Die Cloud-Geschäftseinheit von Alibaba verzeichnet weiterhin ein starkes Wachstum, und die Unternehmensbewertung wird fortgesetzt neu bewertet | Jike Research

Author | Ding Mao

Editor | Zheng Huaizhou

After the Hong Kong stock market closed on May 15th, Alibaba released its financial reports for Q4 and the full year of fiscal year 2025.

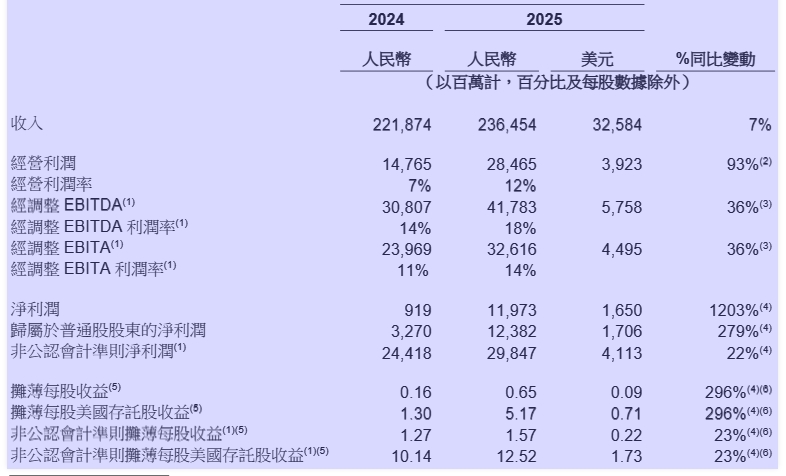

Data shows that benefiting from the steady expansion of the core e - commerce business and the rapid growth of the cloud business driven by AI demand, in this quarter, Alibaba achieved a revenue of 236.45 billion yuan, a year - on - year increase of 7%. During the same period, benefiting from revenue growth and improved operational efficiency, the company's adjusted EBITA was 32.62 billion yuan, a year - on - year increase of 36%, corresponding to an EBITA margin of 13.8%. The adjusted net profit was 29.85 billion yuan, a year - on - year increase of 22%, corresponding to a net profit margin of 12.6%.

It is worth noting that driven by strong AI demand and excessive capital expenditure, the revenue growth of the Cloud Intelligence Group during the reporting period remained remarkable. Within the quarter, the revenue growth rate of Alibaba Cloud accelerated from 13% in the previous quarter to 18%, and the fiscal - year revenue growth rate maintained double - digit expansion.

Although the financial report data for this quarter is still relatively healthy, in the current market environment, not significantly exceeding expectations will be regarded as a pessimistic signal. Therefore, last night on the U.S. market, Alibaba opened with a gap down and finally closed down 7.6%.

So, as the first financial report after the valuation logic was reshaped by AI, how did Alibaba's performance in this quarter actually fare? Looking ahead, can the value re - evaluation brought by AI continue? Does the company still have long - term investment opportunities?

The current - quarter performance is not pessimistic

In Q4 of FY2025, Alibaba achieved an operating revenue of 236.45 billion yuan, a year - on - year increase of 7%, slightly lower than the previous market consensus expectation. However, the core Taotian Group and Alibaba Cloud businesses still achieved better - than - expected growth this quarter. In particular, both the customer management revenue and AI - related revenue that the market is more concerned about reached new highs in recent years. So, although on the surface, Alibaba's growth slowed down this quarter, which to some extent triggered market concerns, in fact, the company's most core business performance remained stable and highly resilient to growth, which greatly enhanced the quality and sustainability of future performance growth.

Chart: Alibaba's revenue and profit performance in Q4 of FY25 Data source: Alibaba's financial report, compiled by 36Kr

While the revenue was growing steadily, the company's profit performance in this quarter also had some highlights. During the quarter, Alibaba's gross profit was 90.8 billion yuan, corresponding to a gross profit margin of 38%, a year - on - year increase of nearly 5 percentage points, mainly benefiting from the improvement of the Taotian Group's monetization rate and the low - base effect of the same period last year. Meanwhile, benefiting from revenue growth and improved operational efficiency, the company's adjusted EBITA was 32.62 billion yuan, a year - on - year increase of 36%, corresponding to an EBITA margin of 13.8%.

