Insights into Consumption Hotspots | OPPO Find N5: Technological Breakthroughs and Market Games in the Foldable Screen Market

On the evening of February 20th, OPPO kicked off a new chapter in the foldable screen market with a futuristic technology event. The brand officially unveiled its new flagship, the OPPO Find N5, which features an ultra-thin body. When folded, it's as thin as approximately 8.93mm, and when unfolded, it's about 4.21mm thin, weighing only around 229g. Positioning itself as the "world's thinnest" foldable flagship, it's making a strong push into the high-end market.

Source: OPPO's official website

Data Performance

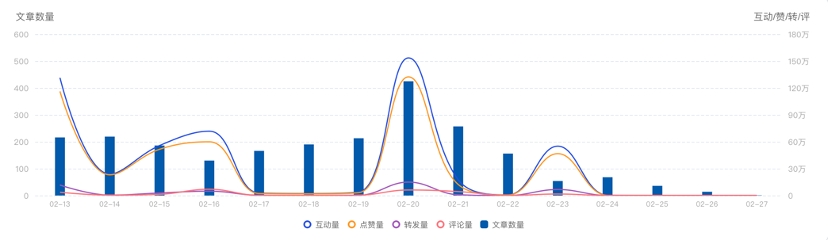

According to the monitoring data from the Shiyan Big Consumption Insight Platform, from the date of OPPO's Celestial Dome Architecture Technology Press Conference (February 13th to February 27th, 2025), the total number of articles related to topics such as "OPPO Find N5 Press Conference" and "OPPO Breaks the Record for the World's Thinnest Foldable Flagship" reached 2,331, with a total interaction count of 5.1928 million.

Total Number of Articles

Image source: Shiyan Big Consumption Index

Total Interaction Count

Image source: Shiyan Big Consumption Index

Communication Trend

Image source: Shiyan Big Consumption Index

OPPO's Technological Breakthroughs Drive the Brand's High-End Breakout: The Key Leap from "Early Adoption" to "Mainstream"

Technological Breakthroughs: Solving Foldable Screen Pain Points and Enhancing User Experience

OPPO has achieved significant technological breakthroughs with the Find N5, directly addressing several pain points of foldable phones, such as heavy and thick bodies (mainstream models are 12 - 14mm thick), obvious folding creases, and poor durability. The Find N5 uses a titanium alloy Celestial Dome hinge and ultra-thin 3D-printed titanium alloy wing plates, with the thinnest part being only about 0.15mm. While the hinge is 26% thinner, its stiffness is increased by 36%, significantly enhancing the product's robustness and portability.

In terms of the screen, the Find N5 is equipped with an ultra-flat mirror diamond screen, emphasizing "invisible folding creases and high brightness and transparency." By collaborating with BOE to customize UTG ultra-tough glass, it further improves the screen performance and user experience. These technological innovations not only meet the actual needs of users but also strengthen the product competitiveness of the Find N5.

Pricing Strategy: Competing for the High-End Market with the Concept of "Technological Equality"

In terms of pricing, the Find N5 is priced lower than the Samsung Z Fold6, which costs 13,999 yuan. With the concept of "technological equality," it aims to attract price-sensitive high-end users. By offering a more competitive price, it hopes to gain a foothold in the high-end market. Additionally, with operator contract subsidies (such as an immediate 2,000-yuan discount when purchasing a phone), the price of foldable phones becomes more affordable, which is expected to expand the user base from tech enthusiasts to a wider range of business users.

Brand Building: The Light and Thin Segment Helps Upgrade the Brand Image

The Find N5 has chosen the "light and thin" segment for differentiated competition. Labeled as the "world's thinnest" foldable flagship, it showcases OPPO's excellent design and craftsmanship capabilities. It also lays a solid foundation for the brand premium of its future high-end product lines and enhances the brand's overall market positioning. At the same time, it promotes the industry to shift from simple "specification stacking" to more innovation focused on niche scenarios. This differentiated strategy helps the brand maintain a leading position in the fierce market competition.

Market Segmentation: Precise Positioning for Different User Groups to Optimize Market Share

The Find N5 has a clear product line differentiation strategy, precisely targeting different user groups. The light and thin models mainly attract female and young users, meeting their needs for portability and fashionable appearance. The all-round flagship models are more focused on business users, offering more comprehensive functions and higher performance to adapt to complex work scenarios. By launching products with specific functions for different user groups, the Find N5 successfully meets diverse needs, improving user satisfaction and brand loyalty.

