Kissinger retired in a hurry. Who can shoulder Intel's AI burden? | Focus Analysis

Author丨Qiu Xiaofen

Editor丨Su Jianxun

On the evening of December 2, Intel announced on its official website that its CEO Pat Gelsinger (hereinafter referred to as Gelsinger) retired and stepped down from the board of directors.

"Suddenly received an email without any prelude," multiple Intel employees told 36Kr, indicating that this news was quite sudden - just four days ago, Gelsinger still went to visit the server room of Musk's company and posted a clock-in photo of himself wearing a safety suit and pointing at an Intel chip on social media.

From Gelsinger's social media

But the strangest thing is that as a super chip manufacturer with a 56-year history, this major personnel change was announced without a successor being determined, and at an awkward time point - recently, Intel has been deeply mired in layoff rumors, and rumors of being acquired have also been rampant.

According to Intel's official information, Gelsinger's duties are temporarily taken over by David Zinsner and Michelle Johnston Holthaus. The former is Intel's CFO, and the latter is the head of CCG (Client Computing Group). Intel also claims that it is still looking for a more suitable CEO successor.

Pat Gelsinger, a veteran who has worked at Intel for 49 years, was the company's first CTO, and has been the CEO for four years. His hasty departure has surprised people from all walks of life, but also feels expected.

"Most likely forced to step down"

"It should not be retirement, but most likely forced to step down", several Intel employees speculated to 36Kr. A CEO being forced to step down by the board is not the first time in Intel's history, but a repetition of history.

The exact same scenario happened to Brian Krzanich, Intel's CEO in 2018, the two predecessors of Gelsinger.

Although this CEO has worked at Intel for 36 years, he did not enable Intel to continue its brilliance in the mobile phone chip business and server chip business during his tenure.

Nowadays, Intel's board of directors generally does not have more than five years of patience for a new CEO.

In the end, the reason for Brian Krzanich's departure was that he was found to be in a relationship with an Intel employee, violating the company's "no deep friendship policy", although both sides later emphasized that it was a free love.

For Gelsinger's four-year CEO tenure at Intel, the internal and external evaluations of him are quite consistent.

From the performance of the secondary market, during Gelsinger's four-year tenure, Intel's stock price has dropped by half, and its market value has directly evaporated by 150 billion US dollars (approximately 1 trillion yuan), equivalent to the value of Meituan.

In contrast, Intel's rivals have continued to lead the AI track. Taking four years as a reference, Nvidia's stock price has increased tenfold, and AMD's market value has also increased by 80%.

Stock price trend after Gelsinger took office in February 2021

"This is the CEO who has eliminated the most market value in history," CNBC commented on Gelsinger today. An Intel employee said straightforwardly - "IDM 2.0 has not been carried out, and Gelsinger can basically be said to be sentenced to death."

Heavily investing in chip foundry in an inappropriate era

Four years ago, the situation of Intel that Gelsinger took over was not optimistic. In terms of the continuous advancement of the advanced manufacturing process, Intel has been continuously postponing and has been labeled as the "Toothpaste Factory".

Intel's backwardness is precisely a facet of the rapid differentiation of the global semiconductor pattern.

When the world gradually reflected on the traditional IDM model (that is, a model that integrates multiple industrial chain links such as chip design, chip manufacturing, chip packaging and testing), the semiconductor industry gradually moved towards refined division of labor - the wafer foundry businesses in Taiwan, China, Japan and South Korea rose rapidly, taking away 80% of the chip manufacturing share, while the share of the United States is only 5%.

Intel's rivals are precisely benefiting and surpassing in this more efficient industrial division.

IDM 2.0 is the most critical strategy during Gelsinger's four-year CEO tenure. In his original vision, this policy is not only one of Intel's revival strategies, but also caters to the demand for local chip manufacturing in the global technology war, and can unite the local chip power and national power in the United States.

Under Gelsinger's leadership, Intel's IDM 2.0 strategy insists on grasping both external foundry and internal foundry to ensure Intel's advantage in the advanced manufacturing process, while improving the production capacity and reducing the cost of the manufacturing department.

At that time, his goal was to become "the world's second-largest wafer foundry by 2030."

