Guangdong is set to witness an IPO with nearly 2 billion yuan in annual revenue | Specialized and Sophisticated Express

Author | Wu Ruoyu

Editor | Peng Xiaoqiu

Yingke has learned that the IPO of Guangzhou Ruili Kemi Automotive Electronics Co., Ltd. (hereinafter referred to as "Ruili Kemi") has recently passed the review smoothly.

Ruili Kemi focuses on the R & D, production, and sales of active safety systems for motor vehicles and precision aluminum alloy die - castings. It is a national "little giant" enterprise specializing in niche markets with cutting - edge technologies.

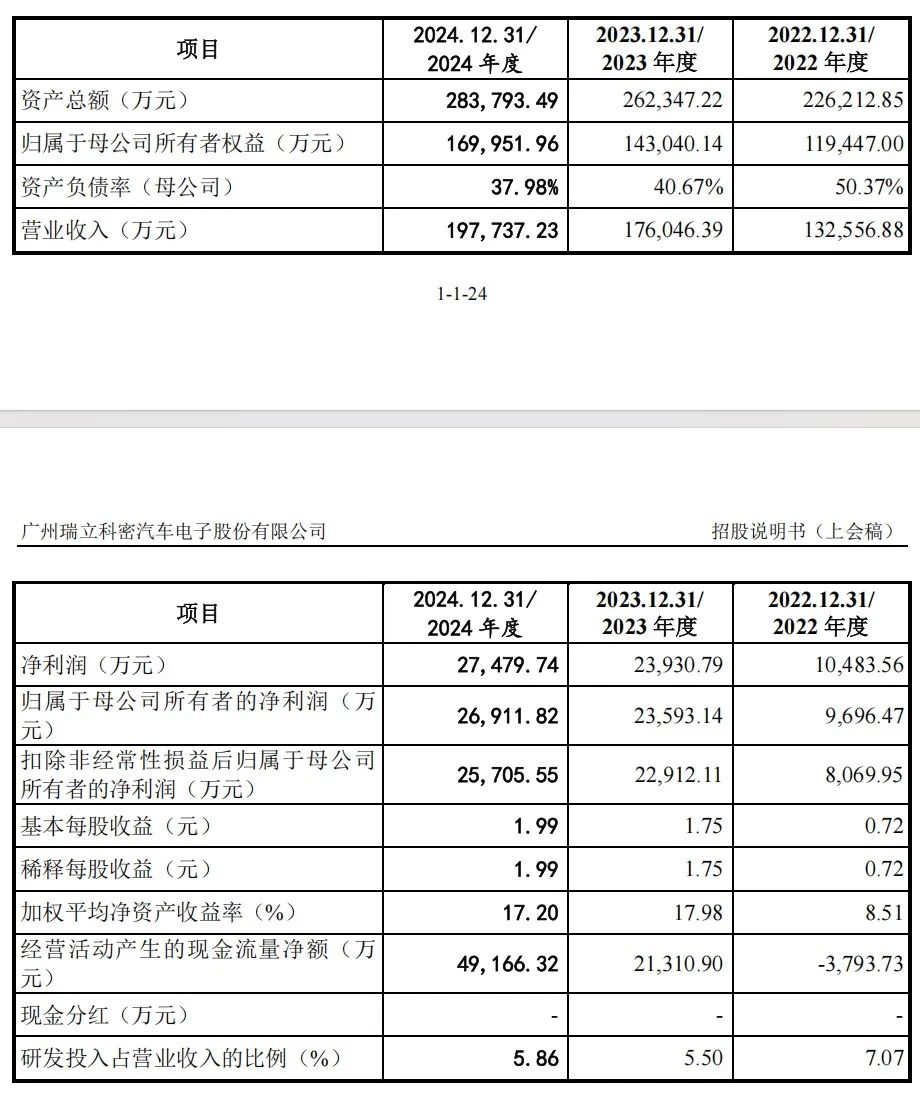

In terms of performance, from 2022 to 2024, its revenues were 1.326 billion yuan, 1.76 billion yuan, and 1.977 billion yuan respectively; the net profits attributable to the parent company after deducting non - recurring gains and losses were 81 million yuan, 223 million yuan, and 257 million yuan respectively; the comprehensive gross profit margins were 22.03%, 29.70%, and 29.73% respectively, with a significant increase in the gross profit margin in 2023.

Performance (Source: Prospectus)

Currently, Ruili Kemi's main business is the active safety systems for motor vehicles and precision aluminum alloy die - castings, with the active safety systems for motor vehicles being the primary focus. From 2022 to 2024, the proportion of this business in the main operating income was 74.24%, 82.37%, and 82.49% respectively. The other business, precision aluminum alloy die - castings, has also entered the supply systems of multinational automotive parts suppliers and automobile manufacturers such as San Dian, Bosch, Mercedes - Benz, and Ford.

