Battery manufacturers have little interest in the humanoid robot market.

After power battery manufacturers tasted the sweet fruits of large - scale profitability in the new energy vehicle field, they welcomed a new customer - humanoid robots.

Some market observers believe that humanoid robots will become the "third growth pole" for power battery manufacturers, in addition to the new energy vehicle and energy storage sectors.

This view makes some sense. Humanoid robots are regarded as the "next - generation computing platform". In the future scenarios of factories, warehouses, and households, batteries are their "hearts".

However, this "heart" of humanoid robots must be lightweight, safe, and quickly replaceable, and also withstand high - frequency charge - discharge cycles. For power battery manufacturers, this is a bet with high R & D investment, low shipments, and an unclear business outlook.

In summary, this seems to be a business full of a sense of the future but may result in losses.

At the World Robot Conference (WRC) held in early August this year, EVE Energy was the only power battery manufacturer participating in the exhibition. A staff member of EVE Energy told "Jazi Guangnian", "Even if we take on all the business of the robot manufacturers at today's exhibition, it won't account for much of our share."

This is not an exaggeration by the EVE Energy staff. The market for lithium batteries used in humanoid robots is simply too small, so small that it is not even enough to attract industry leaders like CATL or BYD to participate.

Therefore, at the product level, battery manufacturers also unanimously keep silent. Almost no enterprise actively promotes that it is researching, developing, or deploying lithium batteries for humanoid robots.

Behind this highly contrasting market appearance lies the difficulty in the large - scale production of special lithium batteries for humanoid robots and the doubts of power battery manufacturers about whether the humanoid robot industry can complete the business closed - loop.

Before these issues are clarified, for power battery manufacturers to enter the robot battery market is nothing less than a gamble.

1. Fanatical Robots and Indifferent Batteries

The new - type robot industry represented by humanoid robots is becoming fanatical.

In April this year, the "Blue Book on the Development of the Humanoid Robot Industry in 2025" released by the GGII predicted that the global sales volume of humanoid robots is expected to reach 12,400 units in 2025, with a market scale of 6.339 billion yuan. Morgan Stanley predicted that by 2050, the global humanoid robot market will exceed 5 trillion US dollars.

Relevant industrial funds have been established in Beijing, Shanghai, Shenzhen and other places. A number of star humanoid robot enterprises have also emerged in the market. Everything seems to be moving in a positive direction.

However, this fanatical market has not attracted the attention of power battery manufacturers. This player that almost participates in all electricity - using industries has disappeared in the robot industry.

We tried to find the presence of power battery manufacturers at robot industry conferences. However, power battery manufacturers, who are keen on participating in various auto shows, do not frequently participate in robot industry conferences.

For example, the 2025 World Robot Conference gathered about 200 enterprises for exhibition, but the number of power battery exhibitors was pitifully small. Only EVE Energy, a leading manufacturer, participated. CATL, BYD, CALB, Gotion High - Tech, Sunwoda, etc. did not participate.

Why was EVE Energy the only one to participate?

Zhao Wei (alias), an employee in the marketing department of a leading battery manufacturer, gave an explanation: "EVE is one of the few manufacturers still insisting on producing small cylindrical batteries. Their production volume is very large. These batteries can be well transitioned from the 3C field to robots. It would be a waste not to do it."

Data shows that in 2024, EVE Energy ranked first in China and fourth globally in the shipment volume of consumer - grade small cylindrical batteries. The highest monthly sales exceeded 100 million pieces, and the annual shipment volume exceeded 1 billion pieces.

This leading position in this niche product type and the absolute advantage in production volume have made EVE Energy always try to expand the application market of small cylindrical batteries, and robots happen to be the most suitable carrier for consumer - grade small cylindrical batteries at present.

