Top 15 Pet Brands in February: Focusing on the Demands of Efficient and Exquisite Pet - Keeping | Brand List of World Research Consumption Index

Image source: Shiyan Big Consumption Index

During this monitoring period, pet food brands Royal Canin, Myfoodie, and Lanshi ranked top three in the comprehensive popularity list with comprehensive popularity scores of 1.89, 1.77, and 1.64 respectively, leaving a gap with the following brands.

The pet feeding standard is advancing towards "eating well", driving brands to layout high - end product lines with functional features

From a segmented perspective, Myfoodie ranked first in sales popularity. From January to February 2025, Myfoodie's total GMV on the three major platforms of Tmall, JD.com, and Douyin reached 324 million yuan, a year - on - year increase of 34.29%. Not only did it launch a new series of milk - based fresh meat staple food products this month, but it also established a high - end sub - brand, NaiFu, emphasizing the breast - milk - level nutrition standard. In addition, Lanshi positions itself as a high - end natural brand, featuring scientific formulas and natural ingredients. It made a grand appearance at the 12th Beijing International Pet Products Exhibition (Beijing Pet Festival), triggering high social media popularity on platforms such as Xiaohongshu. This reflects that under the consumption trend of significantly improving the quality of pet life, leading brands further consolidate their positions in the high - end market by laying out high - end products and sub - brands.

Emerging brands focus on the "health and functional" needs of pets in detail to seize segmented markets. Among them, the brand Careasy launched customized cat food for different breeds, ages, and health conditions; Chengshiyikou and Freshpet attract young pet owners with the selling points of "natural ingredients" and "transparent traceability". Overall, brands upgrade pet consumption from basic feeding to "refined health management" through technological R & D and targeted marketing.

Anthropomorphism and intelligence reshape the pet products ecosystem, and brands focus on the needs of efficient pet - keeping

In the list, brands such as Petkit, Homan, and Freshpet reflect the transformation of pet consumption from "tool attributes" to "emotional companionship" through the layout of intelligent and anthropomorphic products. Petkit positions itself as an "intelligent ecosystem". Its "intelligent visual cat litter box" takes AI as the core, comprehensively upgrading the image capture algorithm to record the characteristics of cats' urine and feces, helping pet owners more accurately understand their pets' urinary and gastrointestinal health, which meets the needs of urban people for efficient pet - keeping. The emerging brand Homan, with its strong performance in the category of pet beauty and cleaning products, especially products such as intelligent drying boxes and air purifiers, meets the washing and care needs of young people and families with a refined pet - keeping style; Freshpet focuses on "human - centered services", such as launching outdoor folding bowls for pets and pet strollers, to meet the usage needs in scenarios such as human - pet outings in the current season.

The core of users' consumption needs has shifted from "meeting functions" to "creating a sense of ritual". Pet owners are willing to pay for high - premium products that improve the well - being of their "furry kids". In the future, brands that integrate emotional design and AIoT technology will dominate the market, and data - driven personalized services (such as toy recommendations based on pet personalities) may become the next competitive focus.

