CR Land's card has been played.

On December 23, China Resources Land Limited issued an appointment announcement:

Mr. Xu Rong, an executive director of the Company, has been appointed as the Company's President and a member of the Company's Corporate Social Responsibility Committee with effect from December 23, 2024.

Xu Rong, born in 1968, is 56 years old. He joined China Resources Land Limited as Vice President in January 2023. Previously, he served as Deputy Director of the Binhai Branch of the Shenzhen Planning Bureau, Director of the Shenzhen Urban Renewal Office, Deputy Director (Deputy Bureau Chief) of the Shenzhen Planning and Land and Resources Commission (Municipal Oceanic Administration), Deputy Minister of the Regional Development Department of China Merchants Group, Deputy Director of the Qianhai Shekou Free Trade Zone Office, and General Manager of Shenzhen Qianhai Shekou Free Trade Investment and Development Co., Ltd.

Xu Rong also led the Shenzhen-Xiongan New Area Planning Working Group during the process of supporting the construction of Xiongan New Area and participated in the planning and compilation promotion work of Xiongan New Area.

After joining China Resources Land Limited, he has successively participated in the old renovation projects such as Hubei Village, Dachong Village, Shajing Street, and Snow Beer Area in Shenzhen.

Therefore, Xu Rong's appointment is also interpreted as China Resources Land Limited's intention to intensify its efforts in urban renewal and prepare for the company's business to reach a new level.

Announcement content

Furthermore, after 2020, China Resources Land Limited has continuously adjusted the company's structure, reduced the number of city companies, and deeply cultivated the regions. Through bold organizational reforms, the company has accelerated its development.

This set of combined measures suddenly makes people realize that China Resources Land Limited is another formidable competitor like China Overseas Land & Investment Co., Ltd.

During the period of rapid industry development, it can maintain self-discipline and not pursue the extreme "three highs", but always remains at the forefront of the industry. When the cycle changes and the industry slows down, it suddenly rushes into the top three.

Data source: CRIC

Previously, the position of President of China Resources Land Limited has been vacant for nearly 15 months since Wu Bingqi was transferred to China State Construction Engineering Corporation in September 2023.

01

Many people may not know that it was actually China Resources that wanted to be the largest real estate developer in China 30 years ago.

Since 1994, China Resources has acquired 70% of the equity of Huayuan Real Estate through equity investment and mergers and acquisitions, becoming the largest shareholder of this early-bird state-owned enterprise in the domestic real estate development industry.

In 2000, China Resources began to invest in Vanke in the same way, planning to integrate "South Vanke and North Huayuan", the two leading real estate brands, into the largest real estate carrier in China, and become the invisible champion behind the giants.

China Resources has the gene of capital mergers and acquisitions in its bones. Therefore, in the first stage, China Resources spreads a "capital net" to lay out the real estate industry.

However, due to the opposition of Huayuan, China Resources' grand narrative of merging Vanke and Huayuan failed. Eventually, it could only remain as the largest shareholder of Vanke in the role of "financial investment" for many years until the "Baonv Dispute" occurred.

After the failure of capital entry, in 2002, China Resources established "China Resources Shenzhen Co., Ltd." to enter the market in person, and it has been 22 years since then.

The idea of China Resources in real estate is also different from that of most real estate enterprises.

Vanke and China Overseas Land & Investment Co., Ltd., the two benchmark enterprises, are representatives that optimize "scale + turnover" under the red line of financial security. What they are best at is actually residential development, and they are cautious about business formats that require "nurturing" such as commercial properties.

Evergrande and Country Garden are representatives that have taken "capital + high turnover" to the extreme and maximized the use of leverage. Because they dislike money with slow turnover, they will not invest heavily in non-sale properties.

The difference of China Resources Land Limited is that it has a very mature residential product line and a prominent commercial brand. It has the gene of capital operation and does not have an amateurish attitude.

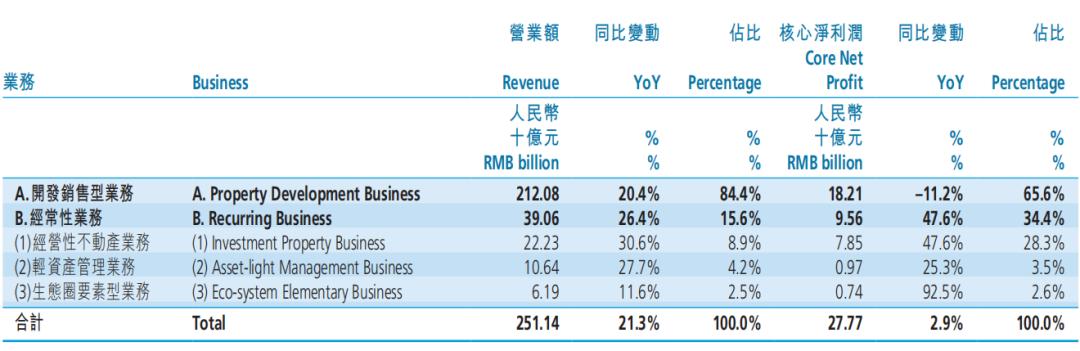

It can be seen from the revenue structure of China Resources Land Limited in 2023 that it is no longer a traditional real estate development enterprise. The ratio of sales property income to operational property income is approximately 5:1, and this structure is more in line with the future urban development needs.

