Not enough to snatch cards, AI companies also want to snatch "electricity" | Pay-to-win · Hard Technology

Author | Geng Chenfei

Editor | Song Wanxin

A nuclear power plant that experienced a nuclear leak 45 years ago is going to be restarted because AI consumes too much electricity.

In 1979, a major accident occurred at Unit 2 of the Three Mile Island Nuclear Generating Station near Harrisburg, Pennsylvania, USA, resulting in a partial meltdown of the reactor core and the release of radioactive substances.

The clean-up work for this accident continued until 1993, and Unit 1, located next to Unit 2 of the Three Mile Island Nuclear Generating Station, did not resume operation until 1985. However, under the influence of cheaper natural gas, as well as wind and solar energy, Unit 1 was also permanently shut down in 2019.

But now, the Three Mile Island Nuclear Generating Station is going to be revived under the new name of "Krane Clean Energy Center".

In September, Microsoft announced that it had signed the largest power purchase agreement in history with Constellation Energy Corporation in the United States, and will purchase 100% of the electricity produced by the Three Mile Island Nuclear Generating Station in the next 20 years to support the operation of Microsoft's AI data centers and cloud services.

According to statistics from The Wall Street Journal, currently, tech giants that are vigorously investing in AI are all in cooperative negotiations with nuclear power plant owners, involving about one-third of nuclear power plants in the United States.

In early October, Google stated that it had signed an agreement with Kairos Power and plans to purchase the electricity from 6-7 proposed small modular nuclear reactors, with a total capacity of 500 megawatt-hours; in March this year, Amazon bought a nuclear-powered data center for $650 million; Oracle also announced that it is designing a data center powered by three small modular nuclear reactors.

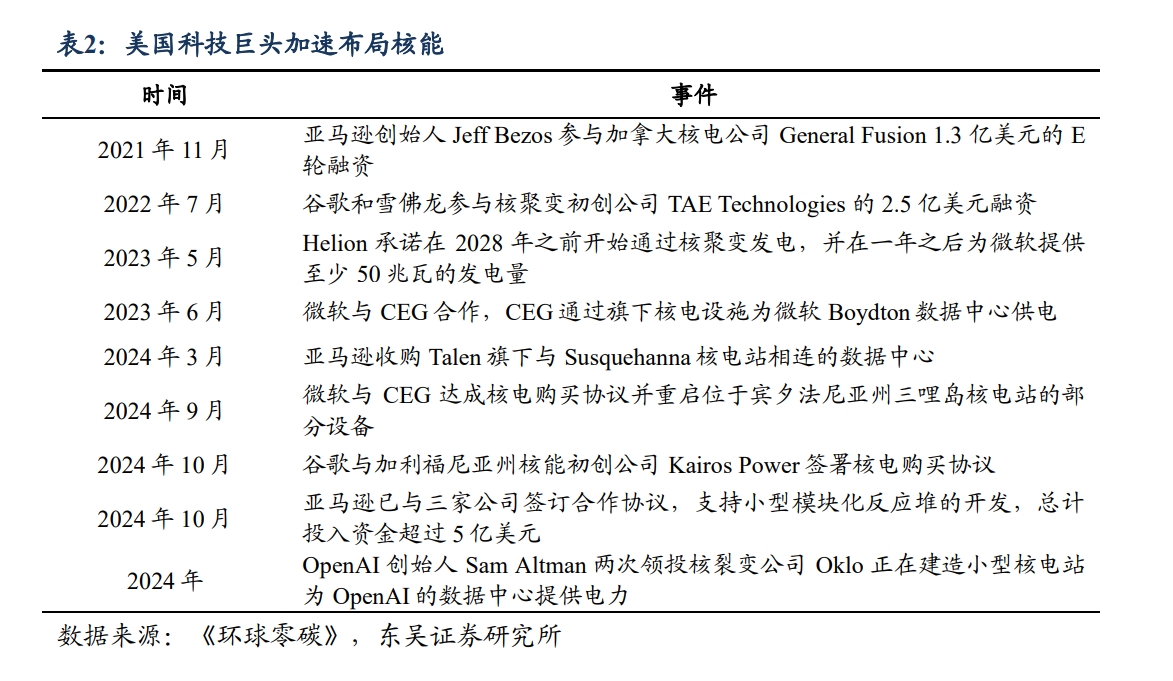

Figure: US Tech Giants Accelerate the Layout of Nuclear Energy Source: Dongwu Securities

Transmitted to the secondary market, nuclear energy stocks have recently risen in response. Among them, Vistra has become the best-performing company in the S&P 500 Index this year, with a stock price increase of 303.53%.

