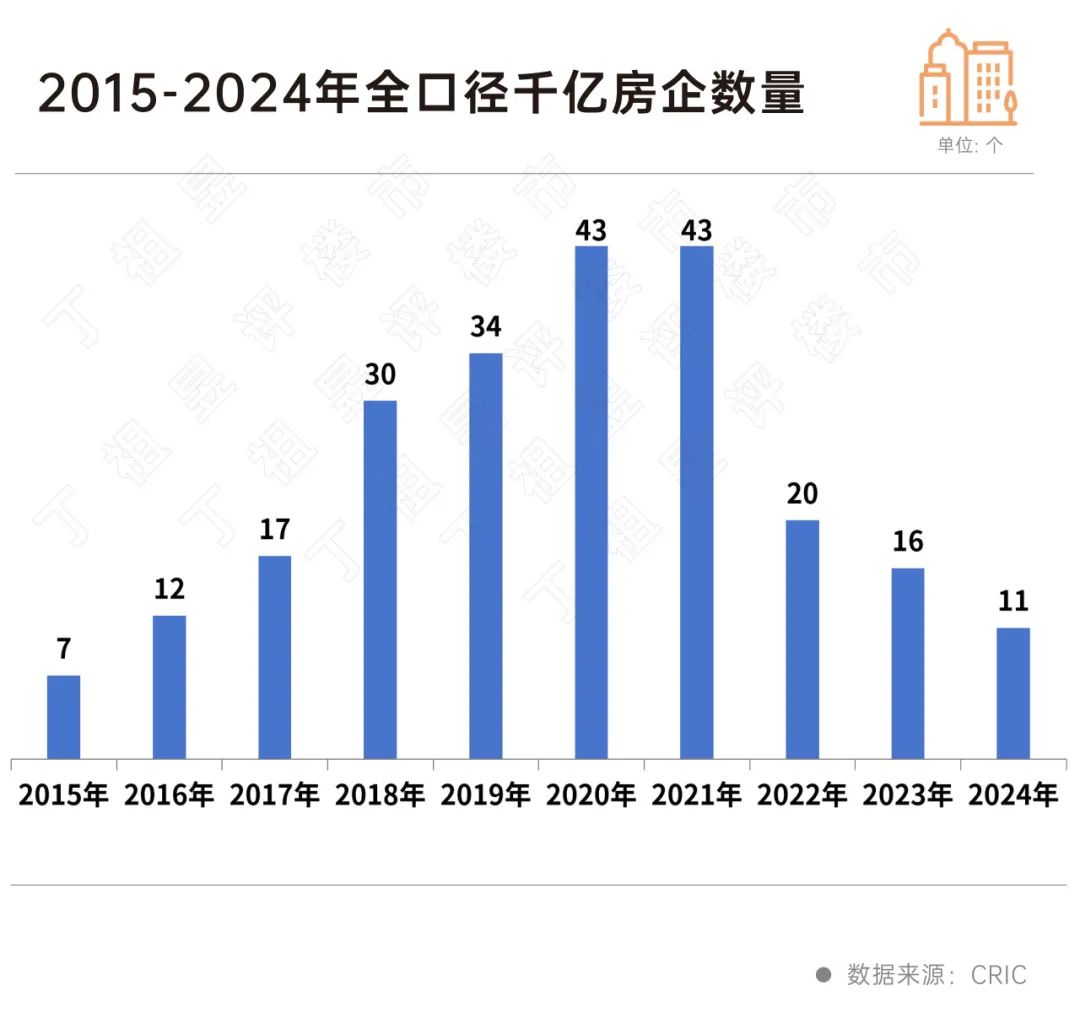

The number of top 100 real estate enterprises has returned to the level of 2016.

Thanks to the stable policies, strong confidence, and expectations, along with the year-end performance rush of real estate enterprises, the supply and demand of new houses in December 2024 ended with an upward trend at the end.

In December, the overall transaction volume in 30 key cities reached 18.01 million square meters. The absolute volume was the same as that in December 2022. It increased by 15% month-on-month and 17% year-on-year, and it rose by 86% compared with the monthly average in the third quarter. The cumulative transaction volume of new houses for the whole year decreased by 23% year-on-year, with the decline narrowing by 3.75 percentage points compared with the previous month.

