ZhiKe | Geschichte miterleben! Ist etwas Schrecklicheres als der Zusammenbruch der US - Aktienmärkte im Gange?

Author | Huang Yida

Editor | Zheng Huaizhou

Last week (April 7th - 11th), as the tariff war kicked off, the US stock market entered a sharp decline mode in a short period, and the US dollar exchange rate weakened. What surprised the market even more was that US Treasury bonds also softened simultaneously. The yield of the 10-year US Treasury bond increased by more than 60 basis points at its maximum last week.

After the above-mentioned triple blow to stocks, bonds, and the exchange rate, from an investment logic perspective, the trends of the US stock market and the US dollar were somewhat expected, while the performance of US Treasury bonds was rather abnormal. Therefore, the market is more worried about the short-term sharp increase in the yield of US Treasury bonds, and there are even discussions about the "collapse" of US Treasury bonds.

So, what caused the unexpected sharp increase in the yield of US Treasury bonds in this round? Why does the market have concerns about the "collapse" of US Treasury bonds?

01 The unwinding of US Treasury basis trades is the main driver of the increase in US Treasury yields in this round

Last week, the yield of the 10-year US Treasury bond increased by more than 60 basis points at its maximum during the week, and together with the US stock market and the US dollar, it achieved a triple blow to stocks, bonds, and the exchange rate in the short term. Such performance does not conform to the general logic of asset pricing at all. Usually, when tariff issues cause a decline in risky assets such as stocks and commodities, safe-haven assets such as bonds and gold will strengthen correspondingly. However, this is not the case.

Looking at the trend of US Treasury yields from the fundamental pricing logic, when the tariff shock occurred, the VIX index climbed rapidly and once reached a high of 60.13, the highest in half a year. Although it declined to some extent afterwards, the current relatively high level indicates that the market has not fully digested this information, and investors' risk-averse sentiment remains high, which is beneficial to safe-haven assets.

Chart: Trend of the VIX index; Source: Wind, 36Kr

From the perspective of inflation and interest rate cuts, tariffs may lead to an increase in reflation expectations. However, the transmission of inflation has a certain lag and generally will not be reflected in the pricing of US Treasury bonds so quickly. Moreover, the current interest rate cut cycle and the long-term expectation of a decline in the benchmark interest rate do not support a trend increase in US Treasury yields. Therefore, the current fundamentals cannot explain the rapid increase in US Treasury yields in the short term.

In terms of market liquidity, according to historical experience, when safe-haven assets and risky assets decline simultaneously, it mainly reflects a rapid tightening of market liquidity in the short term. Some liquidity indicators in the US money market, such as the SOFR - ONRRP spread and the SOFR - OIS spread, show that the liquidity of the US dollar has tightened to varying degrees, but it has not reached the level of the liquidity crisis in 2020. Therefore, the short-term tightening of liquidity is one of the reasons for the recent rapid increase in US Treasury yields.

On the trading side, a report from Bloomberg has attracted much attention from the market, that is, the basis arbitrage trading of US Treasury bonds has encountered large-scale unwinding. Currently, the basis arbitrage trading of US Treasury bonds is mainly participated in by hedge funds. As the largest marginal holders of US Treasury bonds at present, the trading behavior of hedge funds will have a great impact on the pricing of US Treasury bonds.

One of the characteristics of US Treasury basis trades is high leverage, and the trading direction is mainly shorting volatility. When market volatility increases, with losses on the asset side, basis trades can only be unwound passively. By selling assets to obtain liquidity to meet the need for additional margin due to asset losses, it enters a negative feedback loop of continuous asset sales and additional margin calls, and the deleveraging of institutions further amplifies the trading volume.

It can be seen that the unwinding of basis trades is the main driver of the sharp increase in US Treasury yields in this round at the trading level. At the same time, the market's demand for safe-haven assets remains strong. When traditional safe-haven assets lose their safe-haven properties in the short term, investors seeking safety will turn to holding cash and selling assets, thus further intensifying the short-term volatility of US Treasury bonds.