01 Why Nuclear Power?

How power-hungry is AI? Reports indicate that during a training process, just the GPU of GPT-4 can consume 240 million kilowatt-hours of electricity. This does not even include the energy consumption of the supporting facilities of the chip, including servers and cooling equipment.

When users use ChatGPT, a significant amount of electricity is also consumed. A previous report by The New Yorker magazine estimated that ChatGPT's daily electricity consumption may exceed 500,000 kilowatt-hours, which is equivalent to 17,000 times the average electricity consumption of an American household.

BofA Merrill Lynch pointed out in its research report that the electricity consumption of AI in the United States is expected to grow at a compound annual growth rate of 25%-33% from 2023 to 2028, far higher than the compound annual growth rate of 2.8% of the overall electricity demand.

It can be seen that as data centers continue to expand, the infrastructure of the US power grid, mostly built in the 1960s and 1970s, is under unprecedented pressure - tech companies are gradually finding that they are buying more cards, but there is not enough electricity.

In order to compete for the limited access to the power grid, a group of tech companies have been laying out data centers in less developed areas such as Ohio and Iowa in the technology industry to obtain a stable power supply.

Elon Musk predicted in March this year that there will not be enough electricity to run all the chips next year.

Therefore, with its efficient and stable characteristics, nuclear power has become an important direction for tech companies to ensure their own power supply.

Data from the US Energy Information Administration (EIA) shows that the capacity factor of nuclear energy is 93.1%, meaning that it operates at maximum power for more than 93% of the time. In addition, nuclear power plants can provide 24/7 base-load power, not affected by factors such as weather, cycle, region, and season.

CICC Research Report pointed out that nuclear power has an energy density advantage that is difficult to match by other types of units: The energy released by the nuclear fission of 1 kilogram of uranium-235 is approximately equivalent to 2,700 tons of standard coal or 1,700 tons of crude oil.

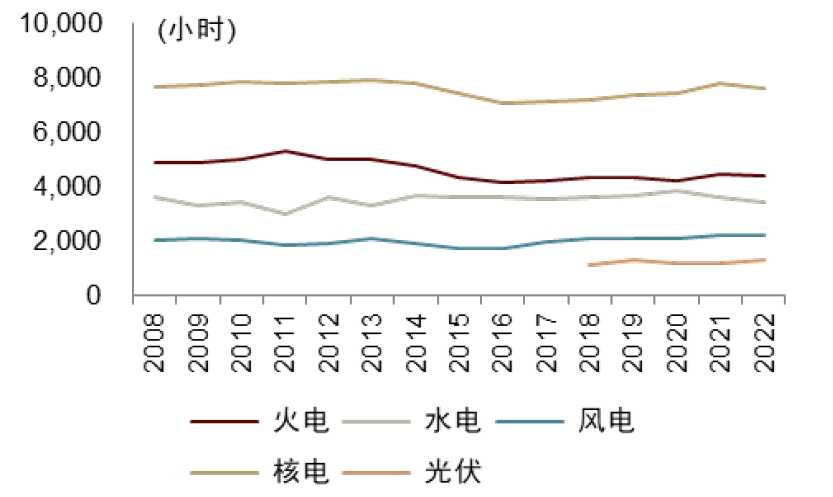

Figure: Changes in Utilization Hours of Different Types of Electricity; Source: CICC Research Report

More importantly, as an important raw material for nuclear power plants, low-cost uranium ore resources are very scarce, which further shortens the best time window for tech companies to layout nuclear power plants.

Huayuan Securities Research Report pointed out that the concentration of the natural uranium industry is relatively high, and low-cost uranium ore resources are relatively scarce and mainly come from Kazakhstan. In August this year, Kazatomprom, the world's largest uranium miner, significantly reduced its production plan for next year. In addition, Kazakhstan also plans to gradually increase the mineral extraction tax for uranium mining to 9% in 2025 and to 18% starting from 2026.

02 Is SMR the Answer?

In the process of tech companies chasing after nuclear power, the development of Small Modular Reactors (SMR) has received more attention from the market and is considered a more flexible and market-demand-oriented nuclear power solution.

