Luxury houses in Beijing and Shanghai are selling like hotcakes, but this data is a bit worrying.

On Christmas Day, Zhonghai Real Estate's luxury residence Zhonghai Lingdi · Jiuxu in Xuhui Binjiang, Shanghai, opened for sale.

This project, with a minimum unit area of 226 square meters and a starting price of 35 million yuan per unit, was sold out within 30 minutes.

Since its opening on June 28, Zhonghai Lingdi has opened for sale five times, and each time all units have been sold out. Within 180 days, a total of 1,200 units have been sold, with a single-project performance of up to 28.2 billion yuan.

Industry insiders are also amazed:

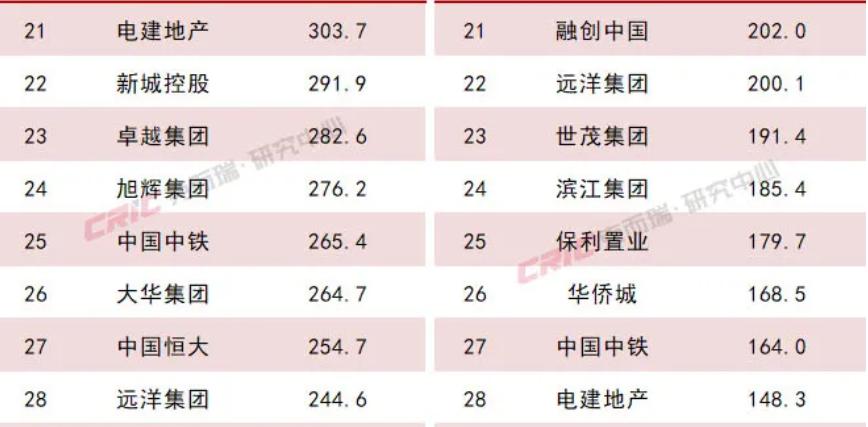

A sales volume of 28.2 billion yuan, taken alone, can rank among the top 25 in the entire industry.

Real Estate Enterprise Sales Ranking from January to November 2014 (Part)

However, what is surprising is not Zhonghai's performance, but the "purchasing power" of the wealthy in Shanghai this year.

Another project of Zhonghai: Shunchang Jiuli, with an average sales price of 172,000 yuan per square meter, opened for sale at the beginning of this year and sold nearly 20 billion yuan at one time;

Poly's Bund 45 in Yangpu Binjiang, with the lowest unit price of about 105,000 yuan per square meter and the highest unit price of over 148,000 yuan per square meter. There are only 74 units available, but 538 people rushed to pay and enter the lottery;

The Sunac Waitan No.1 Courtyard Phase II, with an average price of 170,000 yuan per square meter, has been sold out three times this year and has sold over 20 billion yuan;

Lvfa · Pujiangyuan, with a unit price of 160,000 yuan per square meter, also sold over 10 billion yuan in the month of its opening.

