Dissecting "Baichuan": Wang Xiaochuan's AI healthcare gamble

Text by | Zhou Xinyu

Edited by | Su Jianxun

In mid-March, news spread that Huawei was forming a healthcare business group, focusing on the clinical implementation of medical large models. This news stirred up a hornet's nest within Baichuan Intelligence, one of the "Six AI Tigers".

Huawei's entry into the field means that Baichuan now has a heavyweight competitor at the AI + healthcare table.

Healthcare is the lifeblood of Baichuan's current business. In early March, Intelligent Emergence reported exclusively that Baichuan Intelligence had disbanded its B - side teams responsible for finance, education and other fields, aiming to concentrate resources on healthcare, its core business.

"The aftershocks of DeepSeek are still being felt, and now Huawei has come in with a vengeance," an employee of Baichuan told Intelligent Emergence.

Disbanding the B - side teams and focusing on healthcare was Baichuan's decision in response to DeepSeek's disruptive move. Now, how to avoid direct competition with Huawei, the "B/G Reaper", has become a new topic for urgent discussion within Baichuan.

What exactly is Baichuan Intelligence doing? Where is Baichuan headed under Wang Xiaochuan's leadership? These seemingly simple questions have become increasingly difficult to answer after Baichuan's multiple business adjustments.

Intelligent Emergence interviewed several Baichuan employees in an attempt to present a clear picture of this AI company.

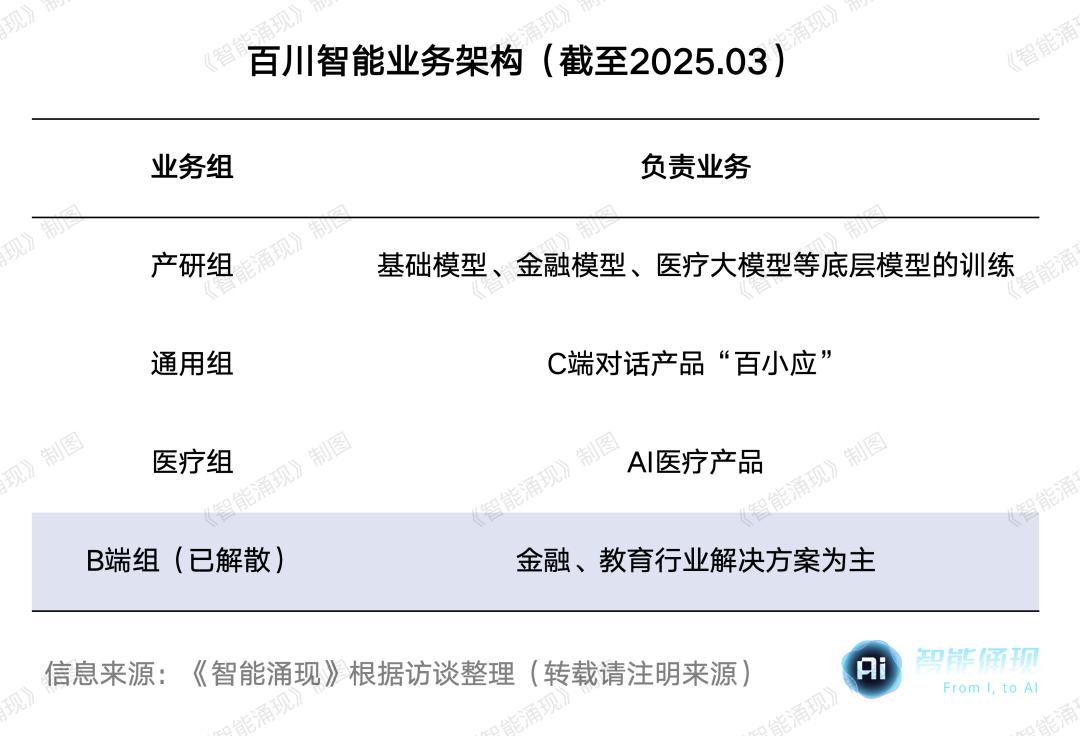

For a long time, Baichuan Intelligence has been supported by four business groups: Product R & D, General, B - side, and Healthcare. Intelligent Emergence learned that since its establishment in April 2023, Baichuan has undergone three strategic changes around these four groups:

From focusing on model R & D and B - side implementation in the finance and education industries, to testing the waters with C - side products and multi - modal models; then transforming to focus on healthcare while parallelizing B - side commercialization; and finally disbanding the B - side teams and focusing on healthcare —— all these adjustments were made to keep Baichuan in the game.

Baichuan Intelligence's business structure.

Currently, Baichuan's greatest confidence in staying at the table of the Six Tigers comes from its cash flow.

At an internal meeting, Ru Liyun, the co - founder of Baichuan Intelligence, divided the cash flow levels of the Six Tigers into five tiers in his speech: those that can survive for 6 months, 12 months, 24 months, 48 months, and over 48 months —— Baichuan falls into the "over 48 months" tier.