02 The function of US Treasury bonds as the anchor of asset pricing is weakening

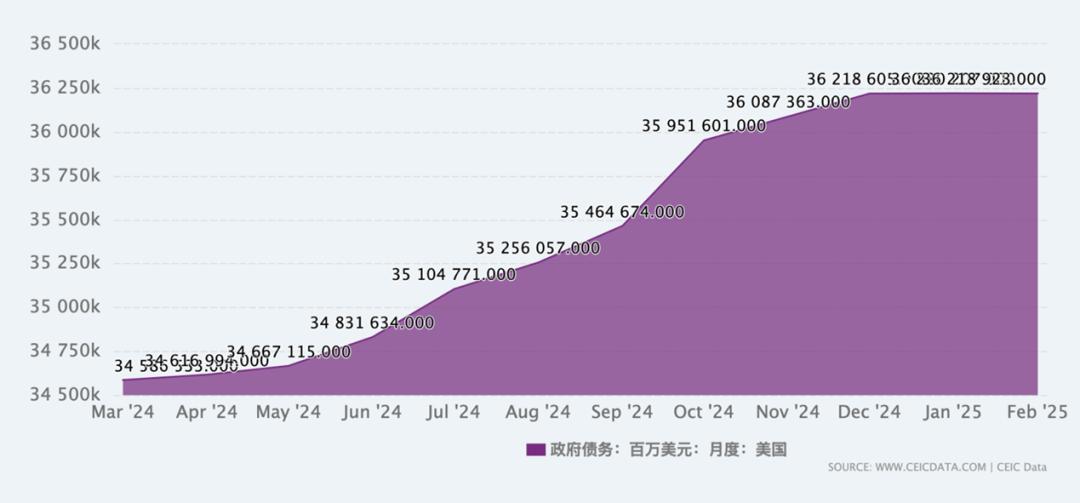

As a risk-free interest rate and combined with the sovereign credit of the United States, US Treasury bonds have long been a natural safe haven for global capital. As of February this year, the total scale of US Treasury bonds exceeded $36 trillion. According to the current holder structure of US Treasury bonds, the scale of relatively active trading positions is also huge. However, from the market performance of US Treasury bonds in recent years, the safe-haven property of US Treasury bonds is gradually weakening.

Chart: Changes in the scale of US Treasury bonds in recent years; Source: CEIC, 36Kr

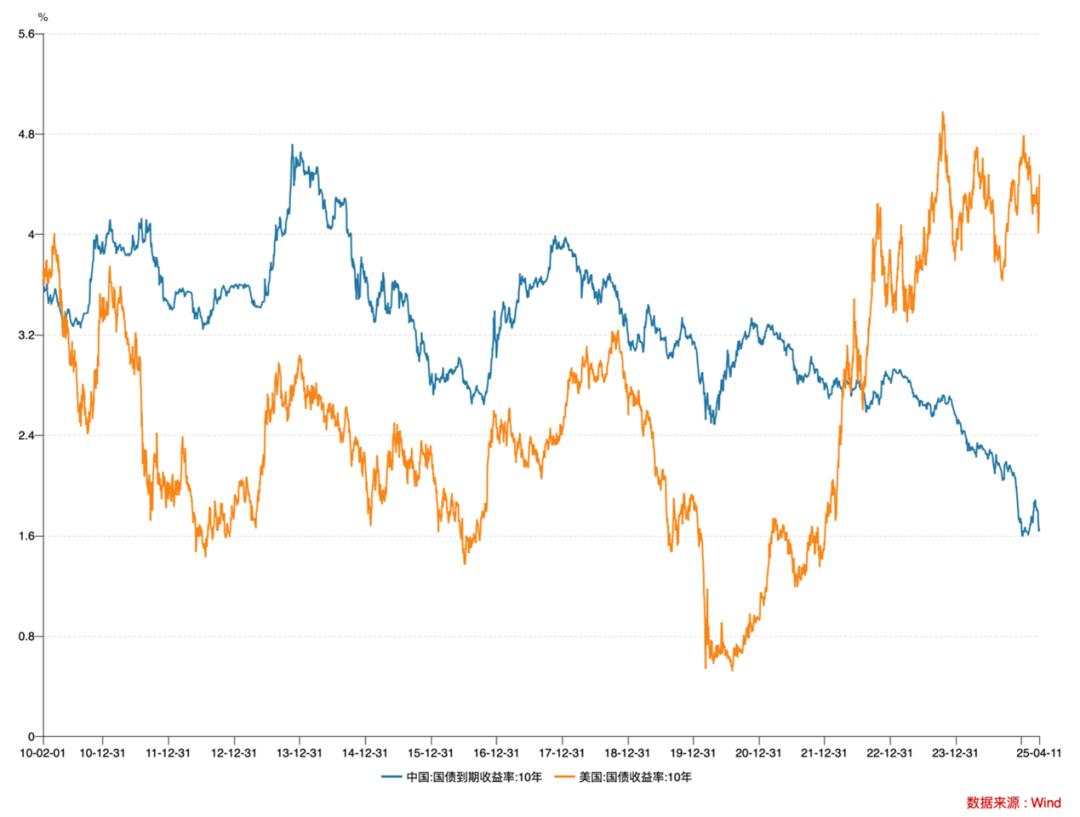

The current valuation form of US Treasury bonds is the result of being reshaped by multiple factors such as the pandemic, interest rate hikes, and geopolitics. One important characteristic is the long-term inversion of the China-US interest rate spread. Although both Chinese bonds and US Treasury bonds are regarded as representatives of risk-free interest rates, due to the difference in sovereign credit, their pricing levels are not the same. Therefore, for a long historical period, the valuation of Chinese bonds with the same maturity is generally higher than that of US Treasury bonds.

After the pandemic and interest rate hikes, the China-US interest rate spread has been inverted for a long time. The deep-seated reason is the long-term deglobalization, which has led to an obvious dislocation of the economic cycles of China and the United States. China's monetary policy has also become more independent, emphasizing self-reliance, thus weakening the correlation between Chinese bonds and US Treasury bonds. In a sense, the anchoring ability of US Treasury bonds to other assets has weakened after the valuation reshaping.

