Zhang Yaxue, Vice President of Meetsocial Group: The Golden Age, Breaking Through in the Entire Region, Insights from the Evolution of Going Global | WISE 2024 Business King

The environment is constantly changing, and the times are always evolving. The "Business Kings" follow the trend of the times, insist on creation, and seek new driving forces. Based on the current great transformation of the Chinese economy, the WISE2024 Business Kings Conference aims to discover the truly resilient "Business Kings" and explore the "right things" in the Chinese business wave.

From November 28 to 29, the two-day 36Kr WISE2024 Business Kings Conference was grandly held in Beijing. As an all-star event in the Chinese business field, the WISE Conference has reached its twelfth session this year, witnessing the resilience and potential of Chinese business in an ever-changing era.

2024 is a year that is somewhat ambiguous and with more changes than stability. Compared with the past ten years, people's pace is slowing down, and development is more rational. 2024 is also a year to seek new economic momentum, and the new industrial changes have put forward higher requirements for the adaptability of each subject. This year's WISE Conference takes Hard But Right Thing as the theme. In 2024, what is the right thing has become a topic we want to discuss more.

Zhang Yaxue

On the morning of November 29, Zhang Yaxue, Vice President of Meetsocial Group and Head of Meetcommerce, delivered a speech titled "Enlightenment from the Evolution of Going Global: The Golden Age, Breaking Through in the Entire Region". The following is the transcript of Zhang Yaxue's speech, edited and sorted out by 36Kr:

Good morning everyone! I'm Zhang Yaxue from Meetsocial Group. Meetcommerce is a platform under Meetsocial Group, focusing on growth-oriented cross-border e-commerce operation solutions. Tomorrow will be my tenth year of joining Meetsocial Group.

We focus on helping Chinese enterprises go global and have witnessed many changes and a thriving scene in cross-border e-commerce in the past ten years. Currently, we often hear such statements as "Going global is not an option but a must" and "Those who don't go global will be out". Then, what exactly should enterprises do to be correct and achieve results?

I still want to look at the current situation of going global from the course of these years of cross-border e-commerce and China's foreign trade. Cross-border e-commerce has been around for more than ten years, and we have seen many changes. These changes are based on the entire process of supply chain development, branding development, and globalization.

In the past ten years, Chinese enterprises have evolved from being the "global OEM at the beginning to gradually cultivating their own technology research and development capabilities, exporting production technology capabilities to the world. Now we can see that more and more enterprises are starting to build global brands overseas and create an integrated online and offline experience for consumers.

In this process, not only the supply chain is going global, but we also see that many overseas platforms have made considerable progress in China. At the same time, in the past ten years, we have iterated out technologies, production capabilities, and a very strong supply chain capability, which are all very important foundations for our cross-border e-commerce enterprises to go global.

Let's also take a look at the global market situation. Europe and North America are very important and traditional destinations for Chinese enterprises to go global, and they are still the first choice for enterprises to go global so far. However, we also see that there are many emerging markets, such as Southeast Asia, Latin America, and the Middle East, which have shown very good growth in recent years.

In addition to these emerging regions, we also see some emerging ways of going global. In the past ten years, many mature e-commerce platforms have also seen new growth. There is the familiar Amazon, which has a very good market share in some specific regions.

In addition to platforms, we also see that more and more DTC models have achieved great success overseas. This is because the e-commerce environment in overseas and China is very different: In China, the mainstream e-commerce platforms Taobao, JD.com, Douyin, and Kuaishou almost cover all our online shopping. However, in overseas, there are still a lot of orders coming from independent websites. Their advantage is that they can integrate the brand's own data, the brand's own traffic, and the consumer group, and simultaneously provide consumers with an integrated online and offline brand experience.

The live-streaming with goods, which is very popular in China, as well as our internet celebrities and top KOLs, also have a trend overseas. Although it is not as mature as in China, some new e-commerce platforms that integrate content and social attributes, such as TikTok Shop, are also rising rapidly. In the past year, we have seen that TikTok Shop has had very good growth in North America. Now it is the peak season for Black Friday and Cyber Monday promotions, and TikTok Shop has grown by 3 to 4 times. With the improvement of overseas infrastructure and the increasing familiarity of overseas consumers with the e-commerce model, we believe that TikTok Shop will be a very important growth potential point for cross-border e-commerce in the future.

We have also seen many leading enterprises succeed in going global, such as SHEIN, Pinduoduo, Anker, etc. But in fact, in the past ten or more years, we have seen hundreds of thousands of enterprises going global. They may not be known to many people, but they are still very important participants and contributors to going global.