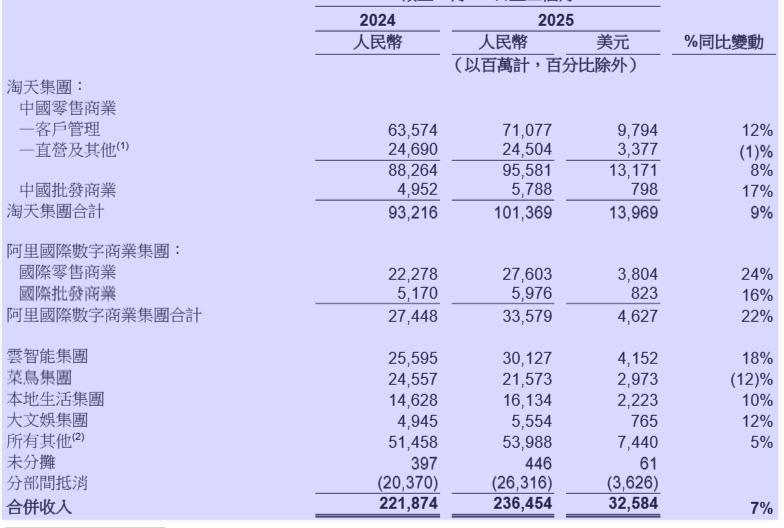

Looking at the business segments, the growth of the two core businesses, the Taotian Group and Alibaba Cloud, was still the biggest highlight this quarter. During the reporting period, the Taotian Group recorded a revenue of 101.37 billion yuan, a year - on - year increase of 9%. Among them, benefiting from the increase in the take rate, the most core customer management revenue was 71.08 billion yuan, a year - on - year increase of 12%. The Cloud Intelligence Group recorded a revenue of 30.13 billion yuan, and the growth rate continued to expand from 13% in the previous quarter to 18%. However, the drawback was that the EBITA margin of the cloud business declined by 1.9 percentage points quarter - on - quarter this quarter, mainly because the increase in depreciation and amortization expenses due to the continuous increase in capital expenditure had a certain impact on the margin, but it was within an acceptable range.

During the reporting period, Alibaba's International Digital Business Group recorded a revenue of 33.58 billion yuan, a year - on - year increase of 22%. The revenue of Cainiao Group was 21.57 billion yuan, a year - on - year decrease of 12%, becoming the biggest drag this quarter. However, the weak performance was mainly due to the transfer of some platform and fulfillment businesses to the Taotian and International E - commerce Groups. Benefiting from the business integration, Cainiao Group's adjusted EBITA increased by 55% year - on - year. The local life service recorded a revenue of 16.13 billion yuan, a year - on - year increase of 10%, but the loss far exceeded expectations, reaching 2.32 billion yuan. The revenue of the Big Entertainment segment was 5.55 billion yuan, a year - on - year increase of 12%. The revenue of other businesses was 53.99 billion yuan, a year - on - year increase of 5%.

Chart: Alibaba's segment business revenue performance in Q4 of FY25 Data source: Alibaba's financial report, compiled by 36Kr

Chart: Alibaba's segment business profit performance in Q4 of FY25 Data source: Alibaba's financial report, compiled by 36Kr

Overall, although Alibaba's financial report performance this quarter is not perfect, the strategic focus has achieved results, and the growth of the core business remains steady. Its future performance is worth looking forward to. The biggest highlight is still the improvement of the company's overall operational efficiency empowered by AI.

On the one hand, it is directly reflected in the fact that the surge in AI demand has driven Alibaba Cloud's revenue into a fast - growth channel. According to the financial report, Alibaba Cloud's revenue growth rate further expanded to 18% this quarter. Among them, driven by the faster growth of public cloud revenue, external revenue increased by 17% year - on - year, and the revenue of AI - related products achieved triple - digit year - on - year growth for seven consecutive quarters.