A Difficult Year for C - side and Multi - modal Business

Until the first half of 2024, Baichuan Intelligence had a clear development path: focusing on the R & D of underlying models while using ToB projects in the finance and education fields as the pillar of commercialization.

As for C - side projects and AI healthcare products, Baichuan conducted small - scale internal tests. An employee of Baichuan recalled that Wang Xiaochuan also attached great importance to the C - side, but his goal was not just a Q&A product; he wanted to gradually develop a "super app".

However, the rapid changes in the industry required companies to quickly deliver C - side results. In early 2024, the popularity of Kimi from DarkSide gave the market a dream of AI ToC. At that time, Q&A products that supported long - text understanding became a must - have for model companies to tell financing stories.

In the view of the above - mentioned employee, Wang Xiaochuan's goal of creating a "super app" was ambitious, but at the product level, "it was rather vague". During the six months from the project's inception to its release, Baixiaoying went through several rounds of feature updates. "He (Wang Xiaochuan) would raise some questions but not provide answers, and new ideas would keep popping up."

Facts have proved that Baixiaoying is far from the "super app" in Wang Xiaochuan's eyes. At the Baixiaoying product launch in May 2024, Wang Xiaochuan was not very enthusiastic about the product: "Baixiaoying is a transitional product from an AI tool to an AI partner under the condition of limited model capabilities."

Subsequently, this "negatively - received" product failed to make a splash in the market. It is reported that since its launch, Baixiaoying's daily active users have never exceeded 5,000.

However, for Baichuan at that time, compared with the setback in the C - side business, the bottleneck in model R & D was a more pressing issue.

An employee told Intelligent Emergence that after Baichuan 4 received a good market response, Wang Xiaochuan shifted part of the focus of model R & D from text to multi - modality.

Different from generative models such as text - to - image and text - to - video, with Wang Xiaochuan's support, the R & D team added a new goal: to develop an "all - modal model" that could cover text, images, videos, and audio.

"The consensus among Baichuan's technical team is that 'the future is multi - modal', and future AGI will definitely be an all - modal model," the above - mentioned employee said. After Baichuan 4 reached the top, the technical team believed that Baichuan had gained experience in training high - performance language models, and the next step should be to transfer the intelligence of text models to multi - modal models.

However, training an all - modal model is difficult for a startup. Due to the immaturity of the technical route and the large amount of computing power consumption, many employees said that Baichuan's progress in multi - modality has been very slow.

It wasn't until October 2024, after nearly five months, that Baichuan delivered a multi - modal result by open - sourcing the all - modal model Baichuan - Omni. However, the first - generation Omni did not have a good reputation in the technical community. Many developers believe that the basic capabilities of each modality of Omni still have a lot of room for improvement and are not ready for implementation.

If it weren't for the slow progress in model R & D, many people believe that healthcare would not have been pushed to the forefront by Baichuan so soon.

"Baichuan has fallen behind in model development, and it also needs to consider its financing story for the next stage," an investor summarized.

Abandoning the B - side, Healthcare to the Rescue

In August 2024, the once - marginal healthcare group came to the forefront of Baichuan Intelligence's business, becoming a bargaining chip for this former star company to raise "winter funds".

In the business world that values historical experience, what the outside world can see in the healthcare field is the difficulty of implementing AI in healthcare and the failures of previous - generation AI companies.

The Four AI Dragons that emerged in 2016 all wanted a share of the healthcare market, but all ended up in failure.

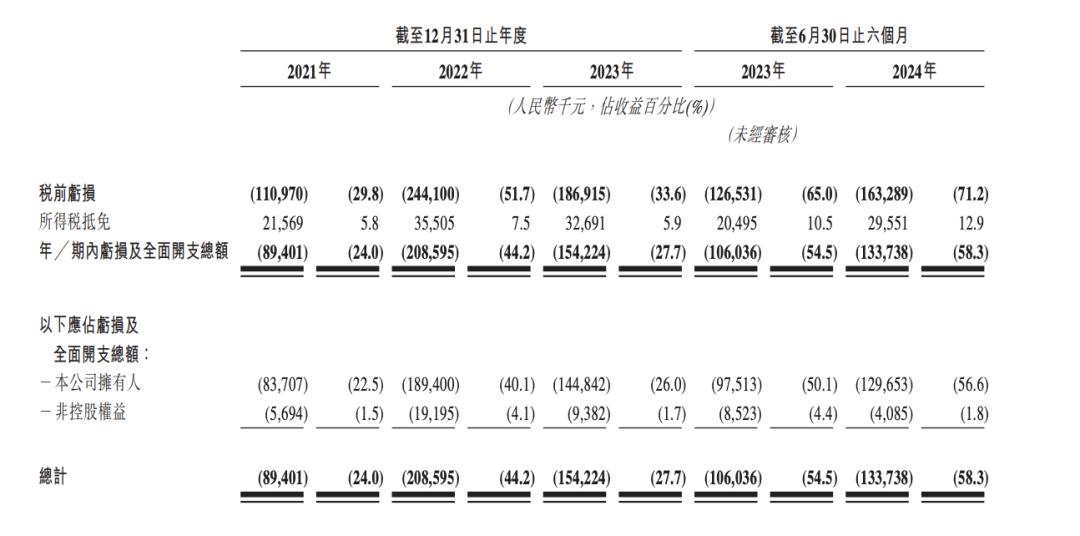

iFlytek, which currently holds the largest market share in the AI + healthcare industry, had a loss of 134 million yuan in its subsidiary "iFlytek Healthcare" in the first half of 2024, and the loss amount was still increasing compared with the same period last year.