Of course, IDM 2.0 is not without any results. At least in the advanced manufacturing process, Intel is no longer as seriously postponed as before.

At the "Innovation 2023" event in 2023, Gelsinger said that Intel "The 'Four Years, Five Process Nodes' plan is progressing smoothly: Intel 7 has achieved large-scale mass production, Intel 4 is ready for production, and Intel 3 will be released at the end of 2023."

In addition to the manufacturing process catch-up, during Gelsinger's four-year tenure, he has also been conducting extensive exploration of chip underlying technology innovation, such as glass organic cover exploration, promoting an open ecosystem in chiplet technology, quantum chips, and so on.

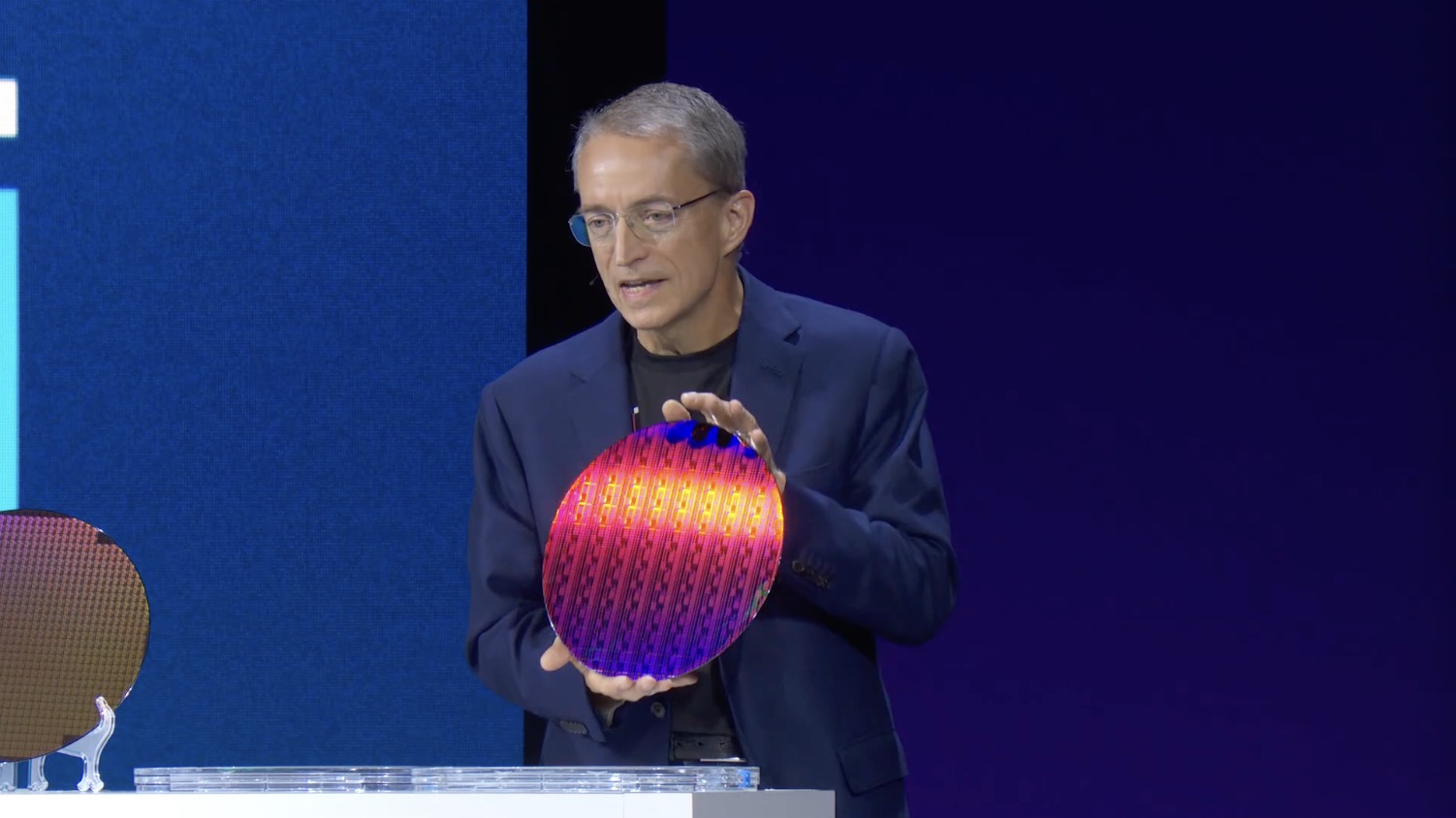

Gelsinger in 2023

However, Chip manufacturing is a business with high costs and an extremely long return period. At a time when Intel's business has been continuously losing money in the past two years, this long-term strategy seems inappropriate.

During the implementation of the IDM 2.0 strategy, Intel has suffered losses of tens of billions of dollars in the chip manufacturing business, but the actual contribution is very limited - In 2023, the revenue of this business only accounted for 2% of the overall revenue.

Not long ago, four former members of the Intel board directly suggested that the US government should step in and force Intel to split into two entities: the manufacturing business and the design business. In their view, this is precisely "the only way for Intel to survive."

"If viewed from the perspective of the United States, IDM 2.0 should be done, but in reality, Gelsinger failed to carry this banner at this stage," an Intel employee said.

