ZhiKe | Raking in $5 billion in Q1, why has Tirzepatide become the top choice for weight loss?

Author | Huang Yida

Editor | Zheng Huaizhou

Novo Nordisk's semaglutide has been a "popular drug" in recent years. After entering the weight - loss field, it has gained significant popularity due to its excellent efficacy and the demonstration effect of celebrities. Eli Lilly's similar drug, tirzepatide, as a rising star, has also performed quite impressively in the past two years, with an exposure level comparable to that of semaglutide.

Reflected in the sales data, Eli Lilly's financial report shows that tirzepatide, with its two indications of blood - sugar control (Mounjaro) and weight loss (Zepbound), achieved a total revenue of $5 billion in Q1 2025, accounting for approximately 39% of the company's revenue during the same period, and its year - on - year growth rate exceeded 100%.

Driven by tirzepatide's remarkable sales performance, Eli Lilly's stock price has also soared. Although Eli Lilly's stock price has adjusted this year, its long - term performance remains quite excellent. Since tirzepatide was approved for marketing in May 2022, Eli Lilly's stock price has risen by as much as 180%.

Chart: Long - term performance of Eli Lilly's stock price; Source: Wind, 36Kr

So, what has enabled tirzepatide to achieve long - term high growth in sales? What challenges will tirzepatide face in the future?

