part of the derivative business.

In fact, since 2020, ChineseAll has begun to test the waters in the video field. First, it jointly established the Chinese Miracle Film and Television Company with iQIYI to focus on IP film and television operations; later, it jointly established Chinese Wannian with Wannian Film Industry, with the main business of developing and producing live-action films and television, further promoting the film and television adaptation of the company's high-quality IP. During this period, online dramas such as "He Crossed the Mountains and Seas to Come" and "Hua Liuli Yiwen" were launched one after another.

But unlike Yuewen Group, which quickly became famous with high-quality online dramas such as "Joy of Life", the online drama business did not bring too much traffic to ChineseAll. Instead, the rise of the short drama business has become the driving force for the company to break through the circle.

In 2021, ChineseAll began to test the water in the medium and short drama business. Based on its rich IP advantages, it launched short dramas such as "Don't Mess with My Sister", "I'm Breaking Up the Official Couple Every Day", and "The Imperial Concubine Becomes the Top Celebrity in the Entertainment Industry", and established the mini-program short drama platform Wild Elephant Theater. With continuous efforts, the launch of "Provoke" in 2023 finally allowed ChineseAll to gain a foothold in the domestic short drama field. The popularity of this drama exceeded 20,000 within 10 hours of its launch, with a cumulative revenue share of over 20 million yuan, setting the highest record for Tencent short dramas.

Figure: Revenue share performance of the Top 10 short dramas from January to November 2023 Data source: Dongwu Securities, 36Kr

However, due to the serious homogeneity and extremely fierce competition in the domestic short drama market, coupled with the low willingness of consumers to pay and the extremely high cost of promoting traffic, most short drama platforms are in a state of spending money to gain popularity. In this context, In 2022, ChineseAll regarded the overseas expansion of short dramas as the key to breaking the deadlock.

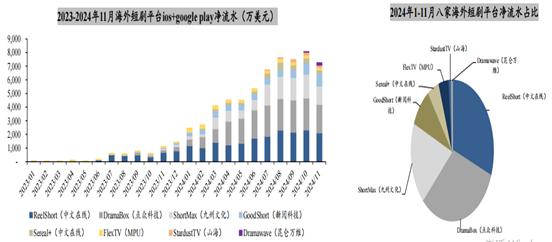

In August 2022, the subsidiary of ChineseAll, Maple Interactive (CMS), launched the short drama platform ReelShort, focusing on the North American short drama market. It adopts a localized operation and shooting method, uses social media for drainage, and actively promotes short dramas with themes such as werewolves, domineering presidents, and vampires. After nearly a year of operation, in July 2023, with the explosion of the two short dramas "Fated To My Forbidden Alpha" and "Never Divorce a Secret Billionaire Heiress", the download volume of ReelShort experienced a rapid growth, repeatedly occupying the top of the download list of the Android and Apple app stores in overseas markets, and firmly establishing itself as the leader in overseas short dramas. According to Sensor Tower data, in January 2023, the net revenue of ReelShort on both ends was only 56,000 US dollars, which exceeded one million US dollars in June. Then, it experienced an explosive expansion in the third and fourth quarters. The revenue in the third quarter was 14.842 million US dollars, and further increased to 18.298 million US dollars in the fourth quarter. The cumulative net revenue on both ends in 2023 reached 36.12 million US dollars. At the same time, the download volume (IOS) also soared from 89,000 in January to 4.443 million in November.

After entering 2024, ReelShort still maintains a rapid expansion trend. From January to November 2024, the net revenue of the platform on both ends has reached 190 million US dollars, which is more than five times that of the whole year of 2023. In terms of the competitive landscape, the market share of ReelShort has been basically stable at around 30% in recent months. And according to Diandian Data, in the first week of 2025, ReelShort once again topped the first place in the Apple Free Overall Chart, with an average daily playback volume of more than 30M, and it is still the largest short drama platform in North America.

Figure: Net revenue and proportion of overseas short drama platforms Data source: SensorTower, Dongwu Securities, 36Kr

Benefiting from the rapid expansion of revenue, the revenue of CMS also experienced a synchronous explosion. According to the company's financial report, the revenue of CMS in 2022 was 366 million yuan, and it increased by 87% to 686 million yuan in 2023. In the first half of 2024, it further increased to 1.087 billion yuan, with a year-on-year growth rate of more than 300%.

CMS Removed from the Consolidated Financial Statements, Revenue Declines

Although ReelShort is developing rapidly, the rapid growth of overseas short dramas has not brought substantial performance support to ChineseAll. The main reason is that the revenue of CMS has no longer been included in the financial statements of the parent company ChineseAll since May 2023.

According to the announcement of ChineseAll in April 2023, the voting rights of its overseas subsidiary CMS were adjusted from 50.9% to 47.8%, and the shareholding ratio remained unchanged at 49.16%. After being removed from the consolidated financial statements after May 1, 2023, it was changed to the equity method for measurement. That is to say, in fact, after May 2023, the income of CMS is no longer included in the consolidated financial statements of ChineseAll, but only shares its profits in proportion and is included in investment income.

As mentioned earlier, the explosion of ReelShort's revenue began after July 2023, but at that time CMS was already in a removed state. That is to say, from a financial substantive perspective, the rapid expansion of ReelShort's revenue scale has not brought actual performance support to ChineseAll. Instead, due to the removal of other businesses from the consolidated financial statements, the revenue of ChineseAll has also declined to a certain extent.

Taking the first half of 2024 as an example, ChineseAll achieved a revenue of 462 million yuan in 2024H1, a year-on-year decline of 29%; the revenue of CMS in 2023H1 was 263 million yuan. Simply calculated according to the shareholding ratio of 49.16% (assuming the impact of being removed from the consolidated financial statements in June 2023 is ignored), the revenue contributed by the subsidiary CMS to ChineseAll in 2023H1 was 129 million yuan, accounting for nearly 20% of its total revenue at that time. If this part of the income is excluded, the revenue decline of ChineseAll in the first half of 2024 will be significantly reduced.

In terms of profits, since CMS is treated as an equity investment after being removed from the consolidated financial statements, its profits will be proportionally included in the investment income of ChineseAll and ultimately reflected in the net profit. Therefore, in fact, the impact of CMS being removed from the consolidated financial statements on the profit of ChineseAll is relatively small. Moreover, considering that the overseas short drama itself is also in the stage of investing in traffic in exchange for growth, the profit performance of CMS short dramas is not as outstanding as the revenue expansion. The net profit attributable to the parent of CMS in 2023 was only 240,000 yuan, and although it increased by 299% in the first half of 2024, it was only 2.3 million yuan. Therefore, the impact of CMS being removed from the consolidated financial statements on the overall profitability of ChineseAll is very limited.

What is the Core Logic of the Increase?

Since CMS has been removed from the consolidated financial statements and the rapid expansion of ReelShort theoretically cannot directly benefit the performance of ChineseAll, then why does the market still favor ChineseAll's short drama business?

First, the explosion of ReelShort indicates that the ChineseAll model has completely succeeded in the overseas short drama track. In this context, although CMS no longer contributes to the scale expansion, with the marginal reduction of the overall cost after the platform's large-scale operation, the future profitability of CMS is likely to be significantly improved, thereby directly contributing to the long-term and stable profit growth of the parent company ChineseAll.

Secondly, and more crucially, Based on the successful experience of ReelShort, ChineseAll has the ability to quickly replicate it to other overseas short drama business platforms, forming a rich short drama product matrix at home and abroad, consolidating the short drama business and expanding the second growth curve.

Behind this successful experience, on the one hand, it benefits from ChineseAll's holding of a large amount of literary IP resources,