△ iFlytek Healthcare has been in the red for three consecutive years. Source: iFlytek Healthcare's prospectus

A former employee of the iFlytek Healthcare team told Intelligent Emergence that the accuracy of AI diagnosis and treatment systems is limited, and hospitals are complex ecosystems. Each department has unique clinical data and medical processes, making it difficult to develop a universal system.

In the eyes of many, Baichuan Intelligence's lack of rich experience in AI healthcare means that choosing healthcare is a risky move, indicating that Baichuan has "lost its rhythm".

However, in the view of several investors who have talked with Wang Xiaochuan, healthcare is a concept that allows Baichuan to differentiate itself from the other Six Tigers, and differentiation is the key to raising funds. Currently, Zhipu has a strong presence in the government and enterprise market, and DarkSide and MiniMax are well - known in the C - side market. Healthcare is a relatively untapped area.

In several interviews, Wang Xiaochuan explained to the outside world that shifting to healthcare is not contradictory to the goal of achieving AGI (General Artificial Intelligence): Healthcare is not a vertical scenario; creating a doctor is equivalent to achieving AGI.

"Currently, the main competitors Baichuan needs to consider in the healthcare field, which also have their own base models, are Zhipu, which has abundant government and enterprise resources, and iFlytek, which currently holds the largest market share in healthcare," an employee of Baichuan's healthcare team told Intelligent Emergence.

He mentioned that Baichuan has seized a "window of opportunity": "Zhipu has not yet entered the healthcare market, and iFlytek's model capabilities are not as good as Baichuan's. Among pure domestic model suppliers in the first - tier in terms of technology, only Baichuan remains."

However, Baichuan also has to face the challenges of entering the healthcare field. An employee gave Intelligent Emergence an example. Baichuan's internal evaluation shows that if only based on existing literature and databases, the current generation of AI medical cases can score 70 - 80 points, but the benchmark for project implementation is 90 points.

The best solution at present is to involve professional doctors in annotation and alignment. At the end of 2024, Baichuan invested in the medical data service provider "Xiao'er Fang" and established a medical product department with more than 30 doctors. At the annual meeting, Wang Xiaochuan specifically introduced two medical experts hired from overseas and Hong Kong at high salaries to lead the professional medical team.

"In the training of medical models, algorithm engineers are secondary. The most important role is played by professional medical staff," the above - mentioned employee said. Whether it is to transform an unstructured medical conversation record into a structured medical case or to conduct feedback reinforcement learning on the medical cases and diagnosis results output by AI, professional doctors are needed.

As of New Year's Day 2025, in several internal meetings, Wang Xiaochuan made very optimistic estimates of the revenue in 2025. An employee remembered that he said at the meeting that the goal in 2025 is to achieve the performance required for listing (1 billion yuan), and once on the green - channel list, the company can go public at any time.

However, soon, the entire AI industry was faced with an uncertain factor due to a change in the landscape. On January 20, 2025, DeepSeek released a high - performance inference model R1 and open - sourced it.

The disruptive move by the dark horse forced AI companies to concentrate their resources on their core businesses. In order to focus on its differentiated advantage in healthcare, the guillotine pulled by R1 first fell on the B - side teams.

Intelligent Emergence reported exclusively that on February 19, Baichuan transferred the PE (Prompt Engineering) team under the B - side group to the R & D group. On March 3, the B - side group was disbanded, and then the PE group was also disbanded.

However, whether Baichuan can maintain its first - mover advantage in the healthcare field is still uncertain within the company.

Several Baichuan employees told Intelligent Emergence that since last year, many hospital departments have had indicators for AI implementation, and customers are willing to sign contracts. "One reason is for personal achievements, another is to publish papers on AI healthcare, and finally, it is for the future sales of medical products."

This means that signing contracts in the healthcare field under the AI wave may very well be a one - time deal. "If there is no real value for medical institutions, contract - signing will not be sustainable," an employee said.

In March 2025, with Huawei's announcement of forming a healthcare business group, Baichuan is also thinking about how to respond.

Intelligent Emergence learned that Baichuan is discussing how to combine healthcare with "Baixiaoying" to develop C - side healthcare products. "Baichuan can build a differentiated advantage in C - side healthcare products, which can bypass Huawei," an employee said.

In order to maintain its technical advantage in the medical model layer, Baichuan has recently increased the recruitment of professional talents in the healthcare field to be responsible for data strategies and feedback reinforcement learning of medical models.

An employee told Intelligent Emergence: "Currently, Baichuan still has the strongest medical model. Now the company should be thinking about how to continue this advantage."

Welcome to communicate!

Welcome to follow!