Chart: Trends of the yields of 10-year Chinese and US Treasury bonds; Source: Wind, 36Kr

Looking at the current valuation of US Treasury bonds, as of April 11th, the yield of the 10-year US Treasury bond was recorded at 4.48%, far higher than the median level of 2.4% between 2010 and 2019. The overall high level of US Treasury yields is mainly because in the previous interest rate hike cycle, US Treasury yields were passively pushed up to a historical high as the benchmark interest rate increased. Currently, it is still in the early stage of the interest rate cut cycle, and the process of interest rate cuts is relatively long. Therefore, the still high benchmark interest rate determines that US Treasury yields are still at a relatively high historical level.

How tariffs affect the trend of interest rate cut expectations is detailed in our Zhike article "Is the Fed indifferent to tariffs?" . Due to the Fed's increasing caution towards interest rate cuts, the pace of the interest rate cut cycle may be extended, which has had a certain negative impact on the downward expectation of US Treasury yields.

From an investment perspective, without the impact of tariffs, going long on US Treasury bonds during the interest rate cut cycle is a very clear investment opportunity. However, precisely because of the impact of tariffs, future geopolitical events will have more frequent short-term impacts on US Treasury bonds. Coupled with the relatively high trading volatility of US Treasury bonds themselves, this increases the risk exposure of investing in US Treasury bonds. Therefore, based on the current valuation level and pricing logic of US Treasury bonds, the risk premium of holding US Treasury bonds is rising, and correspondingly, the safe-haven property of US Treasury bonds is gradually weakening.

03 Will US Treasury bonds really experience a technical default?

The supply and demand issue of US Treasury bonds has also raised widespread concerns in the market. Another reason for the short-term sharp increase in US Treasury yields in this round is that the auction result of the 3-year US Treasury bond on April 8th showed weak demand, which has led the market to worry about the auction demand for the 10-year and 30-year US Treasury bonds in the future.

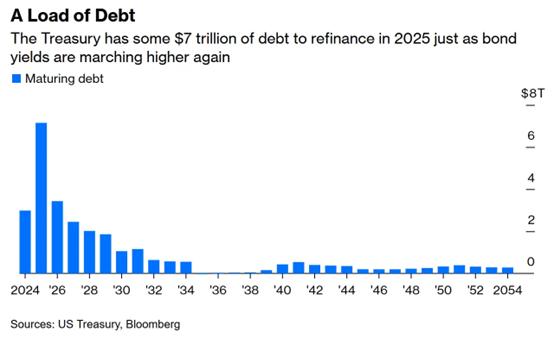

Compared with the above short-term issues, a bigger problem for US Treasury bonds this year is the possibility of a technical default. Bloomberg data shows that more than $7 trillion of US Treasury bonds will mature this year. Considering the pace of interest rate cuts, even if these $7 trillion of Treasury bonds are successfully refinanced, at the current interest rate level, the US government's debt burden will become very heavy.

Chart: Maturity scale and rhythm of US Treasury bonds; Source: Bloomberg, 36Kr

One of Trump's core fiscal demands is to reduce the deficit. However, due to the huge amount of US Treasury bonds maturing this year, the huge interest expenditure caused by refinancing is definitely not what he wants. Therefore, in the "Mar-a-Lago Agreement" proposed in November last year, one of the core issues was the restructuring of US Treasury bonds. One of the notorious measures was to force creditor countries to convert their currently held US Treasury bonds into ultra-long-term zero-coupon bonds.

Japan and China, as the top two holders of US Treasury bonds, are the most affected. It can be seen that tariffs are actually the negotiation chips for the US debt restructuring. However, China is not Japan during the Plaza Accord. China's policy-making has long been based on its own interests, and external constraints are not the main consideration. Especially with the long-term deglobalization, the impact of tariffs on China's economy has been gradually weakened. While adhering to an independent path, there is no need to compromise on tariff issues.

Under the above policy expectations, the refinancing of US Treasury bonds this year will face great pressure. Regardless of the absurdity of the Mar-a-Lago Agreement, given the current situation where the attractiveness of US Treasury bonds is somewhat insufficient, at the critical moment of the huge maturity of US Treasury bonds, the uncertainty of the market's demand for US Treasury bonds may lead to a technical default of US Treasury bonds. Since a large number of financial assets and transactions are anchored to US Treasury bonds, once a technical default occurs, it is very likely to trigger a new round of financial tsunami.

This also explains why the market is so concerned about US Treasury bonds in the context of the tariff war. Facing such risks, according to historical experience, the Fed usually steps in to expand its balance sheet to fill the demand gap for US Treasury bonds. However, considering the Fed's independence, monetary policy will be a tool for the game with Trump to prevent him from going too far on tariff issues. Therefore, investors can be relatively optimistic about this round of the tariff war, but at the same time, they should also be wary of the impact of short-term events on the market.

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment should be cautious. In any case, the information in this article or the opinions expressed do not constitute investment advice for anyone. Before making an investment decision, if necessary, investors must consult professionals and make decisions carefully. We have no intention to provide underwriting services or any services that require specific qualifications or licenses for the trading parties.