CITIC Securities' latest research report pointed out that the capacity of SMR is generally 15MW to 300MW, the reactor volume is smaller, the flexibility is higher, and compared with traditional large-scale nuclear power plants, the construction and operation and maintenance costs are lower, and it is more suitable for powering data centers.

Amazon's investment actions are an industry benchmark. In October this year, Amazon and Google reached a landmark power supply agreement, promoting the deployment of the first batch of SMR in the United States. In addition, Oklo, a nuclear power company invested by OpenAI CEO Sam Altman, plans to put several SMR into use before 2030.

Affected by this, the stock prices of SMR developers have also risen. In the past three months, the stock prices of NuScale and Oklo have increased by 249% and 259%, respectively.

However, NuScale and Oklo, which are highly favored by the capital market, have performance that is significantly deviated from their stock prices. The third-quarter financial report shows that NuScale's sales decreased by 93.2% year-on-year to $475,000, and the net loss was as high as $45.5 million; Oklo's loss per share is eight cents, and since the beginning of the year, Oklo's operating loss has reached $37.4 million.

Short-selling institution Kerrisdale Capital describes Oklo as a "story stock": It has had no income for many years, no regulatory agency-approved design, and the commercial feasibility of its planned SMR has not been verified.

Oklo previously stated that it will deploy the first reactor in 2027, but in fact, the achievement of this goal largely depends on the approval speed of the US Nuclear Regulatory Commission (NRC). Kerrisdale quotes the opinion of a former NRC commissioner, saying that Oklo's schedule is too optimistic, and it "may take at least four years" just to obtain a license.

"Oklo markets exaggerated unit economic benefits to the market in a typical SPAC manner, while seriously underestimating the time and capital required for the commercialization of its products." Kerrisdale Capital said.

Although SMR is regarded as a new hope for the development of nuclear power, it is still questioned by the market due to the uncertainty of completing it on time and within budget, as well as high interest rates and a shortage of customers willing to underwrite the project.

At the end of last year, under the heavy pressure of rising interest rates and inflation, the SMR project cost of NuScale in Idaho increased sharply from $5 billion to $9 billion and was then cancelled. Earlier, private SMR developer X-Energy terminated its merger and listing plan with Ares Acquisition Corporation, citing "severe market conditions".

TD Cowen analyst Marc Bianchi pointed out that the dilemma facing the SMR industry is that customers are unwilling to sign up for the "first reactor" because it is more expensive and riskier than building subsequent reactors.

03 Difficulties in Reviving Nuclear Power in the United States

"The only limiting factor for the United States to continue to maintain its leadership in artificial intelligence is electricity. It is not land, nor is it chips, but electricity. Therefore, this is the primary goal." Clay Sell, the CEO of the US SMR developer X-Energy, once said this.

For the current AI arms race, the bottleneck is no longer chips, but electricity. For this reason, the "nuclear power revival" promoted by the United States is imminent, but many of the plans and goals for nuclear power have quite a bit of exaggeration.

According to the roadmap recently announced by the White House, by around 2050, the United States will deploy an additional 200 GW of nuclear power capacity by building new reactors, restarting nuclear power plants, and upgrading existing facilities. The short-term goal is to put 35 GW of new capacity into operation within more than ten years.

However, despite the ambitious planning, successive US governments have made a lot of noise but achieved little in promoting the development of nuclear power. Whether it is new construction, restart, or upgrade, it is by no means an easy task.