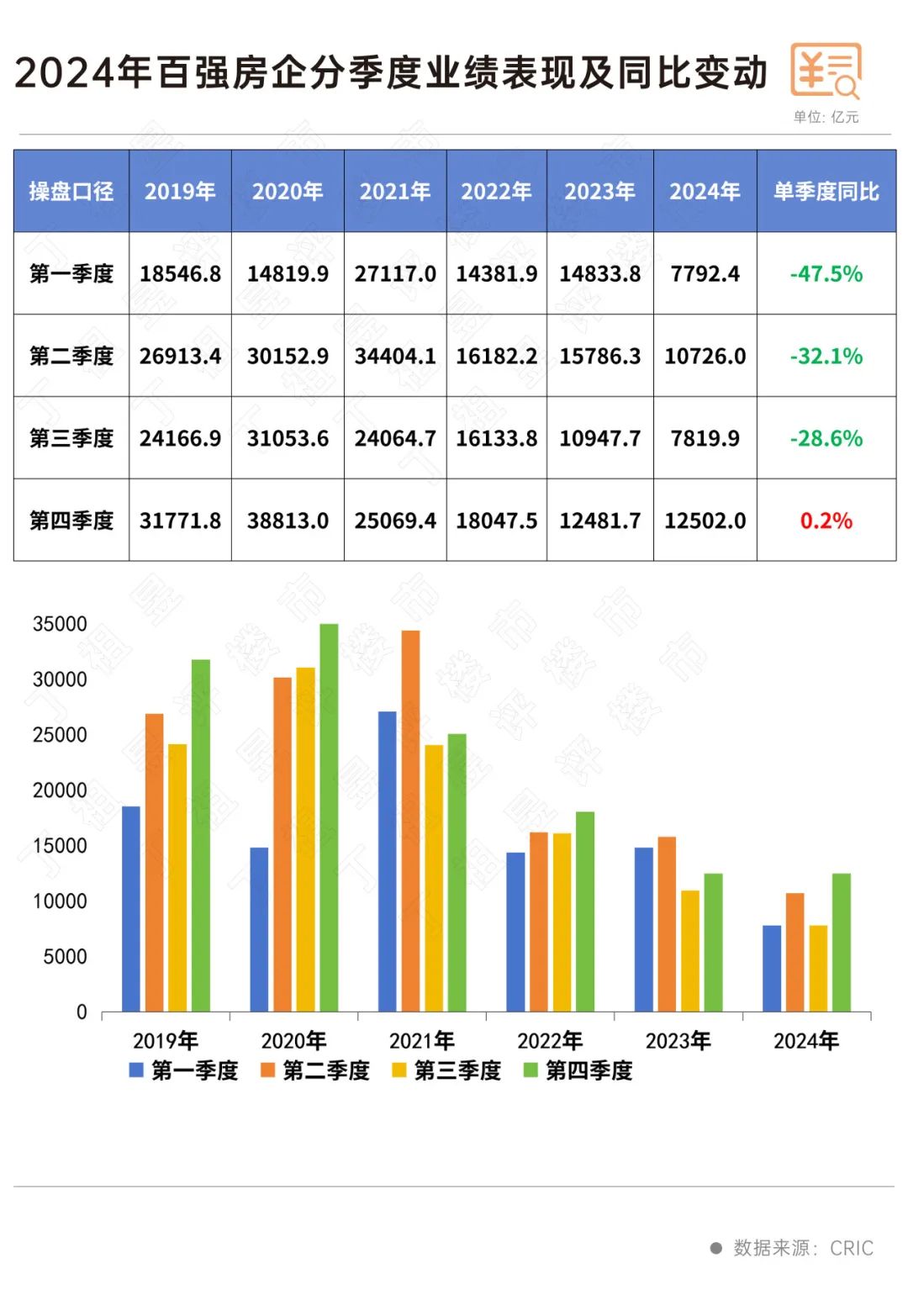

In the fourth quarter, the sales of enterprises picked up at the end of the year. The sales and operation amount of the top 100 real estate enterprises turned positive year-on-year, with a slight increase of 0.2%. The sales performance was significantly better than that in the first three quarters. In December, the top 100 real estate enterprises achieved a sales and operation amount of 451.39 billion yuan, with a 24.2% increase month-on-month and being the same as the same period last year. The cumulative performance decreased by 28.1% year-on-year. In 2024, the number of full-caliber real estate enterprises with a transaction volume of 100 billion yuan further decreased to 11, returning to the level of 2016.

