Another Anhui enterprise fails in IPO, with an annual revenue of 1.1 billion yuan and over 600 million yuan in academic promotion fees in three and a half years | Specialized and Sophisticated Express

Author | Zhao Siqi

Editor | Peng Xiaoqiu

Yingke learned that recently, Anhui Jiren Pharmaceutical Co., Ltd. (hereinafter referred to as "Jiren Pharmaceutical") withdrew its IPO application for the main board of the Shanghai Stock Exchange.

Jiren Pharmaceutical is a high - tech enterprise engaged in the R & D, production, and sales of modern Chinese medicine. It has established three major product lines of Chinese patent medicine, Chinese herbal pieces, and Chinese medicine formula granules, and owns two self - owned brands, "Yaoxin" and "Xinzhi", among which "Yaoxin" is a well - known Chinese trademark.

From the unprecedented boom during the public health incident in 2022 to the recent market recovery and stricter supervision, the listing environment for domestic pharmaceutical companies is rapidly cooling down.

Against this background, the failure of Jiren Pharmaceutical's IPO was expected. The specific reasons are as follows: First, due to the market environment and single - product dependence, the profitability has declined; Second, the sales expenditure is nine times the R & D investment, with academic promotion accounting for the majority; Third, the family holds more than 99% of the shares, posing a high internal control risk.

In terms of performance, from 2021 to the first half of 2024, the company's total revenues were 805 million yuan, 1.025 billion yuan, 1.134 billion yuan, and 593 million yuan respectively; the net profits after deducting non - recurring gains and losses were 97 million yuan, 153 million yuan, 126 million yuan, and 64 million yuan respectively. Among them, in 2023, the revenue increased by 10.63% year - on - year, but the net profit after deducting non - recurring gains and losses decreased by 17.65% year - on - year; in the first half of 2024, the revenue was less than half of that in 2023.

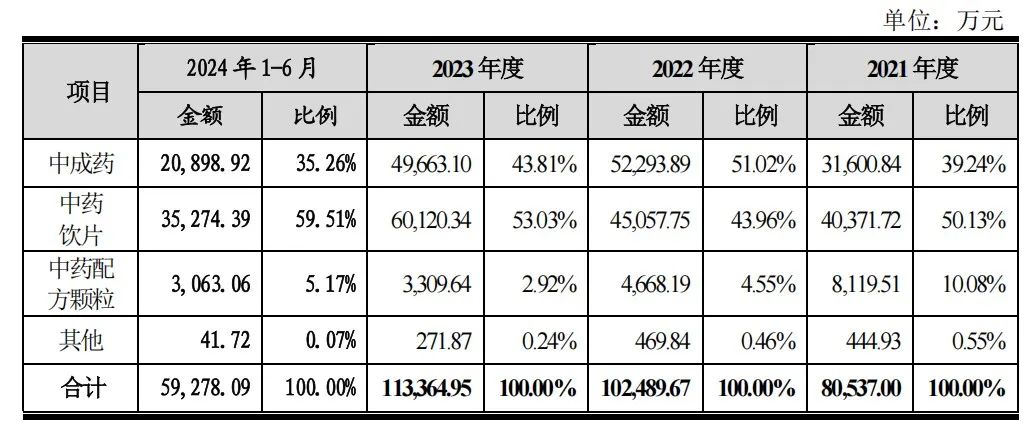

Specifically, the company's core products are Chinese patent medicine, Chinese herbal pieces, and Chinese medicine formula granules. Among Chinese patent medicines, Shufeng Jiedu Capsules dominate the market. From 2021 to the first half of 2024, its revenue accounted for more than 90%. In December 2021, it was included in the diagnosis and treatment plan for COVID - 19 infection with Chinese patent medicines by the National Administration of Traditional Chinese Medicine. As a result, the company's revenue from Chinese patent medicines reached a historical high of 523 million yuan in 2022, accounting for 51.02% of the company's total revenue and exceeding that of Chinese herbal pieces for the first time.

There are more than 700 types of Chinese herbal pieces on sale. From 2021 to the first half of 2024, their revenues were 404 million yuan, 451 million yuan, 601 million yuan, and 353 million yuan respectively, accounting for 50.13%, 43.96%, 53.03%, and 59.51% of the main business revenue respectively. There are more than 500 types of Chinese medicine formula granules on sale, accounting for a relatively low proportion of the company's total revenue, generally not exceeding 10%.

(Source: Prospectus)

The revenue of Chinese herbal pieces, which accounts for the highest proportion in the company's main business, has been steadily increasing, but the profit depends on the single Chinese patent medicine product - Shufeng Jiedu Capsules. The prospectus reveals that the gross profit margin of Chinese herbal piece processing is about 20% - 30%, and that of Chinese patent medicine manufacturing is about 50% - 80%.

