He Yu of Black Ant Capital: In the eight years of consumer investment, we believe that structural opportunities are creating abundant market space | WISE2024 Future Consumption Conference

On November 29, the WISE2024 Future Consumption Conference was officially held in Beijing. This conference is hosted by 36Kr Future Consumption, with the theme of "Always with You", focusing on hot topics in the consumption industry. It invites more than 20 investment institutions, platform sides, brand sides, and service provider executives to jointly explore new trends and opportunities in the consumption industry.

At the conference, He Yu, the founding and managing partner of Black Ant Capital, delivered a keynote speech titled "Eight Years of Consumption Investment: We Believe Structural Opportunities Are Creating Abundant Market Space". He mentioned that although the overall consumption market is undergoing changes today, some structural opportunities are emerging simultaneously, including channel changes, supply chain changes, consumer changes, and the substitution of domestic brands in the lower-tier markets.

He Yu also reaffirmed the investment methodology that Black Ant Capital has always adhered to - the dichotomy of "experience-oriented" and "efficiency-oriented". The former requires extreme product content and differentiation, while the latter means lower costs and better convenience. For investment judgments and entrepreneurship, in this dimension, it is crucial to accurately distinguish the type of the company and whether it matches the type of consumer demand, as well as where the focus of oneself and the company is at different stages.

In the past few years, Black Ant Capital has been regarded as an institution that "best represents consumption venture capital", and they have been behind many star companies. At the end of the speech, He Yu also mentioned that Black Ant has witnessed and experienced many market changes, and still believes today that "the Chinese consumption industry is very large and always full of opportunities." He firmly stated that Black Ant Capital will continue to seek and support generations of excellent Chinese consumption enterprises in the consumption field.

He Yu, the founding and managing partner of Black Ant Capital

The following is the speech record of He Yu:

Thank you for the invitation of 36Kr. The theme of this year's Future Consumption Conference is "Always with You". I would like to say that Black Ant Capital has also been "Always with You" in the consumption industry. Since 2016, Black Ant has been established for 8 years, during which it has invested in more than 40 companies, all of which belong to traditional consumption brands and consumption retail enterprises.

It is a very grateful thing that so many excellent entrepreneurs have been willing to walk with us in the past 8 years. Supporting excellent consumption entrepreneurs and making consumption more valuable has always been our mission. In the future, Black Ant still has full enthusiasm for the consumption industry and is determined to create more value in the consumption field. Today, I will share with you Black Ant's views on the consumption market and what opportunities we are focusing on.

First of all, in the present, what kind of consumption market are we in? Compared with the past two decades, the current consumption market gives people a colder feeling, which may be a common perception, but this is not the so-called "consumption downgrade" - the reason is that the market supply is far in excess. In this case, our consumption quality has not been downgraded, but at the same time, the excess supply has indeed caused a price drop, and the unit price statistics of most categories can support this point.

What is the state of consumers? In fact, consumers have always been difficult to be defined by the purely rational people in economics, and consumer confidence (expectations for the future) will largely affect and shape the actual consumption behavior of consumers. For consumers, a more conservative choice often has a stronger marginal effect on expenditure than the actual income change. This means that the actual income may not have decreased, but the weakening of expectations for the future will make people tend to be conservative, which may have a greater impact on actual expenditure behavior.

But we are not pessimistic about the environment. Whether for entrepreneurship or investment, China is the second-largest single market in the world, and it has structural opportunities to provide us with abundant market space. And what we want to share today are exactly three of them:

First, the lower-tier market with resilience and potential.

Second, the business model that brings efficiency improvement.

Third, the continuously rising spiritual and experiential consumption.

01 The Resilience and Potential of the Lower-Tier Market

In 2021, we conducted an in-depth investigation in the county areas of China. We went to ten counties and entered the homes of many local residents, from morning to evening, to understand their daily life. It was from that time that we had some perceptions of the lower-tier market. At that time, this market was rarely noticed by entrepreneurs and investors, but at the same time, it is a very good market because it is large enough - the markets in third-tier cities and below accommodate more than 60% of China's population.

Almost all companies or retail channels that provide mass consumer goods, in the final stage, the largest companies are often those that occupy the market where the main population is located, and the same is true for the US and Japanese markets. If an enterprise that makes mass consumer goods does not gain a firm foothold in the most core and largest market, it is difficult for it to become a true market leader.

In other words, it is far from enough for an enterprise that supplies mass consumer goods to focus only on first- and second-tier cities. From historical data, first- and second-tier cities have driven overall consumption more in the past for a long period, but new changes have occurred after the epidemic: first- and second-tier cities have instead shown insufficient momentum in driving consumption.

