Top 15 Marken von Spielzeug- und Musikinstrumenten, „IP + Technologie“ bewegt die Trendwelt der Baukasten-Spielzeuge | Markenliste des Verbraucherindex von World Research Vol. 53

During this monitoring period, Lego, Transformers, and Disney ranked in the top three of the list with comprehensive popularity scores of 1.74, 1.57, and 1.45 respectively.

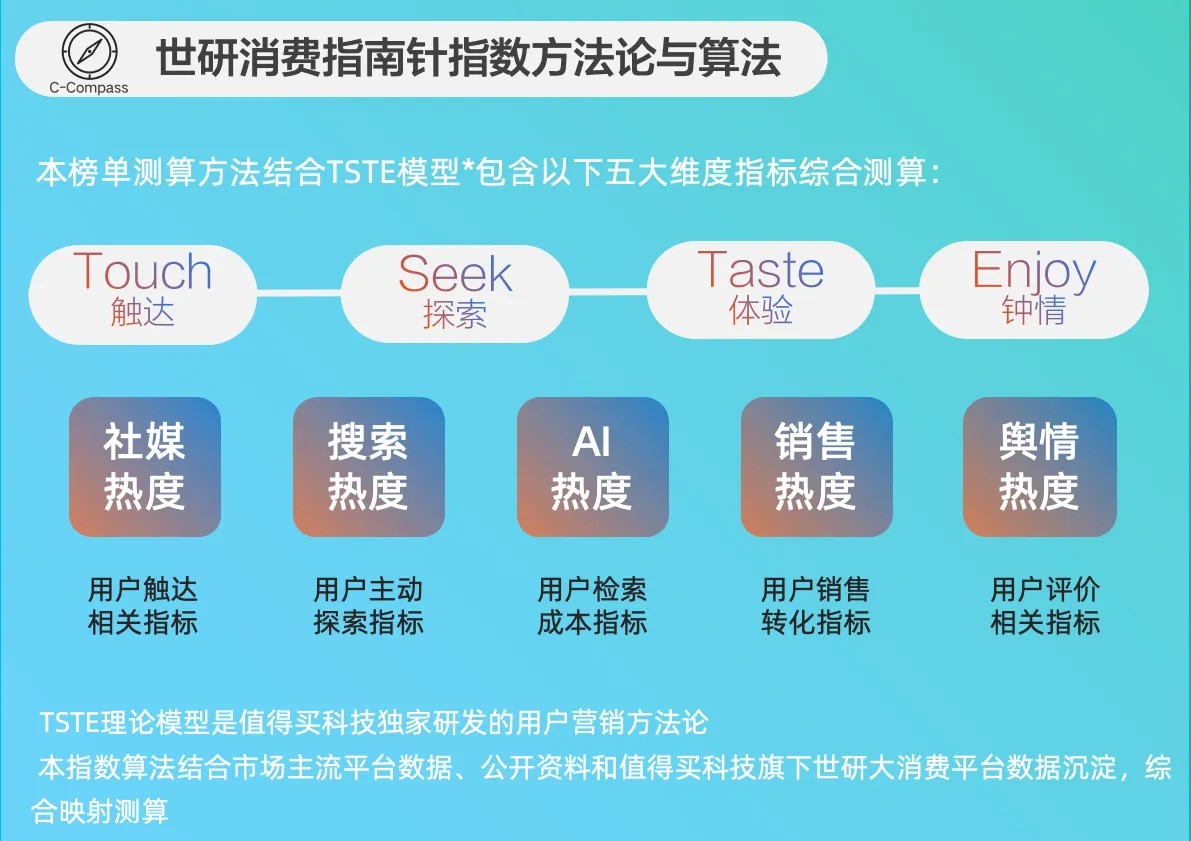

Image source: Shiyan Big Consumption Index

Parallel Progress of Technological Scenarios and IP Localization: Building Block Categories Cater to All Age Groups

In terms of brand distribution, the competition in the building block category this month is characterized by the parallel progress of technological scenarios and IP localization. Technologically, leading brands build moats through differentiated systems. Lego strengthens its ecological barriers with a "compatible system + cross - media narrative." Its adult mechanical sets, such as the Lamborghini model, meet the needs of collection and stress relief with precision parts. Bruk focuses on technological innovation for young children, with a "multi - particle high - dynamic structure" that suits children's hand development and has passed STEM certification to address parents' concerns about safety and educational value. Senbao launched a "space station" building set during the Space Day, using modular design to lower the threshold for experiencing aerospace knowledge.

