In 2024, the startup that refreshed the financing record in the US pharmaceutical industry, why does it "favor" this new Chinese drug exclusively? | Industry Mapping

The BD and NewCo in the pharmaceutical industry have been bustling for a year. As the end of December approaches, the most exciting "winner-takes-all" scenario of this year has finally unfolded.

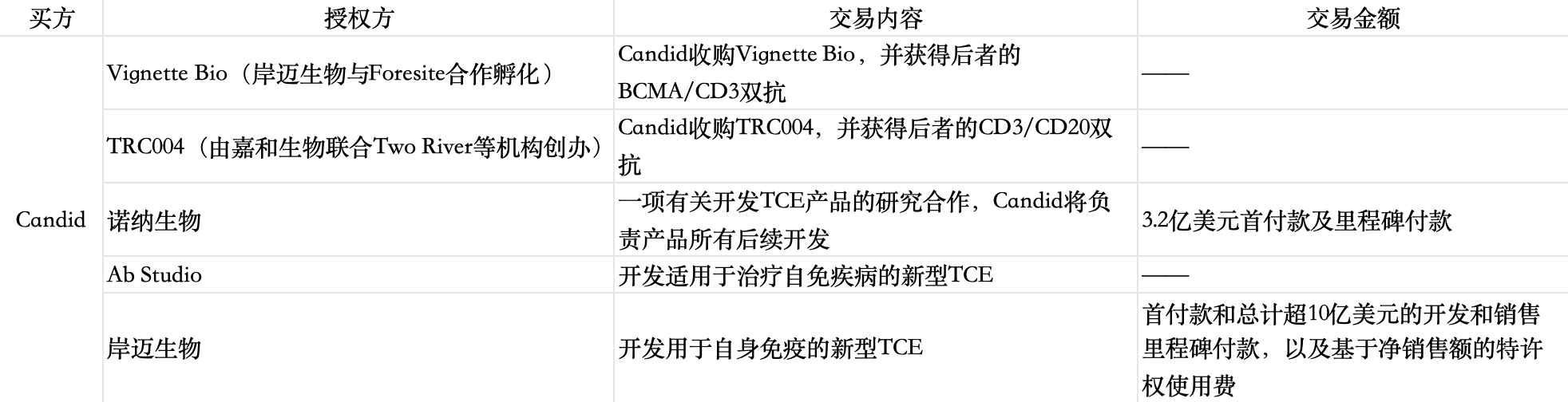

Recently, the American "dark horse-level" innovative drug company Candid Therapeutics, which was established only three months ago, has consecutively announced three transactions related to TCE products, with the disclosed amount exceeding 1.3 billion US dollars. Including the two TCE concept innovative drug companies it acquired in September this year, Candid has intensively completed five collaborations on TCE products, and The collaboration partners are all Chinese enterprises or pharmaceutical companies founded by Chinese in the United States.

Chart by 36Kr, data source from public information

TCE bispecific antibody is essentially an immunotherapy that can activate T cells. Compared with the well-known CAR-T product that costs millions of dollars per injection, it is more convenient and has a cost advantage.

The establishment of Candid comes with a "celebrity aura". In September, the financing amount of 370 million US dollars directly set a new financing record in the biomedical industry this year. Standing behind it are not only nearly 20 US dollar funds such as Foresite Capital and Venrock Healthcare Capital Partners, but the founder Ken Song is also a serial entrepreneur who is "very reputable in the industry" and has a strong ability to realize assets. Before the establishment of Candid, the innovative drug project company he managed was just acquired by Bristol Myers Squibb for 4 billion US dollars.

Such a combination and "shopping spree" speed almost blatantly announce to the global pharmaceutical industry that How much top capital and entrepreneurial teams value the TCE field at present.

It is worth mentioning that TCE asset transactions are also a popular BD direction this year. In addition to Candid, multinational pharmaceutical companies such as GlaxoSmithKline and Merck & Co. have also reached collaborations with Chinese innovative drug companies on TCE products. Among them, Merck & Co. paid a down payment of as much as 700 million US dollars when it purchased Tongrun Biotech's TCE pipeline.

In recent years, there are not few hot R & D directions in the medical industry, but not many can receive this honor.

In the current situation where the entire medical industry is looking forward to the return of prosperity, how big of a splash will TCE make? And what role will Chinese enterprises play in it?

The Hottest New Drug BD Direction in 2024

Never underestimate the willingness of scientists to "follow the trend".

In the pharmaceutical industry, the clinical validation of a new mechanism or the creation of a large sales record for a certain type of product is often the trigger for a BD transaction boom in that type of product, such as PD-1, ADC in the past, and TCE now.

This year, this is also the key direction for multinational pharmaceutical companies to "buy, buy, buy" in China. According to an incomplete statistics by 36Kr, At least 7 Chinese pharmaceutical companies have achieved overseas expansion through TCE assets this year, including Genor Biopharma, Tongrun Biotech, EpimAb Biotherapeutics, LBL Bioscience, CanMabio Pharmaceuticals, etc.

