Liu Qiangdong has returned to the front line. Where has JD.com's new story progressed?

Text | Ren Cairu

Editor | Qiao Qian

“While we're talking, the order volume of JD's food delivery service has nearly reached 20 million orders. This is another milestone.”

Shortly after the start of the post - earnings conference call on the evening of May 13th, Xu Ran, the CEO of JD, brought up the much - watched food delivery business and voluntarily revealed the latest figures after reaching 5 million and 10 million orders.

In the just - concluded first quarter, JD went through a process from relative silence to a high - profile appearance and became the spotlight. In previous quarterly performance communication meetings, the questions raised by analysts always revolved around topics such as “the sustainability of government subsidies”, “the growth momentum after a high - base period”, “the competition landscape in e - commerce”, and “JD's mid - to - long - term advantages”. In this quarter, the biggest focus has shifted to the present and future prospects of the food delivery business.

Of course, a fundamental condition is that JD delivered an unexpected report card full of “double - digit growth”. In the first quarter, JD achieved a total revenue of 301.1 billion yuan, a year - on - year increase of 15.8%, setting the highest year - on - year growth rate in the past three years. The adjusted net profit was 12.8 billion yuan, a year - on - year increase of 43.8%. Meanwhile, JD raised its revenue and profit growth expectations for 2025 to double - digit levels.

Currently, JD is “fighting on two fronts”. Its core retail business continues to grow thanks to government subsidies, but the market is looking forward to more new growth drivers. The newly - invested food delivery business is in the stage of investing resources to capture the market. In the future, it will be responsible for “cultivating users' instant retail mindset” and “using high - frequency consumption to drive low - frequency consumption”, aiming to encourage users to make more “cross - consumption” on the JD app.

This is why the outside world is extremely concerned about the UE (Unit Economic) situation of JD's food delivery service and its subsequent investment plan. However, the management did not give a clear answer. Xu Ran said, “At this stage, we are more focused on the experiences of users and merchants. We are also keeping an eye on the business scale and the ROI of the invested resources. We can share more in the future.”

It's worth mentioning that in the past period, Liu Qiangdong, the founder of JD, has become more prominent. In March this year, Liu Qiangdong visited the Hong Kong University of Science and Technology to check out an AI project. In April, he delivered food and treated delivery riders to hot pot. On May 10th, he appeared on the streets of Japan wearing a T - shirt printed with the QR code of JD's food delivery service.

A JD insider said that Liu Qiangdong now participates in the daily meetings of the retail and logistics sectors several times a week and solves most of the directional problems at these meetings. “Topics related to user experience, such as products, prices, and services, are what he focuses on the most.” Since last year, decisions that have pushed JD into the spotlight, such as salary increases and providing social security for food delivery riders, were all personally made by him.

In the past year, large Internet companies have been busy with new stories, whether it's AI or going global. With its core business facing challenges on all fronts, JD indeed needs some new stimuli, changes, and possibilities. Perhaps the return of its soul figure to the front line will bring about a different look.

The daily order volume has reached 20 million, but it's too early to calculate the profits of the food delivery business

In JD's financial reporting terms, JD's food delivery service, along with Jingxi and overseas businesses, is included in the “new business” category.

Since the food delivery business was officially launched on February 11, 2025, and large - scale expansion only started at the end of the first quarter, its impact on this quarter's financials is not significant. In the first quarter, the revenue of JD's new business increased by 18.13% year - on - year to 5.753 billion yuan, but the loss widened from 670 million yuan in the same period last year to 1.327 billion yuan.

The main reason behind these two changes is the same: the expansion of the Jingxi business, which is also the cost JD has paid to expand its user base in lower - tier markets. In the fourth quarter of 2024, the new business experienced a decline in revenue and an expansion of losses, also attributed to Jingxi. CFO Shan Su explained, “This is in line with our expectations. Lower - tier markets remain a key development direction in 2025.”

Where does the food delivery business, which is at the center of the storm but whose performance is not yet reflected in the data, stand?

On the one hand, the expansion of merchants is still ongoing. As of April 22nd, JD's food delivery service was launched in 166 cities. In most cities, service providers are responsible for recruiting individual merchants. The expansion of leading catering chain brands is negotiated by the headquarters. Executives from two chain brands in the Chinese fast - food industry both told 36Kr that the person in charge of JD's food delivery service visited them in person, analyzed JD's advantageous areas, and provided phased suggestions for brand entry. In addition, Lao K, the chairman of Dada Group, also negotiates with some important brands.

However, problems with the product and system that existed two months ago still persist to some extent. The founder of a catering brand told 36Kr that many national chain brands use the Tian Shang Cai Long SaaS system, which could be smoothly connected to Meituan and Ele.me before. However, the connection with JD's food delivery service is still not going smoothly, thus slowing down the entry process.