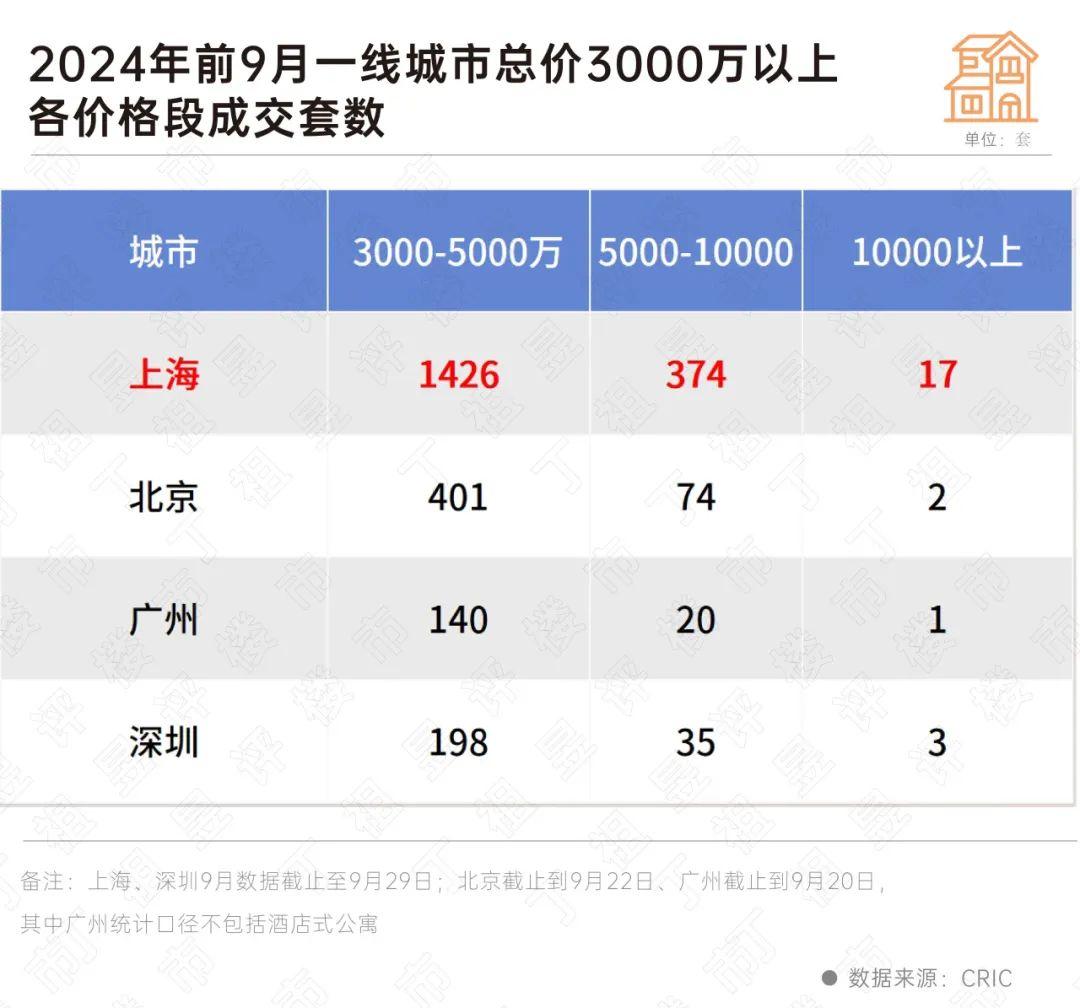

Yiju Kerui once made a statistics. In the first 9 months of this year, a total of 1,817 luxury houses with a total price of over 30 million yuan were sold in Shanghai, and the transaction scale has reached the highest in the past 10 years.

Image Source: Ding Zuyu's Comment on the Real Estate Market

A podcaster who specializes in teaching people to invest in buying houses said in the podcast: There are no more "new property buying" opportunities in the Shanghai real estate market this year!

But still, the luxury houses in Shanghai are selling like hotcakes.

This phenomenon occurs during the downward trend of the real estate market, which is very puzzling to many people. Because the mainstream voice in the market has been shouting "the wolf is coming". In the next economic cycle, what needs to be dealt with is "consumption downgrading", the decline in GDP growth rate, and the decline in asset prices. People who own houses should "escape from the real estate market" as soon as possible, and those who do not own houses can "rent instead of buying".

Some official statistics are also used as arguments:

The data on the total retail sales of consumer goods in Shanghai from January to November released by the Shanghai Municipal Bureau of Statistics: It decreased by 3.1% compared with the same period last year. Among them, the catering industry, which was hyped up in the previous period, has a greater decline.

Moreover, this phenomenon not only occurs in Shanghai, but also in Beijing:

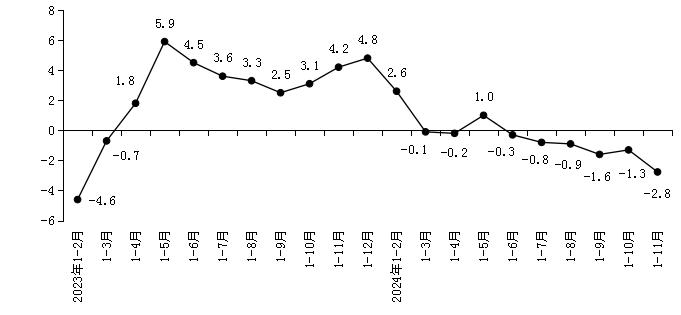

From January to November this year, the total retail sales of consumer goods in Beijing reached 1286.59 billion yuan, a year-on-year decrease of 2.8%.

