Battling in Emerging Markets: Chinese Mobile Phone Brands Unveiling New Stories

Since entering the stock market in 2017, the global smartphone market has been in a slump for as long as 8 years.

However, in the third quarter of this year, the global smartphone market sales increased by 5% year-on-year to 310 million units, achieving the strongest third-quarter growth since 2021. But a deeper analysis reveals that the growth gap between emerging and mature markets remains obvious, with emerging markets being the main driver of the high growth in the global market.

Specifically, the mature markets represented by North America, Europe, and China had year-on-year growth rates of 1%, 0%, and 4% respectively, still in low single-digit growth, and the markets are nearly saturated; while emerging markets in Latin America, Asia-Pacific, and others maintained double-digit expansion during the same period, and have also become the main offensive areas for mobile phone manufacturers in this stock market war.

Another notable phenomenon is that in this tough battle in emerging markets, domestic brands represented by Xiaomi, OPPO, Transsion, Vivo, etc., have shown more obvious growth. They have made great progress in emerging markets, constantly squeezing the market share of international giants such as Samsung and Apple.

Then, how long can the blue ocean of emerging markets last? Why can Chinese mobile phone brands maintain an advantage in this competition? Where should the strategic focus of the next market be?

Emerging Markets Remain a Blue Ocean

The advent of the first-generation iPhone in 2007 opened the door to the rapid growth of smartphones.

After the penetration rate exceeded 20% in 2010, the global smartphone industry ushered in a rapid explosion period in the following five years, and reached a peak shipment of 1.47 billion units in 2016. But after 2017, with the continuous high increase in penetration rate, global mobile phone shipments began to enter a downward channel, announcing the industry has entered the stock era.

However, the internal market development in major regions around the world is not balanced. Among them, the global rapid growth led by mature markets has come to an end, but emerging markets represented by Southeast Asia, Africa, Latin America and other regions are still in the transition period from feature phones to smartphones, and the industry dividend is still there. According to Canalys data, in Q3 2024, the shipments of smartphones in Africa/Southeast Asia/Latin America/Middle East (excluding Turkey) were 18.4 million/25 million/35.1 million/12.2 million units, with year-on-year growth rates of +3%/+15%/+10%/+2% respectively.

Behind this counter-trend high growth in emerging markets, three factors are indispensable.

First, emerging markets have a large population base and a high population growth rate, providing a broad potential space for the penetration of smartphones.

Data shows that the population base of emerging markets such as Africa, South Asia, Southeast Asia, the Middle East and Latin America exceeds 4 billion. Some countries have a low level of economic development, a small per capita mobile phone ownership, and a large potential market space. According to Statista's prediction, by 2025, the mobile phone market space in Africa, India, Bangladesh, Latin America and other regions is expected to grow to $167.24 billion, an increase of $24.4 billion compared to 2022.

Second, the population structure in emerging markets is younger, and the acceptance of new things is higher, which is conducive to the penetration of technological products such as smartphones and opens up the imagination space for the future.

Take Latin America as an example. The average age of the population in Latin America is 31 years old, nearly one-third of the population is under 20 years old, and 84% of the population lives in cities.

Third, compared with mature markets, the smartphone penetration rate in emerging markets is lower, and some regions are still in the stage of transitioning from feature phones to smartphones, with a structural improvement demand. Moreover, in recent years, with the growth of the middle class, the consumption potential of smartphones has also been continuously expanding.

According to the data of "The Mobile Economy 2023" released by GSMA, as of 2022, the global mobile phone penetration rate is about 68%, of which the penetration rates in mature markets such as China, Europe and North America are close to 90%, while the overall penetration rate in emerging markets is relatively low. The penetration rate in sub-Saharan Africa is only 43%, and the Middle East and North Africa region is only 54%. In this context, the proportion of the middle class in emerging markets has shown a growing trend in recent years. Take Latin America as an example. According to the Socio-Economic Database for Latin America and the Caribbean (SEDLAC) data, the poverty rate in Latin America has dropped from 45.4% in 2002 to 29.6% in 2018, indicating that a large number of people have joined the middle class.