01 What are the reasons for the continuous high growth of tirzepatide's performance?

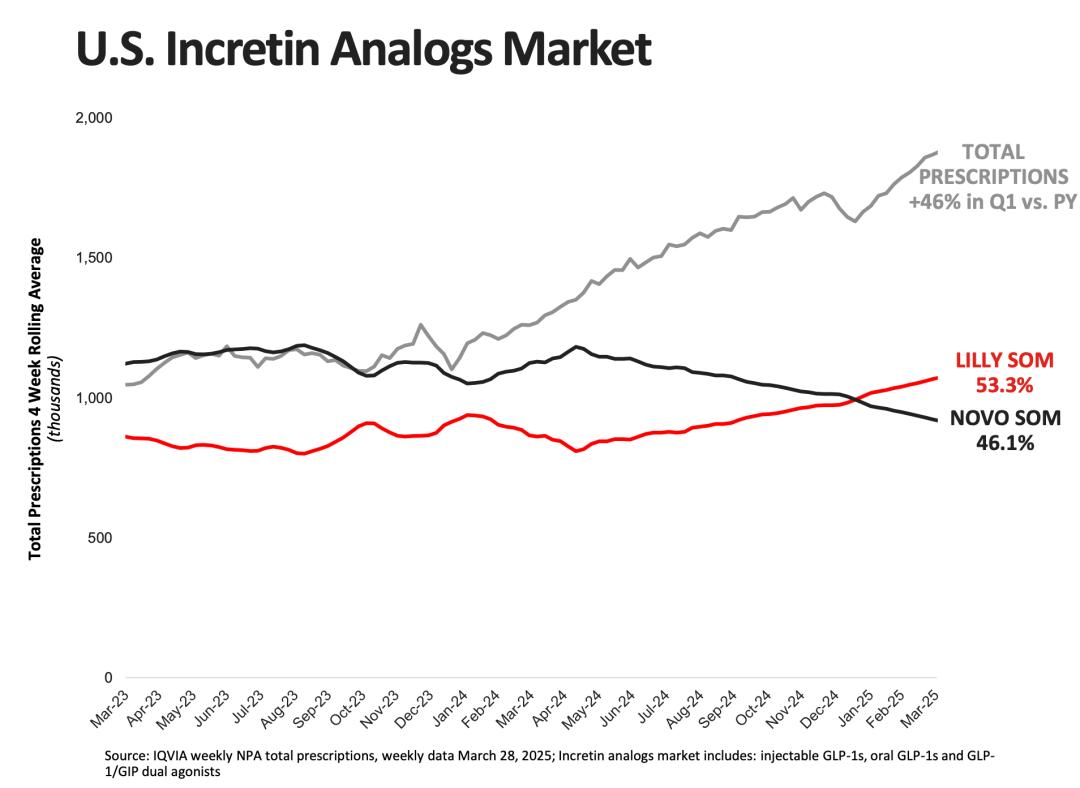

After tirzepatide was approved for marketing in the United States in 2022, the number of prescriptions has continued to grow rapidly, and the growth rate far exceeds that of semaglutide during the same period, driving the rapid increase of tirzepatide's market share. IQVIA data shows that as of Q1 2025, Eli Lilly (including tirzepatide, dulaglutide and other related products) has increased its total prescription volume in the US incretin analog market to 53.3%, surpassing its main competitor, Novo Nordisk. As a late - coming competitor, the rapid increase in the number of tirzepatide prescriptions compared to semaglutide is due to multiple reasons.

Chart: Growth of the US incretin analog market; Source: Eli Lilly's financial report, 36Kr

First, at the patient awareness level, current patients with diabetes and obesity have a higher acceptance of tirzepatide. GLP - 1 drugs have been used to treat diabetes for more than 20 years, and in recent years, weight loss has become another major indication. After long - term promotion and popularization, especially through science education carried out by medical institutions and relevant media, patients have a very in - depth understanding of the efficacy, safety and other key indicators of GLP - 1 drugs. Therefore, when tirzepatide was launched, its target patient group had a stronger acceptance and willingness to try the drug, which is one of the key factors for its rapid penetration.

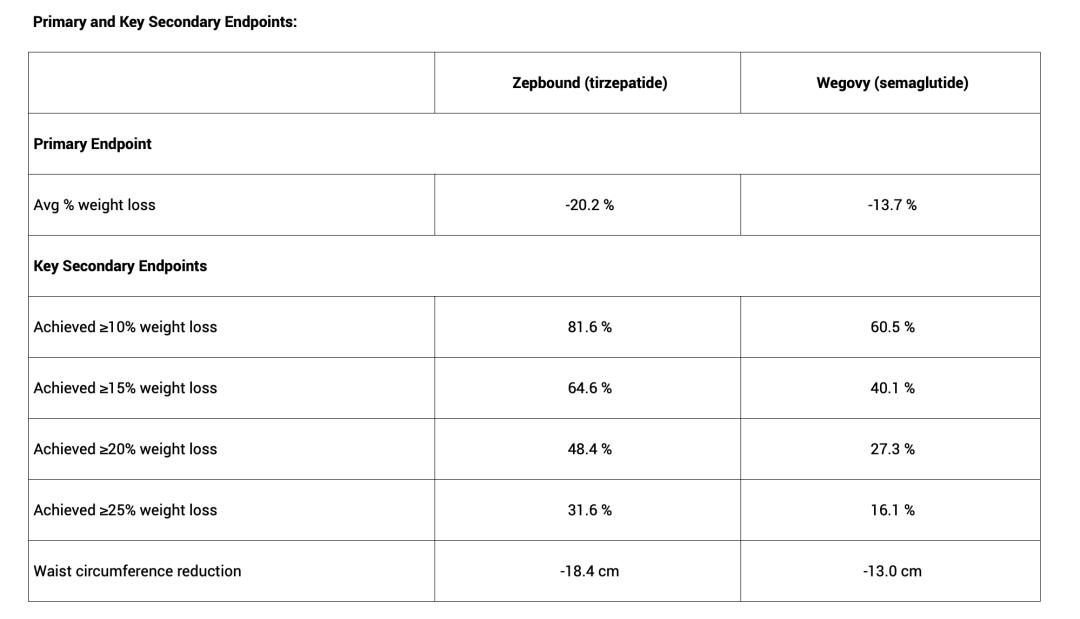

In terms of efficacy, tirzepatide is more effective than semaglutide in the field of weight loss. Eli Lilly designed and conducted a head - to - head clinical trial, SURMOUNT - 5, comparing tirzepatide with semaglutide, and announced the detailed results in May this year. The data shows that tirzepatide is superior to semaglutide in both the primary endpoint data and the five secondary endpoint data. Simply put, using tirzepatide for 72 weeks can result in an additional 8 - kilogram weight loss, which is quite beneficial for its clinical promotion.

