Zhike | Is Kuaishou an e-commerce stock or a tech stock with a 10-times PE ratio?

Author | Huang Yida

Editor | Zheng Huaizhou

Kuaishou disclosed its 2024 Q3 financial report on November 20. The report shows that Kuaishou achieved an income of 31.131 billion yuan in 2024 Q3, with a year-on-year growth of 11.4%. The income growth rate slightly exceeded the market consensus expectations. In terms of profits, Kuaishou recorded an adjusted net profit of 3.95 billion yuan in the same period, with a year-on-year growth of 24.4%. The adjusted net profit level also slightly exceeded the market expectations.

However, despite the better-than-expected performance, Kuaishou's stock experienced a significant decline in the two consecutive trading days after the earnings disclosure on November 21 and November 22, with a total decline of more than 15%. Even in the short term, Kuaishou's stock has been in a state of shock and adjustment since October this year. Considering Kuaishou's fundamentals, the current stock price has a considerable safety margin, and the reasons for the two consecutive trading days of sharp decline seem insufficient.

Figure: Recent trend of Kuaishou Hong Kong stocks; Source: Wind, 36Kr

So, what is the true quality of Kuaishou's 2024 Q3 financial report? What caused Kuaishou's stock to decline sharply after the earnings disclosure? Is the current valuation level of Kuaishou fairly reflecting its fundamentals?

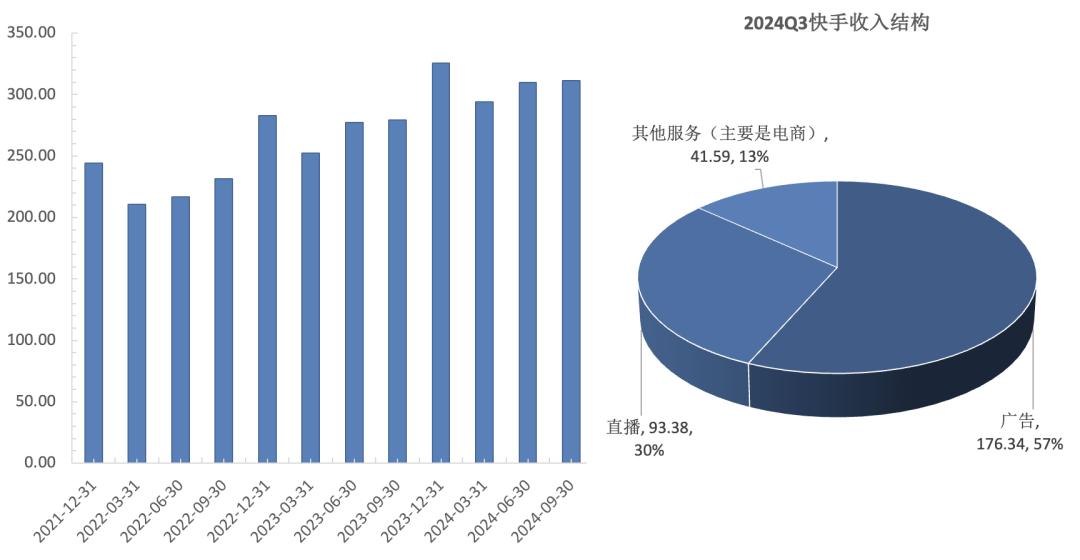

01 Advertising Crossing Cycles, E-commerce Not Weak in Off-season

From the financial performance of Kuaishou in recent years, it can be seen that the business model has become mature, and the income proportion of the three core businesses of advertising, e-commerce, and live streaming remains stable. Advertising and e-commerce jointly drive the company's income growth. Among them, the advertising business contributed about 57% of the company's income in 2024 Q3, the live streaming business accounted for about 30% of the income in the same period, and other businesses (mainly e-commerce) accounted for the remaining 13%.

Figure: Quarterly income of Kuaishou in recent years and the income structure in 2024 Q3

The basis for Kuaishou to achieve income is the continuous construction of content and user ecology. From the operational data, Kuaishou's DUA exceeded 400 million in 2024 Q3, reaching 408 million, with a year-on-year growth of 5.4%. In the same period, MAU recorded 714 million, with a year-on-year growth of 4.3%. After the Internet dividend has peaked, the reason why Kuaishou's traffic data can maintain a steady growth is: on the one hand, it benefits from Kuaishou's status as the third-largest application in China, as the strong always remain strong; on the other hand, it is the result of the construction of the content/community ecology.