The active safety system business for motor vehicles belongs to the category of automotive electronics. Ruili Kemi's products cover mainstream technical routes such as ABS, ESC, EBS, EPB, and ECAS, and are applied in the braking safety fields of commercial vehicles, passenger cars, and motorcycles. They have entered the supply chains of domestic mainstream vehicle manufacturers such as FAW Jiefang, CNHTC, Dongfeng Group, and Beiqi Foton, and are exported to the European and American markets. According to the statistics of the China Association of Automobile Manufacturers, from 2021 to 2023, the company's market share of pneumatic electronically controlled braking system products ranked first.

The proportion of the company's overseas sales has been continuously increasing, reaching 5.06%, 11.68%, and 16.07% from 2022 to 2024 respectively. With the intensification of international trade frictions and disputes, it may affect the company's performance in the future.

Currently, Ruili Kemi's top five customers are Beiqi Group, Xiangdu International Trade, FAW Group, Linghao Industry, and Geely Holding. There have been changes among the top five customers, with Linghao Industry and Xiangdu International Trade being newly added. Ruili Group and its affiliated enterprises were among the company's top five customers from 2022 to 2023, with revenue ratios of 21.10% and 4.51% respectively. From 2022 to 2024, the proportion of sales to the top five customers was 44.24%, 30.74%, and 29.53% respectively, indicating a decrease in customer concentration.

Ruili Kemi's competitors include Wanan Technology (SZ 002590), Yuanfeng Electronic Control, Bethel (SH 603596), Rongtai Co., Ltd. (SH 605133), and Xinan Technology (301170.SZ). Comparing the operating revenues and net profits of the above - mentioned enterprises, Ruili Kemi's performance is at the middle level in the industry.

(Source: Prospectus)

The company's R & D investment is higher than the industry average. From 2022 to 2024, the proportion of R & D investment was 7.07%, 5.50%, and 5.86% respectively. As of the end of 2024, the number of R & D personnel reached 384, accounting for 15.37% of the total number of employees, among which those with a bachelor's degree or above accounted for 54.17%.

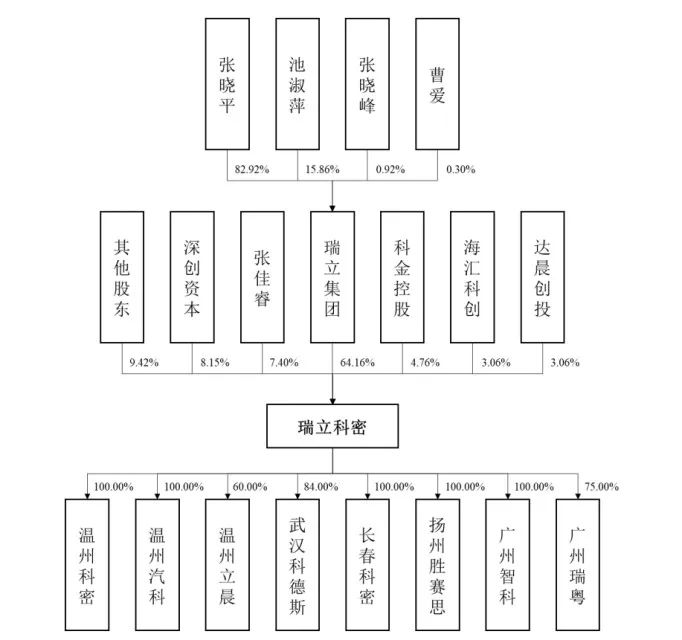

Equity Structure (Source: Prospectus)

In terms of equity structure, Zhang Xiaoping, Chi Shuping and their daughter Zhang Jiarui are the actual controllers of Ruili Kemi. Zhang Xiaoping and Chi Shuping indirectly hold 64.16% of the company's shares; Zhang Jiarui directly holds 7.40% of the shares. In total, Zhang Xiaoping, Chi Shuping, and Zhang Jiarui control 71.56% of the shares.

Zhang Xiaoping was born in 1962 with an associate degree. In June 1988, he founded Ruian Hongqi Auto Parts Factory and served as the factory director. Later, he served as the factory director of Ruian Heavy - Duty Auto Parts Factory, the chairman and general manager of Ruian Heavy - Duty Auto Parts Manufacturing Co., Ltd., and the chairman and general manager of Zhejiang Ruili Industrial Group Co., Ltd. Since September 2002, he has been the chairman and general manager of Ruili Group Co., Ltd. Since March 2008, he has been the chairman of the company.

This time, the company plans to raise 1.522 billion yuan. Among them, 880 million yuan is planned to be invested in the "R & D and Manufacturing Headquarters of Ruili Kemi's Intelligent Electronic Control Systems for Automobiles in the Greater Bay Area" project; 308 million yuan is planned for the R & D center construction project; 83 million yuan is planned for the informatization construction project, and 250 million yuan is for working capital. Ruili Kemi has promoted the import substitution of domestic electronically controlled braking components and reduced the dependence on overseas supply chains. Yingke will continue to follow up on whether the company can be successfully listed this time.