A Shenzhen couple withdraws from an IPO, with an annual income exceeding 1 billion yuan | Specialized and Sophisticated Express

Author | Zhang Yujie

Editor | Peng Xiaoqiu

Yingke has learned that recently, Shenzhen Haobo Window Control Technology Co., Ltd. (hereinafter referred to as "Haobo Window Control") withdrew its IPO application for the main board of the Shenzhen Stock Exchange. This IPO took two years and went through two rounds of inquiries. The original plan was to raise 570 million yuan for the construction of an intelligent system industrial park.

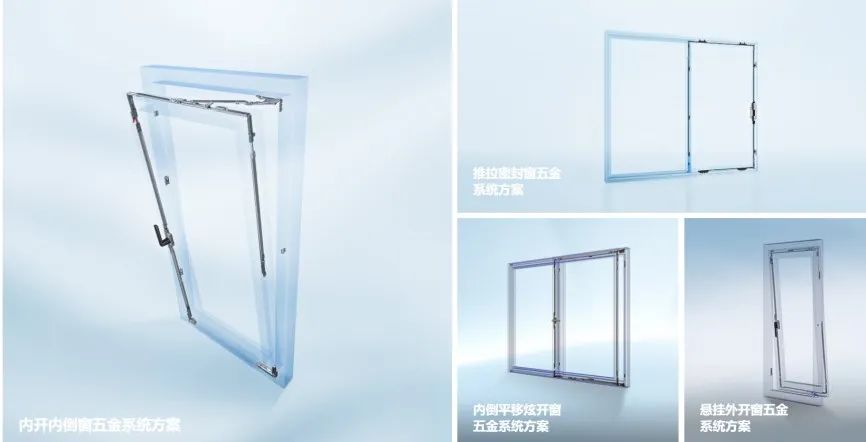

Haobo Window Control was established in 2004 and mainly provides window and door hardware solutions for residents in different regions. Window and door control devices belong to window and door accessories, which control the "opening, closing, and stopping" of windows and doors and are mainly composed of hardware components such as hinges, butt hinges, and corner drives. Compared with cabinet, bathroom, and kitchen hardware, window and door hardware has higher requirements for material durability, strength, and design structure.

(Image source/ Official website)

The upstream of the window and door hardware industry mainly consists of metal product manufacturers such as zinc alloy, aluminum alloy, and stainless steel. The mid - stream enterprises are responsible for product R & D, design, and manufacturing. The downstream customers are mainly window and door factories, decoration companies, real estate companies, building materials traders, etc. The products are mainly used for new and existing residential buildings.

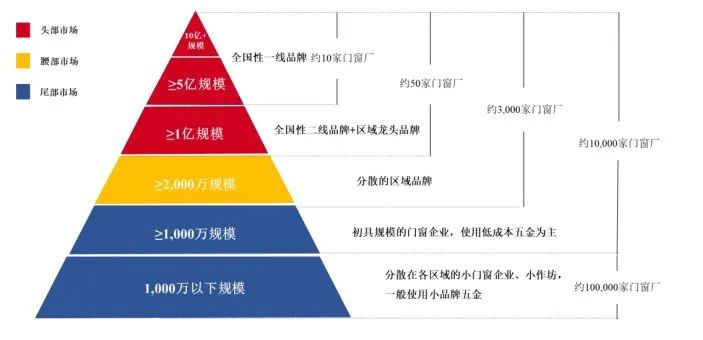

(Image source/ Prospectus)

Currently, in the window and door hardware industry, foreign window and door products have a first - mover advantage and occupy a part of the mid - to high - end market share, such as CMECH (USA), hoppe (Germany), GIESSE (Italy), SIEGENIA (Germany). Domestic local enterprises are gradually establishing brand advantages through technological innovation, such as Jianlang, Hehe, Xingsanxing, and Haobo. The low - end market includes a large number of enterprises with small production scales and weak brand awareness.

(Image source/ Prospectus)

In terms of performance, from 2021 to 2023, Haobo Window Control achieved operating revenues of 668 million yuan, 800 million yuan, and 1.042 billion yuan respectively, with an average annual compound growth rate of 24.9%. The net profit after deducting non - recurring gains and losses was 60.14 million yuan, 85.81 million yuan, and 188 million yuan respectively. The company's performance increased against the trend under the overall downward trend of the real estate industry. The gross profit margin of the main business was around 35%.

