Smart Money | What are the consensuses and differences among securities companies regarding A-share in 2025?

Author | Fan Liang

Editor | Ding Mao

In November, with a series of expectations such as the 10 trillion debt resolution and Trump's election being fulfilled one after another, the Shanghai Composite Index rose to 3500 points and then dropped all the way to the current 3300 points, which is close to the closing point in October.

From the expectation catalyst to the expectation realization, after the A-share market experienced a rise and then a fall, the market sentiment gradually became stable, and the valuation repair of A shares naturally came to an end. Before the new round of incremental policy game has not yet started and the actual performance has not been realized, the investment difficulty of the A-share market that has lost the trading main line has also increased.

Just as the end of the year is approaching, the 2025 annual strategy reports of major domestic securities firms have also been released one after another, which to a certain extent points out the direction for investors. Although the natural position of domestic securities firms determines their generally positive and optimistic overall tone, the consensus and differences in the strategy reports of different securities firms are still worthy of investors' careful consideration.

So, in the 2025 annual strategy reports, what is the attitude of institutions towards the future market? What are the consensus and differences?

Profit Recovery, Disagreement in Magnitude

Under the relative valuation method, the market rise mainly depends on the driving factors of earnings (EPS) and valuation (PE), while the valuation fluctuation often comes from factors such as earnings expectations, liquidity changes, policy orientation and intensity. In the long term, the basis for a sustainable bull market is to have a definite improvement in earnings.

For the earnings forecast of A-share listed companies in 2025, currently, various securities firms generally believe that The earnings of A shares will rebound in the second half of 2025, but the expectations for the full-year rebound magnitude are not consistent among institutions.

Among them, Everbright Securities predicts: The growth rate of the net profit attributable to the shareholders of all A-share non-financial companies in 2025 is 13.8%, and the overall profit growth rate of A shares is 10.2%, while The earnings forecasts of other securities firms are around 5%. For example, Huatai Securities predicts that the growth rate of the net profit attributable to the shareholders of non-financial enterprises in A shares in 2025 is 5.2%; CICC points out that from the top-down perspective, it is expected that the year-on-year earnings of A shares/non-financial companies in 2025 may be around 1.2%/3.5%; CITIC Securities predicts that the year-on-year growth rate of all A-share earnings in 2025 will slightly increase from 0.5% in 2024 to 0.7%, which is far lower than the predictions of Everbright and CICC.

The core reason behind the differences in the earnings forecasts of all A-share non-financial companies by various institutions lies in the different expectations of inflation.

For example, the more optimistic Everbright Securities predicts: By the end of 2025, the year-on-year CPI will rebound to 1.5%, and the year-on-year PPI will rebound to 1.2%, corresponding to an average CPI of 1% and a PPI of -0.2% for the whole year; while Huatai Securities predicts: Under the low-tariff situation, the year-on-year CPI in 2025 is 0.8%, and the year-on-year PPI is -0.9%; Under the high-tariff situation, the year-on-year CPI is 0.7%, and the year-on-year PPI is -1.1%; CITIC Securities predicts: Under the neutral situation, the year-on-year growth rates of PPI and CPI for the next year are -1.3% and 0.3%, respectively.

In general, although the predictions of inflation by various securities firms are different, they have reached a consensus on the trend: that is, The year-on-year CPI further warms up, and the year-on-year decline in PPI narrows, thereby supporting the earnings recovery of A-share listed companies.

Under the background of earnings recovery, the investment strategy naturally switches from a more defensive investment to a prosperity investment, that is, to layout the direction of earnings exceeding expectations, and to some extent, relax the attention to valuation.

Valuation Repair, Key Lies in Institutional Funds

Before September, under the background of the continuous decline in the earnings growth rate of A shares, the valuation was under relatively great pressure. Whether compared longitudinally with history or horizontally with emerging markets, the relative valuation of A shares was in a low state.

Since a series of incremental policies have been implemented since the end of September, the Shanghai Composite Index has rebounded by more than 25% from the bottom, and the ChiNext Index has even exceeded 50%. The short-term rapid rebound of the market naturally comes from the accelerated valuation repair under the improved expectations, but at the same time, the current valuation of A shares is no longer in an obviously undervalued state.