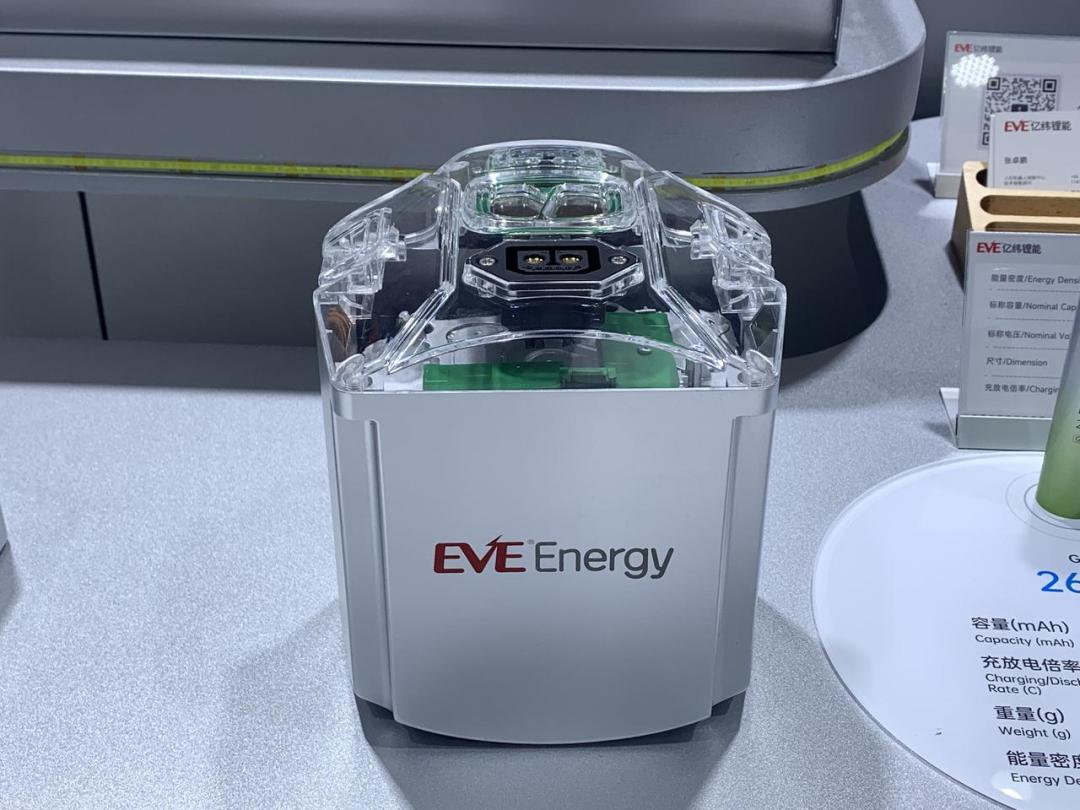

The robot battery compartment exhibited by EVE Energy at the WRC. Photo source: Taken by "Jazi Guangnian"

Due to space and weight limitations, the square batteries, large cylindrical batteries, and blade batteries developed by enterprises such as CATL and BYD can hardly be installed on robots smoothly.

At the same time, these enterprises hardly produce small cylindrical batteries. For these enterprises and the electric vehicle field they focus on, small cylindrical batteries are already obsolete products. Therefore, these enterprises are not seen involved in the robot field at the market level.

This phenomenon raises a deeper question: If the robot industry is really about to explode, why aren't power battery enterprises speeding up the R & D of corresponding battery products?

An obvious reason is that there is almost no standardization for lithium batteries used in robots at present. The battery shapes and sizes used by various robot manufacturers vary. Soft - pack, cylindrical batteries, or even modified batteries from 3C products can all drive robots to operate smoothly.

At the same time, lithium batteries used in robots lack safety certification, and there is almost no industry data on the working conditions of batteries on robots to assist in development. For battery manufacturers, this market is undoubtedly in chaos.

Liu Feng (alias), an employee of another leading battery manufacturer, told Jazi Guangnian: "Humanoid robots themselves lack standards, and their shape designs are too strange. But batteries need to be matched with the robot's circuit and power system. This situation needs to be adjusted. It is risky to rush into such an early - stage market."

But the more fundamental reason is that the market scale of the robot industry is too small. If battery manufacturers specifically develop batteries for this field, it will be a loss - making business.

2. Negligible Market Scale

The market scale of lithium batteries used in robots is almost negligible. What's worse, this market is small now and will still be small in the future.

According to data from the Huajing Industry Research Institute, in 2024, the global shipment volume of robot (including industrial, service, and humanoid) batteries was about 10 GWh, and the shipment volume of robot batteries in China was about 6.8 GWh.

What does this volume mean? According to the annual report, CATL's realized production capacity in 2024 reached 676 GWh, and the under - construction capacity was 219 GWh. If the overseas manufacturing bases in the long - term future plan are included, CATL's nominal production capacity has even exceeded 1 TWh.

At the same time, the single - line production capacity of battery manufacturers' production lines is also getting larger. Even EVE Energy, an enterprise focusing on the production of consumer - grade lithium batteries, put into operation a 60 GWh super energy storage factory (Phase I) last year, which is known as the "largest single - unit energy storage factory in the industry". The single - line production capacity of this factory exceeded 15 GWh.

Zhao Wei told "Jazi Guangnian" that currently, for leading battery suppliers including CATL, BYD, and CALB, the production capacity of a newly built production line is basically above 10 GWh. That is to say, from the perspective of production capacity, one production line of a certain battery manufacturer is sufficient to meet the battery needs of all robots globally in 2024.

Facing this situation, some industry insiders believe that with the development of the market, robots will see an explosion in shipment volume in the next few years, which will strongly drive the demand for power batteries.

But Zhao Wei straightforwardly said, "The market won't be large in the future. It will probably end up in a mess."

Zhao Wei's statement is based on the calculation of the single - unit battery capacity and shipment volume of robots. Take the Unitree H1 of Unitree Robotics as an example. It is Unitree Robotics' first general - purpose humanoid robot. Official data shows that its battery capacity is 864 Wh, which is about 0.86 kWh, equivalent to 1/100 of the battery capacity of a pure - electric new energy vehicle.

According to relevant reports from the media and industrial research institutions such as The Paper, GGII, Deloitte, and IDC, under an optimistic estimate, by 2030, the global shipment volume of humanoid robots will exceed 1 million units, and by 2035, it will reach the level of 5 million units.

