Seven consumer companies received new funds; The footfall at Häagen-Dazs stores in China has decreased; "The male version of lululemon", Vuori, launches its first Spring Festival series | Insights into Venture Capital and Investment

Organized | Li Xiaoxia

Busy Money

"Xiaocaiyuan" Listed on the Hong Kong Stock Exchange

On December 20, Xiaocaiyuan officially landed on the Hong Kong Stock Exchange. Founded in 2013, Xiaocaiyuan is one of the directly-operated chain restaurant brands in the Chinese mass convenience catering market. In addition to the "Xiaocaiyuan" brand, it also has sub-brands such as "Guandi", "Fuxinglou", and "Caishou". All 663 stores currently in operation by the company are in the directly-operated mode, including 658 "Xiaocaiyuan" stores and 5 stores of other brands, covering 146 cities or counties in 14 provinces including Anhui, Jiangsu, Shanghai, Zhejiang, Beijing, Hubei, Tianjin, Guangdong, Hebei, Henan, and Shandong.

"Pilton Petton" Completes 30 Million Yuan Series A Financing

36Kr learned that the pet smart cabin brand "Pilton Petton" has completed a 30 million yuan Series A financing round. This round is led by Anji Industrial Fund, with old shareholders Bohuiyuan Venture Capital and Zhichong Technology participating in the follow-on investment; Qianyou Venture Capital serves as the exclusive financial advisor for this round.

Founded in 2022, Pilton Petton is a pet smart product brand under Xiaochong Technology. Its business initially entered from the offline pet park. Considering improving the pet boarding environment, it developed and launched the "Pilton Pet Smart Cabin".

"Dolphin Dryer" Completes 50 Million Yuan Series A Financing

36Kr learned that "Dolphin Dryer" has recently completed a 50 million yuan Series A financing round, with the investor being Nantian Shujin Venture Capital Management Co., Ltd., and the post-investment valuation is 500 million yuan.

Established in 2021, "Dolphin Dryer" is a shared dryer company focused on essential scenarios such as universities, apartments, and staff dormitories. Based on the independently developed "suspended non-contact" vertical cabinet dryer equipment, it is committed to solving the problem of drying clothes for users due to weather and space reasons.

"Shanji Technology" Completes Tens of Millions of Yuan Series A+ Financing

36Kr learned that the smart hardware brand "Shanji Technology" announced that it has received tens of millions of yuan in Series A+ financing exclusively invested by Oasis Capital, with Yuewei Capital serving as the exclusive financial advisor. Founded in 2020, Shanji Technology recently officially released its first AI glasses - Shanji AI "Pai Pai Jing" A1.

Hubei Jiatai Industrial Co., Ltd. Obtains 12 Million Yuan Series A Financing

36Kr learned that Hubei Jiatai Industrial Co., Ltd. has completed a financing of 12 million yuan RMB, invested by Shenzhen Century Yinlong Investment and Development Co., Ltd. This financing will help the new and trendy snack brand "Hao Ling You" under Hubei Jiatai Industrial Co., Ltd. to accelerate the research and development and market promotion of new products, optimize the product structure, and improve the product quality.

"Narwal Intelligence" Receives Hundreds of Millions of Yuan in New Financing

36Kr learned that the sweeping robot unicorn enterprise "Narwal Intelligence" has completed a new round of financing of hundreds of millions of yuan. The investors are the two state-owned capitals in Shenzhen and Wuxi. This is also the latest capital dynamics of Narwal after a three-year interval. Since 2016, Narwal has completed 8 rounds of financing, with an amount of several billion yuan. The backers also include well-known institutions such as the Qingshuiwan Fund managed by Li Zexiang, ByteDance, Sequoia Capital, Ming Shi Chuang Tou, and Source Code Capital.

"Vimay Medical" Completes Over 100 Million Yuan Series B Financing

Recently, Vimay Medical, the R & D company of the domestic first monopolar radiofrequency product YOUMAGIC, has completed a Series B financing of over 100 million yuan. Founded in 2021, Vimay Medical is a provider of minimally invasive and non-invasive energy medicine overall solutions. With the energy ablation treatment system as the technical core, the company is committed to providing minimally invasive and non-invasive energy medicine overall solutions. The product line covers high-end medical devices such as peripheral interventional radiofrequency ablation systems and medical aesthetic radiofrequency therapy devices.