The competition for IP shows strategic differences. Lego deepens its local operations in conjunction with the summer pre - launch of the Shanghai park, targeting high - net - worth customers with the premium of international IP. Bruk sold over one million pieces of Ultraman blind boxes in a single month and simultaneously launched a research base to bring the IP to lower - tier markets, penetrating second - and third - tier cities with a price range of 39 - 399 yuan. Senbao uses "national trends" to break into the market, with cultural elements like the Forbidden City and the Shandong aircraft carrier precisely capturing the cultural confidence dividend of Generation Z, creating a differentiated competition with international IP. These three brands together reveal industry trends: technological iteration extends from building experiences to educational scenario development, and IP strategies diverge into the localization of international brands and the national trend of domestic brands. Finally, through price stratification, such as high - end collectibles priced in the thousands and affordable products in the hundreds, they meet the needs of all age groups.

Indoor and Outdoor Scenarios Drive Technological Innovation: The "Hardware + Content + Data" Ecosystem for Early Education and Intellectual Development Takes Shape

The core competitiveness of children's educational and intellectual development brands lies in deepening scenarios with technology and accurately segmenting demands. In terms of technological empowerment, Miilu launched an "AI bilingual enlightenment drawing board" to enable real - life interaction with children's paintings. Scenario innovation follows two paths. In the indoor education scenario, Miilu's "open - ended toys," such as large - piece puzzles, lower the operation threshold for young children and emphasize the core of artistic creation. In the outdoor exploration scenario, taking advantage of the spring demand surge, Neway's "children's insect observation box" uses a strong supply chain to support a low - cost strategy of 50 yuan. Childhood Unlimited's "archaeological excavation set" enhances the experience with educational and scientific IP content.

These brands reflect industry trends: technological applications shift from simple function stacking to solving specific scenario pain points, such as special education and outdoor teaching, covering diverse user groups. Finally, they reconstruct the value chain of early education with a "hardware + content + data" integrated model.

Explanation of the List

The Shiyan Consumption Compass Series Index Report is a consumption index evaluation system independently developed by Shiyan Index. This series includes major lists such as the "Brand Consumption Popularity Index List," "Industry Consumption Heat Index List," "Product Consumption Wave Index List," "Popular Consumption Event List," and extended list reports within the corresponding scope. Its purpose is to objectively and truthfully present the trends and characteristics of the consumer world through index evaluation, help industries and brand owners continuously track consumer market trends, provide references for business operations, and enhance comprehensive business competitiveness.

The Shiyan Consumption Compass Series Index List continuously monitors the following industries:

3C digital products, footwear, clothing, and accessories, food and fresh produce, household appliances, sports and outdoor products, beauty and cleaning products, mother and baby products, home decoration, automotive consumption, toys, models, and musical instruments, pet products, and medical and health products, a total of 12 major industries.

Image source: Shiyan Big Consumption Index

Disclaimer

This list is compiled exclusively by Shiyan Index. The views, conclusions, and suggestions in the list are for reference only and do not represent any specific investment advice or decision - making basis.

The data in the list is calculated by combining public data from mainstream platforms and the data accumulated on the Shiyan Big Consumption Platform under Zhidemai Technology. We have taken reasonable measures to ensure the reliability and accuracy of the data, but we cannot rule out some errors or deviations due to the limitations of the data itself. In addition, some of the data in this report has not been formally audited by an independent third - party auditing institution, so there may be undetected errors or omissions. It is particularly noted that market conditions may change at any time, so the predictions, analyses, and conclusions in the report may differ from the actual situation.

Any third - party names, brands, or products mentioned in the report are for illustrative purposes only and do not constitute an endorsement or recommendation. Any mention of these third parties should not be regarded as an endorsement in any form. The copyright of the report belongs to Zhidemai Technology Group and Shiyan Index, and it may not be reproduced or distributed without permission. Zhidemai Technology Group and Shiyan Index shall not be held liable for any losses or damages arising from the use of the information in this report.