智氪丨低点涨幅40%,2024年A股重回亚洲前五

Author | Huang Yida, Ding Mao, Fan Liang

Editor | Zheng Huaizhou

In 2024, the A-share market witnessed the most intense bull-bear battle in the past five years. The annual amplitude of the Shanghai Composite Index was as high as 34%, and the point change exceeded 1,000 points. The essence of high volatility is a significant shift in the macro and capital market policy orientation.

In terms of capital market policies, at the beginning of April, the "New Nine National Policies" was officially released, featuring a strict delisting system, cracking down on underperforming companies, guiding listed companies to increase dividends, and focusing on investor returns, setting the investment tone for the next few years. At the financial policy conference at the end of September, measures such as creating swap facilities for securities, funds, and insurance companies, and creating special re-loans for stock repurchases and increased holdings have brought a huge amount of potential funds to the capital market.

In terms of macro policies, after the Ministry of Finance announced the promotion and implementation of a package of debt resolution plans in November, the Central Economic Work Conference in December also made the most positive tone for 2025, such as "implementing a more proactive and promising macro policy, implementing a more proactive fiscal policy and a moderately loose monetary policy", and clearly boosting consumption, improving investment efficiency, and comprehensively expanding domestic demand.

In terms of results, a series of policies after September 24 successfully ignited the A-share market. The Wind All-A Share Index rose by more than 12% throughout 2024, with a maximum increase of more than 40% from the low point, but it still has not recovered the declines in 2022 and 2023.

Although 2024 has become the past, for investors, if they want to more accurately position the market status in 2025 and judge the stock market situation in 2025, then the market performance in 2024 will undoubtedly be an important anchor point.

Therefore, 36Kr reviewed the key turning points and market hotspots in the capital market in 2024 based on the quarterly timeline, aiming to help investors build an overall understanding of the market in 2024 in order to have a clearer expectation of the market situation in 2025.

First Quarter Review: The Beginning of Change, Emotional Recovery

At the beginning of 2024, the market continued the weak expectation logic of 2023. At the same time, under the impact of events such as the explosion of snowball products and the significant drawdown of quantitative strategies, the market was in a general decline from January to the beginning of February, and the Shanghai Composite Index dropped to 2,600 points.

The turning point occurred on February 7, when Wu Qing was appointed as the chairman of the China Securities Regulatory Commission. His background in securities regulation significantly warmed the market sentiment, and the A-share market started a rebound. The Shanghai Composite Index rebounded from 2,635 points and broke through the 3,000-point mark, reaching 3,041 points at the end of March, with a cumulative increase of 2.23% in 2024Q1.

At this stage, although the market sentiment has turned, the macro factors have not improved significantly. In this context, the "barbell strategy" began to emerge, that is, simultaneously laying out defensive dividend sectors and high-risk sectors that are less affected by the macro environment. At the same time, the market also began to attempt to trade based on the business cycle, laying out in advance the policy-favorable directions.