Previously, Vimay Medical has successively received several rounds of financial investments totaling several hundred million yuan from many well-known domestic investment institutions, as well as strategic investments from Proya, Betaine Group, Chuangjian Group, and Jiuzhoutong Group.

Company Intelligence

The Supplier of Luckin Coffee and Heytea Submits IPO Registration Application

Another company behind the tea drinks may add an IPO.

A few days ago, Hefei Hengxin Life Technology Co., Ltd., which passed the IPO review 21 months ago, submitted for registration. Hengxin Life was founded in 1997 and was initially a business printing company, with its main products being promotional brochures and materials. It was not until 2001 that the company gradually shifted the focus of its products to paper cups and became one of the early domestic enterprises to use flexographic printing for paper cup production. Currently, it has become a provider of paper and plastic catering utensils for many enterprises such as Luckin Coffee, Staples, Amazon, Heytea, Starbucks, Yihetang, McDonald's, Dicos, Manner Coffee, Burger King, etc.

The prospectus (registration draft) shows that in 2021, 2022, 2023, and the first six months of 2024, Hengxin Life achieved revenues of 719 million yuan, 1.088 billion yuan, 1.425 billion yuan, and 733 million yuan respectively; net profits were 81.0821 million yuan, 166 million yuan, 221 million yuan, and 106 million yuan respectively; and net profits attributable to the parent company's shareholders were 80.1636 million yuan, 163 million yuan, 214 million yuan, and 105 million yuan respectively.

The company expects to achieve an operating income of 1.52 billion to 1.60 billion yuan for the full year of 2024, and a net profit attributable to the parent company's shareholders of 213 million to 220 million yuan. For this IPO, the company intends to list on the ChiNext of the Shenzhen Stock Exchange and plans to raise 828 million yuan.

The Customer Flow in Häagen-Dazs Stores in China Decreases

A few days ago, when talking about the business in China in the previous quarter, Jeff Harmening, the CEO of Häagen-Dazs, said that the customer flow in Häagen-Dazs stores decreased by double digits (percentage), but the company is trying to mitigate these adverse factors by expanding its distribution in retail, food service, and e-commerce channels.

In 1996, Häagen-Dazs entered the Chinese market and was once known as the "LV of ice cream", and is also a representative brand of high-end ice cream. Relevant data from the catering data platform Zhaimen Canyanjing shows that as of December 13, there are 403 Häagen-Dazs stores in China, covering 33 provinces and 90 cities, with more than 60% of them distributed in first-tier and new first-tier cities, and 70% of them are in shopping malls.

Häagen-Dazs is also making some efforts to attract more young consumers, including expanding channels and product matrices. In June this year, Yang Mi was officially announced as the brand spokesperson. Whether these strategies will be effective and whether the customer flow in stores can recover remains to be observed.

Chayan Yuese Accelerates Expansion to Other Provinces

After the rumors of going public, Chayan Yuese has started to open stores outside Hunan Province.

A few days ago, a reporter from Nandu Bay Finance and Economics learned from Chayan Yuese that at the end of December this year or the beginning of January 2025, Chayan Yuese will open a store in Yichang, Hubei. This is the sixth city outside Hunan Province where Chayan Yuese has entered, and it is also the first time for the brand to explore a third-tier city outside the province.

Since its establishment, Chayan Yuese has been firmly based in Hunan. It was not until December 2020 that it stepped out of Hunan. In the second half of this year, Chayan Yuese seems to have accelerated its pace. It only opened a store in Suzhou at the end of September, and now it is preparing for the store in Yichang.

In the past, the discussion about Chayan Yuese not being able to go beyond Changsha has never stopped. With the rapid expansion of Chawangbaji and the emergence of up-and-coming brands like Mollynbai, Chayan Yuese may not have much time left.

Future Ideas

Vuori Launches Its First Spring Festival Collection

The American California sportswear brand Vuori is continuously making localizing moves in China.