Strategic wavering in the AI era

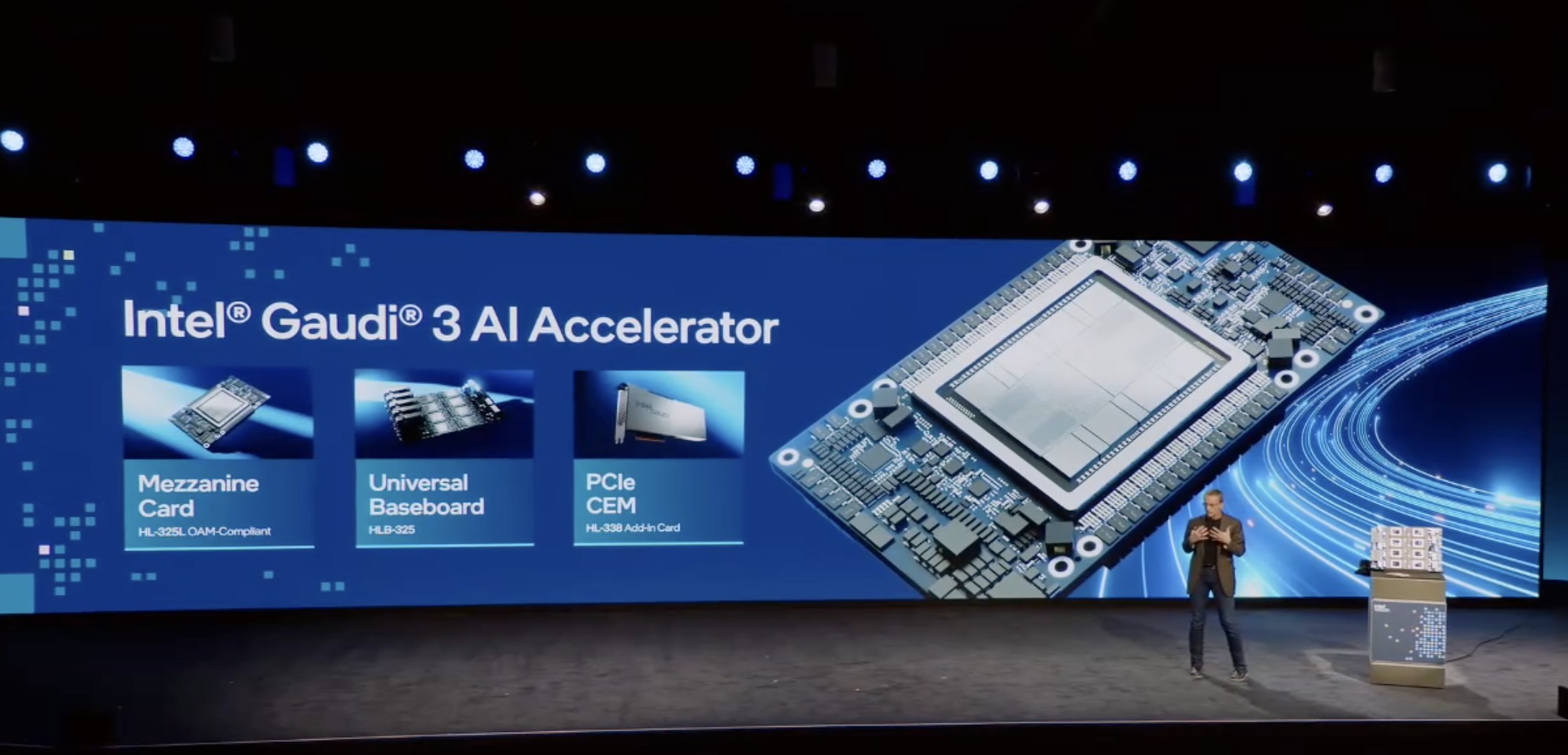

In addition to the IDM 2.0 layout, AI is another important strategy during Gelsinger's tenure. In the past two years, Intel has also been continuously investing in AI PC (Core processors) and independent GPU products (Gaudi series) targeting Nvidia.

"We will drive the development of the ecosystem in these key areas - wafer foundry and AI. In the future, we will have a solid market position," Gelsinger previously stated in a speech - these two businesses are precisely what he wants to leave behind during his tenure as CEO, "I hope to be fortunate enough to be a leader remembered in this iconic company, Intel."

However, In the AI business, Intel's actions in the past two years have been slightly lagging and wavering.

Several Intel employees once told 36Kr that Intel does not attach great importance to the Gaudi series, and the priority of this project within the company is not very high, "All of Gelsinger's energy is on IDM 2.0." Gelsinger previously also confessed to the employees that they have not fully benefited from strong trends such as AI.

From the results, Intel's competitor AMD has made some achievements in the layout of AI chips. AMD previously disclosed that AMD has won orders from hundreds of AI customers and OEM manufacturers, and its share in the data center server has increased from a single digit to about 30%, becoming the fastest-growing business among all AMD's businesses.

"Why is Intel in pain?" A chip investor analyzed to 36Kr that Intel's traditional income comes from the X86 architecture CPU, but now everyone is eroding Intel's original market - whether it is the Arm architecture CPU or the rising star RISC-V.

In the era of generative AI, the proportion of AI servers in the intelligent computing center is getting higher, but this may not be a strong boost for Intel - or rather, Intel is not the most direct beneficiary of this AI wave compared to Nvidia.