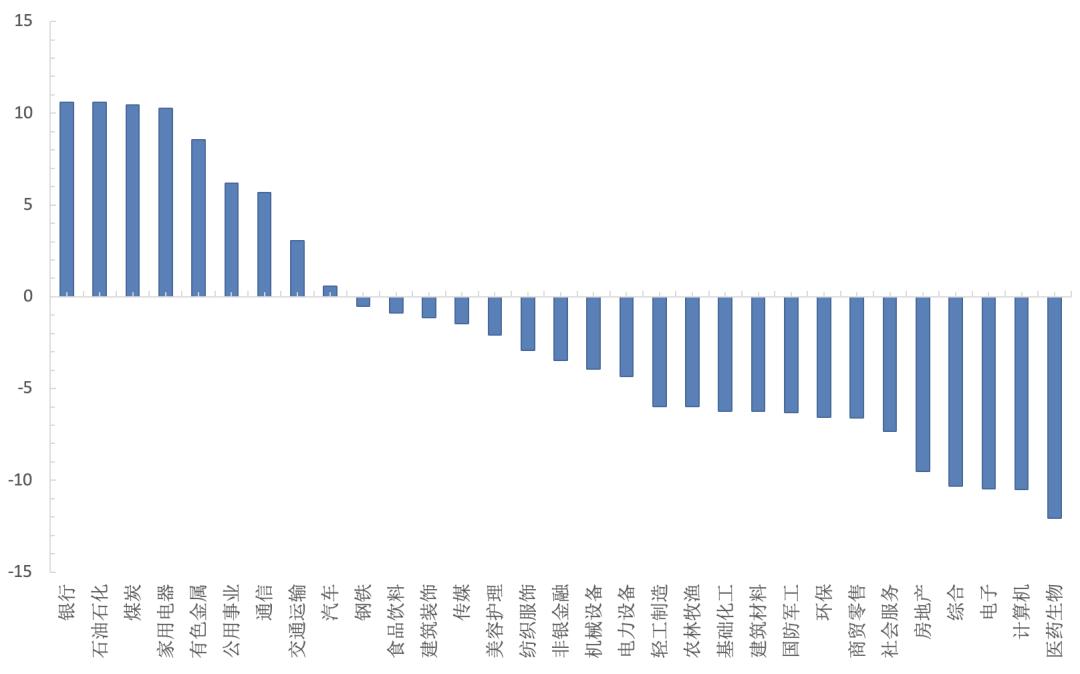

In terms of the performance of broad-based indices, the large-cap style was significantly better than the small-cap style, with CSI 300 > CSI 500 > CSI 1000 > CSI 2000. From the perspective of the performance of industry indices, the most outstanding in 2024Q1 is undoubtedly the dividend sector. The Shenwan Petroleum and Petrochemical, Home Appliances, Coal, and Banking indices all rose by more than 10%; while the Medicine, Electronics, Real Estate and other indices still fell significantly.

The performance of concept indices more easily reflects the aforementioned market trading style. In 2024Q1, the Wind concept indices with a growth rate of more than 10% include policy-driven (equipment renewal, new-quality productivity, central enterprises, and China characteristics valuation) and barbell strategy (central enterprise coal, shipping selection, KIMI concept, optical communication).

In general, 2024Q1 is an emotional repair market under the expectation of capital market rectification, without excessive trading at the macro recovery level.

Figure: The increase and decrease of 31 Shenwan first-level industry indices in the first quarter; Source: Wind, 36Kr

Second Quarter Review: Volatile Downward Trend, Defense Prevails

After entering the second quarter, the trend of the A-share market was first volatile and then declined. Reflecting on the increase and decrease of the broad-based indices, the Shanghai Composite Index fell by 2.43% in the second quarter, the Wind All-A Share Index fell by 5.32% in the same period, and the CSI 300 fell by 2.14% in the same period.

From the perspective of investors, after the sharp rise in the first quarter of the A-share market, especially when the valuations of some stocks have risen to a level that is divorced from the fundamentals, it is normal for a pullback to occur under valuation risks. Moreover, the sharp rise in the early stage also allowed investors to gain considerable returns in the short term, and taking profits is also a reasonable choice.

From the perspective of expectation management, as high-frequency data such as inflation, finance, and business cycle continue to weaken, it is confirmed that the domestic economic operation is cooling, and the market's recognition of the "weak reality" is gradually strengthened. In terms of policies, although the "New Nine National Policies" and the Political Bureau meeting have continuously released positive signals, which have played a certain role in boosting investors' risk appetite in the short term, there is a significant deviation between the degree of policy intensification and the market expectations.

Therefore, the deeper reason for the adjustment of A-shares in the second quarter is the negative resonance between investors' pricing of the "weak reality" and the policy expectation gap.