Recently, Vuori launched its first Spring Festival collection with the theme of "New Year, Natural Beauty and Strength", ingeniously interpreting the dynamic balance of inner and outer strength and the vitality of nature, redefining festival sportswear and creating a new image that combines style and power. The vitality red color scheme launched this time is not only suitable for the festive atmosphere of the festival but also can be easily integrated into daily wear. For the women's collection, the Vuori AllTheFeels™ series features sports bras, sports leggings, and sweatshirts in the vitality red color scheme. In addition, the star products Yosemite sports bra, Daily leggings, and Daily sports leggings with pocket are also refreshed in the vitality red color scheme. For the men's collection, the Strato Tech T-shirt and Kore sports shorts are presented in a new Aden red color scheme.

Vuori officially entered the Chinese market in 2022. Its first step was to open a brand direct online store on Tmall. Although as the management said, Vuori's business is very different from lululemon. Even yoga products are not the largest component in the product structure, but this does not prevent Vuori from becoming popular on social media with the label of "the male version of lululemon".

The release of this Spring Festival collection marks another milestone in Vuori's development journey in the Chinese market. With the successive openings of stores in Jing'an Kerry Center in Shanghai and Grand Gateway 66 in Hongqiao in the past year, Vuori has further deepened its layout in the local Chinese market. Not long ago, Vuori just completed a new financing of 825 million US dollars.

Judydoll Launches the "Happy Gourd" Makeup Collection

Recently, Judydoll's "Happy Gourd" makeup collection has been newly launched, with the main tone of the festive pink and fresh green color combination of the Spring Festival, and the traditional Chinese gourd totem to convey the good wishes of the New Year. It includes the limited packaging of the classic best-selling products "Little Immortal Ginseng" Moisturizing Dry Skin Cushion, "Ice Iron" Essence Mirror Lip Gloss, and the recent popular new product "Stacking Fun" Essence Multi-purpose Cream.

At the same time, from December 16 to February 16, Judydoll will set up offline pop-up devices of the "Happy Gourd" series in three offline brand image stores in Shenzhen, Shanghai, and Changsha, as well as the Sanfu Department Store on Tayuan Road in Suzhou. Not long ago, Judydoll officially announced actress Liu Haocun as the brand's global spokesperson.

Its parent company, Judydoll Group, owns three brands: Judydoll JUDYDOLL, Joocyee, and René Furterer (China business). According to the official 2023 performance data, the group's annual retail sales exceeded 3 billion yuan, and its operating income was 2.61 billion yuan (excluding René Furterer), with a year-on-year growth of 48%. Among them, Judydoll's annual sales exceeded 1.67 billion yuan, ranking first in domestic makeup sales and top five in sales. Joocyee, founded in 2019, had an annual revenue of 940 million yuan last year.

Bimbo Group's Mankattan Brand Launches "Bread Crispy Cubes"

Recently, the baking brand Mankattan (MANKATTAN) has launched "Bread Crispy Cubes", including four flavors: Corn Soup Flavor, Refreshing Garlic Flavor, Rich Barbecue Flavor, and Sea Salt Caramel Flavor.

Bread cubes can be regarded as one of the snacks that have become popular all over the Internet this year. After being popularized by Chayan Yuese, brands and OEMs have also quickly followed up. Instead of choosing the mainstream pretzel bread on the market, Mankattan selects toast made with the soup seed fermentation process as the raw material, which is made through secondary baking and roasting, and the entire production process takes up to 28 hours.

At the same time, during the production process, Mankattan precisely controls the water content of the bread cubes to be below 4%, ensuring that the Bread Crispy Cubes have a unique crispy texture. In addition, in response to consumers' high demand for health and safety, Mankattan Bread Crispy Cubes also use 0 trans fatty acids and are non-fried, and are added with light dietary fiber, aiming to allow consumers to enjoy delicious snacks with ease and without worry.

Zhang Li, the general manager of Bimbo China, said, "China is an important market for Bimbo Group globally. The launch of Mankattan Bread Crispy Cubes is an important manifestation of Bimbo's continuous innovation in local products, and also our deep commitment to Chinese consumers."