On the other hand, under the empowerment of AI, significant cost reduction and efficiency improvement have occurred in the retail and other Internet platform businesses, and the operational efficiency has been significantly improved. Taking the core e - commerce business as an example, on the user side, through AI empowerment and algorithm optimization, the platform effectively improved the matching degree of the user recommendation page, which not only improved the user experience but also brought higher user transaction efficiency and stabilized the platform's GMV growth. On the merchant side, new tools such as the full - site promotion optimized the advertising effect through AI and simplified the promotion process. While lowering the usage threshold, it also improved the marketing efficiency, activated the incremental advertising budgets of more small and medium - sized merchants and white - label merchants, promoted the improvement of the platform's monetization rate, and finally translated into the rapid growth of customer management revenue this quarter. During the reporting period, the Taotian Group's customer management revenue increased by 12% year - on - year, achieving the fastest growth rate in the past 16 quarters. Moreover, the increase in the monetization rate also positively improved the Taotian Group's profit.

How to view the future AI narrative logic

Looking back at the first half of the year, Alibaba's performance in the capital market has been volatile.

After the sharp rise in the stock price at the beginning of the year due to the re - evaluation of Chinese assets, the global financial market crash triggered by the China - US trade dispute in early April, and the recent stock price rebound due to the temporary easing of the trade war, Alibaba's stock price basically returned to the level in mid - February, which corresponds to the starting point of the sharp rise in the stock price caused by the soaring cloud performance and the clear huge capital expenditure in the previous quarter.

Chart: Alibaba's stock price performance Data source: wind, compiled by 36Kr

Standing back at such a critical point, whether the company can continue the valuation reshaping in the future depends on whether the AI narrative can be continuously realized and further stimulate the growth potential of the cloud business, driving Alibaba to comprehensively upgrade from a traditional Internet company to an AI technology company.

In fact, through continuous technological R & D and strategic layout, Alibaba has currently built a "trinity" AI ecosystem. It covers the underlying infrastructure mainly based on Alibaba Cloud, model R & D mainly based on the Tongyi large - scale model, and the commercialization service capabilities brought by its own rich product matrix. The full - scale positioning in each value chain has laid the foundation for its all - around development in the AI era.

According to J.P. Morgan's view, the development of Chinese generative artificial intelligence can be divided into four stages: the initial stage marked by the R & D and optimization of the basic technology of large - scale models; the second stage where AI accelerates to empower existing Internet applications; the third stage where the increase in the penetration rate of AI applications drives the growth of Internet service consumption; and the fourth stage where native generative artificial intelligence killer applications emerge.

The emergence of DeepSeek at the beginning of the year marked that Chinese generative AI officially entered the second stage. The most typical feature of this stage is that traditional Internet applications begin to quickly connect to AI models with excellent capabilities. As the model call volume surges, it directly drives the exponential growth of computing power demand, which is beneficial to the growth of the cloud business represented by Alibaba Cloud.

Specifically, AI stimulates the cloud business in this stage mainly through two ways. One is that the surge in model call volume and the iteration of model capabilities drive the growth of computing power demand, which is reflected in the surge in cloud access volume and directly benefits the computing power leasing revenue of cloud providers. On the other hand, the increase in the number of cloud access users also further promotes the demand for cloud - based calls, driving the increase in the demand for value - added services such as storage, databases, and security services.

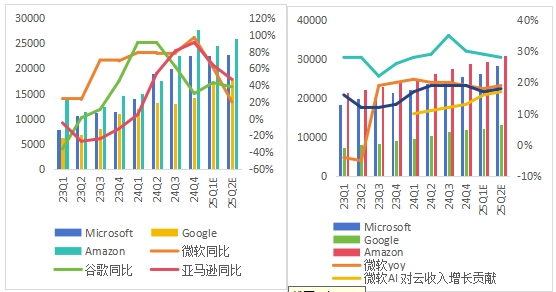

According to North American experience, cloud providers driven by AI demand have shown a typical trend of simultaneous high growth in investment and revenue. Since Q3 of 2023, the capital expenditures of Amazon, Microsoft, and Google, the three cloud providers, have gradually increased. In Q4 of 2024, the capital expenditures of major North American cloud providers all exceeded expectations, maintaining growth for five consecutive quarters with an increasing growth rate.

