Broadcom cannot replace NVIDIA | Pay-to-win · Hard Technology

Author|Song Wanxin

Editor|Zheng Huaizhou

At the end of 2024, the large-scale model was declared by Ilya, the former OpenAI co-founder, that "all the Internet data" had been exhausted. Even though mature downstream applications have not yet emerged, Ilya stated that the "pre-training", which represents the most fundamental technology of the large-scale model, is coming to an end.

This is almost like a bomb that has split the dividing line of the large-scale model process.

Coincidentally, just one day before Ilya's speech, chip giant Broadcom released its financial report, and CEO Hock Tan predicted a revenue scale of $60 billion to $90 billion for its XPU chip in fiscal year 2027.

XPU is an ASIC chip jointly developed by Broadcom with tech giants such as Google, Amazon, and Meta, that is, a custom chip, which is in contrast to Nvidia's general-purpose chip GPU.

For the market, ASIC and GPU play completely different roles in the upstream of the large-scale model, with one being stronger in reasoning and the other in training. Therefore, the predictions of Ilya and Hock Tan coincidentally convey the same message: The demand for AI chips will change significantly, and GPU may no longer be so popular.

As soon as the news came out, Broadcom's stock price soared 24% on the 13th, and its market value exceeded one trillion US dollars. At the same time, Nvidia's stock price has fallen for four consecutive trading days on the other side.

In fact, before the significant increase, Broadcom was already a large company with a market value of $800 billion. The significant increase on this scale shows that the capital market expectations have completely changed, turning to "the end of pre-training", believing that GPU will be replaced by ASIC, and Nvidia's market share will be eroded by Broadcom.

But in reality, the new round of competition in AI chips may not be as intense as imagined.

On the one hand, the competition between GPU and ASIC did not just emerge now. Seven years ago, Google released the first-generation custom TPU for machine learning tasks. On the other hand, the deceleration of pre-training does not mean the end of the general model.

01 The Rise of Broadcom

Judging from Broadcom's latest financial report, what has caused a positive market response is mainly the AI revenue growth exceeding expectations.

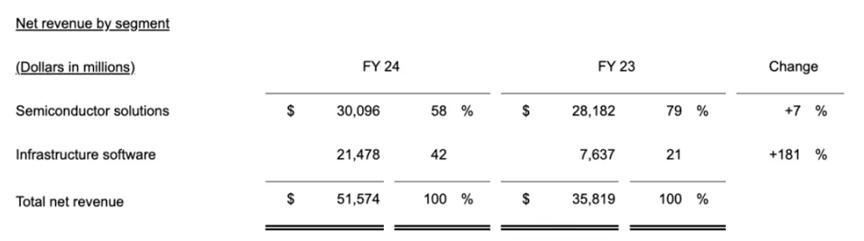

Data shows that Broadcom's AI revenue increased by 220% year-on-year for the entire fiscal year, thereby driving the semiconductor business revenue to a new high of $30.1 billion, an increase of 7% year-on-year.

Coupled with CEO Hock Tan's market size expectation for fiscal year 2027, Broadcom's ASIC business is considered to be entering an upward channel.

It is also worth noting that, in terms of business, Broadcom is divided into semiconductor solutions business and infrastructure software business. The latter has increased by 196% year-on-year, driving the total revenue to increase by 44% for the whole year. This is mainly due to the consolidation of VMware, while the growth of the original software business is relatively small.

In terms of net profit, Broadcom achieved $4.324 billion in the fourth quarter, with a significant improvement. The growth in the revenue segment and the decrease in the expense ratio have jointly improved the profitability, and at the same time, business integration has also accelerated the release of the final profit.

Source: Broadcom's financial report

When analyzing the revenue structure, the ASIC chip, which attracts the most market attention, belongs to the network business under the semiconductor solutions, and it is currently the sector with the highest revenue share, reaching 32%.

In addition to ASIC, the network business also includes Ethernet switch chips/routing chips, PHY chips, and fiber optic transmitters and receivers.

Among them, the emerging ASIC is a new business that Broadcom achieved through the acquisition of the storage company LSI in 2016. Earlier, the Ethernet switch chip under the network business was Broadcom's founding product. In the data center-related network connection equipment track, Broadcom has been the old-generation dominant player.