The Breakthrough Battle in Emerging Markets: From Follower to Leader

Facing the huge growth cake, emerging markets have become the main battleground for major mobile phone manufacturers in recent years.

In fact, domestic mobile phone manufacturers in China have started to explore emerging markets since around 2005. Up to now, leading manufacturers such as Xiaomi, Transsion, and OPPO have been on par with Samsung and others in emerging markets, and even become the absolute leaders in key markets such as Africa. According to Canalys data, in Q3 2024, Transsion continued to dominate the African smartphone market with a 50% market share and an 8% growth rate; while Samsung, which ranked second, although maintaining an 18% market share, saw its shipments plummet by 30% due to the weakened focus on entry-level models and the sluggish demand in South Africa.

Due to the low per capita GDP level, the overall average price of the African smartphone market is relatively low. According to IDC data, more than 40% of smartphones are priced at less than $100, and more than 40% of smartphones are priced in the $100 - $200 range, while the market for smartphones priced above $200 is less than 20%. In such a market environment, the competition for cost performance is still the main competitive strategy of major manufacturers. The African mobile phone market increased by 3% in Q3 2024, but the average selling price (ASP) dropped by 6% year-on-year. The main factor behind this is that manufacturers used the cost advantage in the first half of the year to continuously drive the growth of shipments, resulting in a 35% surge in the price segment below $100.

As one of the earliest mobile phone manufacturers to enter the African market, Transsion has a high reputation and a stable consumer group under its first-mover advantage. At the same time, relying on localisation strategies, strong control over the supply chain and years of in-depth cultivation of channels, Transsion has always dominated the African mobile phone market with a nearly 50% market share in recent years.

In particular, the localisation strategy based on the local market is the key to Transsion's establishment of brand advantages. Transsion customises Camera devices for dark-skinned consumer groups in response to local needs in Africa, and has independently developed several core technical achievements including dark-skinned face detection and recognition technology, body skeleton key point detection, dark-skinned portrait segmentation, and multi-skin colour intelligent beauty. At the same time, in response to the hot climate in Africa and the problem of corrosion and dirt caused by excessive sweating of users, Transsion has developed a mobile phone case with good thermal conductivity, sweat resistance, and light weight. These innovative local designs have truly solved the pain points of local users during use and are deeply favoured by African smartphone users.

Although Transsion's market position in Africa is relatively stable, in recent years, with the popularisation of smartphones and the improvement of the consumption level in Africa, major mobile phone manufacturers have competed to enter the African market, intensifying the competitive situation in the region. In order to be able to consolidate its barriers, Transsion has begun to explore the high-end market while deeply cultivating cost performance. In the first half of the year, Transsion launched flagship products such as PHANTOM X2 Pro 5G, PHANTOM V Fold and PHANTOM V Flip 5G, giving consumers more choices. At the same time, Transsion has always focused on local product planning and technological R & D and innovation for the African market. The company's brand strategy, operational philosophy, technological R & D, and channel layout are all formulated and implemented with Africa as the core, making its position in the African market even more unshakable.

"Using One Point to Drive the Whole Area", Catching Up Vigorously

After establishing a firm foothold in Africa, Transsion began to "use one point to drive the whole area" to promote the comprehensive layout of emerging markets, increasing its investment in South Asia, Southeast Asia, the Middle East, Latin America and other regions. Through localised and differentiated product and sales strategies, it continuously enhances its influence in the overseas market. Official data shows that according to IDC's Global Mobile Phone Quarterly Tracking Report, in the first three quarters of 2024, Transsion's global mobile phone market share was 14.3%, ranking third; among them, the smart phone market share in the global market was 8.8%, ranking fifth; Transsion ranked first in smartphone shipments in Africa, Pakistan, Bangladesh, and the Philippines, and ranked second in Indonesia.