Generally, designing and promoting a head - to - head clinical trial is extremely risky for pharmaceutical companies. If the data is unfavorable to their own drugs, it will not only weaken their market competitiveness, but may even lead to the revocation of the indication by regulatory authorities, causing double blows to the pharmaceutical company in terms of economy and reputation. On the contrary, it will further establish and consolidate the leading position of the relevant drug within its indication, thereby driving a significant increase in sales. Supported by the above head - to - head trial data, tirzepatide is obviously a better treatment option than semaglutide. When the maintenance dose costs of the two drugs are comparable, the trend of continuous high growth in the number of tirzepatide prescriptions and sales will continue.

Chart: Detailed clinical data of SURMOUNT - 5; Source: Eli Lilly's official website, 36Kr

In terms of channels, Eli Lilly is one of the veterans in the field of GLP - 1 drugs. Dulaglutide, developed and produced by Eli Lilly, was approved for marketing in the United States in 2014. The ten - year commercialization process of dulaglutide has enabled Eli Lilly to accumulate a mature sales channel network and rich commercialization experience, especially maintaining good cooperative relationships with medical institutions, drug distributors, chain pharmacies, etc.

From the perspective of drug R & D and clinical application, tirzepatide can be considered to some extent as an upgraded version of dulaglutide. Therefore, after tirzepatide was approved for marketing, Eli Lilly, relying on the market foundation of dulaglutide, fully integrated its successful experience and commercialization resources. In particular, it allocated some of the marketing teams, academic resources and sales channels originally used for dulaglutide to tirzepatide, helping it quickly enter the market and gain a foothold in the GLP - 1 field.

After expanding the weight - loss indication, GLP - 1 drugs also have a strong consumer attribute. Therefore, when promoting tirzepatide, Eli Lilly, on the one hand, uses traditional methods, mainly through academic promotion and advertising to increase awareness, and at the same time focuses on strengthening insurance coverage to improve the accessibility of the drug; on the other hand, in order to enhance the competitiveness of tirzepatide in the weight - loss drug market, it also launched a "small - bottle" version at a reduced price. Relying on its stronger efficacy, it attracts potential patients by reducing the price, thereby further increasing market penetration.

After the weight - loss version of semaglutide was approved for marketing, it quickly became a hot topic on social networks, among celebrities and in the fitness field due to its significant weight - loss effect. Especially after many celebrities shared their usage experiences, it became a "popular drug" globally, greatly increasing the public's awareness and attention to the use of GLP - 1 drugs for weight loss. As a late - coming competitor, tirzepatide quickly captured the minds of patients with its better weight - loss effect when the popularity of semaglutide spilled over. It can be seen that the consumer trend is also a key reason for the increase in tirzepatide's performance.

As GLP - 1 drugs gradually entered the weight - loss field, especially boosted by the popularity of semaglutide, the relevant demand increased explosively, and at the same time, the problem of insufficient production capacity was exposed. Semaglutide once faced a global shortage. In the supply - demand pattern of strong demand and weak supply for GLP - 1 weight - loss drugs, tirzepatide, relying on its advantages in efficacy and channels, effectively absorbed some of the overflowing demand, achieving double growth in sales and market share, and thus establishing its core position in the GLP - 1 weight - loss drug market.

02 What challenges will tirzepatide face in the future?

Since GLP - 1 drugs expanded their weight - loss indication, they have shown the potential to become the "drug of the year". Public data shows that in 2024, the total sales of the three brands of semaglutide, Ozempic (for blood - sugar control, injection), Rybelsus (for blood - sugar control, oral) and Wegovy (for weight loss), exceeded $29 billion, only less than $500 million less than the "drug of the year", MSD's PD - 1 pembrolizumab. The total sales of Eli Lilly's two brands of tirzepatide, Mounjaro (for blood - sugar control) and Zepbound (for weight loss), were approximately $16.5 billion during the same period.