Cumulative Growth Rate of Total Retail Sales of Consumer Goods in Beijing, Unit: %

At the same time, Beijing Chenyuan, with a price of more than 111,000 yuan per square meter, has signed 231 units online since it obtained the certificate on September 28; Jinghua Jiuxu, with a transaction price of about 175,000 yuan per square meter, has signed more than 7.55 billion yuan online. For the project's 325 units, the actual sales rate is 99.4%.

In the transaction list of luxury houses with a price of over 30 million yuan, Beijing far exceeds Guangzhou and Shenzhen, following closely after Shanghai.

Beijing and Shanghai, the two major first-tier cities, have the same "symptoms": Luxury houses are selling well, but the total retail sales of consumer goods are showing a downward trend.

Some practitioners in the financial field said: The contribution of consumption to GDP growth has decreased for three consecutive quarters. The contribution rate of final consumption expenditure to GDP growth dropped from 74% in the first quarter to 47% in the second quarter, and further to 29% in the third quarter.

The real estate market has picked up, but consumption has declined.

Therefore, some people have called for saving consumption now that the most lenient housing purchase policies in history have been introduced to save the real estate market.

This year, the "Le Pin Shanghai" catering consumption vouchers in Shanghai have been issued to the third round, and the Jing'an District alone has issued more than 30 million yuan in catering consumption vouchers.

In addition to issuing eight types of consumption vouchers including home appliances and electronic products throughout the city in Beijing, with a maximum subsidy of 2,000 yuan per item for a single type of commodity and a total subsidy of up to 16,000 yuan per person, the Economic Development Zone, Mentougou and other areas also issue car consumption vouchers by district.

Shanghai estimates: Every 1 yuan of consumption voucher subsidy can bring 4.2 yuan of consumption.

Beijing stated in the statistical bulletin: The retail sales of household appliances and audio-visual equipment increased by 9.2% driven by the "trade-in" policy.

However, people generally feel that such efforts are not enough.

