Top 15 Food and Fresh Produce Brands in February: Innovation Trends in the Wave of Big Health | Brand List of the World Research Consumption Index

Image source: Shiyan Big Consumption Index

During this monitoring period, Liangpinpuzi, Mixue Bingcheng, Yili, Nestle, and Mengniu ranked in the top five of the list with comprehensive popularity indices of 1.79, 1.67, 1.61, 1.55, and 1.52 respectively.

Snack brands expand consumption scenarios through ready-to-eat products, and quality, taste, and health remain the core of consumption

From a segmented perspective, Liangpinpuzi ranked first in sales popularity. This may be because it combined spring hotspots, promoted the concept of "natural and healthy new snacks", and launched limited-edition gift boxes for the cherry blossom season. Its core strategy focuses on ready-to-eat scenarios, launching product lines such as independent small-packaged nuts and marinated foods, like the "pocket-sized" series, which emphasizes "ready to eat right out of the bag and easy to carry around", precisely meeting the needs of office workers and Generation Z for convenient snacks. In addition, listed brands such as Want Want and Three Squirrels also launched small-packaged products to meet the needs of the fast-paced lifestyle. These products not only improve the convenience of consumption but also fit the "fragmented dining" habits of young consumers, while extending product scenarios to diverse fields such as work and travel.

According to the list, Mixue Bingcheng ranked first in both sales popularity and social media popularity due to its cost-effective product positioning. Although its product quality control has caused multiple food safety issues, it has triggered "spoiled consumption" among most users with its diverse low-priced tea products. In addition, its cross-border snack peripheral products, such as the spicy strips series, French fries series, and hawthorn series in small independent packages, also expand consumption scenarios through ready-to-eat products, and most users commented that they are "cheap and delicious".

User demand is shifting from general health to "precise health", driving brands to layout for precise nutrition

From the perspective of brand distribution, the refinement of health requirements is particularly significant in the list. Yili and Mengniu have captured the market with functional products: Yili's "Shuhua Lactose-Free Milk" is targeted at lactose-intolerant people, and its "High-Calcium and Low-Fat" products are customized for those with low-fat needs; Mengniu's "A2β-Casein" milk is aimed at people pursuing high-quality nutrition, all of which enhance added value through precise positioning. Shengnong, with its "antibiotic-free chicken" and transparent supply chain, has made many products such as crispy fried chicken and chicken drumsticks the preferred choices for families and people with a fast-paced lifestyle; Jiannong launched low-GI bananas targeting diabetic patients and those controlling blood sugar. User demand is shifting from "general health" to "precise health", and segmented markets such as high-calcium foods for the elderly, high-protein light meals for fitness enthusiasts, and meal replacement solutions for office workers are growing rapidly.

In addition, environmental protection and sustainability have become important directions for brand upgrading. Nestle is accelerating the promotion of plant-based products (such as vegetarian ice cream) in the Chinese market and has promised to fully adopt recyclable packaging by 2025; CP Foods launched a new recyclable egg carton made of 100% recyclable plastic, which caters to the young consumers' concern about low-carbon diets.

Explanation of the list

The Shiyan Consumption Compass Series Index Report is a consumption index evaluation system independently developed by Shiyan Index. This series includes major lists such as the "Brand Consumption Popularity Index List", "Industry Consumption Heat Index List", "Product Consumption Wave Index List", "Consumption Hot Event List", as well as extended list reports within the corresponding scope. It aims to objectively and truly present the trend characteristics of the consumption world through index evaluation, help industries and brand owners continuously track consumption market trends, provide references for enterprise operations, and enhance comprehensive business competitiveness.

The Shiyan Consumption Compass Series Index List continuously monitors the following industries:

3C digital products, footwear, clothing and accessories, food and fresh products, household appliances, sports and outdoor products, beauty and cleaning products, mother and baby products, home decoration, automobile consumption, toys, models and musical instruments, pet products, and medical and health products, a total of 12 major industries.