Advertising business is currently the cornerstone of Kuaishou's income, and the advertising business achieved an income of 17.6 billion yuan in 2024 Q3, with a year-on-year growth of 20%. Compared with the domestic advertising market, Kuaishou's advertising business has achieved a growth that crosses cycles. Internally, the external circulation advertising is the core driving force for the growth of the advertising business income, and there are two main operating highlights of the external circulation advertising in this quarter:

1. The IAA short drama model has been successfully implemented. The so-called IAA, that is, in-app advertising. Under this model, C-end users can unlock more episodes by watching incentive ads and information flow ads, and Kuaishou realizes income by earning a certain proportion of the investment flow fee share. The successful implementation of the IAA short drama model not only broadens Kuaishou's income sources but also strengthens the long-tail effect of short drama monetization while converting incremental users for advertising clients;

2. The proportion of the UAX fully automatic delivery solution in the marketing consumption of external circulation customers has increased to 50%. The UAX fully automatic solution is mainly aimed at different industries and scenarios, highlighting intelligence and differentiation. The core purpose is to improve the stability and marketing conversion rate of marketing delivery through the efficient operation of the system under the support of intelligence. The rapid increase in the proportion of UAX automatic solution consumption among external circulation customers indicates the recognition of this model by external circulation advertisers.

At the same time, the internal circulation maintained a steady growth in this quarter. In terms of operation, in addition to traditional methods such as policy guidance, product iteration, and algorithm optimization, intelligent delivery is also a major core growth driver of internal circulation advertising. In 2024 Q3, the proportion of the全站 marketing solution and intelligent hosting products in the marketing consumption of internal circulation customers also reached 50%.

As another growth flywheel of Kuaishou, the e-commerce business achieved an income of 4.2 billion yuan in this quarter, with a year-on-year growth of 17.5%. The income of Kuaishou's e-commerce business slowed down significantly in this quarter. On the one hand, the third quarter is a traditional off-season for e-commerce, lacking the protection of major shopping festivals. On the other hand, it is subject to the negative impact of the counter-cyclical on large consumption.

The e-commerce business also has highlights in this quarter, mainly in infrastructure. For example, driven by the strategic new merchant support plan, the number of new merchants entered in 2024 Q3 increased by more than 30% year-on-year, and the commodity ecology of the platform has therefore been further enriched; the e-commerce content operation has been continuously strengthened, and specific measures include cash incentives, traffic tilt, and user subsidies to promote the strong growth of GMV in the corresponding segments; the GMV of the Pan-shelf E-commerce continued to achieve super-market growth in this quarter, and its corresponding GMV proportion has increased to 27%, which has become an important supplement to the content e-commerce.

Kuaishou's live streaming business continues to maintain its position as an infrastructure, achieving an income of 9.3 billion yuan in 2024 Q3, with a year-on-year decrease of 3.9%. From the medium-term trend, the decline in Kuaishou's live streaming income has continued to narrow month-on-month. The income elasticity of the live streaming business is inferior to that of advertising and e-commerce. On the one hand, it is related to its positioning, and at the same time, it is also affected by the counter-cyclical.

In terms of overseas business, Kuaishou achieved an overseas income of 1.3 billion yuan in 2024 Q3, with a year-on-year growth of 104%. Currently, Kuaishou's overseas business is mainly in Brazil, and it conducts business through the international version Kwai. The growth of Kuaishou's overseas income in this quarter is mainly driven by the growth of online marketing income. At this stage, Kuaishou has made some initial progress in terms of goods, content, services, and transaction efficiency, laying a certain foundation for the future development of its overseas business.

02 Investment Strategy

Kuaishou's commercialization path is currently very clear, that is, driven by the dual wheels of advertising + e-commerce. From the financial performance in the past two years, the growth of net profit is quite gratifying, indicating that Kuaishou's commercialization model has been successfully implemented. However, Kuaishou's net profit growth rate narrowed in this quarter, mainly affected by the increase in the base, the counter-cyclical impact on the core business, and a certain increase in period expenses.