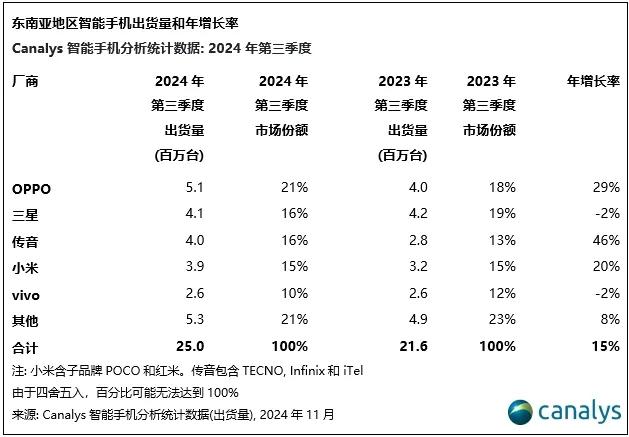

Take the Southeast Asian market as an example. According to Canalys data, in the Q3 2024 Southeast Asian smartphone market, Transsion firmly ranked third with a shipment of 4 million units and a market share of 16%, almost tying with Samsung in second place; the growth rate also ranked first on the list, as high as 46%.

Image Source: Canalys

The reason why Transsion can catch up vigorously in the Q3 quarter is, on the one hand, because Transsion adheres to localised operations and truly solves the pain points of local users.

With the successful experience in Africa, Transsion still takes consumer demand as the starting point in the operation of the Southeast Asian market. Through accurate insight into the precise needs of local users, its mobile phone products are more in line with the consumption preferences of Southeast Asian consumers.

The Southeast Asian market has a huge population base and a high proportion of young people who love to explore and are fond of technological innovation. With the popularisation of smartphones and the rapid development of the mobile Internet, it has also become one of the rare "honey lands" for mobile games in the world, and the lifestyle centred around mobile games is popular among the younger generation. In response to this feature, in 2024, Transsion successfully attracted this market segment by providing high-performance gaming devices at affordable prices.

Transsion's Infinix brand deeply understands the preferences and popular trends of local consumers and integrates these factors into product design. In the first half of this year, Infinix launched the gaming flagship GT 20 Pro and carried out in-depth cooperation with globally popular games IPPUBGM, MLBB, and HOK, making GT 20 Pro the official designated competition machine for multiple top e-sports events. Infinix also signed contracts with game clubs to carry out activities such as campus alliance mobile game tours, establishing a deep connection with a large number of game lovers. In the first three quarters, in the Philippines, Transsion's mobile phone brands Infinix and TECNO respectively occupied the top two spots in the smartphone market; in the third quarter, Infinix grew rapidly in the Indonesian smartphone market, ranking fourth.