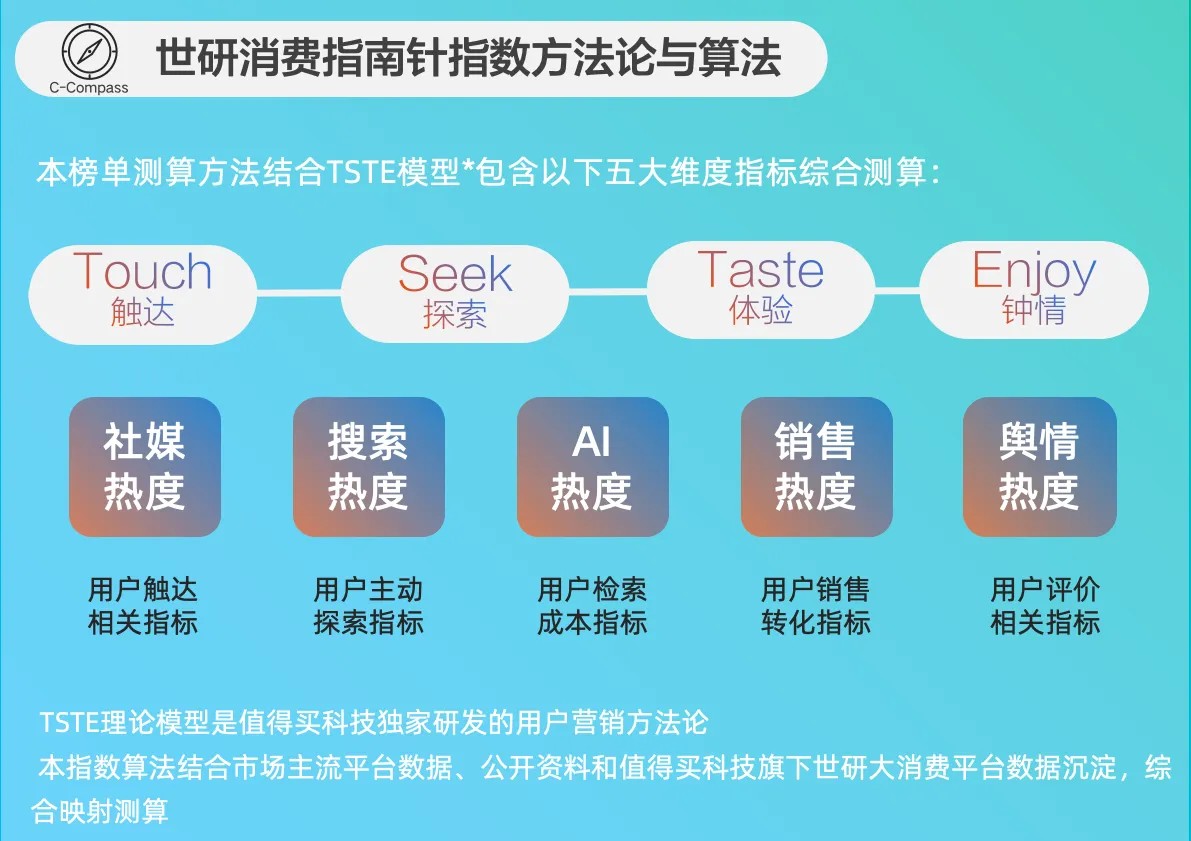

Image source: Shiyan Big Consumption Index

Disclaimer

This list is independently compiled by Shiyan Index. The views, conclusions, and suggestions in the list are for reference only and do not represent any specific investment advice or decision-making basis.

The calculation of the list data combines public data from mainstream platforms and data accumulated on the Shiyan Big Consumption Platform under Zhidemai Technology. We have taken reasonable measures to ensure the reliability and accuracy of the provided data as much as possible, but we cannot rule out some errors or deviations due to the limitations of the data itself. In addition, some data in this report have not been formally audited by an independent third-party auditing institution, so there may be unrecognized errors or omissions. It is particularly reminded that the market situation may change at any time, so the predictions, analyses, and conclusions in the report may differ from the actual situation.

Any third-party names, brands, or products mentioned in the report are for illustrative purposes only and do not constitute an endorsement or recommendation of them. Any mention of these third parties should not be regarded as an endorsement or recommendation in any form. The copyright of the report belongs to Zhidemai Technology Group and Shiyan Index, and it shall not be reproduced or distributed without permission. Zhidemai Technology Group and Shiyan Index shall not be liable for any losses or damages caused by the use of the information in this report.