After Kuaishou announced its results, there was a significant decline for two consecutive days. The main reason is that investors saw that the income growth rates of the two core businesses of advertising and e-commerce both narrowed, especially the growth rate of e-commerce income slowed down more significantly. At the same time, the Hong Kong stock technology sector is currently weak as a whole after the 924 market situation, and a negative resonance has formed between the corporate fundamentals and the Hong Kong stock market.

However, to understand the true quality of Kuaishou's 2024 Q3 performance, the key is to combine the corresponding macro background and understand Kuaishou's own technological attributes.

Take the advertising business as an example. It is a typical pro-cyclical industry. When the economy is good, advertisers have a stronger willingness to invest, and the opposite is true in a counter-cyclical situation. The reason why Kuaishou's advertising business can achieve growth that far exceeds the industry average and even shows certain counter-cyclical attributes is, on the one hand, it benefits from Kuaishou app's national-level status in the mobile terminal. The natural channel advantage is the cornerstone for Kuaishou's advertising performance to maintain strong growth; on the other hand, Kuaishou's advertising business has a strong endogenous growth ability, which includes both incremental income brought by exploring new business models and high-quality growth under the addition of technology.

As a leading domestic consumer technology enterprise, Kuaishou currently has an industry-leading AI matrix, including specific products such as the Kuaishou Language Model, the Video Generation Model KeLing AI, and the Promotion Model. These AI tools can not only empower content creation and help build the content ecology but also are handy tools for advertising marketing.

From the business perspective, AI tools can help advertisers achieve advertising content creation. After continuous iterative upgrades, the current video presentation effect of the visual generation model has achieved industry-leading, which helps to improve the user stickiness of video advertising and the conversion of new users. At the same time, combined with the intelligent automatic delivery platform and the promotion model, it can better help advertisers make marketing decisions and thus better implement marketing strategies.

The application of these AI tools in content generation and interaction is already very extensive. Under this trend, Kuaishou's monetization efficiency will be further improved in the future. Therefore, AI tools will also become a very important marginal force to boost Kuaishou's advertising income growth. Reflecting in the data, in the first three quarters of 2024, Kuaishou's average daily consumption of AI advertising exceeded 20 million yuan; the number of users of KeLing AI has exceeded 5 million, and the monthly transaction volume of commercial orders exceeds 10 million.

In terms of valuation, as of the press release (November 25), Kuaishou's PE-TTM is only 12 times. This valuation level does not give a relatively fair pricing to Kuaishou's technological attributes and counter-cyclical attributes. It is only equivalent to e-commerce stocks and even inferior to some strong manufacturing enterprises. Therefore, from the perspective of being bullish on Kuaishou's technological attributes, Kuaishou is currently significantly underestimated by the market.

Looking forward to the future, with the gradual implementation of the announced package of economic stimulus policies, the current economy has shown some improvement on the margin. Then, in the scenario of a strong economic recovery in the future, the negative impact from the macro level on Kuaishou's two core businesses of advertising and e-commerce will gradually fade away, and Kuaishou's core businesses will therefore have a stronger growth potential. At the same time, with the help of high-tech such as AI tools and intelligent delivery platforms, Kuaishou's operating efficiency will also be improved. The continuous improvement of Kuaishou's gross margin in recent years has confirmed this view.

Therefore, Kuaishou's fundamentals will have a better expectation in the future. When the growth space is opened, with the current valuation level, Kuaishou has huge valuation elasticity. The strong expectation of technology-driven performance growth and the status of a national-level application are the basis for Kuaishou's long-term investment value. Even in the short term, with Kuaishou's current significantly underestimated state, it still has a good safety margin.

*Disclaimer:

The content of this article only represents the author's opinion.

The market is risky, and investment needs to be cautious. Under no circumstances does the information in this article or the opinions expressed constitute an investment recommendation for anyone. Before making an investment decision, if necessary, investors must consult a professional and make a cautious decision. We do not intend to provide underwriting services or any services that require a specific qualification or license for trading parties.