Data on Consumption

Ready-to-Drink Coffee Has the Largest Year-on-Year Growth Rate Decline Among Beverages

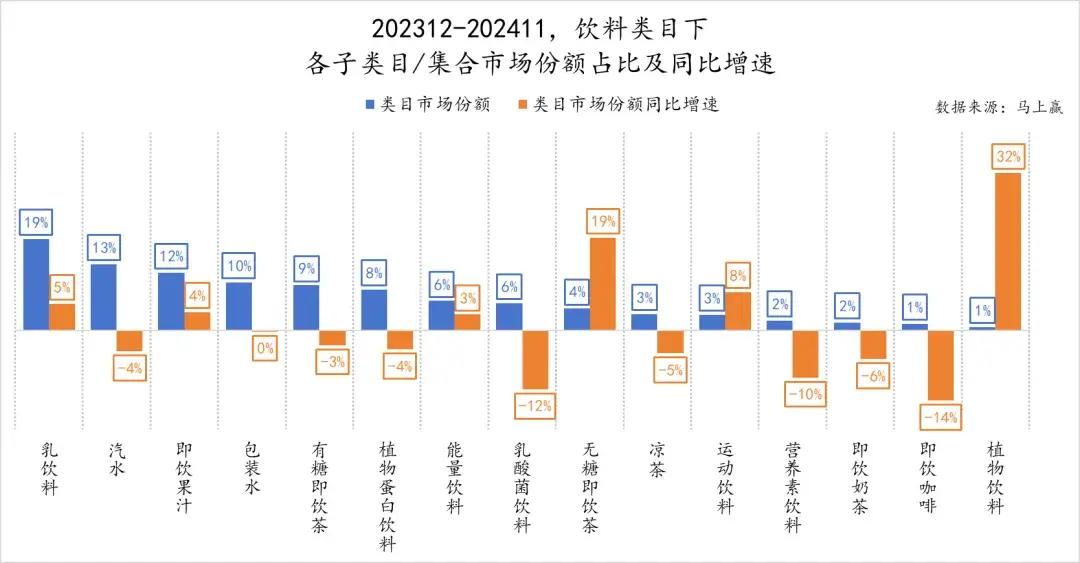

Recently, Ma Shang Ying Intelligence Station released the "2024 Beverage New Product TOP100 Review". From the perspective of market share, dairy beverages, carbonated beverages, ready-to-drink fruit juices, packaged water, sugared ready-to-drink tea, and plant protein beverages all exceed or are close to 10%, accounting for a relatively high proportion in the entire beverage category. At the same time, the space for growth rate fluctuations is also relatively small, and they are relatively stable.

In addition, with a relatively low market share, ready-to-drink coffee has become the beverage with the largest year-on-year growth rate decline in this review cycle. Plant beverages are the category with the smallest market share in this review, but at the same time, it is also the category with the highest year-on-year growth rate, leading all categories, and its year-on-year growth rate also far exceeds the sugar-free ready-to-drink tea, which has been popular in the past two years.

From the category distribution of the new product TOP 100 SKUs, ready-to-drink tea (sugared ready-to-drink tea + sugar-free ready-to-drink tea) continues the hot trend in 2023, with a total of 27 new products included.

From Ma Shang Ying

Cocoa Prices Reach a New Historical High

In 2024, the prices of the key ingredients of chocolate have soared, prompting analysts to warn of extreme price fluctuations.

In the early morning of Tuesday, Eastern Time, the New York cocoa futures contract for March delivery on the New York Mercantile Exchange rose by 1% at one point, reaching $11,938 per metric ton, setting a new historical high.

So far this year, the futures price has risen by more than 180%. Strategists at ING Bank in the Netherlands said that the continued tightness in the cocoa and coffee markets, along with weather uncertainties, means that prices are likely to continue to fluctuate next year.

National Catering Revenue Increased by 5.7% Year-on-Year from January to November

According to data released by the National Bureau of Statistics, the total retail sales of consumer goods in the country in November 2024 was 437.63 billion yuan, with a year-on-year growth of 3.0%; among which, the catering revenue was 580.2 billion yuan, accounting for 13.26% of