01

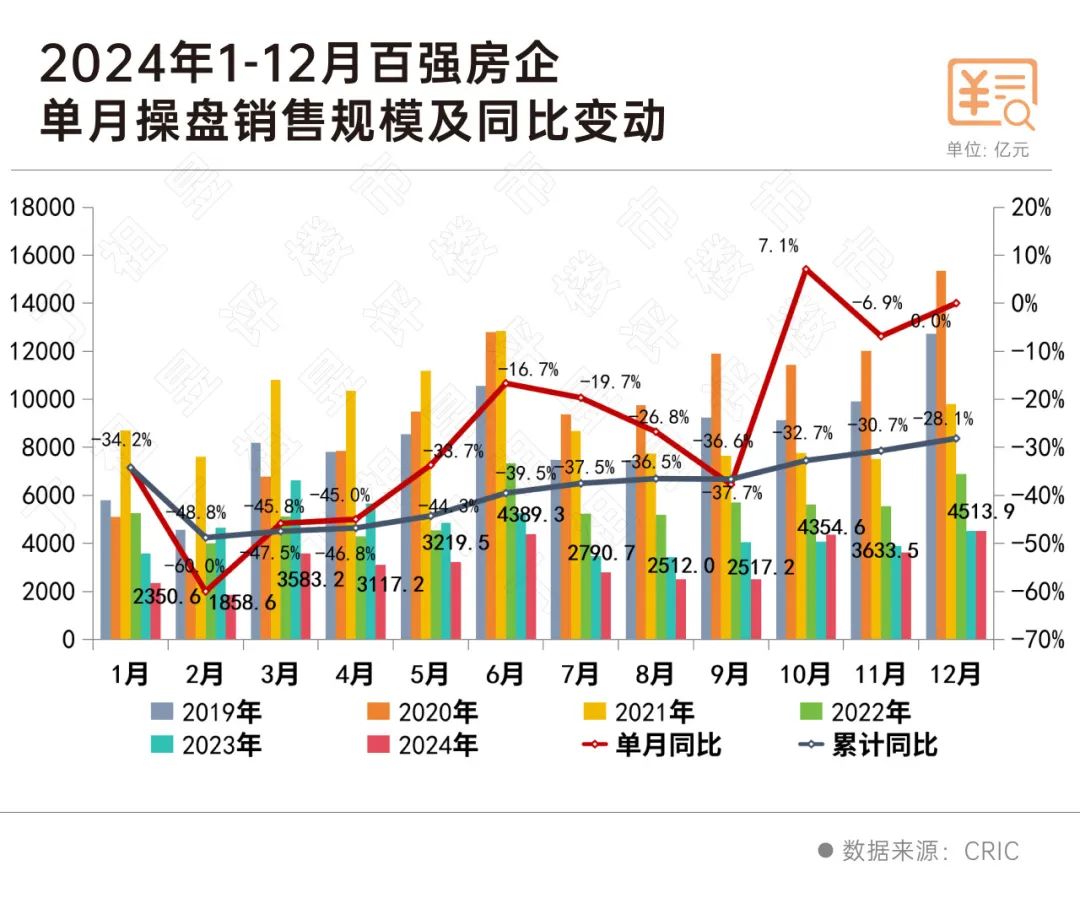

The cumulative performance of the top 100 real estate enterprises decreased by 28.1% year-on-year

In December 2024, the top 100 real estate enterprises achieved a sales and operation amount of 451.39 billion yuan, with a 24.2% increase month-on-month and being the same as the same period last year. In terms of cumulative performance, from January to December, the top 100 real estate enterprises achieved a sales and operation amount of 3884.02 billion yuan, with a 28.1% decrease year-on-year, and the decline narrowed by nearly 2.6 percentage points compared with November.