This investor gave an example to 36Kr. From the traditional data center in the past to the current intelligent computing center, the composition of a node is that two CPUs are matched with eight GPUs, "The number of CPUs in the node has not changed, but there are eight more GPUs, and these are all Nvidia's increments."

Gaudi 3

"When a company passes its peak period, if it cannot reinvent itself, the only ending is to die," a chip industry insider said straightforwardly.

However, several Intel employees told 36Kr that during Gelsinger's tenure, although there were strategic mistakes, he actually made many efforts in the institutional culture.

"Bureaucracy" used to be a heavy label on this chip giant, and Gelsinger has been advocating the return of the "Grove-style" culture, hoping that this 56-year-old company will once again take "discipline, engineering, excellence, and data" as the core.

In practice, Gelsinger not only rebuilt a new development process, requiring engineers to "advance at a rhythm and manage risks", which is internally called "Tick Tock 2";

In addition, he also redefined Intel's OKR, that is, "Objectives - Key Results", redefining the mode of tracking performance and work linkage between teams and management teams.

In the eyes of many people, Gelsinger is not a rigid leader, but is full of "American enthusiasm".

Just as he used a push-up as his entrance move at Intel's conference last year, even though he is in his sixties. "I hope to be fortunate enough to be a leader remembered in this iconic company, Intel," Gelsinger once said.

But for the CEO of a giant company, a more cruel fact is that history judges heroes by success or failure. "If the most important thing is not accomplished, no matter how well other things are done, the significance is not great," an Intel employee said straightforwardly.

At present, after Intel's market value has dropped by the equivalent of a "Meituan", this chip giant still needs a more pragmatic savior.

Extended Reading:

end