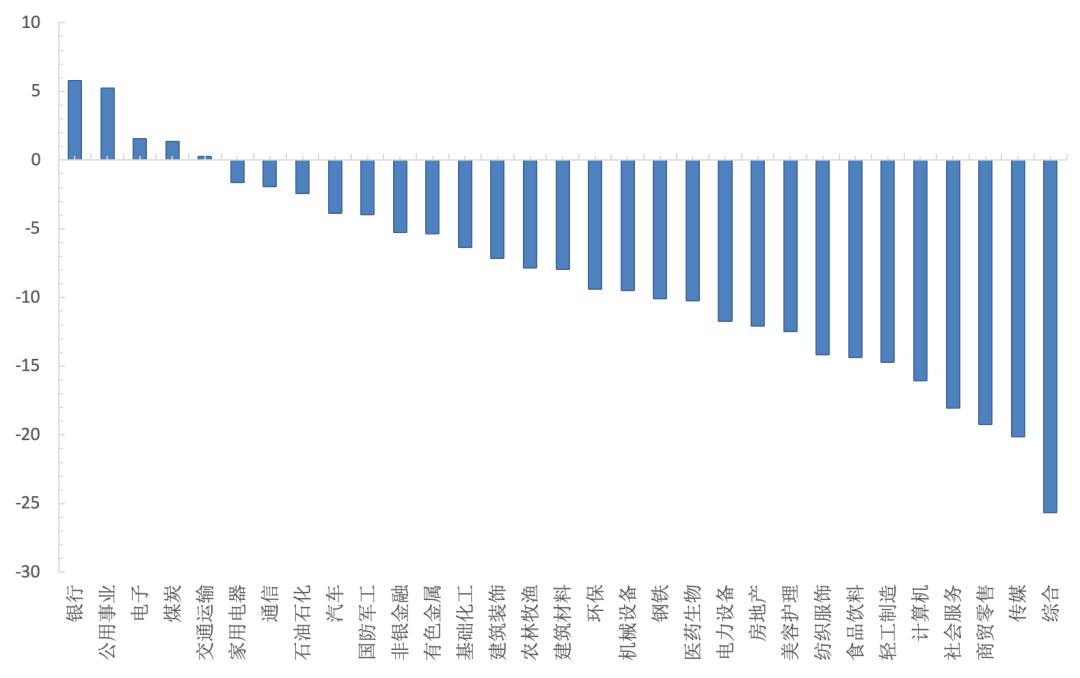

From the performance of broad-based indices and concept indices, due to the depressed investor sentiment and the continuous market adjustment, the defensive strategy prevails in style, manifested as large-cap value stocks being more resilient than small-cap stocks, and the typical representative of defense, the dividend sector, has continued the market mainline position since the first quarter.

It is worth noting that dividend stocks have shown obvious differentiation according to industries/concepts. Coal and banks, as major dividend payers, have been favored by investors. The Wind Central Enterprise Coal Index and the Central Enterprise Bank Index rose by 12.3% and 7.3% respectively in the second quarter, and coal ranked first in the concurrent increase of all Wind concept sectors.

As the core dividend asset of public utilities, the market style at that time was very favorable to it, and its own fundamentals were good. The Shenwan Public Utilities Index rose by 5.2% in the second quarter, second only to banks in the first-level industries. The nuclear power sub-sector of public utilities also benefited from the policy benefit of "vigorously developing new-quality productivity". China Nuclear Power and China Nuclear Engineering Construction rose by 16% and 13% respectively in the second quarter.

In contrast, affected by the "weak reality", the overall performance of large consumption was weak. Structurally, optional consumption and consumer services fell more. The Wind Consumer Services Index fell by 20.3% in the second quarter, and the Wind Optional Consumption Retail Index fell by 19.8% in the same period. In terms of real estate, the policy bottom line has played a certain positive role in improving the industry's expectations, but the fundamentals of the real estate industry have not reversed in the short term, and the Shenwan Real Estate Index fell by 12% in the second quarter.

Figure: The increase and decrease of 31 Shenwan first-level industry indices in the second quarter; Source: Wind, 36Kr

Third Quarter Review: V-shaped Reversal

The A-share market in the third quarter can be described as a world of ice and fire. The market trend ran a V-shaped rebound with September 24 as the boundary. Between July 1 and September 23, the market continued the decline in the second quarter, with a continuous downward adjustment. Until September 13, the Shanghai Composite Index closed at the second lowest point of the year, and the small rebound in the following few days was mainly the mean reversion after the extreme compression of valuations.

Looking at the performance of the A-share market at this stage from the total volume dimension, under the weak economic recovery, the market is at a relatively bottom. Although the continuous decline and adjustment lasted for a long time, it did not break the low point at the beginning of this year. During this period, even though there were some short-term structural market trends driven by events such as the pulsed inflow of foreign capital, the improvement of trading rules by regulation, and the reorganization of securities companies, the pessimistic economic expectations led to a lack of sufficient upward momentum and catalyst for the market, and the defensive dividend strategy remained a safe haven for investors.

On September 24, after the announcement of a package of economic stimulus policies and the shift in macro policy expectations, the performance of A-shares was magnificent, and the short-term sharp rise recovered the previous losses. The Shanghai Composite Index rose by 12.44% in the third quarter, and the increase from September 24 to September 30 was as high as 21.4%. This stage is the well-known September 24 market, and the policy shift has driven the establishment of an A-share bull market.

In the week before September 24, the Federal Reserve officially announced a rate cut, and the pressure on the depreciation of the RMB exchange rate eased. Under the continuous repair of the capital outflow of the dollar tide and the Sino-US interest rate spread, the external constraints affecting China's monetary policy have been significantly weakened, which is one of the bases for the future monetary policy to remain loose. With the further easing of liquidity expectations, it quickly resonated with the bull market expectation opened by September 24.