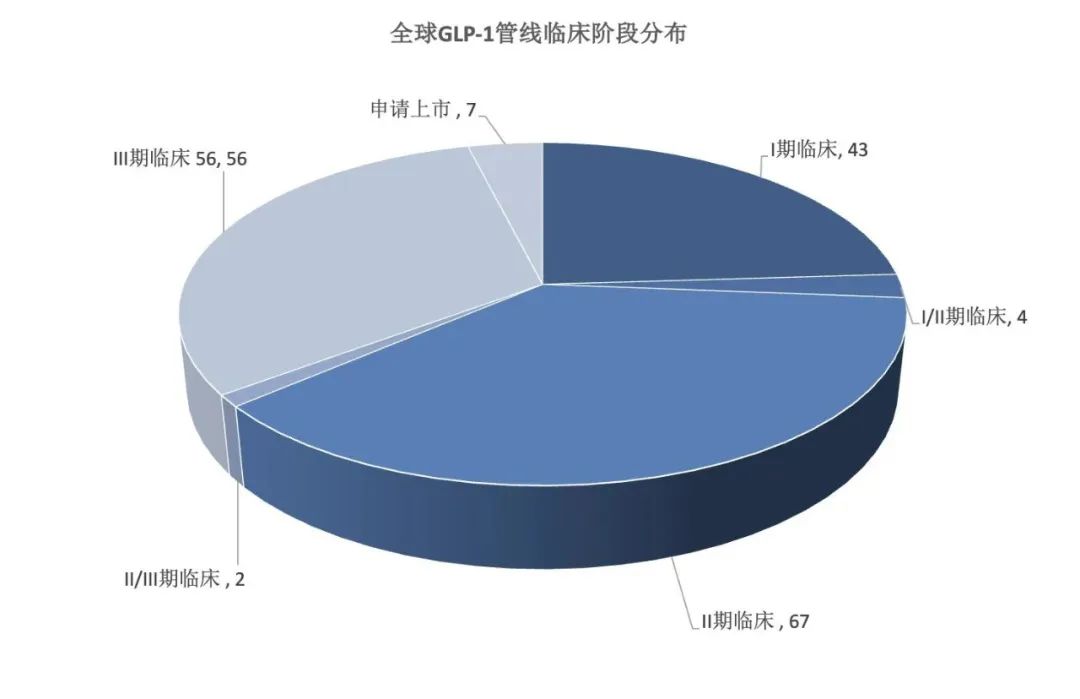

Under the high popularity, many pharmaceutical companies have followed suit. According to the statistics of the PharmaGo database, as of early February 2025, there were 179 GLP - 1 pipelines in the clinical stage globally, from 45 pharmaceutical companies, institutions and cooperation units. Among them, 7 pipelines have submitted marketing applications, and 56 have advanced to Phase 3 clinical trials. Although the competition in the GLP - 1 drug field is not as intense as that of PD - 1 drugs back then, there are still a considerable number of similar clinical trials. As subsequent competitors are gradually launched, semaglutide and tirzepatide, the leaders in the GLP - 1 drug field, will also face significant sales pressure.

Chart: Distribution of global GLP - 1 pipelines in the clinical stage; Source: PharmaGo database, 36Kr

It is worth noting that the patents of semaglutide in China and India will expire in 2026. According to historical experience, the price of generic drugs is usually 1/10 of that of the original drug. After the patent of semaglutide expires, GLP - 1 drugs in these two markets will quickly become very cheap. Looking at tirzepatide, its efficacy is not far ahead. When generic drugs are quickly launched, the price impact from generic drugs is foreseeable.