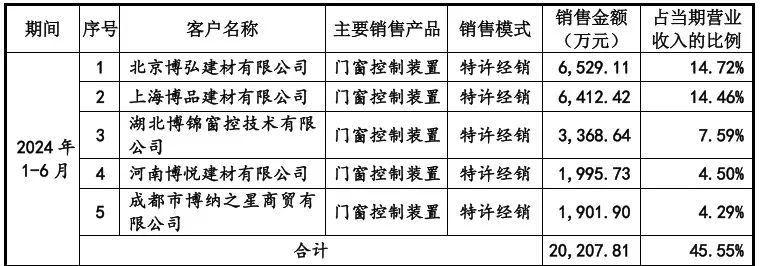

(Image source/ Prospectus)

The company's main products include three parts: window and door control devices, intelligent window and door control products, and STORO system window and door solutions. Among them, the sales revenue of window and door control devices accounts for 90% of the main business revenue in each period. Intelligent window and door control products are the future development direction. The revenue from STORO system window and door solutions accounts for a relatively small proportion.

(Image source/ Prospectus)

Based on factors such as different regional climates, geographical environments, and consumer habits in China, Haobo Window Control has developed a variety of product series, such as inward - opening and tilting windows, integrated window screens, externally - hung opening windows, and swing doors. It owns brands such as wehag, HOPO, iHandle, HESE, and essential.

Product solutions for high - temperature and high - humidity areas (Image source/ Official website)

From 2021 to 2023, the proportion of the company's overseas revenue was 3.11%, 3.36%, and 2.06% respectively. In the first half of 2024, the sales revenue from the top five customers accounted for 45.55% of the operating revenue, and all of them were domestic franchised dealers. This concentrated channel structure may make the company's operation affected by a few dealers.

(Image source/ Prospectus)

As of December 2024, the company had 931 employees, including 263 with a bachelor's degree or above and 668 with an associate degree or below. There were 139 R & D personnel, accounting for 14.93% of the total employees. From 2021 to the first half of 2024, the proportion of the company's R & D investment in operating revenue was 4.97%, 4.68%, 4.45%, and 4.92% respectively.

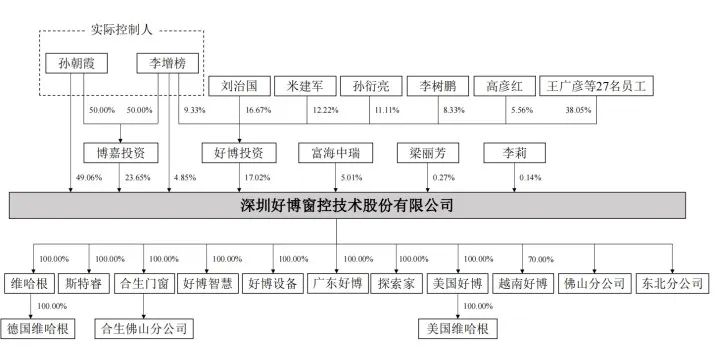

Sun Zhaoxia and Li Zengbang, a couple, are the actual controllers of the company. Li Zengbang is the chairman of the company and directly holds 4.85% of the shares. Sun Zhaoxia is the director and deputy general manager of the company and directly holds 49.06% of the shares. The two together control 94.58% of the voting rights of the company's shares.

Equity structure (Image source/ Prospectus)

Li Zengbang was born in November 1971 and has a master's degree. From 1996 to 1998, he served as the executive general manager of Jinan Huadu Trading Company. From 1998 to 1999, he was the marketing manager of Jinan Jinlong Real Estate Development Co., Ltd. From 1999 to 2007, he served as the regional manager of the southern region and the national key account manager of Jinan G-U Building Hardware Co., Ltd. From 2010 to 2015, he was the executive director and general manager of Shenzhen Ruicheng Hardware Co., Ltd. From 2017 to 2020, he served as the executive director of Haobo Co., Ltd. Since 2020, he has been the chairman of Haobo Co., Ltd.

Sun Zhaoxia was born in January 1974 and has a bachelor's degree. From 1997 to 2000, she was a designer at Jinan Yuanshou Knitting Co., Ltd. From 2000 to 2001, she was a designer at Shenzhen Nanmeng Garment Co., Ltd. Since 2003, she has been the executive director and general manager of Haobo Industry.

Haobo Window Control's listing process encountered in - depth inquiries: The first - round inquiry involved as many as 19 items, including performance stability, business model, and distribution revenue. In the second - round inquiry, issues such as performance stability, business model, and distribution revenue were raised again. Yingke will continue to follow up on the subsequent progress of Haobo Window Control.