Insta360, the global leader in panoramic cameras, is about to go public. Is its market value of 19 billion yuan underestimated? | Intelligence Kr

Author | Ding Mao, Fan Liang

Editor | Zheng Huaizhou

The Insta camera, which has become a hit on the Internet, is just one step away from hitting the market.

On June 3rd, Insta360, the parent company of the "Insta 360" brand, announced the lottery results for its initial public offering. The issue price was set at 47.27 yuan per share, and it plans to issue 41 million shares. Roughly calculated, the amount of funds raised will reach 1.9 billion yuan, corresponding to an issue valuation of about 19 billion yuan.

According to the prospectus, the raised funds will be mainly used for the following two aspects: the construction of a smart imaging device production base and the construction project of Insta360's Shenzhen R & D center.

As the 7th listed company on the Science and Technology Innovation Board this year, how is Insta360's fundamental performance? What kind of performance will it have after going public?

Diverse Channels, Global Sales

Founded in 2015, Insta360 is a globally renowned leader in smart imaging devices based on panoramic technology. Currently, the company has formed three major product portfolios around its core brand "Insta360", namely consumer - grade smart imaging devices, professional - grade smart imaging devices, as well as accessories and other products. These comprehensively cover consumer and commercial scenarios and offer a wide range of creative accessories to expand usage scenarios.

Specifically, the company's consumer - grade products mainly focus on panoramic cameras represented by the ONE R series and ONE (X) series, and action cameras represented by the Ace series. Professional - grade products are VR panoramic cameras represented by the Pro series and TITAN series. According to Frost & Sullivan data, in 2023, the "Insta360" brand held a 67.2% global market share in panoramic cameras, ranking first. In the action camera field, the company ranked second globally in 2023.

In terms of the business model, in a nutshell, the company independently designs products, develops algorithms, and purchases key raw materials upstream. Then, in the mid - stream, it manufactures products through OEM (for consumer - grade products) and in - house production (for professional - grade products) methods, and uses its brand effect as an endorsement. Finally, in the downstream, it reaches global consumers through a combination of online and offline channels.

Throughout the process, the company is mainly responsible for the design, brand, and sales links, which are more technologically intensive and value - added. This ensures the stability of product performance and quality to a certain extent, as well as the speed of product updates and iterations. The outsourcing processing model is more conducive to maximizing efficiency, enabling the company to ensure product and brand strength while guaranteeing iteration efficiency and profit margins.

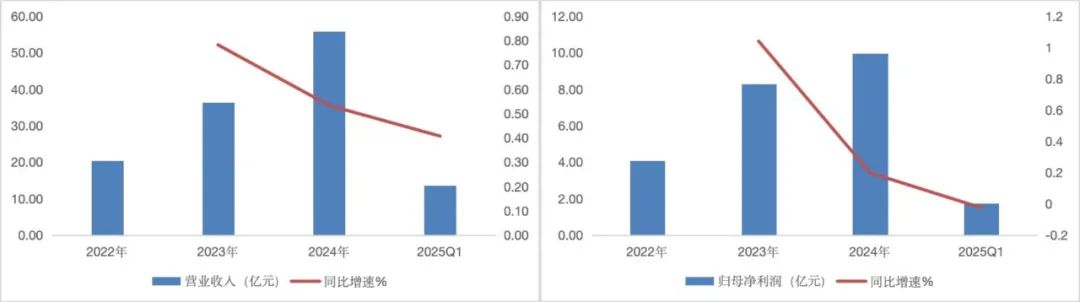

In terms of performance, from 2022 to Q1 2025, Insta360's operating revenues were 2.041 billion yuan, 3.636 billion yuan, 5.574 billion yuan, and 1.355 billion yuan respectively, with year - on - year growth rates of 78.16%, 53.29%, and 40.7%. The compound annual growth rate (CAGR) from 2022 to 2024 was 57.67%, showing a high - speed growth overall. In terms of profit, from 2022 to Q1 2025, the company's net profit attributable to shareholders was 407 million yuan, 830 million yuan, 995 million yuan, and 176 million yuan respectively, with year - on - year growth rates of 103.66%, 19.91%, and - 2.76%. The CAGR from 2022 to 2024 was 56%, indicating good profitability in the past few years.