The previous continuous decline also made the A-share market highly elastic at that time, and the market style shifted from a defensive strategy to a comprehensive general rise. Brokerages and trading software led the rise, and the stock trading software index and the brokerage equal-weighted index rose by 88% and 41% respectively in the third quarter. Under the bull market expectation, the risk appetite also increased significantly, and the good expectations of the science and technology innovation sector were prematurely consumed. The Growth Enterprise Market low-priced stock index rose by 75% in the third quarter.

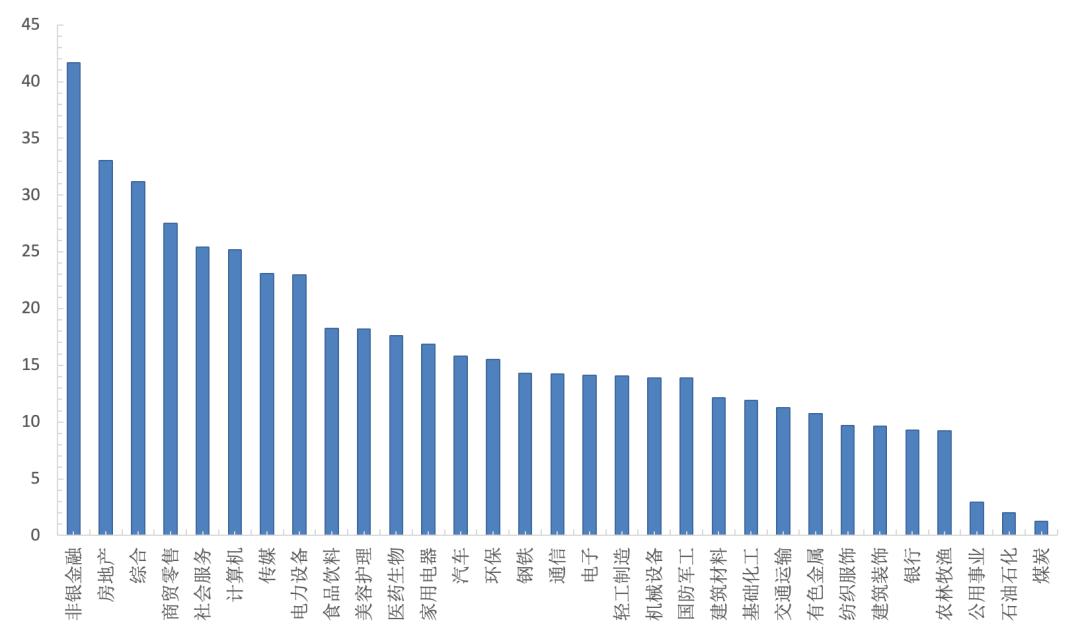

At the industry level, driven by the September 24 market, all first-level industries closed up in the third quarter. The Shenwan Non-bank Financial Index rose by 42% in the quarter, ranking first among the first-level industries; although the fundamentals of the real estate industry did not improve significantly, under the resonance of many factors such as good policy expectations, valuation advantages, and market sentiment, the Shenwan Real Estate Index rose by 33% in the third quarter, ranking second only to the non-bank financial industry among the first-level industries; the industries that performed relatively well in the second quarter, such as banks, coal, and public utilities, had relatively lower growth rates.

Figure: The increase and decrease of 31 Shenwan first-level industry indices in the third quarter; Source: Wind, 36Kr

Fourth Quarter Review: Volatile Upward Trend

After the crazy bull market from the end of September to the beginning of October, the A-share market began to turn into a slow bull market with consolidation and upward movement after the National Day, and transitioned from the previous comprehensive general rise to a structural market. During this period, several important characteristics were shown:

1. The market continued to rise, but the strength and volume decreased significantly. The Shanghai Composite Index rose by 0.46% and the Wind All-A Share rose by 1.62% in the fourth quarter, both significantly lower than the performance in the third quarter. At the same time, the average trading volume and trading value of the market also continued to decline.

