How much is RT-Mart really worth?

Written by Peng Qian

Edited by Qiao Qian

After more than a year of negotiations, Alibaba's sale of RT-Mart has finally been completed on the first day of the new year.

On the evening of January 1, Alibaba announced in the Hong Kong Stock Exchange that it would sell 73.66% of the entire equity of RT-Mart's parent company, Sun Art Retail Group Limited, for up to HK$13.1 billion. Since Sun Art Retail Group Limited released the equity merger and acquisition announcement on September 27, Alibaba has finally completed the overall sale of RT-Mart.

The buyer of this transaction is DCP Capital. After the transaction is completed, DCP Capital will replace Alibaba as the absolute controlling shareholder of RT-Mart.

DCP Capital is a private equity investment company registered in Hangzhou. The company has invested in Haier, Mengniu, Xingsheng Youxuan, Nanfu Battery, Belle International, Hengan Group, etc. The founder, Liu Haifeng, once served as the global partner and president of Greater China at KKR Group. He left KKR in 2017 and established DCP Capital. Some industry insiders commented to 36Kr that DCP's playing style is similar to KKR, "mainly investing in later-stage projects, and has also made many merger and acquisition transactions, and is good at the consumer field".

Alibaba's connection with Sun Art Retail Group Limited began seven years ago. In 2017, Alibaba first invested in RT-Mart's parent company, Sun Art Retail Group Limited, acquiring a 36.16% stake for HK$22.4 billion. In 2020, Alibaba continued to acquire shares in Sun Art Retail Group Limited, with a shareholding ratio reaching 72%, becoming the actual controller, and the investment also increased from HK$22.4 billion to HK$50.2 billion. From a financial perspective, Alibaba has suffered a loss of HK$37.1 billion this time.

During the seven-year partnership, it is not just a monetary transaction. Under Alibaba's leadership, RT-Mart has carried out a certain degree of integration with Taobao Tmall, Hema, and Ele.me. Representative projects include Taoxianda and Hema Xiaoma, involving many aspects such as supply chain, delivery, technology, and membership system.

However, the results prove that the "new retail" story of integrating online and offline, and empowering offline with online, which seemed extremely attractive at that time, has not worked.

In the past three years, RT-Mart's revenue has continued to decline. It experienced a single-digit decline in the fiscal year 2023, a double-digit decline in the fiscal year 2024, and a single-digit decline in the mid-term of the fiscal year 2025. The profit performance is also not good. It suffered a loss for the first time in the mid-term of the fiscal year 2023, briefly turned around, but suffered a loss again in the fiscal year 2024, and only turned profitable in the mid-term of the fiscal year 2025. Compared with the market value of hundreds of billions when Alibaba took control in 2020, the stock price is only 20% left.

In 2024, the price of retail assets has further declined. The retail industry, boosted by Sam's Club, Costco, and Pangdonglai, is no longer a stagnant pool. Sellers including Alibaba are still eager to get rid of their assets, and the "bottom-fishing" moment for buyers has arrived.

A Transaction Negotiated for Over a Year

From the rumors of the sale to the completion of the transaction, it took Sun Art Retail Group Limited more than a year to be sold twice, and the buyers also changed several times in the middle.

According to the exclusive understanding of 36Kr, the acquisition case of Sun Art Retail Group Limited mainly experienced three rounds of negotiations:

In the first round in December 2023, Alibaba began to look for potential buyers for RT-Mart. By March 2024, Alibaba had basically decided to package and sell Sun Art Retail Group Limited and Hema to COFCO. COFCO offered a price of about RMB 10 billion for RT-Mart and about RMB 20 billion for Hema. A person close to Sun Art Retail Group Limited told 36Kr that in this round, COFCO actually cared more about the brand value of Hema, and the acquisition of RT-Mart was a bundled one. However, the valuation of RMB 10 billion was significantly lower than Alibaba's expectations, and the transaction was ultimately not concluded.

In the second round in August 2024, several private equity institutions went to RT-Mart's offline stores for research. In mid-October, the senior management of Sun Art Retail Group Limited and RT-Mart went to Alibaba in Hangzhou to negotiate the transaction with the consortium led by Hillhouse Capital.