In 2023, we think it is a year with both opportunities and challenges. The entire industry has undergone very big changes, which is a situation we have not seen in the past many years. The annual GMV of small and medium-sized cross-border merchants is about several hundred thousand or millions. However, in 2023, 52% of merchants' revenues have declined, and 59% of merchants' profits have declined. The reasons for this situation are, on the one hand, the changes in the entire going global environment. There are more and more different types of going global enterprises in China, the regulatory policies are tightened, overseas e-commerce platforms are adjusted, and geopolitical influences have inevitably squeezed the survival of merchants.

At the same time, we also see that the new e-commerce culture is iterating. In the past, many merchants adopted the stocking model, that is, taking advantage of the domestic supply chain to obtain very low prices, testing and selling popular products overseas. Merchants with this model have undergone a very big iteration in the past year.

The current environment requires existing going global merchants to change and innovate. For many domestic brands that want to go global now, what are they required to do to cope with the new market situation and new competition?

First is the product strategy. We see that more and more enterprises that do very well overseas will focus on sub-segmented vertical categories and dig deep in one category. What they dig is not only their own technology and products but also the overseas consumers. They find the preferences of overseas consumers in a certain sub-segmented category.

Another is the channel strategy. We see that more and more going global enterprises will make a very scattered and extensive channel layout. They will not only focus on the mainstream e-commerce platforms but also pay attention to some emerging channels; in addition to online, they will also pay attention to offline, with the brand and sales growing simultaneously.

Then there is the operation strategy. Successful going global merchants or enterprises should not only build brands and supply chains overseas but also establish deeper links with overseas consumers, so that they can truly realize that in addition to exporting low-priced goods, we can also export very good Made in China brands.

OBSBOT Seek

This is a client we serve, OBSBOT Seek, an AI intelligent imaging brand. Their products use AI and other technologies to enhance the experience of consumers in scenarios such as meetings and live-streaming. A large number of their consumer groups come from overseas internet celebrities and enterprise users.

They have achieved very good results in going global. In terms of channel strategy, they not only have laid out some very traditional platform e-commerce, such as Amazon, but also have their own independent website. At the same time, through the sharing of internet celebrities, they allow overseas consumers to better understand the product advantages, technical advantages, and support for consumer scenarios in the usage scenarios. We have also formulated a very good advertising strategy and traffic strategy with them, which can not only help them seize the top traffic but also simultaneously conduct multimedia integration, integrating efforts from social media to search to various overseas social media.

What makes them different from many going global enterprises is the brand strategy. Many merchants tell us that we will sell the goods first, and the brand is something we will think about later. However, we can see that if merchants only focus on selling goods, it is difficult for them to go far. Because the traffic cost is getting higher and higher, it has caused very great pressure on enterprises. It is difficult for merchants to control costs simply by buying traffic to acquire customers. Therefore, if enterprises want to develop in the long term, we think a better path is to parallel brand investment and effect investment.

We have served more than 100,000 going global merchants, and we are also thinking about what methods we can use to empower Chinese going global enterprises with our experience, technology, and most importantly, our data.

