Meituan Xiaoxiang Supermarket initiates overseas expansion, with Saudi Arabia as the first stop. The team size has exceeded one hundred. | Exclusive

Text|Ren Cairu

Editor|Qiao Qian Yang Xuan

Three months after Keeta officially launched in Saudi Arabia, Meituan's overseas expansion map has been further filled.

36Kr has learned from multiple independent sources that Meituan's front warehouse business, "Xiaoxiang Supermarket," has started its overseas expansion process. The first stop is still in Saudi Arabia, led by "former Meituan employee" Liu Wei. Liu Wei previously served as the person in charge of Kuai Lv-related businesses, the regional operation department of Meituan Youxuan, and the product department of the In-store Business Group.

According to informed sources, the members of the Xiaoxiang Supermarket overseas project team are mainly selected from Youxuan, Kuai Lv, and Xiaoxiang businesses. Among them, the product research and development team goes first, with over a hundred people, and the business team also has dozens of people. "The scale is not small, but the early stage is done very carefully, and the confidentiality is also very high."

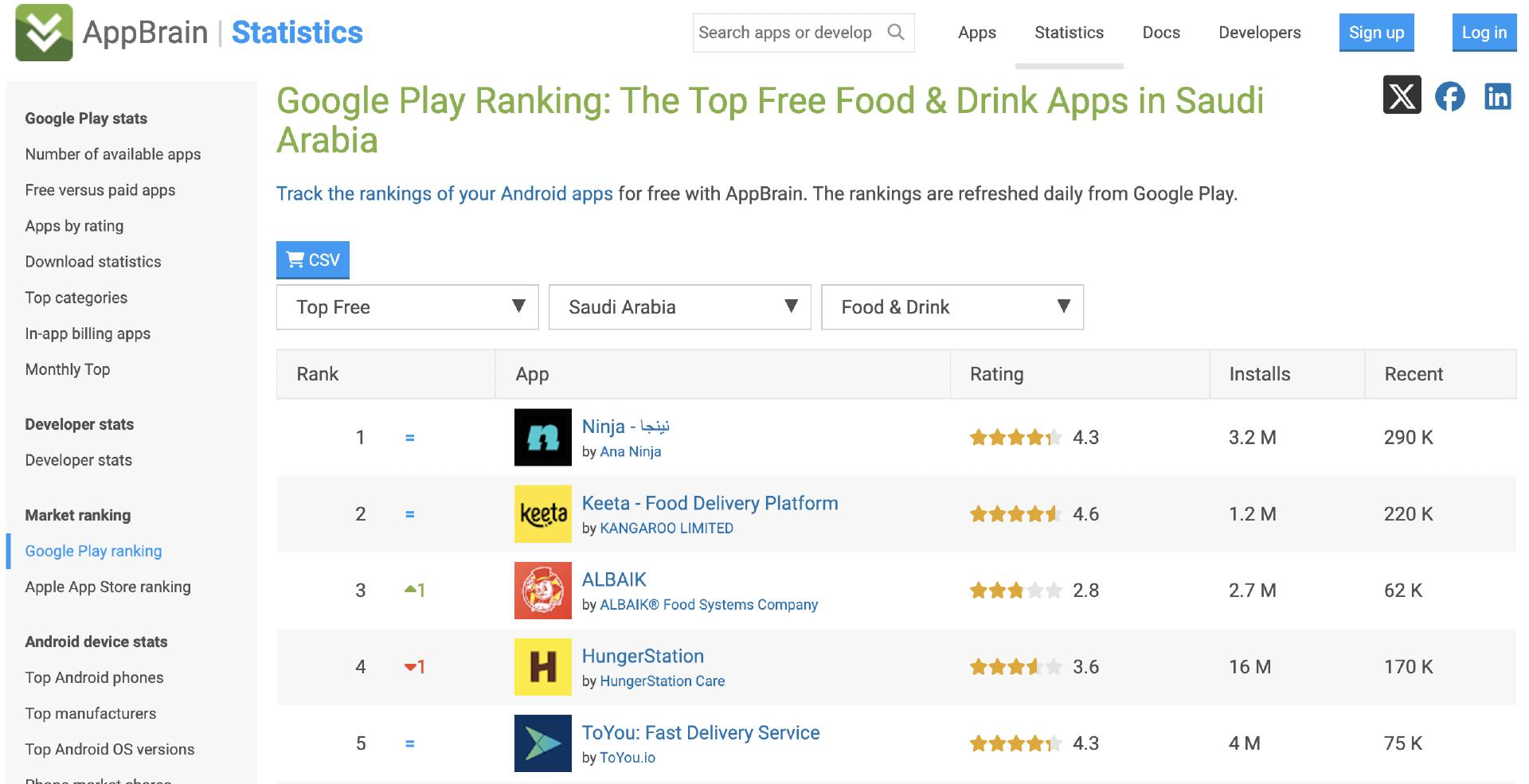

The above-mentioned person describes this move as a "very good choice". Judging from the existing exploration foundation, Keeta's food delivery business in Hong Kong has achieved a consensus "success". Its order volume share has quickly surpassed Deliveroo and Foodpanda, ranking first. Since its launch in Saudi Arabia, although Keeta is still not mature, its growth is optimistic. Up to the time of publication, it has ranked in the TOP 2 of the food application list in Saudi Arabia. Informed sources said that Keeta's food delivery will continue to expand to places like Dubai next year.

Keeta's download volume in Google Play Store has ranked in the TOP 2 of the food application list