In such a situation, the importance of the lower-tier market is self-evident. First, the demand side is stable enough. One is that residents' income is relatively stable; the second is the consumption expectation that plays a key role as mentioned earlier. Residents in the lower-tier market and county areas also have a relatively stable expectation. In addition, in recent years, with the support of national policies, with the urbanization development centered on county towns, the county population has continued to increase in recent years.

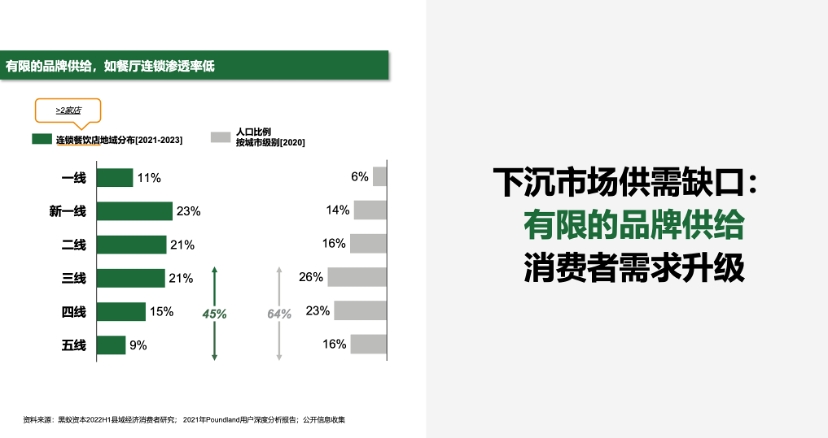

The demand side of the lower-tier market and county areas is steadily increasing, but on the other hand, the quality improvement on the supply side is limited, thus creating an obvious gap between supply and demand. A typical case that occurred in the lower-tier market in the past is that due to the very long retail distribution chain before reaching consumers, some fast-moving consumer goods are even cheaper in first- and second-tier cities. For a long time, the needs of residents in the lower-tier market and county areas have not been well met.

The gap between supply and demand in the lower-tier market

In this context, with the emergence of high-quality supply, the demand in the lower-tier market has supported the vigorous development of many business forms. In the past few years, the chain brands that can achieve more than 10,000 stores or 5,000 stores have basically captured this market and achieved rapid national expansion with this as the core.

It can be foreseen that innovation on the supply side in the lower-tier market will be a long-cycle opportunity. The core of innovation lies in improving efficiency. One is how to be closer to users, and the other is to achieve lower costs - this mainly includes optimizing supply chain costs, that is, making better use of the large-scale supply chain and high-quality manufacturing capabilities that already exist in China; as well as innovating in the business model to achieve better channel costs.

02 Business Model Bringing Efficiency Improvement

In recent years, we have paid more attention to offline opportunities because some structural changes are taking place offline. Although in many categories, the online market share has been increasing, and the offline share is decreasing. But when the offline market share drops to a certain extent, and combined with macroeconomic changes, many retail models in the past have been completely disrupted, as evidenced by the performance and stock prices of traditional department stores and supermarkets.

And the opportunity for offline retail lies in that the transfer of channel traffic has triggered a reconstruction of the value chain, and some innovative business models have taken over the traffic from traditional hypermarkets. For example, the discount retail business model that compresses the gross profit margin is one of the very important trends. In the future, discount retail will definitely gradually become the mainstream of offline retail channels, and even more than 50% of the retail models will adopt the business model of discount retail.

How to practice the business model of discount retail, there are some differentiations on the supply side. We see that there is the membership warehouse store model represented by Sam's Club to meet the needs of middle and high-income groups, and there is also the snack collection store format represented by Mingming Hen Mang, which Black Ant Capital has invested in, to meet the needs of the middle and lower market and residents in the lower-tier market. In the future, vertical integration retail models including multiple categories and comprehensive categories will emerge. Some of these companies may be new companies, and some may also be traditional retail companies that have successfully transformed. We have been paying attention to the changes that occur in traditional retail companies, supermarket companies, and department store companies.

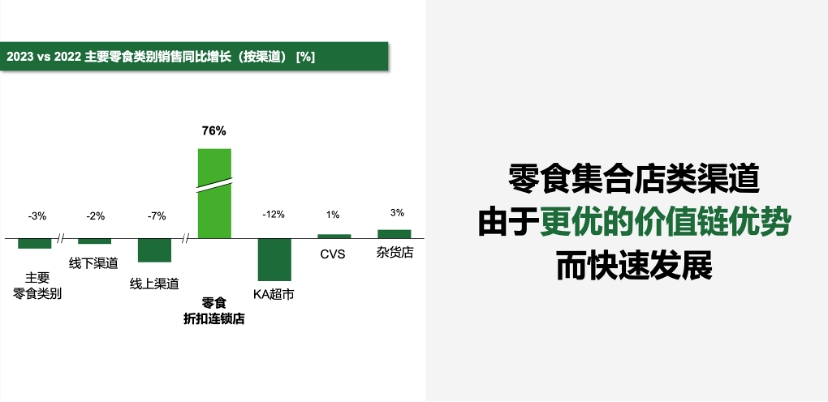

The redistribution of traffic in retail channels

We believe that in the next few years, we will see larger companies in the offline retail field in China. This is because in the past, retail companies often only focused on the first- and second-tier markets, or on a certain region, but in terms of the consumption volume of the Chinese market, this is not enough.