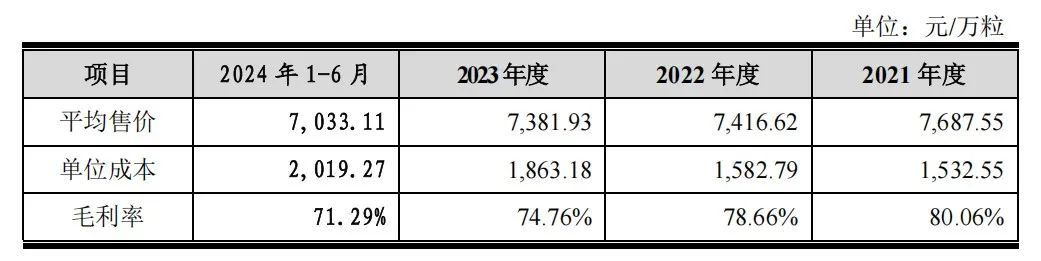

However, from 2021 to the first half of 2024, the gross profit margin of Shufeng Jiedu Capsules declined from 80.06% to 71.29%. This is mainly due to the decrease in the average price and the increase in the unit cost. On the one hand, since 2022, the company has cooperated with channel distributors and chain pharmacies to expand the terminal market and offered price discounts; on the other hand, the raw material prices have risen rapidly due to frequent natural disasters, increased planting costs, and the decline in the company's production scale.

Therefore, the gross profit margin of the company's main business has declined significantly, dropping from 52.70% in 2021 to 43.32% in the first half of 2024.

(Source: Prospectus)

More importantly, during the deepening of the national medical system reform, policies such as centralized procurement, zero - markup on drugs, restrictions on adjuvant drugs, and medical insurance cost control have been frequently introduced. Most drugs, including Chinese patent medicines, face the risk of price decline or restricted use, which limits the company's prospects for improving its profitability.

In terms of market competition, the prospectus reveals that the market scale of China's pharmaceutical manufacturing industry is large, but the industry concentration is relatively low. According to the statistics of the Ministry of Industry and Information Technology, as of November 2023, there were more than 10,000 above - scale pharmaceutical manufacturing enterprises in China.

In the fierce competition, the revenue of the company's core business - Chinese herbal pieces - was 601 million yuan in 2023, which is at the median level of the same - year business scale of A - share listed companies in the same industry (461 million - 908 million yuan). Shufeng Jiedu Capsules, the core profit source, had a market share of about 5% in various medical terminals from 2021 to the first half of 2024, second only to Lianhua Qingwen Granules and Lianhua Qingwen Capsules of Yiling Pharmaceutical. However, in the retail end such as physical pharmacies, the sales scale is relatively small due to prescription drug restrictions.

It is worth noting that Yiling Pharmaceutical, a competitor in the segmented market, achieved revenues of 10.117 billion yuan, 12.533 billion yuan, 10.318 billion yuan, and 4.604 billion yuan from 2021 to the first half of 2024 respectively. In contrast, there is still a large gap compared with the company's operating scale of about 1 billion yuan.

(Source: Prospectus)

In terms of expenditure, from 2021 to the first half of 2024, the company's sales expenses were 218 million yuan, 226 million yuan, 271 million yuan, and 133 million yuan respectively, accounting for 27.01%, 22.04%, 23.93%, and 22.35% of the current revenue. The total sales expenditure in three and a half years was 848 million yuan. However, the R & D investment within the same period was less than 100 million yuan, amounting to 94.3574 million yuan.

The sales of the domestic pharmaceutical industry largely depend on market promotion and the construction of sales channels, resulting in a relatively high overall sales expense ratio. According to the prospectus, from 2021 to the first half of 2024, the average sales expense ratios of comparable companies in the same industry were 33.11%, 32.92%, 30.72%, and 25.98% respectively.

Specifically, the company's sales expenses mainly come from academic promotion activities (including academic conference fees, promotion visit fees, market management fees, etc.). From 2021 to the first half of 2024, the proportion of academic promotion fees in sales expenses exceeded 70%. Taking 2022 as an example, the gross profit margin of Shufeng Jiedu Capsules was 78.66%, and the direct cost rate was 21.34%. The corresponding academic promotion fees accounted for 28.35% of its revenue, more than twice the direct cost of the drug.

Jiren Pharmaceutical was established in April 2001. The controlling shareholder is Zhu Yuexin, and the actual controllers are the couple Zhu Yuexin and Wang Xuewen, and their son Zhu Qiang, who jointly control 99.12% of the company's shares. Among them, Zhu Yuexin personally holds 87.06% of the shares, Wang Xuewen holds 9.67%, and Zhu Qiang, who is the company's director and deputy general manager, controls the remaining shares through a partnership enterprise. The absolute control by the actual controllers of the company poses an internal control risk.

In summary, Jiren Pharmaceutical's withdrawal of the IPO application not only reflects the current severe listing environment for pharmaceutical companies but also embodies the trend of stricter market supervision and more transparent drug pricing. Yingke believes that in the future, the way for pharmaceutical companies to survive is to maintain their core competitiveness in product structure, R & D, and quality control during the industry integration process and improve their risk - resistance ability.