Returning to the core question, what exactly is TCE?

Understood from the principle, this is an innovative bioengineering antibody, and its advantage lies in being able to bind to different antigens on two cells simultaneously. One end is the CD3 molecule on the surface of T cells, and the other end is a specific antigen expressed by tumor cells or cells related to autoimmune diseases. Compared with the traditional monoclonal antibody product, the design of TCE bispecific antibody can spatially shorten the distance between T cells and target cells, thereby activating T cells and achieving a stronger "killing" effect.

Thanks to the characteristic that it can be expressed in most tumor cells, the bispecific antibody pipeline developed based on the CD3 molecule almost occupies half of the global bispecific antibody drug research and development; and from a commercial perspective, the development of TCE products means stronger cost advantages and safety.

Thanks to this, in the early years, TCE products were once a competitive highland for multinational pharmaceutical companies. Up to now, 11 TCE drugs have been approved for marketing globally. Common target combinations include CD3×CD19, CD3×CD20, CD3×BCMA, etc., and the indications are concentrated in the field of hematological tumors such as multiple myeloma and diffuse large B-cell lymphoma.

TCE products that have been marketed (Source: Haitong International Research Report)

From a sales perspective, some TCE products have also shown the strength of a "blockbuster product". For example, Johnson & Johnson's sales expectations for its two products have both reached 5 billion US dollars.

Under the temptation of the huge market, Chinese pharmaceutical companies are naturally unwilling to give up this "piece of cake". According to Haitong Securities, currently, in the two major fields of hematological tumors and solid tumors alone, there are as many as 30 TCE bispecific clinical projects being advanced in China.

However, in comparison, on the one hand, Chinese enterprises started relatively late in the overall research and development of bispecific antibody drugs; on the other hand, the existing mature products have achieved remarkable results in the development of relatively easy hematological tumor indications, while the development of solid tumor indications with a larger market has safety problems. When domestic enterprises explore the TCE pipeline, there are actually many limitations.

This is also the reason why most of the CD3 pipelines in China are in the early clinical stage. For example, among the multiple TCE pipeline BD transactions disclosed this year, Tongrun Biotech's CN201 (CD13xCD19) is considered a pipeline with relatively fast clinical progress, but it has only reached the Ib/II phase.

"Multinational pharmaceutical companies prefer to choose products with definite efficacy or certain basis. But so far, Most of the transactions between multinational pharmaceutical companies and Chinese TCE assets are concentrated in the IB to IIA clinical stage, and it is still a distance from the real drug, and it is too early to prove which product is better through the advancement speed and data." A domestic pharmaceutical company person who is seeking a BD transaction of TCE bispecific antibody products believes.

In other words, the outcome is undecided, and anyone could become the next "dark horse".

Waiting to be Verified: The New Outlet of Autoimmune Diseases

However, what really may determine the future of Chinese TCE concept enterprises may not be the tumors where clinical research is currently "clustered", but autoimmune diseases.

An interesting phenomenon is that although Most of the domestic TCE pipelines were conducting research on tumor indications before BD, after multinational pharmaceutical companies spent real money, they actually intended to use these TCE pipelines developed based on tumor indications for autoimmune clinical trials.

The transaction of the TCE pipeline is the first overseas licensing completed by Xu Yao's enterprise since its establishment. This transaction began to brew at the J.P. Morgan Healthcare Conference (JPM) in January this year. At that time, "although the company showed all tumor data, the overseas pharmaceutical companies and funds that came to inquire valued its potential for autoimmune diseases."

Recently, the new collaborations that Candid has reached with Ab Studio and EpimAb Biotherapeutics will also focus on autoimmune diseases. And previously, the two TCE pipelines that Candid acquired through the merger and acquisition of Vignette Bio, although the phase I clinical trials related to tumors have been completed, Will now also turn to autoimmune disease research, and it is expected to obtain safety data around 2025.

On the one hand, this is because as the competition in the TCE bispecific antibody in the tumor field becomes increasingly crowded, based on the ability of bispecific antibodies to kill B cells by using T cells as effectors (B cells play a key role in autoimmune diseases, and deep clearance of B cells may benefit many autoimmune diseases), some domestic and foreign enterprises have turned their attention to the broader autoimmune blue ocean market. "Unlike a single indication such as tumors, autoimmune diseases can derive more than a dozen or even dozens of indications. Coupled with the deepening aging trend and the continuous improvement of the payment system in China, the follow-up potential of autoimmune diseases is greater." Xu Yao believes.

On the other hand, since this year, some mature TCE products have been verified in the clinical development of various autoimmune diseases, laying a sufficient foundation of confidence for the followers.