Source: CRIC

Source: CRIC

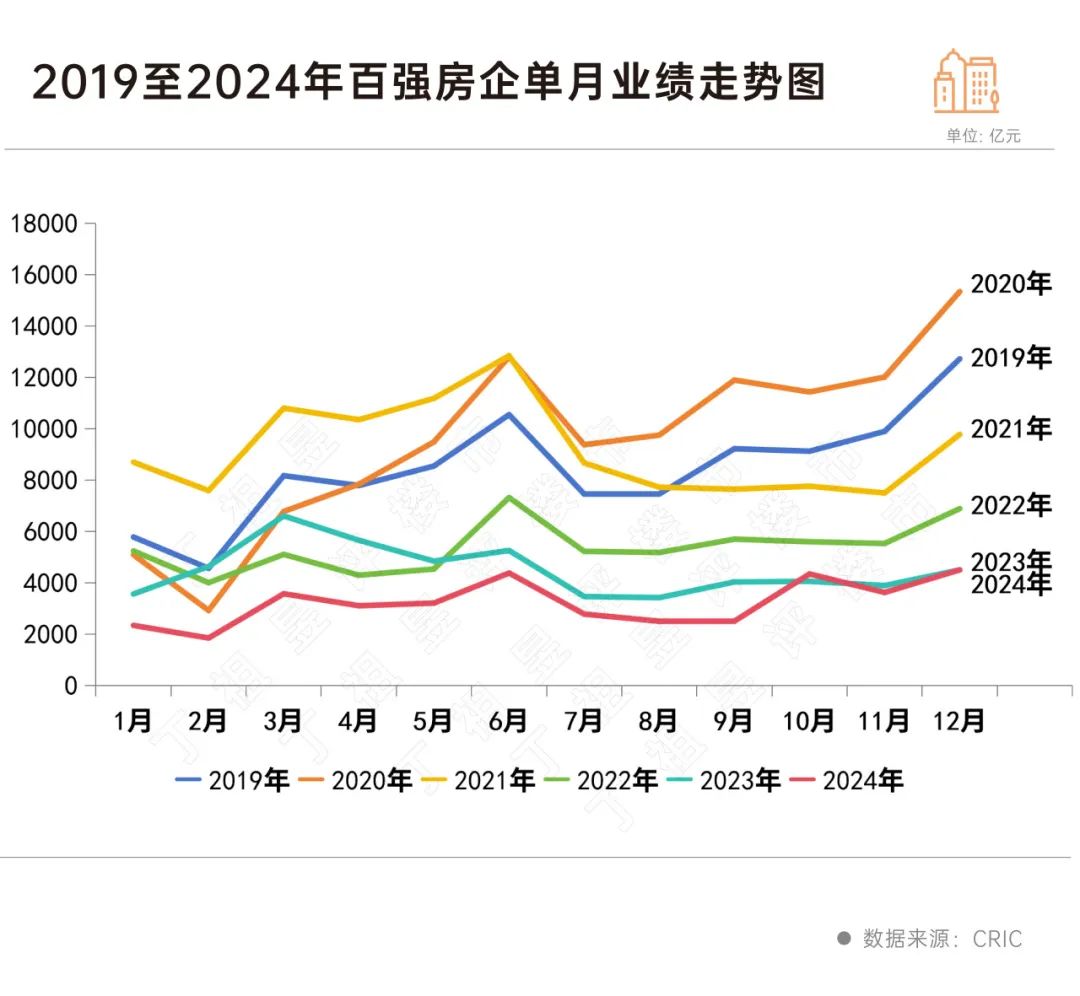

Overall, the Chinese real estate market in 2024 continued the trend of bottoming out and adjusting, and the market in the first three quarters was basically at a low level.

Thanks to the continuous favorable new policies at the end of September, The sales of enterprises picked up at the end of the fourth quarter, and the sales and operation amount of the top 100 real estate enterprises in the fourth quarter turned positive year-on-year, with a slight increase of 0.2%. The enterprise sales performance was significantly better than that in the first three quarters.