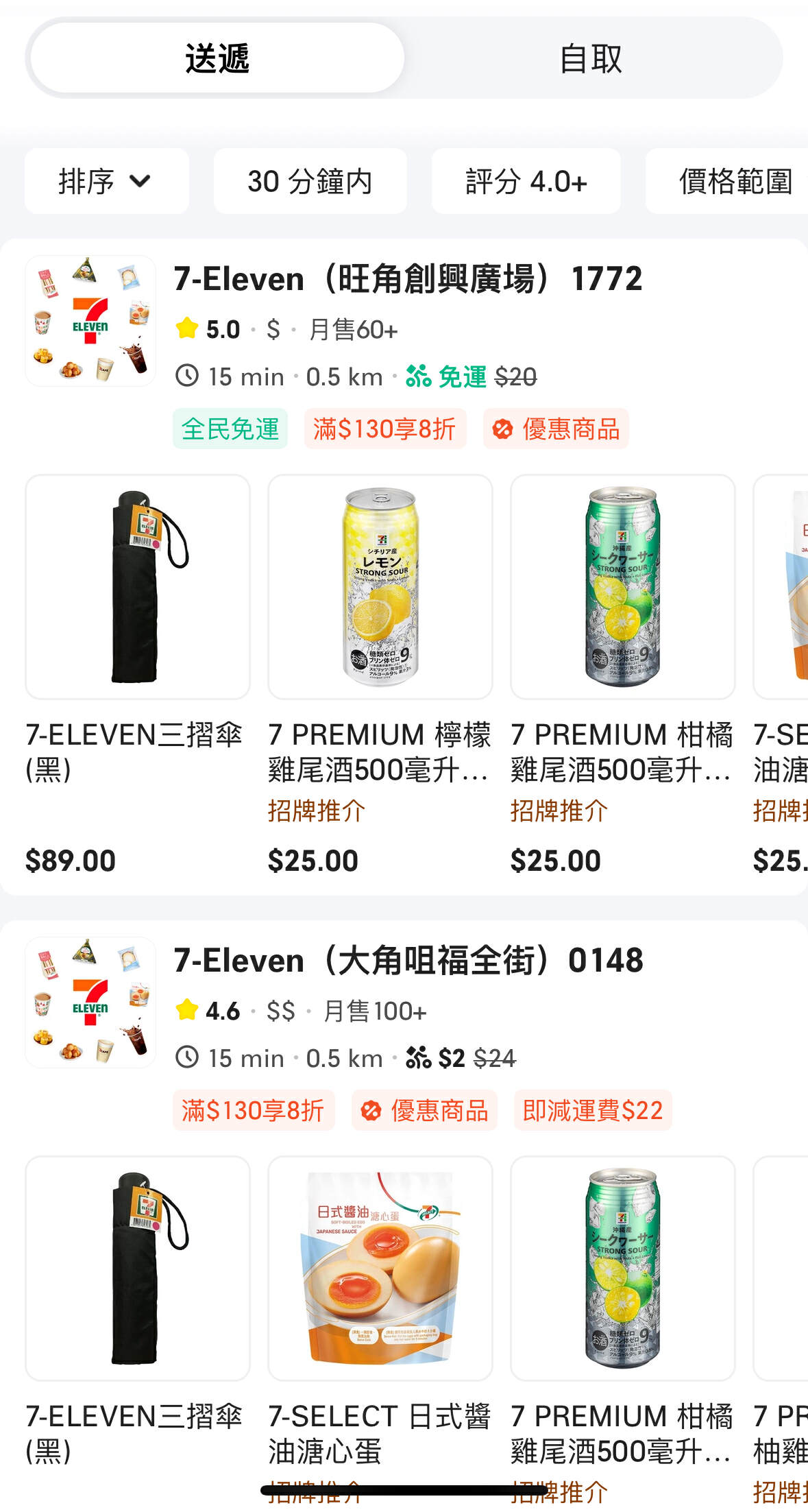

In the next step, the horizontal extension of the business also seems natural. In July this year, Keeta's supply categories in Hong Kong expanded from food delivery to convenience store categories, and 7-Eleven convenience stores also entered at that time. The above-mentioned person analyzed to 36Kr that "Food delivery itself is a low-threshold and high-frequency business format that can attract different groups of people, thereby creating a huge user pool. Subsequently, the platform can also provide various hierarchical and classified services based on the user pool." Behind this, the ability of immediate delivery is interlinked and reusable.

7-Eleven has entered Keeta Hong Kong

Specifically for the Middle East market, the perennial extremely high temperatures and strong ultraviolet rays make the demand for immediate fulfillment more certain. For example, the parent company of the food delivery platform Talabat, which has a high penetration rate in Saudi Arabia, Delivery Hero, just completed its listing in Dubai on December 10. During the fundraising period, its CFO said that the company will focus on expanding its influence in the current eight countries in the Middle East and North Africa because "the markets we operate in are growing rapidly, and it is definitely wise to continue to penetrate and invest in these markets."

