Multi-language AI Financial Investment Analysis Platform, "Bridgewise", Receives Strategic Investment of Tens of Millions of US Dollars | Exclusive from 36Kr

Written by | Zhang Zhuoqian

Edited by | Yuan Silai

36Kr has learned that Bridgewise LTD (hereinafter referred to as "Bridgewise") has announced the completion of a strategic financing of tens of millions of US dollars. This round of financing is led by strategic investors such as SIX Group, Group 11, and L4 Venture Builder. The funds from this round of financing will be mainly used for the research and development of the AI platform and the expansion of the global market.

Founded in 2019, "Bridgewise" has global offices in Tel Aviv, New York, Singapore, and São Paulo. It is a global financial AI investment advisory firm. It has established a global securities analysis platform based on AI intelligent tools. By analyzing the basic data of more than 90% of globally listed securities, it provides clients with securities performance scores, fund and stock analysis, multilingual insight reports, and investment advice. "Bridgewise" clients include exchanges, banks, trading platforms, investment companies, wealth advisors, financial media, and education platforms, etc.

In the investment intelligence industry, fragmented financial market information makes it difficult for many investors to obtain reliable and high-quality analysis. Moreover, language barriers and regional biases further exacerbate this problem. In addition, traditional investment intelligence models often lack transparency and interpretability, making investors question the reliability of the analysis results. On the other hand, due to the strict regulatory requirements faced by financial institutions, it is difficult for them to provide investors with globally compliant and easily accessible investment insights.

In response to these market pain points in the investment industry, "Bridgewise", with its independent AI technology, provides objective and data-driven analysis, avoids human biases, and supports 25 languages to meet the needs of different global investors. The "Bridgewise" platform mainly has three products: EquityWise, FundWise, and Bridget™.