Securities firms have also basically reached a consensus on this, that is, The longitudinal comparison shows that the valuation of A shares has entered a reasonable range, but the horizontal comparison is still slightly lower than that of emerging markets. If there is an inflow of incremental funds in the future, the valuation is still expected to rise slightly.

Longitudinally, Huatai Securities believes: "The first stage of valuation repair since the '924' policy combination has basically been in place in terms of time and space. Currently, The PE-TTM of the Wind All A Index is about 18 times, which is already at a neutral and reasonable point in the current macro environment, and there is no obvious undervaluation or overvaluation; Everbright Securities also has a similar view, pointing out that as of October 22, 2024, the PE(TTM) of the Shanghai Composite Index is near the average since 2010.

But horizontally, A shares still have a discount compared with emerging markets. Huatai Securities statistics show that the PB discount of the CSI 300 compared with the MSCI Emerging Non-China Index is about 10%, while under the same caliber, before 2023, the PB of the CSI 300 compared with the MSCI Emerging Non-China Index was basically at par or even had a small premium (with an average of about 5%).

CICC also pointed out: From the global comparison perspective, the A-share market has a relatively high investment cost performance. The valuation of the A-share market is still at a low level globally. Considering that the current proportion of overseas assets in the A-share allocation is not high, and the correlation of returns between Chinese and foreign assets is at a low level, The A-share market has a better investment attractiveness for global investors at present, and may become an ideal choice for overseas assets to diversify and spread risks.

For the expectations of the source of subsequent incremental funds, all securities firms believe that institutional funds are the core force. This round of the significant rebound of A shares is mainly driven by retail funds, and the institutional positions have not increased much and are still potential bulls.

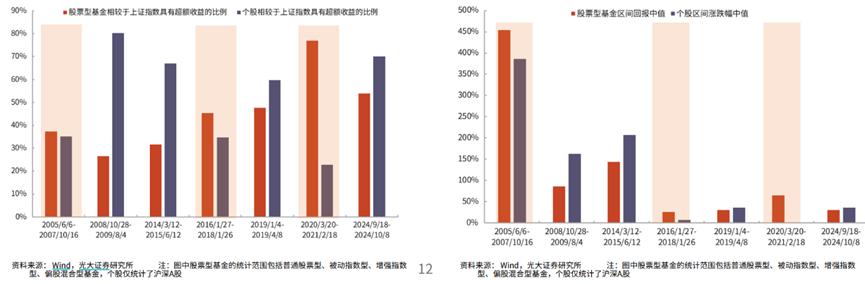

Generally speaking, the earnings performance of equity funds is mainly driven by institutional funds, while the earnings performance of individual stocks is driven by retail funds, and in this round of bull market, the excess returns and the median range increase of individual stocks are significantly stronger than those of equity funds, so the retail power in the current market is stronger.

Figure: Statistics of Equity Fund Earnings Source: Everbright Securities, Organized by 36Kr

To confirm this, CICC data shows that The number of new A-share accounts opened in the Shanghai Stock Exchange in October was 6.85 million, which is the third-highest level in a single month in history. At the same time, the balance of A-share financing with a high individual participation increased from 1.36 trillion yuan on September 23 to 1.77 trillion yuan on November 8. In contrast, The equity positions of some private equity funds only increased from 48% in August to 56% in September, and the equity fund positions of public offerings changed little. The active foreign capital tracked by EPFR briefly flowed into A shares and then flowed out again recently.

The institutional funds entered the market relatively late. On the one hand, it is because individual investors prefer to enter the market themselves in the early stage of the bull market and tend to buy funds in the middle and late stages of the bull market. On the other hand, it is also related to the certain lag in the fundraising and investment of funds.

In general, the relative valuation of A shares has entered a reasonable range at present, and the "repair market" has come to an end, but there is still expected to be an inflow of institutional incremental funds in the future, which can still support the valuation repair.

Prosperity Investment as the Main, Disagreement on Consumption

Under the two consensus expectations of earnings recovery and reasonable valuation, major securities firms believe that the risk appetite in the future market is expected to increase, Therefore, prosperity/growth investment is mentioned the most, and industrial autonomy and AI are the investment keywords.