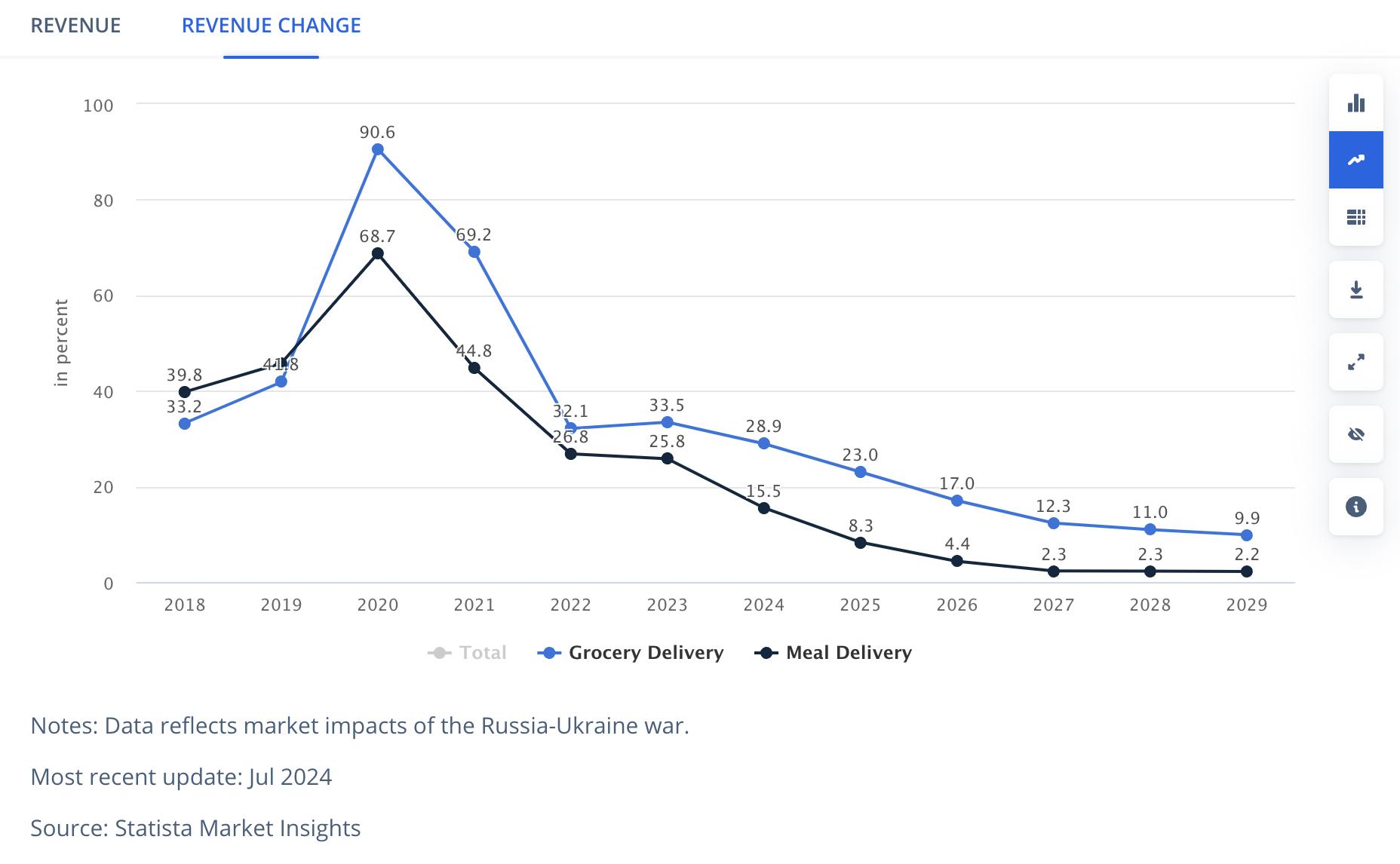

Further subdividing the demand for immediate fulfillment, the benefits in the grocery field seem to be stronger - in Saudi Arabia, the immediate delivery market in the grocery field is in the early stage of high growth, and the growth rate is also higher than the relatively mature food delivery.

Data from Statista shows that although the grocery delivery scale in the Saudi market has always been lower than that of food delivery, the growth rate of grocery delivery has been higher than that of food delivery since 2020, and this trend will continue in the next five years.

Statista data shows that the growth rate of grocery delivery is higher than that of food delivery

The report of Lucidity Insights also shows that by 2028, the Saudi grocery delivery market is expected to increase to $2.8 billion at a compound annual growth rate of 18.2%, which is three times the growth rate of the food delivery market. The driving force behind this is that "grocery delivery is still in its infancy in Saudi Arabia, and the number of participants in this field is continuously increasing."

Based on this, in recent years, some promising front warehouse players have emerged in Saudi Arabia. At the beginning of 2023, Ninja and Nana completed seed round financing and a $133 million Series C financing respectively. Both adopt the front warehouse (referred to as "dark store" overseas) model, covering categories including fresh agricultural products, skin care products, pet food, and more. Among them, Ninja has currently ranked as the TOP 1 in the local food application downloads, and Nana was founded in 2016. It innovatively launched the front warehouse model in Saudi Arabia, featuring "delivery within 15 minutes."

However, in addition to the strong demand, the front warehouse business also represents a high investment.

The business logic of food delivery and front warehouse is very different. The former generates revenue through commissions and advertising after completing the early stage of merchant recruitment and user accumulation. The latter requires a heavier upfront investment - building a warehousing system, building a commodity pool through a large number of investigations and negotiations with suppliers, etc. This is also the necessity of transferring employees from Kuai Lv.