For example, in April this year, the data of Amgen's Blinatumomab (CD19/CD3) successfully treating 6 patients with refractory rheumatoid arthritis was published in "Nature Medicine", confirming that TCE drugs are a feasible treatment method for B-cell-mediated autoimmune diseases such as rheumatoid arthritis; in June, the drug also published a series of data on the treatment of systemic sclerosis (SSc), achieving disease improvement while maintaining good safety.

"An important point in using TCE for autoimmune indications is to solve the safety problem, because the requirements for the safety threshold of tumors and immunity are completely different. Ten years ago, everyone might have found the combination of 'TCE + autoimmune' unimaginable because at that time, people had not yet learned how to design this molecule to control its safety in the clinic and avoid cytokine storms, etc. With the continuous clinical feedback, follow-up, and optimization over the years, there has been the current technological breakthrough, and the TCE market has thus reached the critical point before the current explosion."

At this "critical point", no decisive gap has been opened among global enterprises. Although the layouts of some leading multinational pharmaceutical companies are relatively earlier, most of them have just advanced to the phase I clinical stage, such as Roche's Mosunetuzumab, which is under development for systemic lupus erythematosus, and IGM/Sanofi's imvotamab for rheumatoid arthritis/systemic lupus erythematosus.

The progress of domestic enterprises is mostly in the preclinical stage, such as Hengrui Medicine, Suzhou Guangxin Biopharmaceuticals, and Antengene Corporation. And for those with faster progress, such as Shenzhoucell Biotechnology's SCTB35, it has been approved by the National Medical Products Administration to carry out clinical trials for autoimmune diseases in September this year.

Overall, the development of TCE products in autoimmune indications is still in its infancy. With the advancement of clinical development, the competition among these first-tier players Will basically only be discernible in one to two years.

And the "king of drugs" in the TCE field may be among them.

(Xu Yao is a pseudonym)

Company Review:

Genor Biopharma: Genor Biopharma was founded in 2007 and was once a star innovative drug company that attracted much attention in the Hong Kong stock market, with an IPO fundraising of more than 2.4 billion Hong Kong dollars. Recently, Genor Biopharma reached a reverse acquisition with CSO company Eddingpharm.

Tongrun Biotech: Tongrun Biotech was established in 2018 and is an innovative drug company incubated by WuXi Biologics. This year, the TCE pipeline CN201 that reached a collaboration with Merck & Co. is also the core pipeline that the company introduced from WuXi Biologics at the beginning of its establishment, which is said to be "one of the best innovative drug pipelines established by WuXi Biologics". In terms of financing, Tongrun Biotech received a 150 million US dollars financing in the early stage of its establishment, and the investors include 6 Dimensions Capital, Boyu Capital and Temasek.

EpimAb Biotherapeutics: EpimAb Biotherapeutics focuses on the development of multispecific antibodies and has now established a bispecific antibody technology platform with independent intellectual property rights, FIT-Ig®. In the TCE licensing boom in 2024, EpimAb Biotherapeutics is also one of the most outstanding Chinese enterprises, having reached two collaborations with Candid successively, and the second transaction amount exceeded 1 billion US dollars.

Enmabio: Enmabio was established in 2016 and recently announced the completion of its Series B financing, with the investors being Foresite Capital and Lilly Asia Ventures. It is worth noting that Foresite Capital is also one of the important backers behind Candid. After reaching an 800 million US dollars collaboration with GSK on the TCE trispecific antibody CMG1A46, the future development direction of CMG1A46 will focus on autoimmune diseases represented by systemic lupus erythematosus (SLE) and lupus nephritis (LN), and it is expected to start the phase I clinical trial for SLE in 2025.

LBL Bioscience: LBL Bioscience was founded in 2012 and has started to layout the CD3 T-cell engager technology since 2020. Based on its own LeadsBody™ research platform, it has developed pipelines such as GPRC5D/CD3 bispecific antibody LBL-034 and MUC16/CD3 bispecific antibody LBL-033. Among them, LBL-034 was granted Orphan Drug Designation by the US FDA in October this year for the treatment of multiple myeloma. At the end of November, LBL Bioscience has submitted an application to the Hong Kong Stock Exchange.

CanMabio Pharmaceuticals: It is a Hong Kong-listed company with a dual-layout in autoimmune and chronic diseases + tumors. The TCE pipeline CM336 that reached a collaboration this year is a BCMA/CD3 bispecific antibody developed based on CanMabio Pharmaceuticals' nTCE bispecific platform. Currently, CM336 is advancing a multi-center, open-label phase I/II clinical study for the treatment of patients with relapsed or refractory multiple myeloma.

Harbour Biomed: It is a subsidiary of HBM Holdings, and is an important role for the latter to explore a new profit model. In the first half of this year, Harbour Biomed's research service fee reached 2.326 million US dollars, with a year-on-year growth of 167.4% (approximately 16 million yuan); in addition, the company has earned large incomes through licensing and other forms many times.