If calculated with a battery capacity of 1 kWh per robot, in the next 5 years, the global market scale of lithium batteries used in robots will only be 1 GWh, and in the next 10 years, only 5 GWh.

Gu Xiaoli, a partner at CMC Capital, told "Jazi Guangnian", "The battery capacity demand created by the embodied intelligence industry cannot be compared with that of the automotive industry and the energy storage industry at all. They are not in the same dimension and cannot bring any new business growth curve to battery suppliers."

In addition, in terms of the product itself, the product characteristics pursued by lithium batteries used in robots are highly similar to those of the electric vehicle industry: high energy density and high discharge power. However, there is almost no mature battery that can meet the volumetric energy density required by humanoid robots, which leads to the problem of insufficient battery life for all humanoid robots.

For example, on April 19, 2025, the "Tianguang Ultra" robot of the Beijing Humanoid Robot Innovation Center won the championship of the world's first humanoid robot half - marathon. However, during the 2 - hour - and - 40 - minute race, this robot changed its battery three times.

The "Tianguang Ultra" robot. Photo source: Beijing Humanoid Robot Innovation Center

If a battery manufacturer can produce a battery with extremely high energy density in a "palm - sized" dimension, it means that it will gain a leap - forward technological lead. It also means that this technology will be first applied in electric vehicles or energy storage systems, rather than on robots.

Only by investing technology in these larger and more competitive industries can battery manufacturers ensure their profit margins and then continue to increase investment in technology, enabling product performance to enter a virtuous cycle.

Zhao Wei told "Jazi Guangnian", "The current robot industry is not worth our large - scale R & D investment. We don't even know when we can get back the cost. In essence, we are all businessmen. Only fools would do unprofitable things."

3. A Loss - Making Business

The pessimism of battery manufacturers towards the robot industry is not simply about not being optimistic about its market growth. The more important factor is their distrust of the business logic of the robot industry.

Zhao Wei said, "When I make a battery for a product, I need to consider the commercial value of this product. But many current robots are just dancing, boxing, or playing football. I don't think such a business model can bring any returns to supply - chain enterprises."

This view may seem one - sided to robot industry practitioners, but it does represent the views of some battery industry practitioners.

Views can easily turn into emotions, and emotions can further turn into actions. The fact that leading battery manufacturers are not much involved in the robot battery field can illustrate this problem.

Compared with the mature electric vehicle, energy storage, or 3C markets, battery manufacturers need to invest more costs in making a battery compartment for robots.

After communicating with the staff of EVE Energy, "Jazi Guangnian" learned that currently, if robot manufacturers cooperate with battery manufacturers, the required battery compartments basically need to be custom - produced by battery manufacturers, including the manufacturing and assembly of battery cells, packs, BMS, and casings.

Liu Feng told "Jazi Guangnian", "If a manufacturer custom - develops a battery according to the customer's requirements, based on the current shipment volume of robot batteries, this product is at least 50% more expensive than other mature products with the same capacity. If it involves re - designing tooling fixtures during the manufacturing process, this proportion will be even higher."

Moreover, even though the manufacturing cost has increased, the cost proportion of batteries in the overall cost of robots is still at a relatively low level.

According to a report from "LatePost", the Tesla Optimus robot is equipped with a 2.3 - kWh battery, but the cost only accounts for 3% of the robot's overall BOM cost (production material cost).

Zhao Wei said that currently, the cost proportion of batteries installed on domestic humanoid robots is even less than 1%. The profit that battery suppliers can obtain from it is almost negligible.

In contrast, the cost proportion of batteries in electric vehicles is about 40%; in energy storage systems, it is even higher. Depending on factors such as air - cooling, liquid - cooling, and charge - discharge rates, it can reach 60% - 70%.

Therefore, in the face of unclear market demand and extremely low product profits, early - stage layout and product R & D obviously cannot bring sufficient returns to battery manufacturers.

The problems in the commercial application of humanoid robots do not end here. For example, in terms of the selling price, if the price is not reduced, the market will be difficult to open; if the price is reduced, the profits of all supply - chain enterprises, including battery manufacturers, will be further compressed, and the R & D speed of related technologies and products may even be slowed down.

Gu Xiaoli said that the performance of components is the least worrying issue in the current robot industry. He said, "If the business scenarios of robots are sorted out and the volume is increased, rest assured, the problems of components will naturally be solved by someone in the industrial chain. Currently, the robot industry is 'lacking one out of four', not 'needing one to complete three'."

Of course, some people are very optimistic about the future of the humanoid robot industry. For example, Elon Musk once said that the final hardware cost of humanoid robots will reach the level of an electric vehicle, but the number in use will be 20 times that of electric vehicles. Eventually, there will be 20 - 30 billion humanoid robots serving the whole society globally.

But at present, it is still quite difficult to achieve this vision. If a battery manufacturer decides to start R & D on a special battery for humanoid robots now, it is no different from a gamble.

(Cover image: Generated by an AI tool)

This article is from the WeChat official account "Jazi Guangnian". Author: Zhang Lin. Republished by 36Kr with authorization.