The pricing basis of this round was the market value of Sun Art Retail Group Limited at that time. In the negotiation, Alibaba offered HK$40 billion, which is 80% of the final acquisition price of HK$50.2 billion that Alibaba paid for Sun Art Retail Group Limited in 2020. However, due to the high price, the first parent company of RT-Mart, Ruentex Group, quickly withdrew from this round of negotiations. At this time, DCP Capital also joined the negotiation, but ultimately this round of negotiation also failed due to the failure to reach an agreement on the price.

In the third round at the end of November 2024, Hillhouse Capital withdrew from the acquisition of Sun Art Retail Group Limited, and DCP Capital conducted in-depth negotiations with Alibaba, and finally finalized the acquisition of RT-Mart for HK$13.1 billion. This price is much lower than the market value of HK$20 billion of Sun Art Retail Group Limited during the negotiation.

"There are two main considerations for this pricing: One is the 'assets' in RT-Mart's balance sheet. RT-Mart has many 'self-owned properties', and its current replacement cost or market value can be calculated, as well as cash assets; the other is to estimate the performance recovery brought about by the improvement of operational efficiency after the buyer takes over, corresponding to the PE level after 3 to 5 years, and then discounted to the current price." A person close to the transaction told 36Kr.

RT-Mart's "Assets"

Let's take a look at the asset portfolio of Sun Art Retail Group Limited.