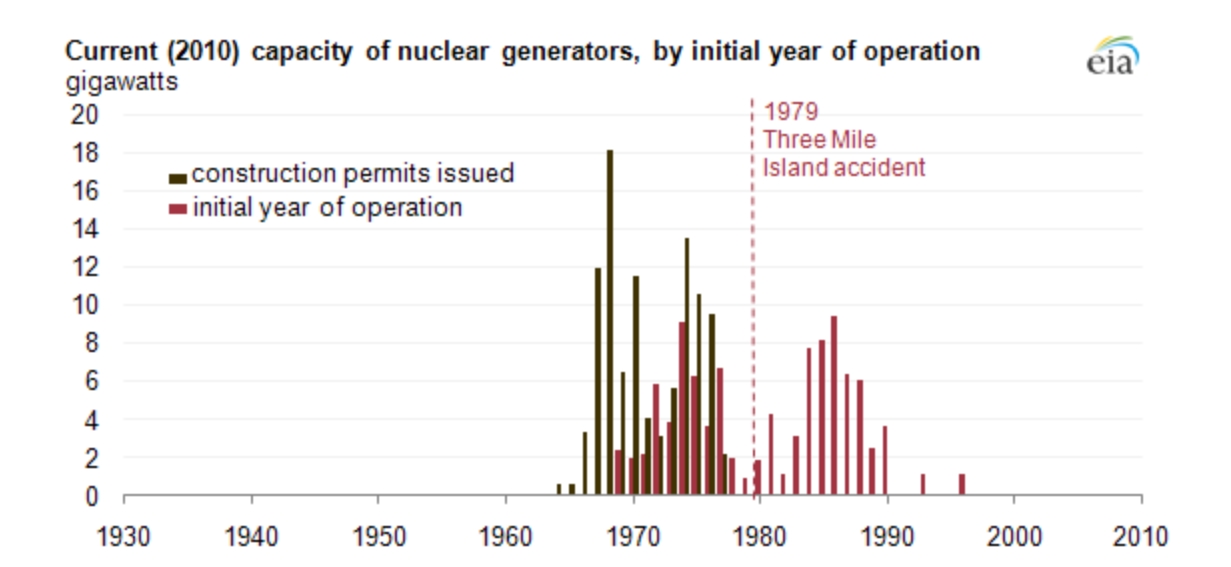

For the United States, although the Three Mile Island Nuclear Accident did not cause casualties, as the first core meltdown event in the history of human nuclear energy development, this accident completely shattered the myth of the "absolute safety" of nuclear power plants and became a turning point in the development of nuclear power in the United States.

Although from a technical perspective, the United States still maintains an advantage, its infrastructure construction capacity has significantly declined compared to its peak period.

According to data from the US Energy Information Administration, from 1979 to 1988, 67 planned nuclear reactor construction projects were cancelled one after another. In July last year, Unit 3 of the Vogtle Nuclear Power Plant in Georgia, USA, was officially connected to the grid for power generation. This is the first new nuclear power unit built in the United States in more than 30 years and the first nuclear power unit to be connected to the grid for power generation in 7 years.

The Associated Press pointed out that with the successive commissioning of Units 3 and 4 of the Vogtle Nuclear Power Plant, there are currently no nuclear power plants under construction in the United States, and the Vogtle Nuclear Power Plant has also become the only commercial nuclear power project that the United States has initiated and continuously implemented in the 21st century.

It is precisely because the scale of nuclear power units has been unable to expand for a long time that tech companies have begun to turn their attention to shut-down nuclear power units.

But unfortunately, in the United States, projects with "revival" conditions like the Three Mile Island Nuclear Generating Station are rare, and relying on the resumption of work of decommissioned nuclear power plants cannot fundamentally solve the problem.

Another hidden concern for the development of nuclear power in the United States is the aging problem of the currently operating nuclear power plants in the United States. Data from the US Energy Information Administration (EIA) shows that as of April 30, 2024, the average age of commercial nuclear power reactors in operation in the United States is about 42 years.

Figure: Most of the US Nuclear Power Units Were Built and Put into Operation in the 1970s; Source: US Energy Information Administration

Equipment aging not only significantly increases safety risks but also leads to a decrease in operating efficiency and a significant increase in maintenance costs. How to gradually replace these old reactors while accelerating the construction of a new generation of reactors has become an urgent problem to be solved in the US nuclear power industry.

After all, in addition to the long development cycle, huge upfront investment, and the risk of cost overruns, the construction of nuclear power plants also requires a complex approval process and faces continuous questioning and concerns from the public about nuclear safety and nuclear waste management, all of which make the advancement of the construction of new nuclear power plants extremely difficult.

The road to nuclear power is still full of variables.

Reference Materials:

Reluctantly, Microsoft "Takes Over" a Decommissioned Nuclear Power Plant? Outlook Think Tank

Global Nuclear Power Industry Research: Seventy Years of Turbulence, and the New Wave Is Coming; Dongwu Securities

Nuclear Power Equipment: A Long Slope with Thick Snow, Steadily Moving Forward and Innovating; CICC

AI Electricity: AI Drives the Development of Nuclear Power in the United States, and SMR May Become a New Trend; CITIC Securities

Nuclear Safety in the United States Is on the Decline; China.org.cn

Is the End of AI Nuclear Power? Semiconductor Industry Insights

Follow for More Information