On the other hand, the participation of users and merchants is indeed increasing. While the order volume continues to break new records, as of press time, JD ranks fifth in the Apple App Store, only behind Ji Meng, Doubao, Hongguo Short Drama, and Yunshanfu.

It's worth noting that after using subsidies to drive rapid growth and “zero commission” to attract merchants, JD's food delivery service's current monetization path is still unclear. Data from multiple investment banks shows that in April, the unit loss of JD's food delivery service hovered around 10 yuan.

Investors are practical. The outside world's focus on the growth of JD's food delivery order volume is shifting to the construction of the UE model. The brokerage BERNSTEIN believes that JD's food delivery strategy will ultimately follow the typical Chinese Internet path: vigorously attract users, then cut subsidies, and improve profitability when the time is right. How to proceed after the intense subsidy war is a problem that JD needs to solve.

Regarding the fierce competition in the recent period, merchants generally feel that Meituan is becoming more proactive in responding to JD. The founder of a chain coffee brand told 36Kr that the account manager of Meituan's food delivery service collects the daily JD transaction data from the brand every day and requests the brand to “withdraw from JD's 10 - billion - yuan subsidy program”. However, JD has not taken similar actions. “They can't manage it all.”

This person believes that JD's food delivery service still needs to improve in areas such as on - the - ground capabilities, system building capabilities, and management granularity. Xu Ran also objectively said, “Even today, there is still a lot of room for improvement in our system and operations. After all, we've just entered this industry, and we're putting more energy into improving the experiences of users and merchants.”

There is a general consensus that using high - frequency users of the food delivery service to drive the growth of instant retail and even the core e - commerce business is the starting point for JD to enter the food delivery market. In this quarter's conference call, “cross - selling” brought about by the food delivery service was also a frequently discussed topic. However, the management also did not give a direct answer about the current situation, only saying that “the food delivery service has improved JD's overall traffic conversion rate. Currently, the cross - category purchasing behavior of food delivery users mainly occurs in the supermarket and lifestyle service categories.”

All in all, the development strategy and UE capabilities of the food delivery business after the subsidy war, as well as the linkage consumption brought about by the food delivery service, are all new challenges for JD. Calculating the profits is also an inevitable task, and more details may be revealed in the second - quarter financial report.

Beyond government subsidies, where is the growth momentum for retail?

Beyond the dazzling new businesses, JD's core retail business performed well this quarter.