China Resources Land Limited's 2023 performance composition

On the one hand, the urbanization process is about to reach its peak, the incremental demand for real estate is slowing down, and the growth rate of sales-oriented businesses will also decline accordingly.

On the other hand, in the past urban development process, the "spreading pancake" model was mostly adopted. Now the urban construction scale has reached its peak, but there are still a large number of old cities waiting to be updated and upgraded. This will become a new increment for the future development of real estate development enterprises.

However, the future old city renovation will definitely be different from the past. The large-scale demolition model will be replaced, and comprehensive development and old city upgrading and replacement will become the mainstream model. This is why urban renewal projects are becoming more and more difficult, the total investment is getting higher and higher, and the requirements for the capabilities of development enterprises are becoming more and more demanding.

Under China Resources Land Limited, there are residential developments, shopping centers, office buildings, hotels, its own supermarket and other commercial brands, and it can also provide light asset services such as construction agent and operation.

Moreover, China Resources Land Limited has many experiences in the development of super-large urban complex projects, such as China Resources Shenzhen Bay Complex, with a construction area of approximately 490,000 square meters, including super high-rise buildings (office buildings), residential buildings, hotels, apartments, and shopping centers.

Comprehensive development capability is the way to survive in the second half of the real estate industry. This point may be understood by enterprises such as Vanke, but China Resources Land Limited may be the most balanced one in terms of background, capital, and business layout.

And Xu Rong's appointment as President is obviously to continue to strengthen the comprehensive development capability of China Resources Land Limited. His previous experience will bring a broader vision to China Resources Land Limited and strengthen its advantages in urban planning, government-business relations, and other aspects.

02

The current top three in the industry sales scale are three central state-owned enterprises: Poly Developments and Holdings Group Co., Ltd., China Overseas Land & Investment Co., Ltd., and China Resources Land Limited.

These three enterprises have different development focuses and business characteristics, representing the extreme scale that they can achieve on their respective routes under the current industry background.

The ratio of sales property income to operational property income:

- China Resources Land Limited: Approximately 5:1

- China Overseas Land & Investment Co., Ltd.: Approximately 48:1

- Poly Developments and Holdings Group Co., Ltd.: Approximately 14:1

How the rankings of the three enterprises will change in the future is not only a comparison among the three enterprises but also a dispute over the development route of the real estate industry.

For China Resources Land Limited, it is still in the role of a pursuer.

China Resources Land Limited's sales volume exceeded 100 billion for the first time in 2016. At that time, Poly Developments and Holdings Group Co., Ltd.'s annual sales volume was 220.3 billion, and China Overseas Land & Investment Co., Ltd.'s was 192.5 billion. There was a significant gap between China Resources Land Limited and the latter two.

Since then, China Resources Land Limited has been catching up. From 2020 to 2023, China Resources Land Limited's performance and rankings are as follows: 285.03 billion yuan (9th), 315.76 billion yuan (8th), 301.33 billion yuan (4th), and 307.03 billion yuan (4th).

However, Poly Developments and Holdings Group Co., Ltd. and China Overseas Land & Investment Co., Ltd. still have obvious advantages, especially China Overseas Land & Investment Co., Ltd., which has started to make aggressive moves in the land market and sales end this year.

If China Resources Land Limited wants to catch up, it cannot neglect any of the three aspects: residential development, old city renovation, and commercial properties.

In the field of residential development, on the one hand, China Resources Land Limited is closely following China Overseas Land & Investment Co., Ltd. in the land market.

Data source: China Index Academy

On the other hand, China Resources Land Limited is also more willing to leverage more performance through cooperation.

For example, China Resources Land Limited is involved in the Beijing Haidian Gongdesi plot. The 18.512 billion yuan total price land king in Shenzhen was jointly acquired by China Resources and China Overseas Land & Investment Co., Ltd.

In the sales performance in the first 11 months of this year, the equity ratios of China Resources Land Limited, Poly Developments and Holdings Group Co., Ltd., and China Overseas Land & Investment Co., Ltd. are: 69%, 78.8%, and 90% respectively.

Obviously, China Resources Land Limited has a more "open" attitude.

In the field of investment properties, China Resources Land Limited has reserved 10.04 million square meters of land (as of the end of 2023), 70% of which is for commercial use, and there are 50 shopping centers under construction and in planning.

In this field, China Resources Land Limited is currently in the leading position and has already built a scale-based moat.

If residential development and investment properties are the guarantees for the "steady growth" of China Resources Land Limited, then old city renovation is the "breakthrough" point for China Resources Land Limited. Therefore, Xu Rong's appointment as President is an important "card" played by China Resources Land Limited and also an acceleration signal.