Zhike | Why Is Trump Trade 2.0 Meeting with Cold Response?

Author | Huang Yida

Editor | Zheng Huaizhou

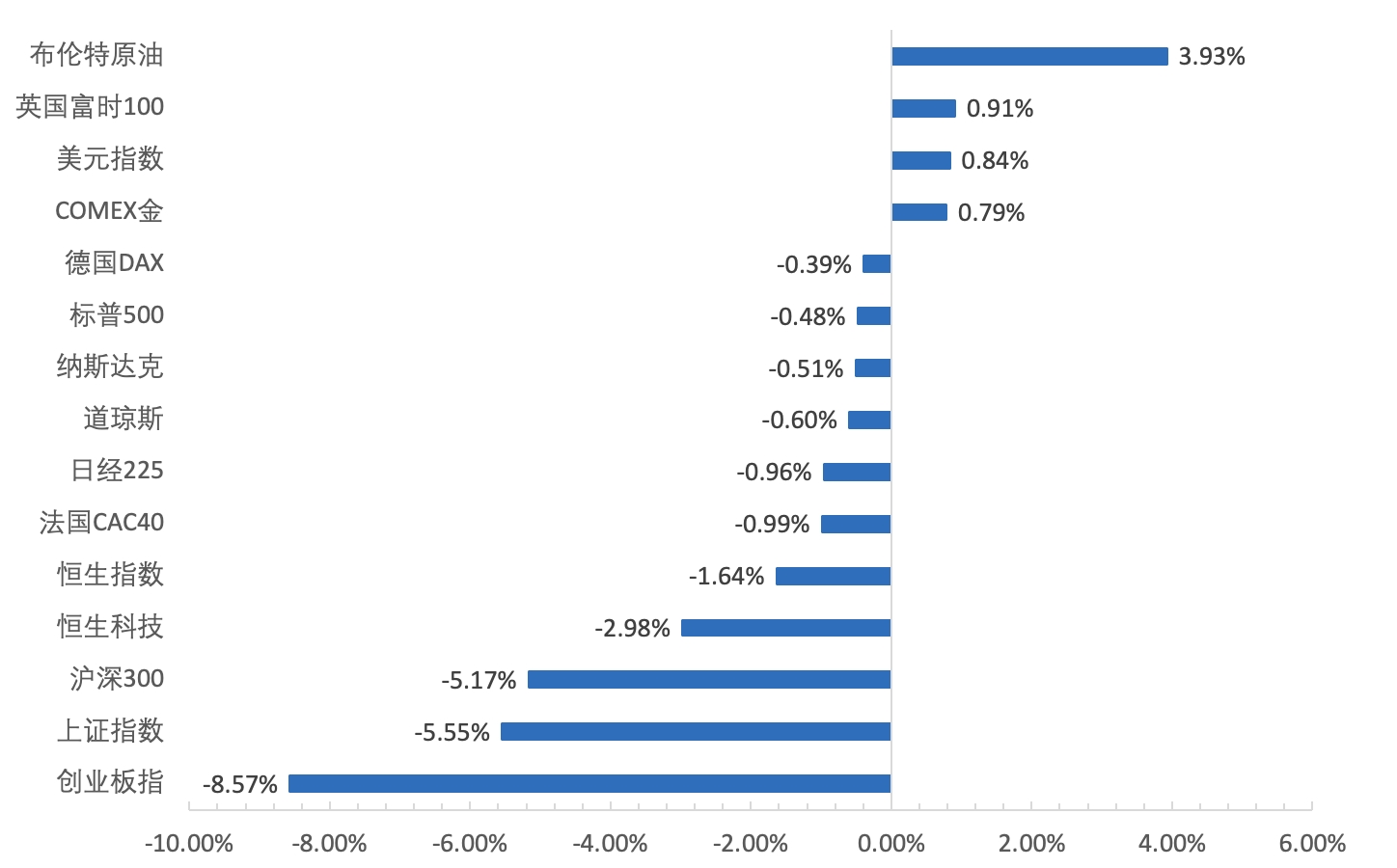

This week (December 30 - January 3), the A-share market witnessed three consecutive days of decline. The Shanghai Composite Index dropped by 5.55% within the week and closed at 3211 points on January 3; the Wind All A Index decreased by 7% this week.