Chart: Insta360's performance in the past three years. Data source: wind, compiled by 36Kr.

Looking at products separately, consumer - grade smart imaging devices are currently the company's main source of income. Since 2021, they have maintained a proportion of over 80%, and in the past two years, the proportion has slightly increased to around 87%. In contrast, the income from professional - grade smart imaging devices has shown a downward trend year by year, with the income proportion dropping below 0.5% in 2024. Specifically, from 2022 to 2024, the income from consumer - grade smart imaging devices was 1.704 billion yuan, 3.132 billion yuan, and 4.789 billion yuan respectively, accounting for 84.81%, 87.18%, and 86.59% of the total income. The income from professional - grade imaging devices was 48 million yuan, 34 million yuan, and 24 million yuan respectively, accounting for 2.38%, 0.95%, and 0.43% of the total income.

Chart: Insta360's performance by product. Data source: the company's prospectus, compiled by 36Kr.

Looking at channels separately, the company's product sales mainly adopt a model that combines online and offline, direct sales and distribution. Offline channels include direct - operated stores, distributors, and large - scale supermarkets or professional sales channels such as Best Buy, Suning, Sam's Club, Costco, and Yodobashi Camera. Currently, the offline sales network covers more than 10,000 retail stores and more than 90 domestic and overseas airports around the world. Online channels mainly include the official mall, Amazon, Tmall, JD, and other mainstream domestic and overseas e - commerce platforms. From 2022 to 2024, the company's online/offline sales amounts were 1 billion/1.01 billion, 1.685 billion/1.907 billion, and 2.652 billion/2.878 billion respectively, accounting for 49.75%/50.25%, 46.91%/53.09%, and 47.95%/52.05% of the total sales. The overall distribution is relatively balanced.

Chart: Insta360's performance by channel. Data source: the company's prospectus, compiled by 36Kr.

Looking at different countries, as of 2024, 76% of the company's income comes from overseas markets, but the concentration in a single market is not high. Among them, the United States, Europe, Japan, and South Korea are the main export markets, accounting for 23%, 23%, and 8% of the income in 2024 respectively. The domestic market accounted for 24% during the same period. This indicates that fluctuations in the trade environment will have a certain impact on Insta360's performance, but the relatively diversified overseas layout will not cause a severe setback to the company's business.

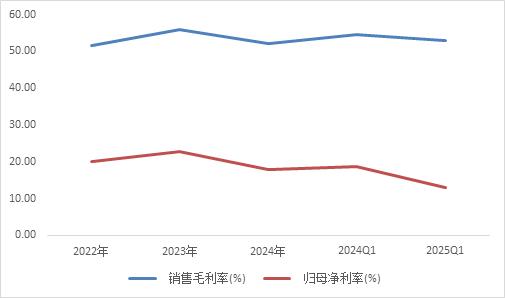

Profitability Comes from Precise Positioning

From 2022 to Q1 2025, Insta360's gross profit margins were 51.49%, 55.95%, 52.20%, and 52.93% respectively, and the net profit margins were 19.96%, 22.81%, 17.85%, and 13.01% respectively. Without discussing the changing trends of Insta360's gross profit margin and net profit margin for now, in terms of absolute values, its gross profit margin and net profit margin are undoubtedly at a relatively high level.

Chart: Comparison of Insta360's profitability in the past three years. Data source: wind, compiled by 36Kr.

In comparison, in 2024, the average gross profit margin and net profit margin of the Shenwan brand consumer electronics index were 26.18% and 7.33% respectively. The gross profit margin and net profit margin of Anker Innovations, the leading A - share brand consumer electronics company, were 43.67% and 8.95% respectively. Among Insta360's competitors, the gross profit margin and net profit margin of GoPro, a US - listed company, were 33.85% and - 53.94% respectively.

So, how did Insta360 achieve such a high profit margin?

