Spending hundreds of millions to build an intelligent computing center, but 80% of the GPUs cannot be rented out | Focus Analysis

Welcome to "Intelligent Emergence"

Author | Qiu Xiaofen

Editor | Su Jianxun

In the Chinese AI industry in the past two years, there is a wonder:

Many listed companies without any GPU background or computing power industry experience regard the intelligent computing center as the starting point for their development of the second curve, planning to transform into the AI field - for example, the company that produces monosodium glutamate (Lianhua Holdings), the company that manufactures dyes (Jinji Co., Ltd.), and even the players in the gambling industry (Hongbo Co., Ltd.), etc.

But by the end of 2024, the situation has reversed.

On November 29, Lianhua Holdings announced that only 12 of their nearly 700 million GPU server procurement contracts have been delivered, and the remaining 318 units were decided to terminate the contract due to "uncertainty".

Not only Lianhua Holdings, but also many listed companies have recently announced that they have decided to suspend or cancel the originally planned intelligent computing center construction projects, not hesitating to take the risk of contract default.

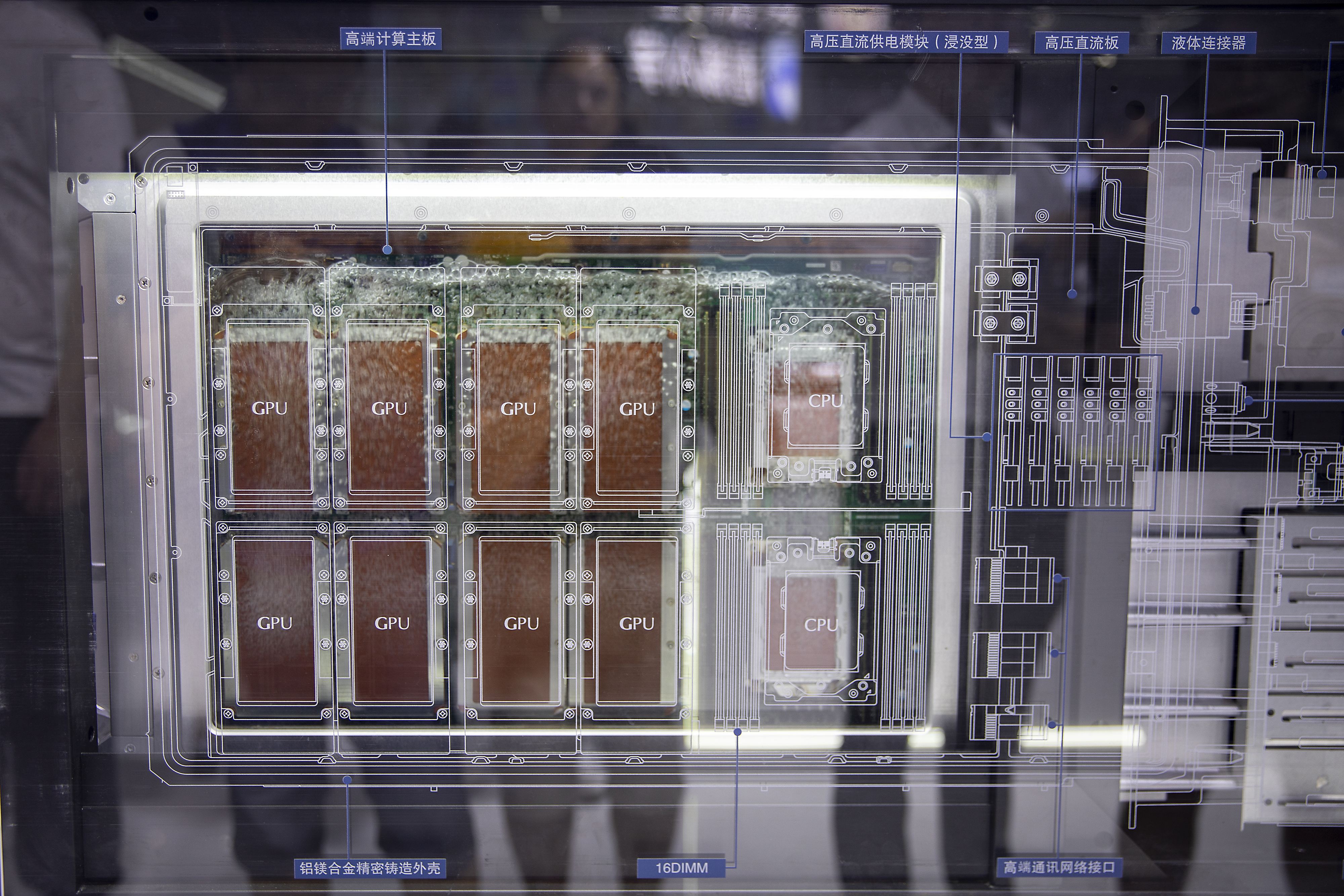

Source: IC Photo

In the two years when the industry's expectations for AI were high, the construction of intelligent computing centers in China can be described as crazy - as of the first half of this year, the domestic computing power scale has reached 246 EFLOPS, and the intelligent computing power has increased by more than 65% year-on-year. There are more than 13,000 computing power application projects in multiple fields such as industry, education, medical care, and energy.

These listed companies play different roles in the wave of intelligent computing center construction. Some choose to simply and rudely participate in the investment and construction with money, some choose to provide equipment (such as GPU / software solutions / algorithm models), and some intervene in a more lightweight way to help the computing power center provide operation services.

From the rush two years ago to the cooling down now, what happened to the domestic intelligent computing centers?

A Difficult Account

Recently, when many intelligent computing center personnel visited major intelligent computing centers in China, they were amazed at the current industry situation. They unanimously told "Intelligent Emergence" that the current domestic computing power center market has fallen silent.

"At present, The rental rate of computer rooms is generally between 20% and 30%, and some enterprise-level intelligent computing centers even only about 10%", an industry insider said.