In terms of sectors, all 31 first-level industries in the Shenwan Index declined this week. Among them, the coal, banking, and petrochemical sectors were relatively resilient, while the computer, military industry, communication, electronics, and media sectors led the decline this week.

From the perspective of style, dividends and large market capitalization are relatively resilient. Reflecting on the performance of style indices and broad-based indices, the Dividend Index, Shenzhen Dividend, FTSE China A50, Shanghai 50, and MSCI China A50 Connectivity Index had relatively smaller declines, while the CSI 2000, Wind Chuangchuang, and Guozheng 2000 indices had deeper falls.

The Hong Kong stock market fluctuated and declined this week. The Hang Seng Index dropped by 1.64% within the week; the Hang Seng TECH Index fell by 2.98% this week. In terms of sectors, among the 12 Hang Seng Industry Indices, only the energy and raw materials sectors rose, while the consumer staples, finance, comprehensive, healthcare, and other sectors had smaller gains or losses.

In terms of overseas major asset classes, most of the major stock indices in the US and Japan declined this week, while most of the major stock indices in Western Europe except Germany and France rose. In terms of commodities, crude oil rose sharply this week; among basic metals, aluminum rose, while steel, copper, and iron ore fell; most precious metals rose; among agricultural products, sugar, corn, and soybeans rose. The US Dollar Index rose overall this week.

Chart: Weekly changes in major global asset classes; Source: Wind, 36Kr

01 Trump Trade 2.0 Recently Encountered Structural Cooling

This week is the New Year's crossover, and there are only 4 trading days in the A-share market, with a lackluster market. However, some interesting changes are taking place in the overseas market. Before and after Trump's victory in November, Trump Trade 2.0 was once in full swing. From September to November last year, the US stock market performed quite well. The Nasdaq and the S&P 500 had interval gains of 8.5% and 6.8% respectively, and the amplitudes in the same period were as high as 15% and 11% respectively.

However, after entering December, the rise of the US stock market did not last long and entered a new round of adjustment. In the December adjustment, the S&P 500 fell by 2.5%, with a maximum drawdown of 4.4% in the interval; the Nasdaq rose by 0.48% in December. Due to the continuation of the previous upward momentum until mid-December, the subsequent adjustment was very large, resulting in a maximum drawdown of the Nasdaq of more than 5% in December last year.

Looking at it from the industry dimension, among the 11 first-level industries of the S&P 500, only the communication services, consumer discretionary, and information technology sectors rose in December; in contrast, the energy, real estate, industrial and other sectors that benefited more from Trump Trade 2.0 in the early stage performed poorly in December, with sector declines ranging from 8.1% to 9.6%. It can be seen that Trump Trade 2.0 in the US stock market obviously cooled down in December last year.

Chart: The two-stage changes in the first-level industries of the S&P 500; Source: Wind, 36Kr