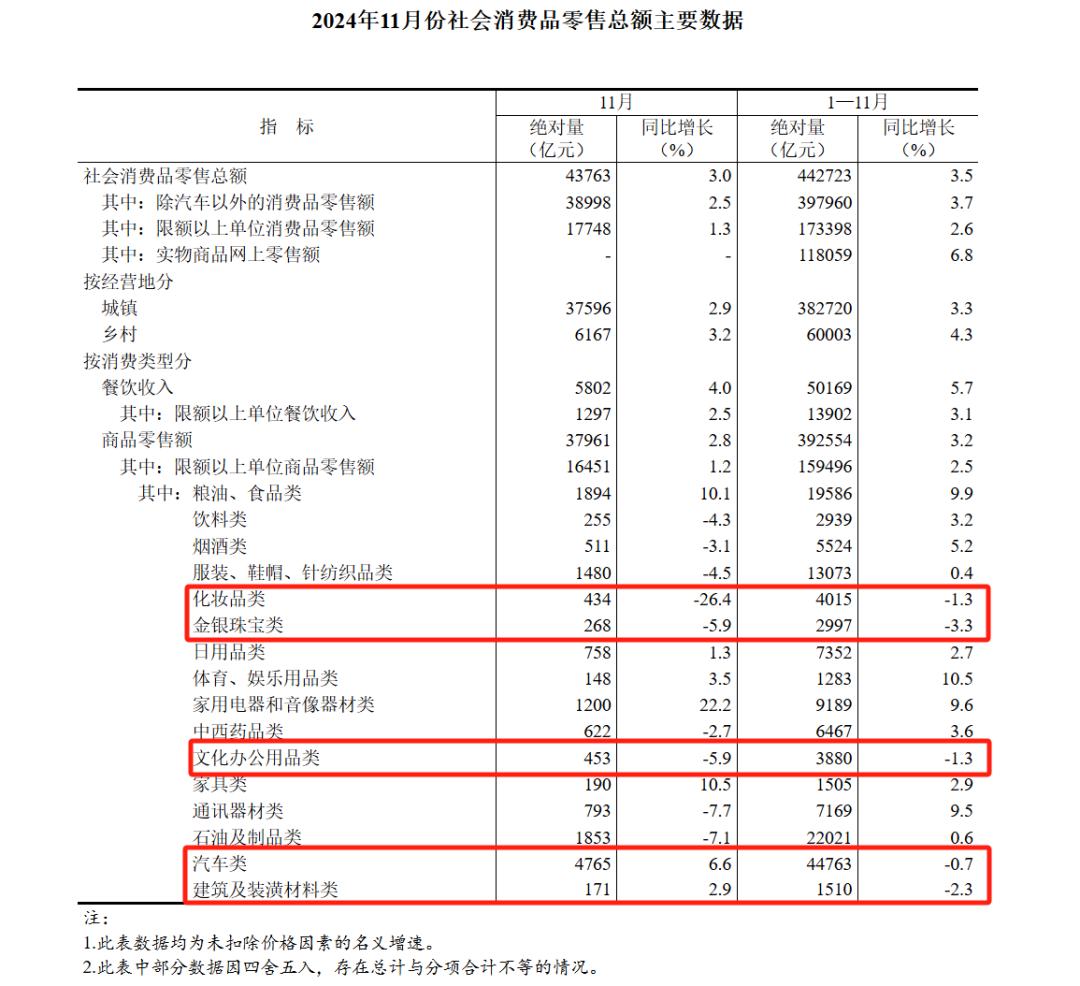

From a national perspective, the total retail sales of consumer goods are still growing year-on-year, but several categories have declined rapidly at the end of the year: cosmetics, gold and silver jewelry, and cultural and office supplies.

The middle class, the main force of consumption, mostly exists in Beijing and Shanghai. The decline in consumption data in these two strongest first-tier cities indicates that the middle class has also begun to tighten their wallets.

Data Source: National Bureau of Statistics

People in first-tier cities will have a common feeling: When the economy is good, the so-called middle class will create a feeling of "continuous improvement" through consumption. They often buy several luxury bags and try big-brand cosmetics.

They are also the group that leveraged the most during the rising period of the real estate market. With 5 million yuan in hand, they dare to buy a luxury house with an entry-level price of tens of millions of yuan.

In the downward period of house prices in the past two years, they have become the most active group in prepaying their loans. Among the people I know, there is a case of "a house worth tens of millions, with a personal monthly consumption of 3,000 yuan". In order to reduce the pressure of buying a house with leverage, they keep cutting their own consumption, eliminating cosmetics and eating out.

Therefore, although Beijing and Shanghai are the two cities with the highest per capita deposits of residents in the country and also the two with the largest middle-class groups among the large and medium-sized cities in the country, due to the previous "advanced" house buying, they are now facing huge pressure to reduce consumption.

Data on Per Capita Deposits of Urban Residents in Cities across China in 2023

The middle class is facing the pressure of paying off the debts for the previous excessive consumption, but the real wealthy people do not follow the same logic.

The wealthy do not generate cash flow by salary, so they are more inclined to view asset allocation issues with an investment mindset. What they care more about now is "how to keep the fruits of victory previously obtained".

In the recent luxury house markets in Beijing and Shanghai, there are many out-of-town customers. These people come from the mineral and other physical industries. Different from the previous investment expansion and heavy investment in financial assets, they now choose to invest cautiously, and the luxury houses in first-tier cities are more in line with the requirement of "low risk".

Therefore, essentially, it is the localization of consumption and the concentration of real estate investment from the whole country to the first-tier cities and the core cities of the metropolitan area, which to a certain extent aggravates the phenomenon of "weak social retail sales and hot sales of luxury houses",

This is in line with the developers' concentration in key first- and second-tier cities.

From January to November this year, the national residential sales area decreased by 16.0% year-on-year. In contrast, the data for Beijing and Shanghai are: a decrease of 4.7% and a decrease of 3.5%, respectively.

First-tier cities are pulling away a wider gap from other cities.