From a purely commercial perspective, this is not a healthy state. An industry insider disassembled the cost composition of an intelligent computing center for "Intelligent Emergence" -

Take a kilocalorie cluster intelligent computing center composed of a NVIDIA H100 as an example. The upfront investment cost is:

About 300 million for purchasing computing power equipment;

About 25 million for network equipment costs;

About 10 million for storage and security equipment costs;

About 10 million for platform software and liquid cooling transformation costs;

A total upfront cost of about 350 million yuan.

And the intelligent computing center not only requires heavy assets investment in the early stage, but also requires daily electricity, maintenance, personnel expenses, etc. in the subsequent operation process. It is estimated that the annual expenditure is about 50 million yuan.

That is to say, In China, to build a small intelligent computing center of a kilocalorie cluster scale, 350 million hard costs need to be paid in the early stage, and 50 million yuan needs to be spent every year to support the operation.

Image from IC Photo

And after these intelligent computing centers are built, to whom will the computing power be delivered? How to make money?

At present, the way domestic manufacturers solve AI computing power is: Large Internet companies, well-funded AI companies, and leading enterprises in segmented tracks generally build their own intelligent computing centers based on security considerations. And most other companies that need AI computing power basically choose to lease computing power from third-party intelligent computing centers.

In addition, these intelligent computing centers will also supplement some computing power for the first three types of players when needed to deal with unexpected needs.

In the past two years, part of the enthusiasm for the construction of intelligent computing centers stems from the fact that although the cost is high, fortunately, government subsidies have alleviated it. In the past two years, various localities have introduced a variety of policies to support the construction of intelligent computing centers, such as capital subsidies, tax incentives, and land supply.

For example, some local policies suggest that when the total investment of the project is more than 100 million yuan, a subsidy will be given at a proportion ranging from 5% to 15% of the actual investment amount. In some provinces with abundant wind/solar resources, excess photovoltaic indicators will also be given to enterprises that invest in the construction of intelligent computing centers.

An industry insider summarized that the support policies for the construction of intelligent computing centers in various places need to be at the level of "discussing on a case-by-case basis in each place".