Along with high - level capital expenditures and strong computing power demand, the revenues of the three major overseas cloud providers have entered a prosperous period, maintaining double - digit year - on - year expansion since Q3 of 2023. In 2024, the average revenue growth rate of the three cloud providers was 21%, a year - on - year increase of nearly 5 percentage points.

Chart: Capital expenditures and AI revenue growth performance of overseas cloud providers Data source: wind, compiled by 36Kr

Back to the domestic market, based on Alibaba's all - around layout in the AI ecosystem, especially its leading large - scale model capabilities and underlying cloud infrastructure, Alibaba has become the most prominent beneficiary in the current AI development stage. In terms of model capabilities, at the end of April, Alibaba open - sourced the new - generation hybrid inference model Qwen3 (abbreviated as Qianwen 3). In multiple authoritative lists, its performance comprehensively exceeded that of global top - tier models, and at the same time, the cost was significantly reduced. As of the end of April, Alibaba's Tongyi had open - sourced more than 200 models, with a global download volume of over 300 million times and more than 100,000 derivative models of Qianwen, becoming the world's largest open - source model family.

The leading large - scale model capabilities have become an effective tool for Alibaba to empower AI implementation in various industries. After the reported cooperation with Apple at the beginning of the year, Alibaba recently further clarified the details of its cooperation with BMW and others. At the same time, according to the financial report, in addition to the Internet, intelligent automotive, finance, and online trading industries, the AI demand growth in many traditional industries such as animal husbandry is also significant at present.

Based on the strong AI demand, with the implementation of more cooperation in the future, the expected call volume of the Tongyi model is expected to accelerate. At the same time, considering the boost from the spill - over of computing power demand brought by advanced models such as Qianwen 3 and DeepSeek, it will jointly strengthen Alibaba Cloud's position as a "computing power provider". Ultimately, it will continuously translate into the growth of capital expenditure and cloud business revenue.

In fact, such a logical chain has been gradually realized in the financial reports of the past two quarters. The revenue of AI - related products has achieved triple - digit year - on - year growth for seven consecutive quarters, driving Alibaba Cloud's revenue to continue to accelerate in the past two quarters, reaching 13% and 18% respectively. At the same time, Alibaba's capital expenditure in Q3 of FY25 was as high as 31.4 billion yuan, and on this basis, it further invested 24.6 billion yuan in Q4 of FY25. In February this year, Wu Yongming also announced that in the next three years, Alibaba will invest more than 380 billion yuan in building cloud and AI hardware infrastructure, with the total amount exceeding the sum of the past ten years.

The explosion of AI applications is the accelerator for Alibaba's future valuation expansion

With the continuous improvement of model capabilities and the cost - reduction trend, the expected explosion of native AI applications in the future is the key factor to boost Alibaba's long - term performance and will also directly determine how much room there is for Alibaba's future valuation to increase.

As mentioned above, open - source models such as DeepSeek and Tongyi Qianwen have led large - scale models into the era of "equal rights", becoming a comprehensive popularization of large - scale model capabilities. This means that the cost of using advanced models has dropped sharply. The general market expectation is that after the cost reduction of models, a new round of explosion of native AI terminal applications will be triggered.

Once a new round of innovation cycle of native AI applications starts, it will promote the emergence of more "cloud - native enterprises", further boost the demand for cloud - based calls, and drive the cloud computing market into the third round of high - speed expansion cycle.

In fact, this logic is very similar to the first wave of cloud computing expansion driven by the transformation from PC Internet to mobile Internet from 2014 to 2018.

In December 2013, the