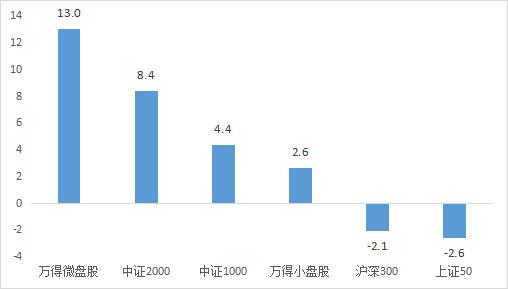

2. The market differentiation is obvious, and the performance of small and micro-cap stocks is better than that of large-cap stocks. In the fourth quarter, the CSI 1000, CSI 2000, Wind Small-cap Stock and Wind Micro-cap Stock indices rose by 4.4%, 8.4%, 2.6% and 13.0% respectively, significantly better than the -2.1% and -2.6% of the CSI 300 and Shanghai 50 in the same period.

Figure: The increase and decrease of broad-based indices in the fourth quarter; Source: Wind, 36Kr

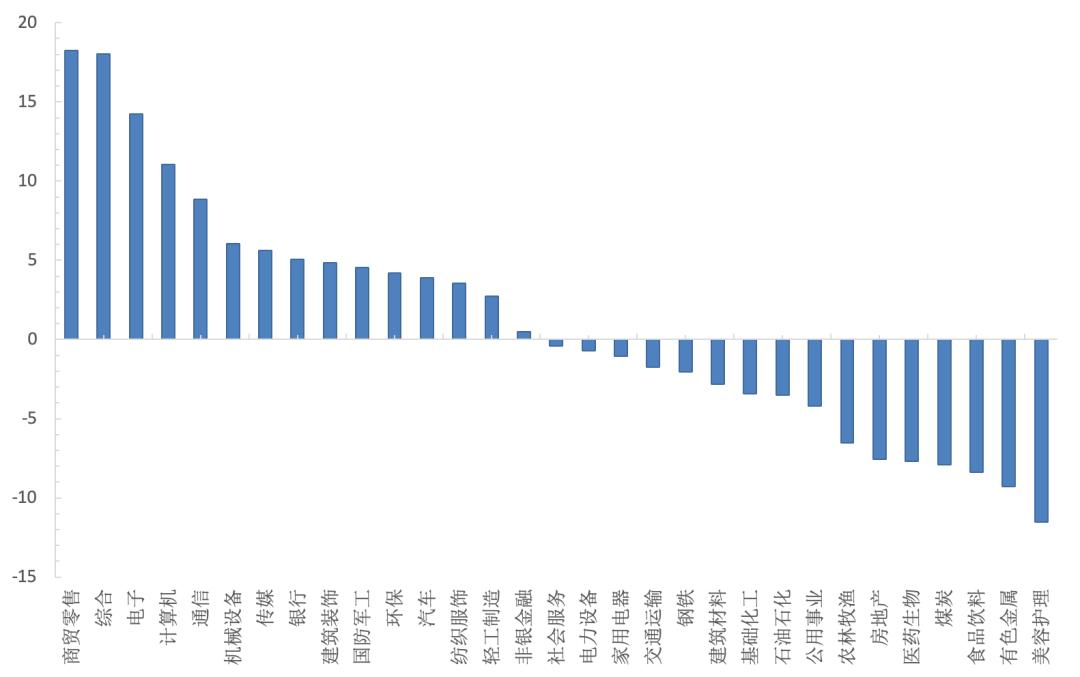

3. There is a lack of a clear main line, and the rotation between sectors is accelerating. Concepts such as millet economy, low-altitude economy, initial public offering concept, merger and acquisition, and cultivated diamonds have shown turns of performance. At the same time, AI computing power and dividends, which were active in the first half of the year, reappeared. Overall, 15 of the 31 Shenwan first-level industries achieved growth. The top three industries with the largest increase were Commerce and Retail (18.2%), Comprehensive (18.0%) and Electronics (14.2%), and the top three industries with the largest decline were Beauty Care (-11.5%), Non-ferrous Metals (-9.3%) and Food and Beverage (-8.4%); the concept sectors also showed mixed ups and downs. The top five Wind popular concept indices with the largest increase were Cultivated Diamond (53.2%), Smallest Market Capitalization Index (51.7%), Ice and Snow Tourism Index (41.5%), Initial Public Offering Economy Index (39.7%) and ASIC Chip Index (38.8%).

Figure: The increase and decrease of 31 Shenwan first-level industry indices in the fourth quarter; Source: Wind, 36Kr

Attributionally, after entering the fourth quarter, the overall valuation of A-shares has been significantly repaired, basically returning to a reasonable level near the ten-year valuation center. After the safety margin has narrowed, the market optimism has also converged. In this context, the market in the fourth quarter is on the one hand continuously digesting the previous market sentiment, and on the other hand waiting for the verification of the actual boosting effect of the loose policies on the economic fundamentals.