Image source: Shiyan Big Consumption Index

The Market Landscape of Foldable Phones: Growth Bottlenecks and the Reconstructing Competitive Order

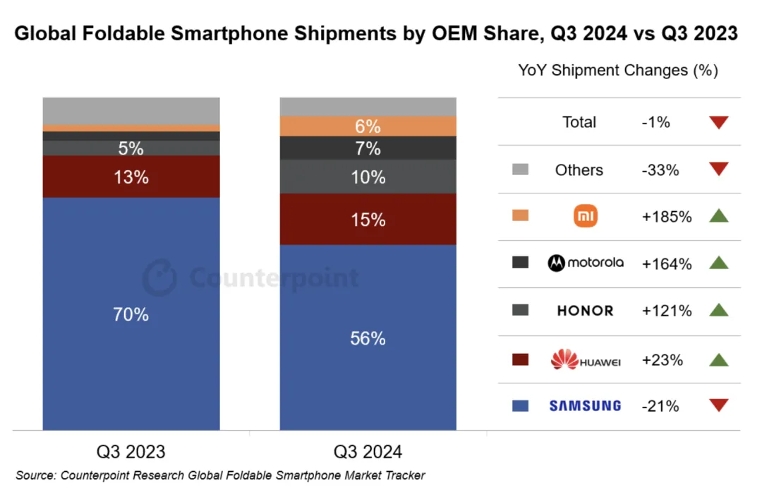

Looking at the market trend, the global foldable phone market reached a critical turning point in 2024. The market growth rate slowed down, transitioning from an explosive growth phase to an adjustment phase. The core characteristics were the stall in volume growth and structural differentiation. According to Counterpoint data, the year-on-year growth rate of global foldable phone shipments dropped to 37% in 2024, compared to 73% and 52% in the previous two years. In the third quarter, the global foldable phone shipments even declined year-on-year, and the global foldable panel shipments plummeted by 38% during the same period, all reflecting the industry's shift from "wild growth" to "stock competition" among brands.

Huawei has built a double moat of "technological barriers + brand potential" with its Mate X5/X6 series. It has achieved a market share of over 50% in the Chinese market and a staggering 85% market share in the 10,000-yuan price segment. With a precise product strategy, it covers both business and female users, filling the high-end market vacuum left by Samsung's retreat and forming a market landscape of "one dominant and many strong."

Meanwhile, Samsung's global market share dropped to 56% in Q3 2024, a significant reduction of 21% compared to the same period in 2023. Chinese manufacturers quickly encroached on the mid - end market. Xiaomi drove an 185% growth in shipments with its Mix Flip small foldable model, validating the effectiveness of the "differentiated segment + price reduction" strategy and demonstrating the rise of Chinese brands.

Year-on-year change in global foldable phone shipments between Q3 2024 and Q3 2023, *Data source: Research firm Counterpoint Research

However, the breakthroughs in key technology areas for foldable phones have reached a bottleneck. The iteration speed of hinge and screen technologies has gradually slowed down, failing to bring significant improvements in user experience and thus unable to stimulate large - scale replacement demand. The diminishing marginal innovation makes it difficult to drive market growth through technological innovation. Although the price range of mainstream foldable phone models still centers between 8,000 and 15,000 yuan, this price segment has formed a relatively obvious market ceiling, making it difficult to further penetrate the high - end consumer circle.

Therefore, the early launch of new large - foldable models in 2025 is actually a survival strategy of "attacking to defend."

OPPO May Reconstruct the Competitive Landscape of the Foldable Screen Market

Compared with other brands' foldable flagships that often cost over 10,000 yuan, the OPPO Find N5 starts at 8,999 yuan. With its breakthroughs in thinning technology and a differentiated approach, it has opened up a gap in the market, capturing consumers' minds with the concept of "ultimate portability" and becoming a dark horse in the high - end market. In the long run, this is actually a battle for a position in the high - end market. By using self - developed hinges, UTG screens and other core technologies, it reconstructs the competitive dimensions, promoting the industry to shift from low - price involution to high - value - added innovation.

This will prompt brands like Xiaomi and vivo to accelerate the R & D process of lightweight products to maintain their competitiveness. At the same time, it will further increase the overall R & D costs in the industry and may also compress the survival space of small and medium - sized brands, forcing them to find new differentiated paths in the fierce market competition.

Therefore, this is not only a competition at the product level but also a preview of the reconstruction of industry rules: only by deeply integrating technological breakthroughs, ecological collaboration, and user insights can a brand survive market cycles and define the value standards of the next - generation intelligent terminals.