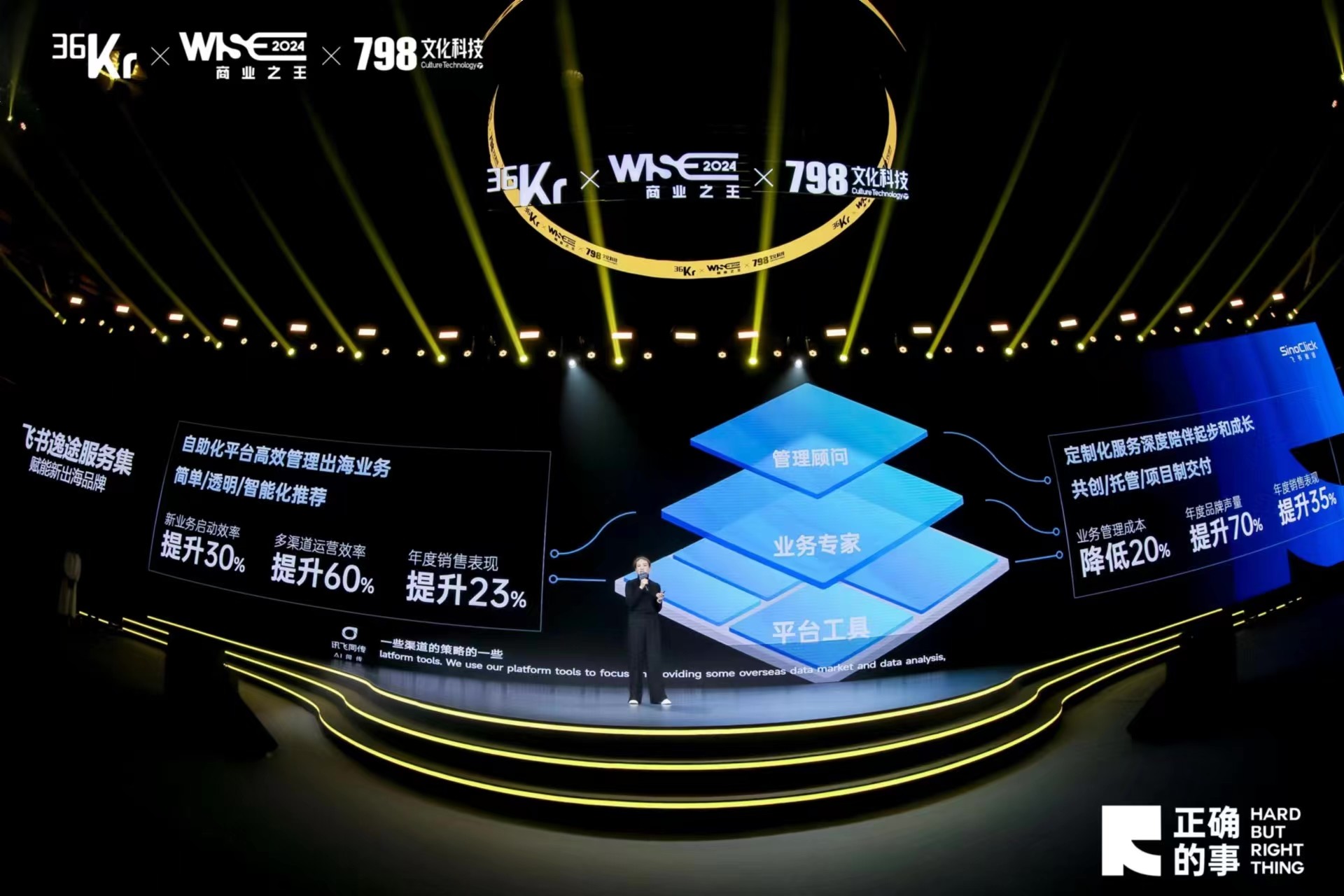

My team has more than 100 people and can serve more than 100,000 customers. An important point for us to achieve this service efficiency, or to improve the efficiency of customers going global, is to use our own platform tools. The reason why we develop such a basic tool is that we found that for enterprises that are just starting out, they do not have a strong ability to pay. If we provide a very complex or high-unit-price customized service, enterprises will have a lot of pressure. We integrate our accumulated strategies, data, technologies, experiences, etc. into our own platform tools. Through our platform tools, we provide merchants with analysis of the overseas market and data, channel strategy suggestions, advertising account risk warnings, etc. At the same time, according to the data trends, we give merchants advertising and marketing optimization suggestions. Our platform is provided to merchants for free.

When customers grow to a certain size or have some personalized problems, we will also have going global experts to help customers overcome difficulties. When merchants encounter management-level problems, such as whether they should set up a team overseas, which market they should choose, etc., we will have more senior management consultants to provide customized solutions for customers. With the help of our services, we can not only help merchants improve advertising effectiveness and marketing efficiency but also reduce operating costs.

Relying on our own e-commerce operation capabilities, we can now provide integrated operation solutions for starting and growing merchants, from Amazon, independent websites to TikTok Shop. We integrate multi-channel operation data, collect data in multiple dimensions such as products, marketing, and operations, to help merchants reduce the workload of data analysis. At the same time, we will also give merchants industry data references. In our system, merchants can see where they are in the entire going global business and which links need to be improved compared with good competitors. Whether my advantage is in operation or products. Our platform can provide enterprises with visual and one-stop data analysis.

At the same time, we will also help enterprises manage the assets of e-commerce platforms, such as the data assets of advertising accounts. These can not only protect the safety of enterprises' overseas assets but also greatly improve the management efficiency of enterprises.

The parent company of Meetcommerce is Meetsocial Group, which is a leading digital global marketing service group in China. Meetcommerce is a platform for operation solutions for growth-oriented cross-border e-commerce.

In the past ten years, we have been serving going global brands. We not only have the experience of serving leading enterprises to go global but also can meet the pain points and needs of starting and growing enterprises to go global. We hope to build an aggregated approach of "products" + "e-commerce channels" + "digital media" to enable every cross-border e-commerce enterprise to enjoy the success of going global.

Thank you!