Source: CRIC

02

The number of 100-billion-yuan real estate enterprises returned to the level of 2016

The threshold of the top 100 continues to decrease

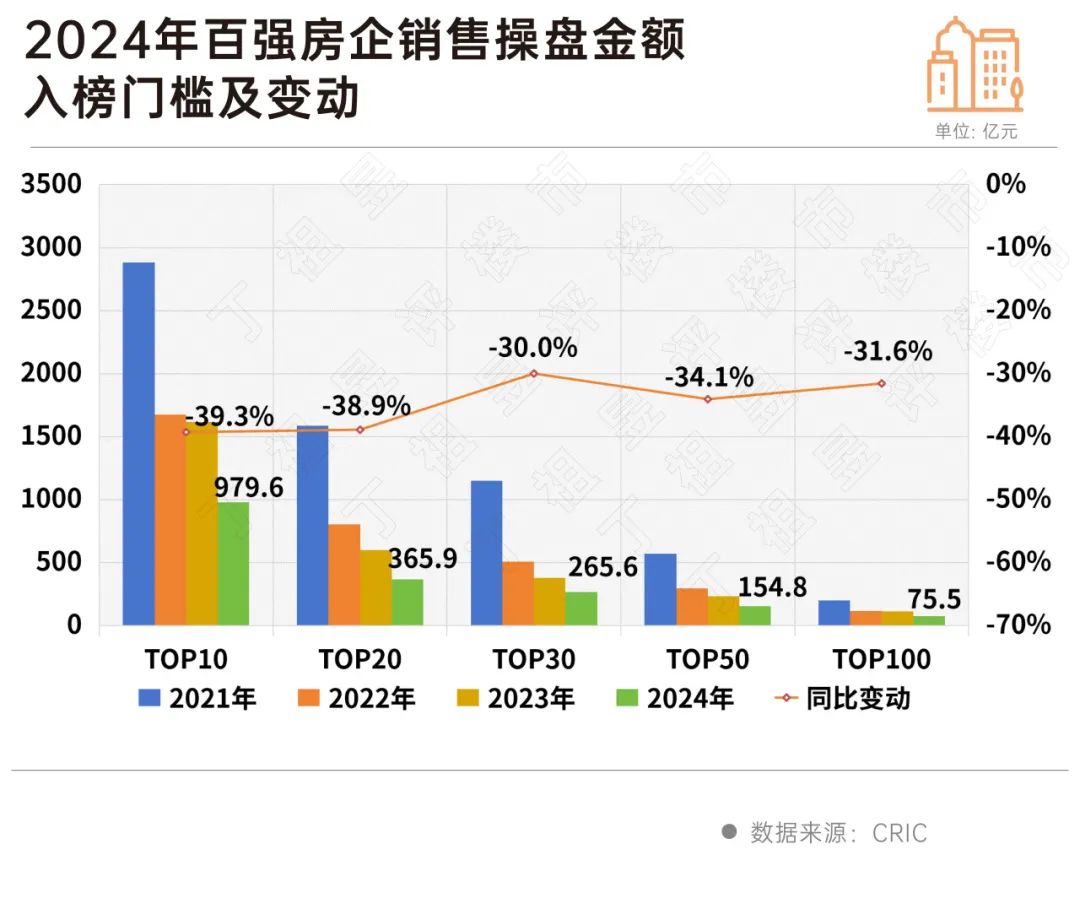

In 2024, the sales threshold of the top 100 real estate enterprises continued to decline, and the thresholds of all echelons reached the lowest in recent years.

Among them, the sales and operation amount threshold of the top 10 real estate enterprises decreased by 39.3% year-on-year to 97.96 billion yuan. The thresholds of the top 30 and top 50 real estate enterprises also decreased by 30% and 34.1% respectively to 26.56 billion yuan and 15.48 billion yuan. The sales and operation amount threshold of the top 100 real estate enterprises decreased by 31.6% to 7.55 billion yuan.

In addition, the number of full-caliber 100-billion-yuan real estate enterprises in 2024 further decreased to 11, returning to the level of 2016.