Regarding the significant growth of the network connection equipment market driven by the AI data center, the optical module chip manufacturer Marvell, whose stock price has soared this year, can also be referred to.

Market data shows that for data center equipment using Nvidia chips, each device requires approximately 9 1.6T optical modules. Under the market situation of following Nvidia to make profits, Marvell's stock price has doubled within the past year.

Originally, Broadcom's switch products also followed this logic, but in 2019, Nvidia entered the switch market by acquiring Mellanox, forming a competitive relationship with Broadcom in this field.

In this context, ASIC has become an important new cash cow for Broadcom's network business.

However, the market's concern about ASIC is that as a dedicated chip, its R & D cost is relatively higher than that of general-purpose chips. Only when customers have a real demand and can afford the cost will they consider ASIC.

Hock Tan also stated in the last quarter's earnings call that only large cloud vendors have the ability to bear the cost of custom chips, and for small and medium-sized customers, the cost performance is too low.

Judging from the current demand side situation, Broadcom does not lack orders in the short term. Google, as an old customer of Broadcom's TPU, almost uses all TPUs internally, and the scale has exceeded 2 million last year, second only to Nvidia's market scale.

If the three customers represented by Google are the basic market of Broadcom's ASIC, then the "defection" of giants outside the "allies" adds more certainty to the prospects of ASIC.

For example, the recent close cooperation between Microsoft and OpenAI has begun to show contradictions, which have been revealed on multiple occasions.

Microsoft CEO Satya recently directly stated in an interview that he holds a different view from Sam Altman on AI development - Sam requests a huge amount of training resources from Microsoft, but Satya believes that the application layer is the focus, and the model layer is in "general commoditization".

It can be seen that Microsoft's focus has been on reasoning, and the diversity of reasoning scenarios will give more opportunities to ASIC.

At the Goldman Sachs Conference in September this year, Hock Tan proposed a possible future outcome: AI computing power will be evenly divided between ASIC and GPU, and the AI computing power allocation of all giants will be like Google's, with all ASIC used internally and all GPU used externally.

02 Ending the Monopoly

"The slowdown in Nvidia's growth is inevitable, but it is impossible to be surpassed and replaced." A senior investor told 36Kr.

"The market is telling us that after the end of pre-training, there is an excess of algorithms, and power saving needs to be considered. But the actual situation is that for all AI companies, the priority is still computing power. To expand, computing power is the first priority, which is the main factor that makes Nvidia difficult to be shaken in the short term."

The rise of Broadcom is undeniable, but whether Nvidia can be replaced remains a question mark.

First, from a technical perspective, although the market highly associates ASIC with reasoning, in fact, GPU can also perform reasoning tasks. For example, Nvidia's GB200 reasoning performance has increased by 30 times compared to H100.

It's just that ASIC is strong in low power consumption and small size, and can be embedded in more edge scenarios.

Secondly, when the entire AI industry has been suffering from "Nvidia" for a long time, in the secondary market, the logic of ASIC is easier to be realized.

In the stage of pursuing high performance, major model manufacturers have hoarded a large number of Nvidia GPU chips in order to seize the time window. Now, in the stage of cost performance, Nvidia has almost become the "enemy" of all manufacturers, and everyone wants more choices.

And as the only "enemy" that can compete with Nvidia at present, Broadcom has become the "friend" of major model manufacturers.

Looking more calmly, the switch between training and reasoning is more about releasing the computing power from the chain that is subject to Nvidia and giving more opportunities to the reasoning framework.

Therefore, many market voices believe that Broadcom's increase is overdrawn in the future, while Nvidia is over-sold.

Some industry insiders point out that the deceleration of pre-training does not mean the end of the general model. If ASIC quickly replaces GPU, it is basically equivalent to denying the existing LLM framework.

"Elon Musk's startup xAI is still frantically snapping up Nvidia's GPU, and the competition with Microsoft, Google, and meta will intensify, and the scale is still expanding, so Nvidia's demand has not peaked." The aforementioned investor said.

At present, as long as the capital expenditures of overseas cloud computing giants on AI servers do not slow down, Nvidia, Broadcom, and Marvell will still be able to benefit from the artificial intelligence arms race.

However, the key problem lies here. In the absence of mature applications, how long can major model manufacturers continue to burn money?

Follow for more information