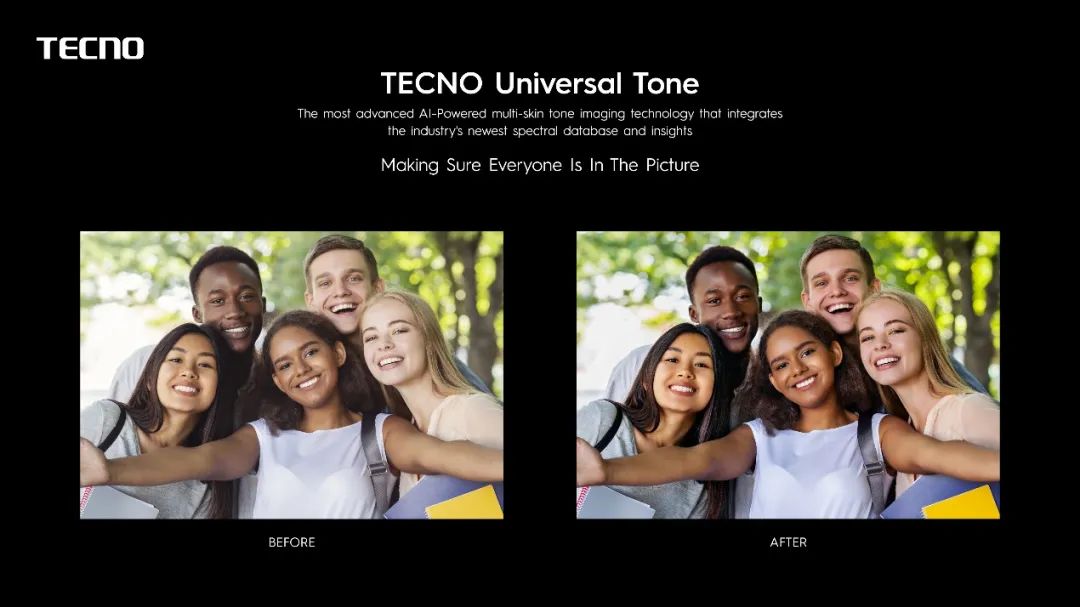

At the same time, in order to better meet the diversified image needs of regional users, Transsion focuses on solving the technical difficulties related to the portrait and local scene experience of user groups of various skin colour types, and has developed the Transsion Multi-skin Colour Imaging Technology System, establishing new standards for multi-skin colour portrait technology and multi-skin colour science, and building the core imaging technology capabilities to support multi-regional markets.

On the other hand, it is by continuously deepening the brand stratification strategy to meet the diversified needs of consumers.

In the early stages of development, Transsion formulated a brand stratification strategy. The three mobile phone brands TECNO, Infinix, and itel are respectively positioned for the emerging middle-class consumer group, the fashionable young group and the mass group, and carry out personalised designs for the different needs of different groups, which are welcomed by consumers.

Compared with Africa, the per capita GDP of emerging markets such as Southeast Asia is significantly higher, which means that emerging markets outside Africa have higher consumption capacity and willingness to consume, and can afford mobile phone products with a higher unit price. In view of this, in the past two years, Transsion has continuously released large and small folding phones, getting a share in the high-end field of the emerging market and significantly improving the unit value of the brand in the Southeast Asian market. While attacking the high-end market, Transsion also released the hundred-yuan-level product Pop 9 series at the end of September, further expanding the "sinking market" in Southeast Asia.

In the Latin American market, Transsion has also achieved significant growth through devices priced below $200 in the past few quarters. It continues to supply cost-effective devices to the market and has successfully defended the market share it has gained. According to Canalys data, Transsion ranks fourth with a 9% market share, with a year-on-year growth of 3%.

AI Phones Become the Next Battleground

As mentioned earlier, after entering the stock era, the competition in the global smartphone market has become increasingly fierce. Even in the blue ocean of emerging markets, with the rising cost of components and the excessive saturation of channels, it has brought new challenges to the long-term profitability and sustainable growth of manufacturers.

The emergence of AI phones in 2024 is expected to break this deadlock. With the new upgrade of the interaction mode, AI phones are expected to break the sluggish situation of the smartphone industry for many years and start a new round of phone replacement wave. According to IDC's forecast data in July, the shipment of the new generation of AI phones is expected to enter a rapid growth stage starting from 2024. It is expected that the global AI phone shipments will reach 234 million units in 2024 and increase to 827 million units in 2027, with a compound annual growth rate of 100.7% from 2023 to 2027.

Facing the innovation of the industry, major mobile phone manufacturers are gearing up to seize a new strategic high ground in the AI field. For a time, competing on models, talking about ecosystems, and promoting concepts have become the focus of efforts.

However, in this fierce competition, unlike other manufacturers, Transsion focuses on the implementation of application scenarios, focusing on creating a deeply localised "practical AI", and allowing consumers to truly understand the capability boundaries of AI phones through the display of application scenarios. In September this year, the artificial intelligence joint laboratory jointly built by Transsion Holdings and MediaTek was officially inaugurated in Shenzhen. The two sides will integrate the superior technical resources in the field of artificial intelligence to accelerate the application and popularisation.