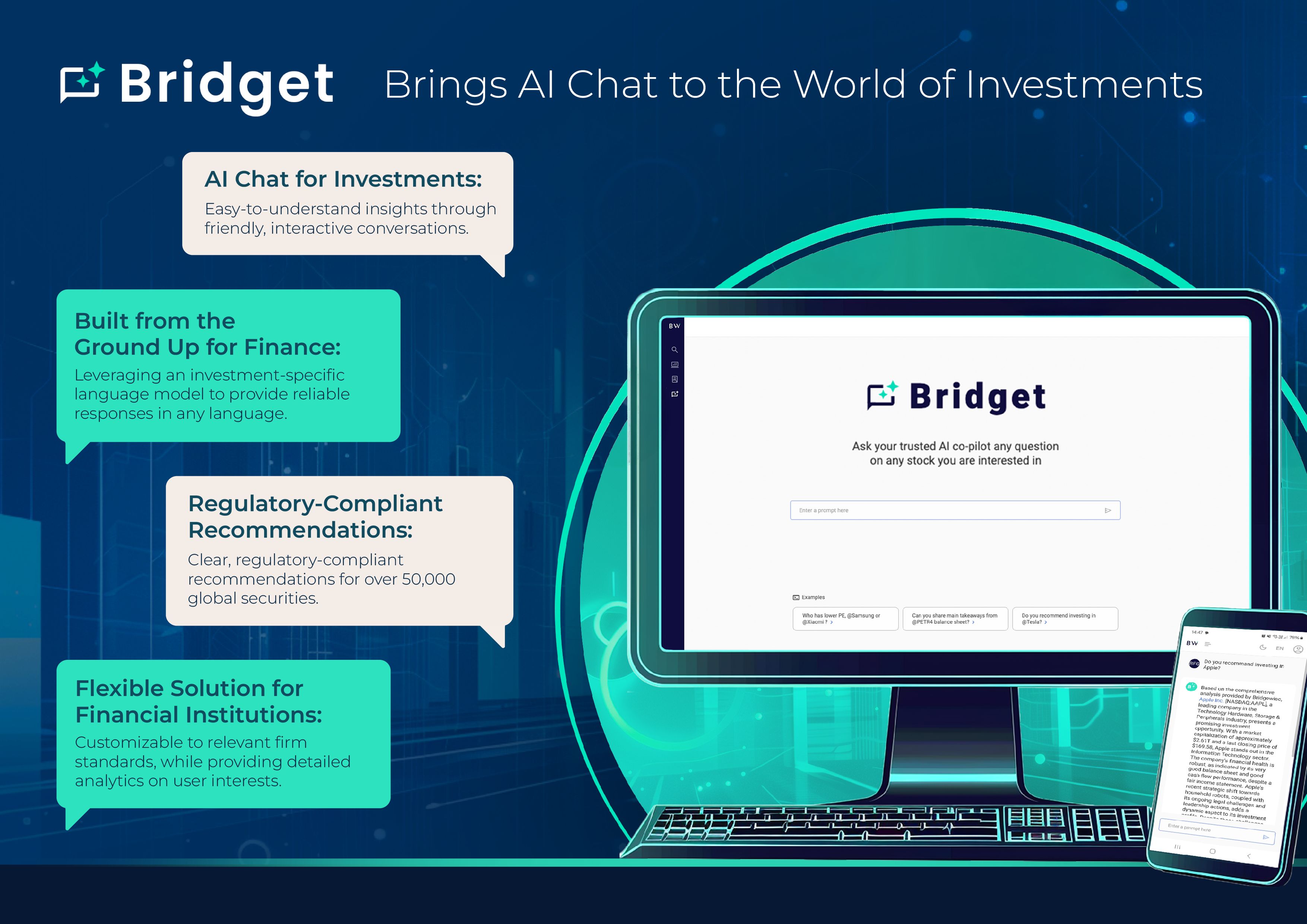

EquityWise integrates information on more than 90% of global stocks and generates investment reports through AI technology. It provides well-founded recommendations, and its investment reports cover the data of most global exchanges. FundWise focuses on financial product analysis and provides detailed recommendations on 12,000 global funds. Its core advantage lies in the analysis of the fund's holdings, which provides in-depth analysis of the fund's performance for investors. FundWise fully complies with regulatory standards, including the comparison of active and passive funds, as well as industry-level performance indicators. Bridget™ is a conversational AI specifically designed for the investment field. It transforms traditional investment intelligence into an interactive and regulatory-compliant conversation, thereby enhancing the user's sense of participation. Unlike ordinary chatbots, Bridget provides recommendations on more than 50,000 securities worldwide based on financial knowledge and a specialized language model. Bridget can also be customized according to institutional needs to help financial institutions meet higher compliance requirements and provide investors with easy-to-understand and attractive investment insights.

Bridget

As an AI-driven investment intelligence platform, the core technology of Bridgewise is based on two pillars. One is the machine learning algorithm, which is trained based on more than 20 years of historical data, analyzing more than 50,000 listed stocks and assigning a performance score to each stock. The second is the generative AI built based on the independently developed Micro Language Model (MLM), which can generate easy-to-understand reports for each security and support multiple languages. With the core technology, the Bridgewise platform has launched a series of customized products to meet the needs of leading financial institutions and service providers.

Bridgewise adopts a subscription-based revenue model, supports 25 languages, and provides localized services to global users through customized service solutions. Its solutions have been applied in 15 countries and currently serve more than 50 institutional clients, including Japan Exchange Group, Nasdaq, London Stock Exchange Group, B3, Interactive Brokers, SIX Swiss Exchange (the first exchange where Bridget was launched), eToro, and Suno Investimentos, etc.

The Bridgewise team consists of more than 100 professionals and cooperates with industry-leading enterprises. Deborah Fuhr is the Managing Partner and Founder of ETFGI. She has accumulated rich expertise in Exchange Traded Funds (ETFs) during her leadership positions at BlackRock and Morgan Stanley. Christian Reuss was the former CEO of the Swiss Stock Exchange. He is experienced in capital markets and regulatory affairs and has worked at Goldman Sachs. Dato Neto is the founder of Eleven Financial Group and the former Managing Director of Banco Modal. He has supervised initial public offerings (IPOs) and other transactions with a total amount of more than $5 billion. He has extensive expertise in the private and public markets, early-stage investments, and exits.

Currently, Bridgewise has established its Asia-Pacific headquarters in Singapore and will further explore the Asia-Pacific markets such as Hong Kong, India, Japan, and Singapore. In the Asia-Pacific region, Bridgewise plans to double the number of investors using the Bridgewise solution by adjusting our products and services according to local needs.