As mentioned above, Insta360 mainly relies on procurement rather than self - production for its core raw materials, and the production of its main products depends on OEM. In 2024, the composition of Insta360's operating costs was 85.56% for direct materials, 11.17% for outsourced processing, and 1.79% for manufacturing expenses. Therefore, hardware costs are not the main source of Insta360's high profit margin.

In the prospectus, Insta360 gave an explanation: the company's high gross profit margin mainly comes from product pricing power and sales channels.

First, let's look at the pricing power. In 2024, the average unit price of the ONE X series, the company's main product accounting for over 50% of the revenue, was 2,641.55 yuan, and it has increased for three consecutive years. This high pricing power mainly comes from the company's ability to precisely meet user needs and the high recognition of the Insta360 brand by customers.

Liu Jingkang, the founder of Insta360, shared the company's product methodology in an interview with GeekPark, that is, not to define scenarios or verify needs by oneself, but directly look at which scenarios and needs already exist. At the same time, identify the pain points and problems of these customers. Chen Yongqiang, the co - founder of Insta360, also pointed out in an interview that "in fact, the camera itself is not a complete solution that consumers need. There are still problems such as not knowing how to edit and color - correct after shooting, and not knowing how to express with the lens. The gap between a camera and a professional photographer is the direction of our technological reserve."

To achieve demand - driven product upgrades, the company needs high - intensity R & D in software algorithms, hardware adaptation, product iteration, etc. as support.

From the perspective of R & D expense ratio, from 2022 to 2024, Insta360's R & D expense ratios were 12.54%, 12.31%, and 13.93% respectively, and in the first quarter of 2025, it further increased to 17.09%. According to the prospectus, Insta360's core technologies mainly include panoramic image acquisition and stitching technology, anti - shake technology, AI image processing technology (AI editing, color correction), computational photography technology (purple fringing removal, single - frame HDR), software development technology framework, modular waterproof camera design technology, audio processing technology and framework, etc. Among them, software algorithms such as AI image processing, computational photography, anti - shake algorithms, and stitching algorithms are the keys to realizing the unique functions and experiences of its products.

In terms of product iteration, the launch cycle of Insta360's new products is 0.5 - 1 year, and the overall product life cycle is about 1 - 1.5 years. For example, the ONE X series, the company's main product, has been iterated to the fifth generation since its launch in 2018.

Next, let's look at sales channels. In 2024, 54% of Insta360's revenue came from developed countries with low price sensitivity such as Europe, the United States, Japan, and South Korea, and the domestic sales accounted for 24%. At the same time, Insta360 has a relatively high proportion of revenue from direct online sales channels. In particular, overseas customers tend to purchase directly through the company's official website, and the gross profit margin of direct sales through the official website (excluding contract performance costs and after - sales service fees) exceeds 65%, while the gross profit margin of offline distribution is just over 50%. In comparison, GoPro, a competitor, relies too much on distribution channels, resulting in a much lower gross profit margin than Insta360.

Chart: Insta360's gross profit margin by channel (excluding contract performance costs and after - sales service fees). Data source: the company's prospectus, compiled by 36Kr.

However, it is worth noting that since 2024, the company's profit growth rate has declined, and there was even negative growth in Q1 2025, which has raised market concerns. Behind the decline in profit growth rate, on the one hand, the company has accelerated the expansion of the domestic market, and the competition has intensified, resulting in a decline in the average price of consumer - grade products. At the same time, the increase in the sales of low - margin products such as the Ace series in the past two years has led to a change in the company's product structure, which has had a certain impact on the overall gross profit margin, causing the gross profit margin to drop from 55.95% to 52.9% in Q1 2025. According to the prospectus, the proportion of the Chinese market increased from 19% to 23% in 2024. During the same period, the sales volume of the company's consumer - grade products increased from 1.386 million units to 2.2296 million units, a year - on - year increase of 60.86%, but the average unit price dropped from 2,259.32 yuan to 2,147.74 yuan, a year - on - year decrease of 4.94%. In 2024, the income proportion of the Ace series products increased from 2.7% to 10.4%, while the proportion of the ONE X series products decreased from 55.9% to 52.7%.