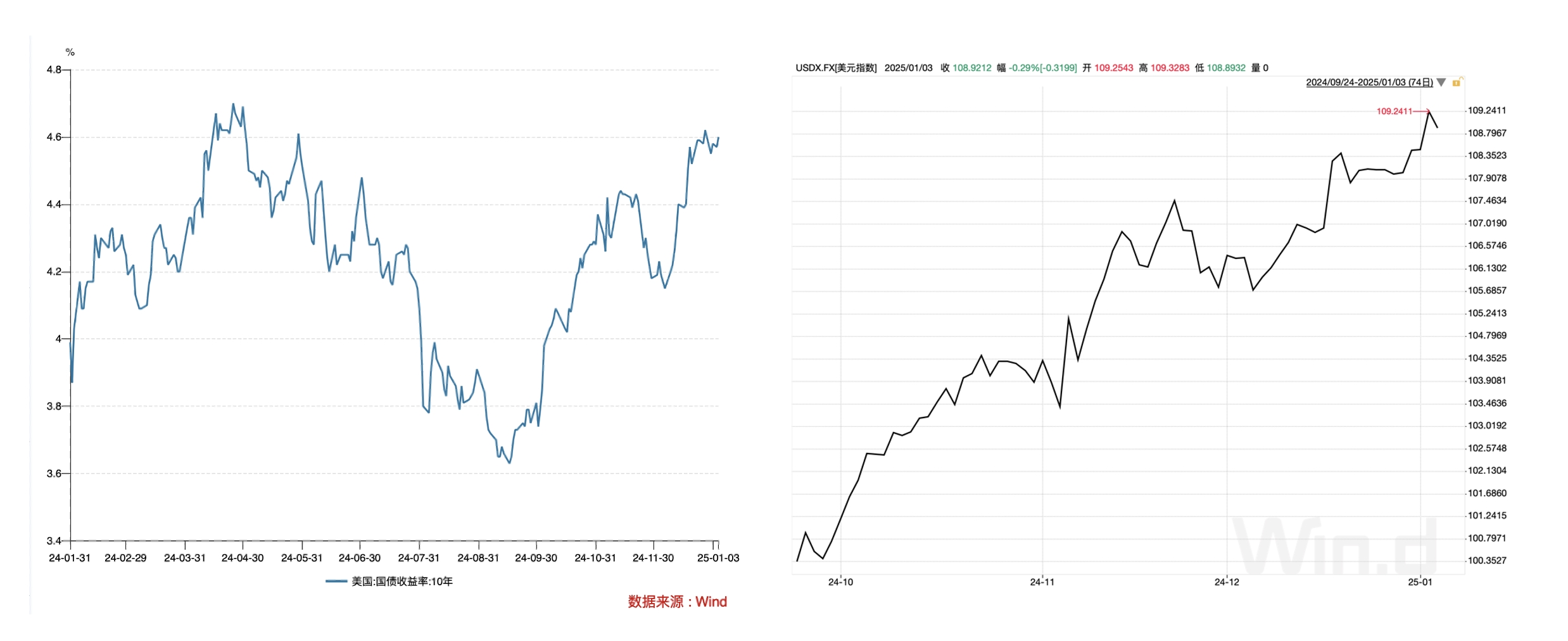

In terms of US bonds, from the perspective of asset prices, Trump Trade 2.0 is still the main theme, and US bonds have also maintained an overall weak pattern in the short term, with disturbances from other factors during this period. It can be seen that the 10-year US bond interest rate declined by 28 bps between November 21 and December 6. The mainstream market view believes that Trump's nomination of Baysent as Treasury Secretary drove a brief Baysent trade. The logic behind it is that Baysent's policy of controlling the deficit is beneficial to the bond market. Affected by this, during the two weeks when the US bond interest rate declined, the US Dollar Index correspondingly showed a phased weakening.

Chart: The recent trends of the 10-year US bond interest rate and the US Dollar Index; Source: Wind, 36Kr

Judging from the volatile market of gold prices between November and December last year, the impact of Trump Trade 2.0 on gold is twofold. On the one hand, the pattern of a strong US dollar and a weak US bond will have a certain suppression on the gold price; on the other hand, Trump's trade policy's impact on the future global trade environment will stimulate investors' risk aversion demand to rise, thereby constituting a positive factor for the gold price. The two rounds of pulsed rises in the gold price between November and December last year indicate that investors' understanding of Trump Trade 2.0 is more comprehensive and in-depth, and the inherent pattern of weak precious metals has also been broken.