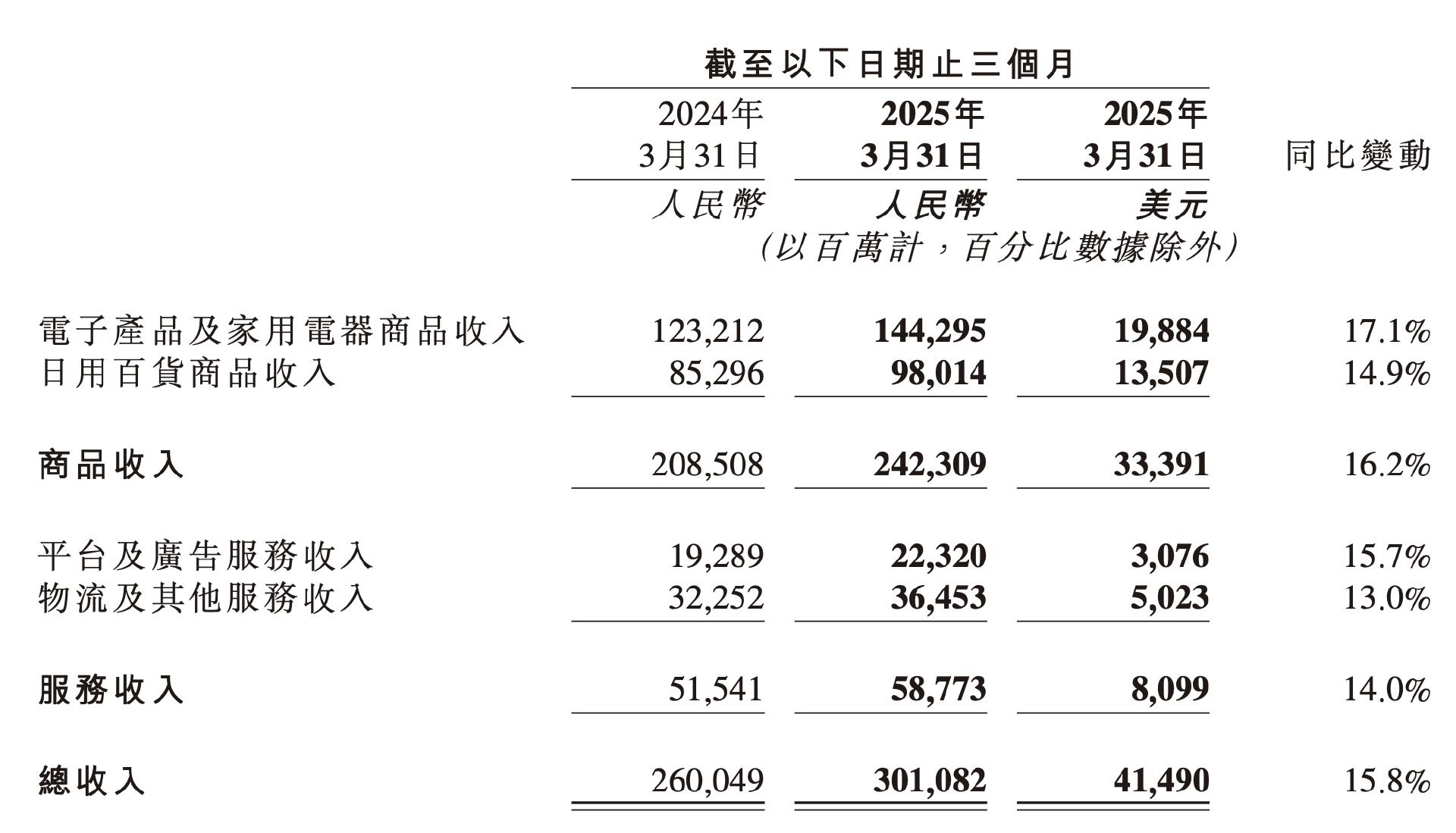

In the first quarter, both JD's merchandise revenue and service revenue achieved double - digit growth. Among them, merchandise revenue increased by 16.2% year - on - year to 242.309 billion yuan, and service revenue increased by 14.0% year - on - year to 58.773 billion yuan. At the same time last year, both JD's merchandise revenue and service revenue had single - digit growth.

In terms of merchandise revenue, JD's most advantageous 3C electronics category increased by 17.1% year - on - year, similar to the increase in the total retail sales of the household appliance category from January to March. Similar to the narratives in previous quarters, the boost from government subsidies is still crucial. For example, thanks to government subsidies, an iPhone 16 priced at 5,999 yuan can enjoy a 500 - yuan discount on JD.

The world beyond government subsidies holds more expectations for JD's retail business. In the conference call after the release of the 2024 annual report, an investor asked, “Apart from household appliances, what strategies does JD have in the supermarket, department store, 3P business (third - party merchants), and price competitiveness to achieve growth higher than the industry average?” At that time, the management emphasized reducing self - operated procurement costs, expanding the 3P business, and specifically mentioned the supermarket and fashion categories.

This answer has been somewhat confirmed now.

The growth of the daily necessities category was a highlight in the first quarter. Among them, the supermarket and fashion categories both recorded double - digit growth, and the quarter - on - quarter growth rate also increased further, making them the main “contributors”. The CFO said in the conference call that the supermarket business has recorded double - digit growth for five consecutive quarters and is also an important scenario for cross - selling in the food delivery business. “JD Supermarket can further release the synergy effect of the food delivery and instant retail businesses.” The fashion category is an area where JD has focused its efforts in the past year. It invested an additional 1 billion yuan in the third quarter of last year and recently launched exclusive support policies for new merchants.

In addition, service revenue, especially platform and advertising service revenue, which can directly reflect the effectiveness of the 3P business, has also given the market some confidence. Since JD started implementing the “low - price strategy”, the importance of the 3P business has been continuously increasing, representing JD's ability to enrich its own ecosystem.

In the first quarter of this year, JD's platform and advertising service revenue increased by 15.7% year - on - year to 22.32 billion yuan. The growth rate of this indicator was only 1.2% in the same period last year. The entry of third - party merchants has brought more monetization benefits to JD. According to the CFO, in the first quarter, both the number of users and the order volume of the 3P business maintained rapid growth, and the growth rate was faster than the overall growth of the retail business. “In the long run, the 3P business will gradually release its growth potential.”

JD's Q1 revenue in 2025

In addition, the growth of JD's retail business in lower - tier cities is faster than that in higher - tier markets. This is in line with the “lower - tier market” strategy among the three must - win battles (traffic field, omni - channel, and lower - tier market) determined by JD Retail in March this year.

Looking at JD's retail business, the lower - tier market, categories other than 3C (especially supermarkets and fashion), and the improvement of the 3P ecosystem are all expected to drive growth. Looking at the entire JD, whether it's the food delivery or retail business, whether it's going deeper into the lower - tier market, expanding overseas, or venturing into AI, new stories are essential.

For JD today, having new things to celebrate and imagine is already a new step forward compared to the past three years. Looking ahead, the annual 618 shopping festival is coming again, and JD will face another opportunity to shine on its home court.