We see some changes are taking place: Sam's Club shows a high-speed growth; the snack collection store is a phenomenal business model in the offline format, achieving from scratch to a scale of 10,000 stores in just a few years. We have seen that the snack collection store has created consumer value in the middle and lower market and the lower-tier market through efficiency improvement, and has quickly caused an explosive demand in the market. This is still very impressive.

The rapid development of the snack collection store channel

In addition, "white-label" is also a growing market. It should be noted that "white-label" is not a low-quality product, but a product with very high quality, but consumers do not care so much about the brand attributes of these categories. Especially in the categories of the masses, just-needed, and high-frequency, the market does not need so many brands to exist. Users only need the best price, the best product, and the most convenient way to purchase.

"White-label" products are very good supply chain products, or a product form where the supply chain and the channel coexist. This is more obvious online, and there will be more and more online "white-label" products. And the reduction and focus of the number of SKUs offline, and the deep excavation of product quality and cost, will also be a major trend in the future.

03 The Continuous Rise of Spiritual and Experiential Consumption

Finally, I would like to talk about a direction that we are very concerned about, that is, "spiritual consumption" and "experiential consumption".

In the past two years, the economy has slowed down, and people may doubt whether this direction is still worth doing. We believe there are opportunities, and we continue to spend a lot of time tracking some companies in this direction and insisting on investigating the user development and changes in this field.

With the development of society, our income has gradually entered a new stage. Especially after batches of young people who have received better education and have more cognition of life enter the society, people will pay more and more attention to spiritual needs, whether it is the need for companionship, the need to expand boundaries, the need for self-realization, and so on. Consumers' willingness to spend and expense on spiritual consumption and experiential consumption is increasing - first of all, the time consumers spend in this direction is increasing.

Today's young people will spend more time on spiritual consumption. The definition of "spiritual consumption" is relatively broad. It may be traveling, visiting exhibitions, or buying a bottle of aroma diffuser, fragrance, or a figurine, or watching a movie or a stage play. People are willing to spend time on this and increase their expenses. This expense does not mean that the cost will be very high. They are often more cost-effective, and spending a small amount of money can get a good spiritual experience.

This may be a direction that is suitable for entrepreneurship in the long term. Because this is not an extremely involute track where there is no opportunity once someone imitates. This is a highly differentiated thing that requires entrepreneurs to be very attentive in terms of products, brands, and cultural content, and at the same time, the brand also needs time to settle in the consumer side. In this context, time can indeed be the "friend" of entrepreneurs.

To give a few examples, such as Pop Mart, which we have invested in. In the current environment where consumers' expectations are weakening, Pop Mart not only maintains a good growth in China, but also is expected to achieve more than a twofold increase in overseas revenue in 2024. The reason is that people are willing to spend money on products that seem "useless". Some products have strong functionality, while some products do not seem to be "useful" for survival, but they are useful in terms of consumers' emotional and value recognition. We believe that the market space for such products will become larger and larger in the future.

Another example is Laopu Gold, which represents a new interpretation of traditional Chinese culture. Laopu Gold has built a high-end jewelry brand with brand premium, very strong user loyalty and popularity through the material that Chinese people like very much - gold, and has been opened in almost all the highest-end shopping malls in China. This is almost something that domestic jewelry brands could not achieve in the past.

Brands like Laopu Gold may not have existed in the past, but will there be in the future? We believe there will be, but it takes time to settle. Brands need to be polished for a long time in product craftsmanship, store design, and user service, and must insist on a high-end positioning to construct the brand content. Taking a wrong step in the middle may be abandoned by consumers. But as long as the brand insists on doing this, we think there will be more and more such companies in the future.

Outdoor sports is also a direction that we are very optimistic about in the long term, because this is a very spiritual consumption. In addition, domestic brands are growing rapidly in these categories such as pets, coffee, food, skin care products, and beauty products, and the substitution of foreign brands is taking place in an all-round way.

04 Black Ant Consumption Investment Dichotomy

Finally, I would like to share our view on the consumption business that we have always had. Maybe it is not particularly fashionable to talk about it today, but we still believe that the ultimate form of consumption brands is two types of businesses - one is experience-oriented, and the other is efficiency-oriented.

Finding the most extreme companies in the experience-oriented and efficiency-oriented

Whether it is entrepreneurship or investment judgment, we make