From the industrial trend of GLP - 1 drugs, the main R & D directions are oral small - molecule drugs and long - acting drugs. Therefore, in the future, tirzepatide will also face challenges from monthly formulations and small - molecule oral drugs. Currently, the administration method of tirzepatide is injection with a pen. The key problem is that the clinical risk of injection administration is slightly higher, and due to the physical feeling, it will also affect the medication compliance. Oral administration is obviously a more convenient method; the one - week administration cycle of tirzepatide is also relatively short, and long - acting formulations usually have better medication compliance.

In terms of R & D competitors, Amgen's MariTide has achieved once - a - month administration. According to the Phase 2 clinical data in November 2024, the average weight loss after 52 weeks was 20%, with efficacy comparable to that of tirzepatide and semaglutide, while achieving a lower frequency of administration. As of February this year, there were 35 GLP - 1 oral small - molecule pipelines in the clinical stage, accounting for about 20% of all GLP - 1 pipelines under R & D. Among them, the relevant products of pharmaceutical companies such as Pfizer, Eli Lilly and Viking are progressing relatively fast.

03 Investment strategy

Tirzepatide was approved for marketing in May 2022. Since then, Eli Lilly's stock price has risen by as much as 180% (as of June 24), and the maximum increase during the period has exceeded 240%. From a fundamental perspective, according to the sales data in Q1 2025, the sales revenue of tirzepatide (including weight - loss and blood - sugar control) accounts for approximately 39% of the company's total revenue during the same period, and it has become the pillar of Eli Lilly's performance. It can be seen that the increase in tirzepatide's sales in recent years has made great contributions to supporting the company's valuation.

In terms of valuation, Eli Lilly's PE - TTM on June 24 was 66x. Wind predicts that Eli Lilly's PE will drop to 37x by the end of 2025. Considering Eli Lilly's current revenue structure and the fact that tirzepatide is in a stage of rapid revenue growth, and the market has a positive growth expectation for it, the performance created by this drug is one of the core driving forces for the company's valuation switch, providing more room for the further rise of Eli Lilly's stock price.

GLP - 1 drugs represented by tirzepatide not only show the potential to become the "drug of the year", but also activate the investment boom in the entire GLP - 1 industry chain, and relevant investment opportunities have thus emerged. Downstream, pharmaceutical preparation companies have followed suit, and many domestic GLP - 1 pipelines are progressing rapidly; due to the continuous strong downstream demand, mid - stream API companies have seen a surge in orders; CDMO companies have benefited from the significant increase in outsourcing demand.

In terms of specific targets, Hengrui Medicine has a rich GLP - 1 pipeline. Its key product, HRS9531 (injection), has entered Phase 3 clinical trials, and HRS - 7535 (oral small - molecule) has also advanced to Phase 3 clinical trials. Compared with the relatively fast progress of its core pipeline, Hengrui's BD transaction for overseas expansion through the NewCo model is quite eye - catching. In this transaction, Hengrui licensed three GLP - 1 pipelines to Kailera Therapeutics. The incremental revenue brought by the BD transaction is the main driving force for the continuous rise of Hengrui's stock price this year.

Domestic pharmaceutical preparation companies that have deployed GLP - 1 innovative drugs and are progressing rapidly also include Huadong Medicine (oral small - molecule HDM1002, dual - target HDM1005, triple - target DR10624), Innovent Biologics (Marsdulotide), Zhongsheng Pharmaceutical (bi - weekly formulation RAY1225), Borui Pharmaceutical (BGM0504), CSPC Pharmaceutical Group (monthly formulation advanced to Phase 1 clinical trials), etc. The core targets in the GLP - 1 industry include Nuotai Biotech, Shengnuo Biotech, Aoruite, Hanyu Pharmaceutical, etc. Most of the above - mentioned companies have been deeply involved in the peptide field for many years, and have obvious production capacity advantages and certain technological advantages. Supported by the strong downstream demand, their performance is expected to benefit.

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment should be cautious. In any case, the information in this article or the opinions expressed do not constitute investment advice to anyone. Before making an investment decision, if necessary, investors must consult professionals and make a careful decision. We have no intention to provide underwriting services or any services that require specific qualifications or licenses to the trading parties.