Explanation of the list

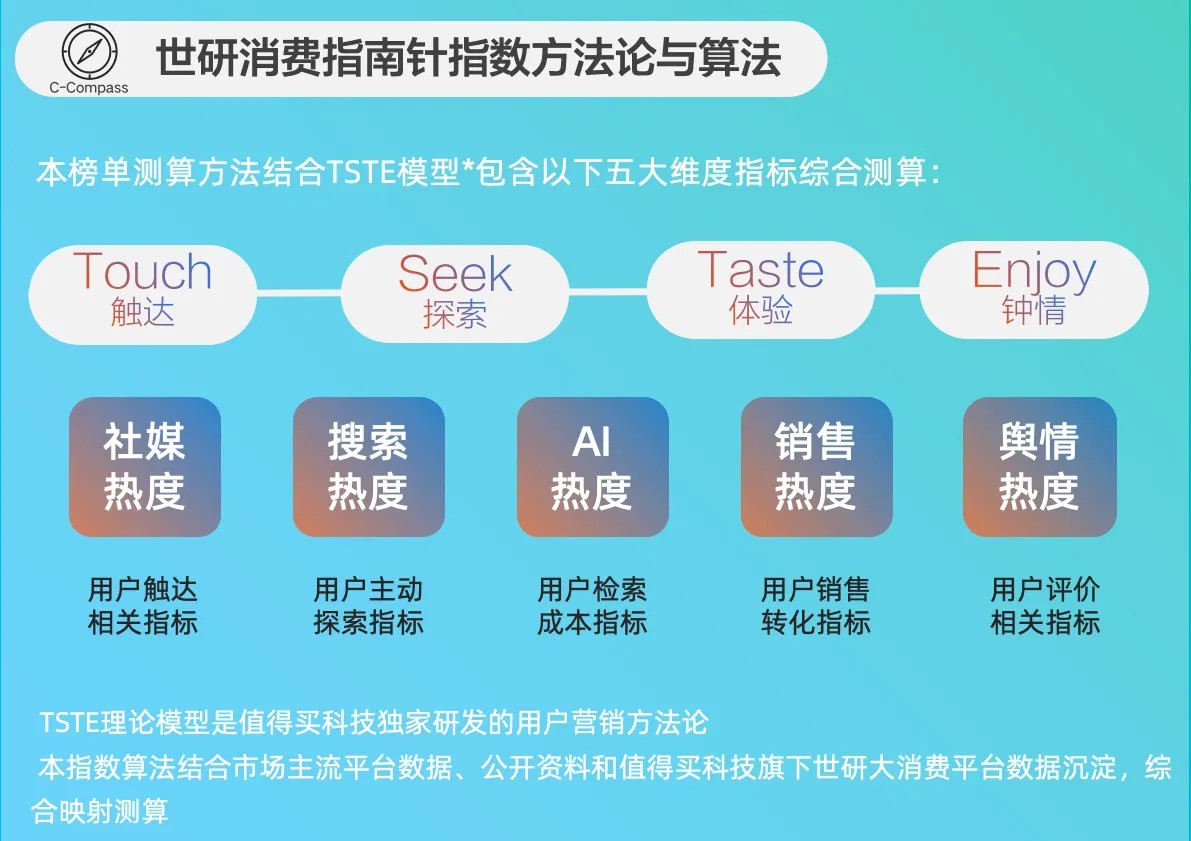

The Shiyan Consumption Compass Series Index Report is a consumption index evaluation system independently developed by Shiyan Index. This series includes major lists such as the "Brand Consumption Popularity Index List", "Industry Consumption Heat Index List", "Product Consumption Wave Index List", "Consumption Popular Event List", as well as extended list reports within the corresponding scope. It aims to objectively and truly present the trend characteristics of the consumption world through index evaluation, help the industry and brand owners continuously track consumption market trends, provide references for enterprise operations, and enhance comprehensive business competitiveness.

The Shiyan Consumption Compass Series Index List continuously monitors the following industries:

3C digital products, footwear, clothing and accessories, food and fresh produce, household appliances, sports and outdoor products, beauty and cleaning products, maternal and infant products, home decoration, automobile consumption, toys, models and musical instruments, pet products, and medical and health products, a total of 12 major industries.

Image source: Shiyan Big Consumption Index

Disclaimer

This list is independently compiled by Shiyan Index. The views, conclusions, and suggestions in the list are for reference only and do not represent any specific investment advice or decision - making basis.

The calculation of the list data combines the public data of mainstream platforms and the data precipitation of the Shiyan Big Consumption Platform under the ownership of Zhidemai Technology. We have taken reasonable measures to ensure the reliability and accuracy of the provided data as much as possible, but we cannot rule out some errors or deviations caused by the limitations of the data itself. In addition, some data in this report have not been formally audited by an independent third - party auditing institution, so there may be unidentified errors or omissions. It is particularly reminded that the market situation may change at any time, so the predictions, analyses, and conclusions in the report may differ from the actual situation.

Any third - party names, brands, or products mentioned in the report are for illustrative purposes only and do not constitute recognition or recommendation of them. Any mention of these third parties should not be regarded as an endorsement or recommendation in any form. The copyright of the report belongs to Zhidemai Technology Group and Shiyan Index, and it shall not be reproduced or distributed without permission. Zhidemai Technology Group and Shiyan Index shall not assume any legal liability for any losses or damages caused by the use of the information in this report.