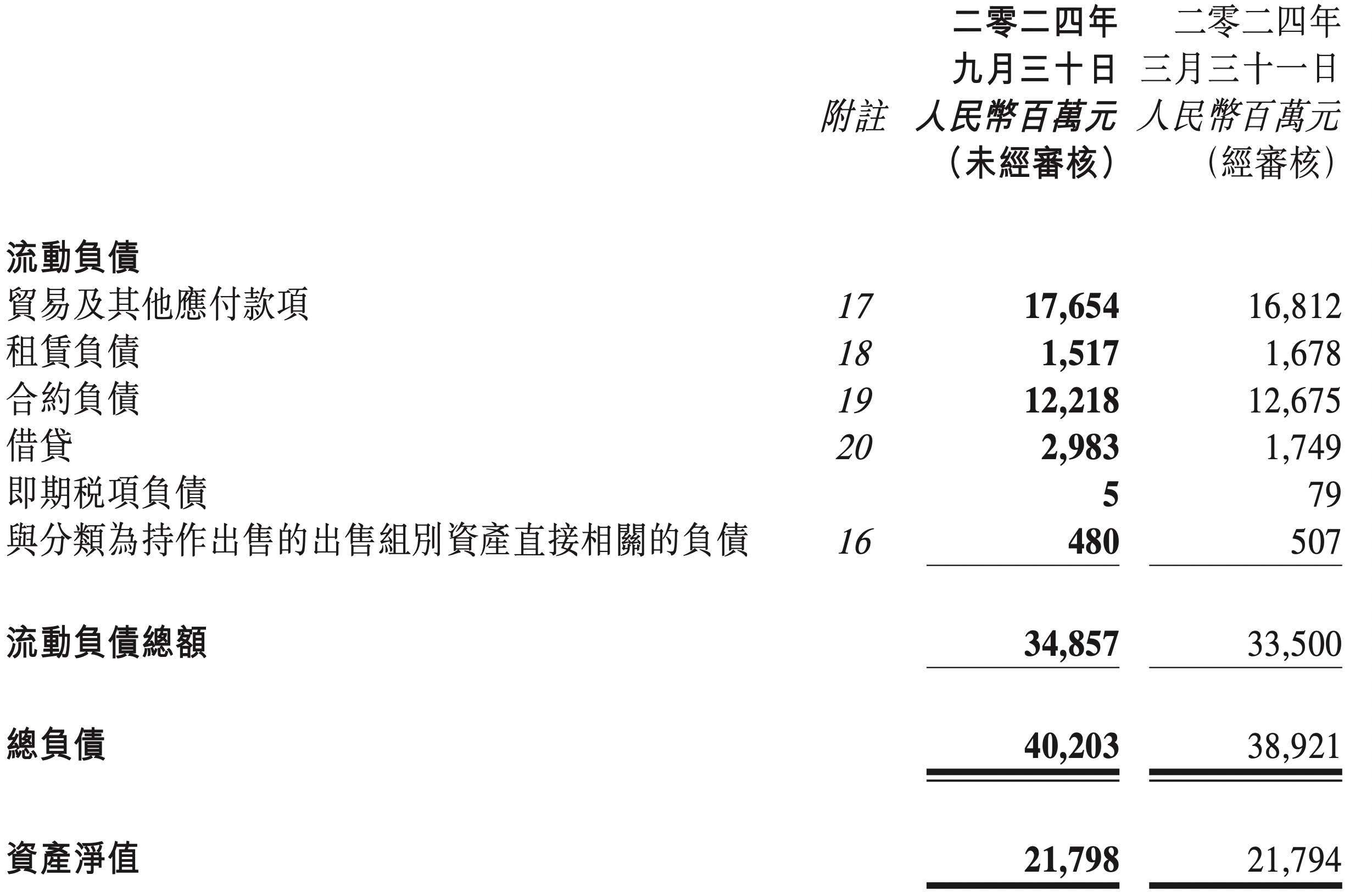

The interim results for the six months ended September 30, 2024, showed that the net asset value of Sun Art Retail Group Limited was RMB 21.798 billion, unchanged from the same period in 2023; the net cash was RMB 14.635 billion, a 11.3% decrease from March 31, 2024.

Needless to say about the cash. The assets of supermarket enterprises like Sun Art Retail Group Limited generally include fixed assets (properties) and intangible assets (brand value and supply chain resources). Sun Art Retail Group Limited operates hundreds of hypermarkets, and the main brands include RT-Mart, etc. According to the financial report, as of September 30, 2024, Sun Art Retail Group Limited has 466 hypermarkets, 30 medium-sized supermarkets, and 6 membership stores, totaling approximately 14 million square meters. 66% of the business area of hypermarkets and medium-sized supermarkets is leased, and 34% is self-owned properties. Among the 6 membership stores, 4 are self-owned properties. In addition, it also has a complete warehouse and distribution network, and previously, businesses such as Taoxianda provided online ordering services based on this.

34% of self-owned properties is a relatively high level in the industry.Almost all of Walmart's more than 300 stores in China are leased properties,and among Yonghui Superstores' nearly 1,000 stores nationwide, only 10 are self-owned properties - which is why in the case of Miniso's acquisition of Yonghui, the "assets" have almost negligible impact on the price.

RT-Mart's Cash and Liability Situation

For a buyout transaction to be successful, bottom-fishing in "price" is only the beginning. The real difficulty lies in improving the performance through operational transformation and increasing the "value".

Some retail industry insiders told 36Kr that RT-Mart is a good target. It has already turned from loss to profit, and its business fundamentals are better than Yonghui, which is still in loss. From the location of the stores, in the lower-tier markets, RT-Mart is mostly a street-facing store that can be seen at a glance, with a good foundation of foot traffic.

However, from the stores to the products, the transformation of supermarkets is a huge project that requires continuous investment. Lian Shangwang once reported that the cost of upgrading an old store of RT-Mart to version 2.0 is about tens of millions of yuan. This year, the single-store renovation cost of the "fat" Yonghui, which is vigorously carried out, is also about 20 million yuan. And RT-Mart has more than 400 old stores that need to be upgraded to version 2.0. Like Yonghui, which still has more than 700 stores after closing some stores, the transformation itself requires a lot of money, not to mention the need to reform products and supply chains. Traditional supermarkets need to eliminate many "back-office expenses", which will lower the gross profit.

For Alibaba, it is indeed a financial loss of HK$37.1 billion. However, in a complex macro environment and a fierce competitive environment, Alibaba's determination to refocus on its main business is very firm. While vigorously investing in e-commerce, AI, and cloud, it is undoubtedly necessary to divest offline assets and reduce staff. By selling Sun Art Retail Group Limited, Alibaba Group has reduced 85,778 people, almost half of its workforce.