Source: CRIC

Source: CRIC

03

The property market in December ended with an upward trend at the end

It is expected to turn positive year-on-year in the first quarter of 2025

Thanks to the stable policies, strong confidence, and expectations, along with the year-end performance rush of real estate enterprises, the supply and demand of new houses in December ended with an upward trend at the end.

According to CRIC monitoring data, the overall transaction volume in 30 key cities in December was 18.01 million square meters. The absolute volume was the same as that in December 2022, with a 15% increase month-on-month, a 17% increase year-on-year, and an 86% increase compared with the monthly average in the third quarter. The cumulative transaction volume of new houses for the whole year decreased by 23% year-on-year, with the decline narrowing by 3.75 percentage points compared with the previous month.

By energy level, the market heat in first-tier cities continues. The four first-tier cities increased slightly by 1% month-on-month and rose by 35% year-on-year, with an 80% increase compared with the monthly average in the third quarter. The cumulative year-on-year decline was 11%. Except for Shanghai and Shenzhen, which decreased month-on-month, Beijing and Guangzhou both increased month-on-month and year-on-year. Among them, Guangzhou had a significant increase, with a 9% increase month-on-month, a 39% increase year-on-year, and a 73% increase compared with the monthly average in the third quarter. This also made the transaction volume in Guangzhou basically the same as that of last year. It is worth noting that Shanghai and Shenzhen, which were greatly affected by the favorable new policies in the early stage, both showed a month-on-month decline this month. It can be seen that the favorable effect of the new policies is diminishing. With the continuous release of the stock of customers who intend to buy houses in the short term, the transaction growth also shows a weak trend.

The transaction volume in second- and third-tier cities continued to fluctuate at a low level, and the cumulative year-on-year decline was significantly higher than that in first-tier cities. The cities can be divided into the following categories: (1) Cities with a significant "tail-up" at the end of the year include not only second-tier cities with a good fundamental situation such as Wuhan, Suzhou, Changsha, and Ningbo, but also third- and fourth-tier cities such as Wuxi, Zhuhai, Xuzhou, and Jiaxing. After several months of sluggishness, the demand for home purchases had a concentrated release period at the end of the year. (2) Tianjin, Nanjing, Kunming, etc. had a month-on-month increase of less than 15%, lower than the average, and ended smoothly; (3) A few cities such as Xi'an, Jinan, Xiamen, Huizhou, etc. continued to decline both month-on-month and year-on-year, mainly due to the phased weakness after the concentrated release in the early stage, and the overall transaction volume continued to hover at a low level. It is worth noting that the cumulative year-on-year decline in 9 cities has narrowed to within 20%, and the purchasing power in Tianjin continues to recover, and the overall transaction volume shows a low-level recovery. However, the current transaction volume in most cities such as Ningbo, Kunming, Xiamen, Fuzhou, Foshan, Changzhou, Jiaxing, and Zhuhai is basically close to the bottom and has nowhere to fall.

Looking ahead to the future market, we believe that from January to February 2025, it is a high probability event that the transaction volume will decline month-on-month due to the Spring Festival holiday. However, considering the policy support and the current weak recovery transaction inertia, the "Little Spring" market in March is expected to continue. Considering the low base in 2024, there is still a possibility of a year-on-year positive return in the first quarter.

By energy level, the transaction heat in first-tier cities continues, and the overall transaction area is slightly decreasing while remaining stable. The transaction scale in second-tier cities remains stable, with a rotational recovery between strong and weak cities. The transaction scale in third- and fourth-tier cities will continue the bottoming-out trend, but the overall adjustment is close to the market bottom, and the decline is expected to continue to narrow. It is worth noting that the resilience of the second-hand housing market is still stronger than that of the new housing market, but the share will gradually shift towards the new housing market. The diversion effect of the demand for just-needed housing customers will still exist, but for the improvement and high-end customer groups, the new housing products will be upgraded with the price following the market, with outstanding cost performance and attracting customers to return to the new housing market.

This article is from the WeChat official account "Ding Zuyü's Comment on the Real Estate Market", authored by the CRIC Research Center, and 36Kr is authorized to publish it.