However, after all, subsidies are not in the commercial category. After the white money is used to build an intelligent computing center, whether the money can be recovered later is mainly linked to how many cards can be rented out (that is, the utilization rate of the computer room) and the rental price after the actual operation.

At present, these two data are not optimistic. "Intelligent Emergence" pointed out in an article not long ago that the rental price of a NVIDIA H100 server (8 cards) has dropped from 120,000 - 180,000 yuan per month at the beginning of the year to the current 75,000 yuan per month, with a drop of about 50%.

If calculated based on the current 20% computer room utilization rate, the annual revenue of an NVIDIA H100 kilocalorie cluster intelligent computing center is only 23 million yuan (that is, 75,000 yuan / month ✖️ 12 months ✖️ 128 servers ✖️ 20%) - that is to say, even if an computing power center barely maintains its operation, the result is basically only able to cover half of the normal operating costs, let alone recovering the previous heavy assets.

Investing in the construction of an intelligent computing center is currently a difficult account.

Computing Power Centers, Waiting for Payback

Many industry insiders told "Intelligent Emergence" that the core reason for the serious idleness of the intelligent computing centers at present is that after the computing power centers are put into application, it is found that the AI demand has not increased as rapidly as expected, and the computing power is difficult to be consumed.

"Previously, everyone expected that the domestic computing power leasing market would increase by at least 10% per year. As a result, it seems that it is only about 5% at present."

Therefore, the current goal of each intelligent computing center is to cover the operating costs, "Returning the capital is even the highest standard and a long-term ideal". Yue Yuanhang, CEO of an intelligent computing center industry chain company "Zhibole Technology", told "Intelligent Emergence" that after their calculations, they found that even if the equipment rental rate of an intelligent computing center increased to 60%, it would take at least 7 years or more to return the capital.

Image from IC Photo

In addition to the fact that the AI demand has not appeared as expected, the idleness of the intelligent computing centers is essentially related to a certain lag.

For example, when some intelligent computing centers are designed and researched, they are generally designed according to the current market demand and hardware conditions. And by the time it is actually implemented, several months or even several years may have passed - and at this time, the hardware products may have been iterated several rounds, and even the market demand may have undergone a dramatic change.

In order to reduce the daily operating costs as much as possible, some intelligent computing centers have taken measures respectively.

Some intelligent computing centers directly shut down the equipment that cannot be rented out, "When you walk into the computer room, you find that the lights are off, and there is no buzzing fan cooling sound anymore," Yue Yuanhang said. In addition, some intelligent computing centers choose to directly sell off old equipment from Intel and NVIDIA to relieve the financial pressure as much as possible.

For some intelligent computing centers that have not been completed, some enterprises choose to suspend the projects under construction, or directly cancel the second-phase projects in the plan. An industry insider even told "Intelligent Emergence" that due to the suspension of the intelligent computing center project, the NVIDIA cards that they previously purchased at a high price of tens of millions of yuan were "stuck in their hands".

Obviously, the computing power market is quietly transforming into a buyer's market. In the past two years, if the industry was in a situation where "one chip is hard to find" and "computing power is hard to find", it is completely the opposite now.

At present, most AI companies are more inclined to save computing power and avoid unnecessary cost expenditures. They generally choose the appropriate computing power resources according to their needs and budgets, such as requiring lower preferential prices and better services.

Some intelligent computing centers, in order to maintain the sales of computing power and strive for market share, do not hesitate to adopt methods such as lowering prices or improving services (such as improving operational capabilities and helping downstream optimize models, etc.) to attract downstream users.

Computing power, as an existence like water, electricity, and coal, firmly holds the lifeline of the AI industry, especially in the current situation where the international situation is not clear. Although the computing power center is a difficult account at the current stage, it is also difficult for us to simply conclude that it should not be built anymore.

For the long term, an industry insider raised a question -

"Perhaps the inability to consume AI computing power is only a short-term phenomenon. Is it better for you to let the computing power center be idle for the time being? Or is it better for you to rush to build a computing power center when the AI application explodes in the future?"

Extended Reading:

"The Rent Has Dropped by 50% in 10 Months. Why Is NVIDIA H100 Not Popular Anymore? | Focus Analysis"

end