Specifically, CICC believes: The growth industries have experienced a continuous compression of valuations in the past three years, and some areas have fully expected and priced the downward trend of the fundamentals. With the macro environment becoming more stable and the risk appetite improving, prosperity investment is expected to come back into view. Specifically, pay attention to Several directions such as supply-side clearance, industrial autonomy, AI and other new industrial trends.

CITIC Securities suggests: Pay attention to the main line of independent and controllable with enhanced expectations, as well as the emerging industry opportunities driven by technology. First, after Trump's re-election, it is expected that the United States will continue to impose restrictions on China's technology industry, and the expectations of the main line of independent and controllable are expected to continue to be strengthened. Second, it is recommended to pay attention to the investment opportunities for industrial upgrading brought about by the development of new-quality productive forces. Currently, technological innovations represented by artificial intelligence, new-generation information technology, new materials, and biotechnology are driving the arrival of the fourth industrial revolution.

Everbright Securities Is relatively optimistic about the earnings repair of A shares, but the investment strategy is more cautious. It points out: Investors have formed a strong expectation for the future economic and corporate earnings improvement, but Whether the economic and corporate earnings can actually improve is still unproven. It is not excluded that this round of market may only be driven by the improvement of expectations, but it cannot be disproved at present, so high-risk appetite varieties are also worthy of investors' attention.

Huatai Securities believes: From now until the first half of 2025, the "pro-cyclical" broad fiscal expectation in the United States may bring an upward risk to the US dollar, and the absolute valuation of A shares may have "bumps"; in the second half of 2025, if the US dollar shows a phased adjustment window, combined with the improvement of the credit cycle at that time, the initial signs of supply-side clearance, and the stabilization of real estate sales, A Shares are expected to usher in the second round of valuation中枢 uplift opportunities, during which The large-cap growth style will dominate.

For the performance of the consumer sector in 2025, the views of various securities firms are also inconsistent.

Everbright Securities and CITIC Securities believe: The consumption direction that benefits from policies can be used as an investment main line. The reason is that under the background of the uncertainty of external demand due to trade factors, boosting domestic demand, especially consumption, has become a feasible choice. In the future, the main focus is on policy guidance and the implementation effect of policies. In terms of allocation strategy, CITIC Securities suggests that from the end of this year to the middle of next year, the allocation strategy within the consumer sector will gradually progress from a balance of offense and defense to more flexible varieties.

CICC includes consumer leaders with high-quality cash flow in the "new dividend" sector and takes it as the investment main line. It believes: In the future, the high-dividend strategy will be differentiated, and the dividend yield cost performance of traditional natural monopoly industries will decline to some extent, while the consumer sector is a new perspective. Huatai Securities also expressed a similar view, that is, paying attention to the domestic demand consumer sector with a high cash flow yield.

For the export chain that the market is more concerned about, the general view of securities firms is to adopt an avoidance strategy. The main reason is that after Trump takes office, it may have a certain impact on the export of Chinese enterprises. Huatai Securities statistics show that, from the experience of 2018 - 19, the research of Jiao et al. (2022) 1 shows that During the trade friction in 2018 - 19, on average, for every 1% increase in the export price including tariffs at the enterprise level, the profit margin of Chinese export enterprises will decrease by 0.35 percentage points, and for every 1% increase in the enterprise-level export price including tariffs, China's overall exports will decrease by 0.83%.

Therefore, in investment, enterprises with a high proportion of exports should be avoided as much as possible, or attention should be mainly paid to areas with strong export resilience and relatively small impacts.

In general, for the A-share investment in 2025, the strategy reports of various securities firms have shown a positive expectation for the improvement of earnings. Based on this, under the relatively reasonable valuation, the preference for prosperity investment has significantly increased; at the same time, institutions are also more optimistic about the consumer industry driven by policy benefits and consumer leaders with sufficient cash flow; for the export chain with a greater impact from external risks, an avoidance strategy needs to be adopted.

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment needs to be cautious. Under no circumstances do the information in this article or the opinions expressed constitute investment advice for anyone. Before making an investment decision, if necessary, investors must consult a professional and make a cautious decision. We do not intend to provide underwriting services or any services that require a specific qualification or license for trading parties.