A person close to Meituan told 36Kr that the consideration of demand and cost may also be the reason why Hong Kong was not chosen for the trial. "The density of convenience stores in Hong Kong is high, and users' reliance on online grocery orders is not as high as that in Saudi Arabia. The profit margin for doing food delivery is sufficient; but if doing front warehouse retail, unless you vigorously develop your own brand, the profit margin is not enough, and it may be a money-burning business after it is set up."

The story of extending from food delivery to the grocery field is actually the process of Meituan expanding its boundaries in China over the past few years - first building an immediate delivery network and capability in the market competition of food delivery, and then relying on this to extend to broader needs. Flash Sale and Xiaoxiang businesses are respectively using the shelf model and the self-operated front warehouse model to cover the immediate delivery needs of categories such as fresh produce, daily necessities, and more.

Nowadays, the front warehouse model represented by Xiaoxiang Supermarket is ushering in a new spring in China. According to media reports, by the second quarter of this year, Xiaoxiang Supermarket has opened more than 680 front warehouses, of which 550 are located in the four first-tier cities of Beijing, Shanghai, Guangzhou, and Shenzhen.

In addition, the increased investment of JD 7Fresh and Sam's front warehouse, as well as the profit of Dingdong Maicai, seem to give this model an optimistic meaning.

Not long ago, Dingdong Maicai officially started its overseas expansion, and the first stop was also selected as Saudi Arabia. Media quoted internal sources as saying that Dingdong Maicai's overseas model is mainly to sell pre-made dishes to local customers, and there will also be categories such as fresh produce, refrigerated products, and general merchandise.

Regarding the overseas expansion of Xiaoxiang Supermarket, the person close to Meituan mentioned above said, "This thing will definitely be done, and there are enough reasons." The person listed the following: First, the policies in the Middle East are friendly, and the overall development is slower than that in developed countries, with more opportunities; second, relying on the foundation of Keeta's food delivery, the problems of customer acquisition cost and user stickiness are better solved than those of competitors; third, after the Xiaoxiang model is successful, it means that many of Meituan's self-operated products and supply chains can expand overseas, which is a new increment and possibility.

After the alternating evolution of "falsification" and "verification" in the Chinese market for many years, the curtain of the front warehouse may be unfolding again on the land of the Middle East.