Chart: The trend of COMEX gold prices; Source: Wind, 36Kr

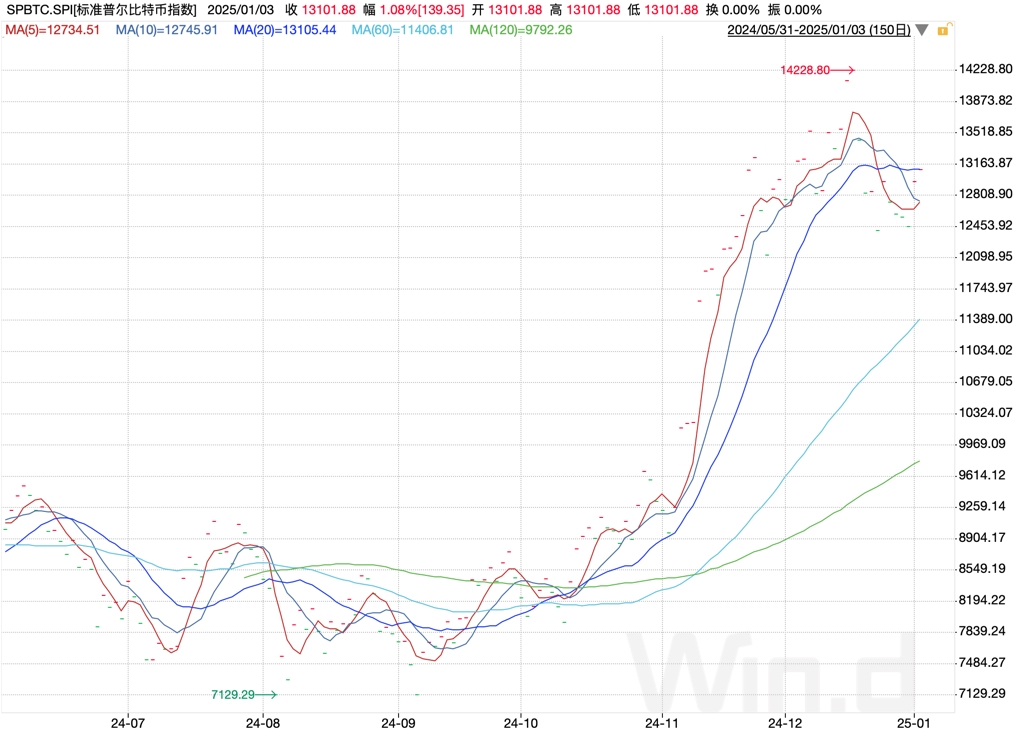

The impact of Trump Trade 2.0 on Bitcoin is worthy of attention. Bitcoin is a typical high-risk asset. It is itself benefited by Trump Trade (risk appetite rises, favorable for risky assets), and Trump's supportive attitude towards Bitcoin is an important support for its strong unit price. Therefore, after Trump's victory, the unit price of Bitcoin skyrocketed from the beginning of November to the middle of December, and the performance of the Bitcoin-related stock index was also very strong during the same period. However, in the Fed's interest rate meeting in the middle of December, Powell's statement that he had no intention of participating in the Bitcoin Strategic Reserve Plan (BSR) led to a sharp drop in the unit price of Bitcoin, and the Bitcoin-related stock index also experienced a significant adjustment at the same time.

Chart: The trend of the S&P Bitcoin Index; Source: Wind, 36Kr

02 Why Did Trump Trade 2.0 Encounter Structural Cooling?

Trump Trade 2.0 is essentially the pricing reflection of Trump's policy orientation on major asset classes. His core policy orientations, such as the "small yard, high wall" strategy, fiscal easing, regulatory easing, tax cuts, manufacturing reshoring, and emphasis on traditional energy, are beneficial to economic growth in terms of policy logic, and therefore are more favorable to risky assets. Therefore, the expected pattern of major asset classes under the influence of Trump Trade 2.0 will be a strong US stock market, a strong US dollar, strong crude oil, strong basic metals, a weak US bond market, and weak precious metals.

However, as can be seen from the price changes of major asset classes in December, The other side of Trump's policy orientation, especially the reflation caused by policies such as tariffs and immigration, is affecting the monetary policy orientation of the Fed, and thereby affecting the prices and expectations of major asset classes. With the resurgence of inflation expectations in the United States, the Fed has to respond with high interest rates, so investors have expectations of a tightening monetary policy, and the US economy also has a potential stagflation risk.

From the perspective of event-driven factors, the Baysent trade between November and December, as a continuation of the logic of Trump Trade 2.0, drove a short-term bull market in stocks and bonds. Thereafter, due to investors' doubts about Baysent's proposition to control the deficit, combined with the long-standing debt problem of the US fiscal, the Baysent trade sentiment weakened. Then, at the Fed's interest rate meeting in December, the market began to face up to the risks of credit tightening and stagflation, resulting in the weakening of both US stocks and bonds in December.

Looking forward to the future, as Trump takes office, the expected difference in policy strength is the focus of the market. Therefore, Trump Trade 2.0 will have further interpretations, and the core of the trade is still centered around the marginal changes in reflation expectations, monetary policy expectations, and economic growth expectations. Its impact is deduced through scenario assumptions. For example, in the case where the strength of immigration and tariff policies is weaker than the market expectations, with the weakening of the reflation risk, the monetary policy expectations are dovish, thereby benefiting risky assets and being bearish on hedging assets; conversely, there may be another situation of a double bear market in stocks and bonds.

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment needs to be cautious. Under no circumstances does the information in this article or the opinions expressed constitute investment advice for anyone. Before making an investment decision, if necessary, investors must consult a professional and make a cautious decision. We have no intention of providing underwriting services or any services that require holding a specific qualification or license for the transaction parties.