Die Top 15 Sport- und Outdoor-Marken im Februar: Kunden zahlen für ein abenteuerliches Lebensstilkonzept | Markenliste des Weltforschungs-Verbraucherindex

Image source: Shiyan Big Consumption Index

During this monitoring period, Li-Ning, Adidas, and Nike ranked top three in the comprehensive popularity list with comprehensive popularity scores of 1.90, 1.87, and 1.80 respectively.

The functional value of sports consumption gives way to the spiritual value, and brands drive users to pay for their lifestyle

The three major brands, Li-Ning, Nike, and lululemon, have jointly responded to the deep - seated demand transformation of users from "buying products" to "subscribing to values" through the triple - strategy of "creating scenarios, telling technological stories, and elevating emotions". Firstly, in terms of creating scenarios, brands have shifted from product display to the construction of spiritual domains. For example, Li-Ning created a light outdoor utopia with a real - life film of a "spring outing journey", conveying the concept of "outdoor is life"; Nike built a professional competitive hall through cross - country races, creating a technological perception of "Nike = cross - country authority". In essence, they all eliminate the tool attribute of products through scenario immersion.

Secondly, in terms of technological storytelling, brands have achieved a shift from parameter stacking to cognitive monopoly. For example, Nike's ZoomX foam technology is bundled with event - level certifications, and Li-Ning's reflective technology windbreakers are integrated with variety - show content. In essence, they transform technological indicators into "perceivable value symbols". Finally, in terms of emotional elevation, it's a shift from functional satisfaction to the expression of life state. lululemon uses a 78 - year - old fitness idol to break through "age shame", and Li-Ning uses intangible cultural heritage elements to awaken cultural identity. They all use products as "value carriers" to convey brand concepts.

As Generation Z and the silver - haired population have become the main forces in sports consumption, users' needs have expanded from "body shaping and muscle building" to spiritual propositions such as "fighting age anxiety" and "achieving cultural belonging". The strategic commonalities of the three major brands reflect a fundamental change in the sports consumption market: users no longer pay for "sports" itself, but for "the lifestyle imagination represented by sports". The consumption trends pursued by users have shifted from "functional satisfaction" and "physical sense of ownership" to "identity recognition" and "spiritual gain".

The demand for immersive experience has spawned the creation of flagship store domains, and spatial storytelling has reconstructed the concept of outdoor consumption

Arc'teryx and KAILAS have reconstructed the outdoor consumption experience through a flagship store scenario revolution this month. The driving factors stem from users' dual needs for "immersive professional perception" and "brand belief building". Arc'teryx's "Cliff House" in Changsha displays equipment such as ice axes and crampons in sections according to climbing and skiing scenarios. Through the restoration of rock textures and extreme states, the store is transformed into an "outdoor spiritual church"; KAILAS' "Rock Space" in Shenzhen creates an equipment museum in a black - and - white minimalist style, centrally displaying professional product lines such as the MONT series of hard - shell windbreakers and 8000GT one - piece down jackets, and strengthening performance authority with a "full - scenario coverage" technology matrix. The two brands jointly reveal that consumers have shifted from "buying single products" to "paying for scenario solutions". They not only require products to handle real outdoor challenges such as extreme cold protection and rock climbing but also need to obtain identity recognition through spatial storytelling. The flagship store has become a domain where brands and users conclude an "outdoor belief contract". In essence, outdoor consumption has been upgraded from functional satisfaction to a two - way pursuit of "technological worship + spiritual belonging", driving the industry to shift from "selling equipment" to "selling adventure lifestyles".

Explanation of the list

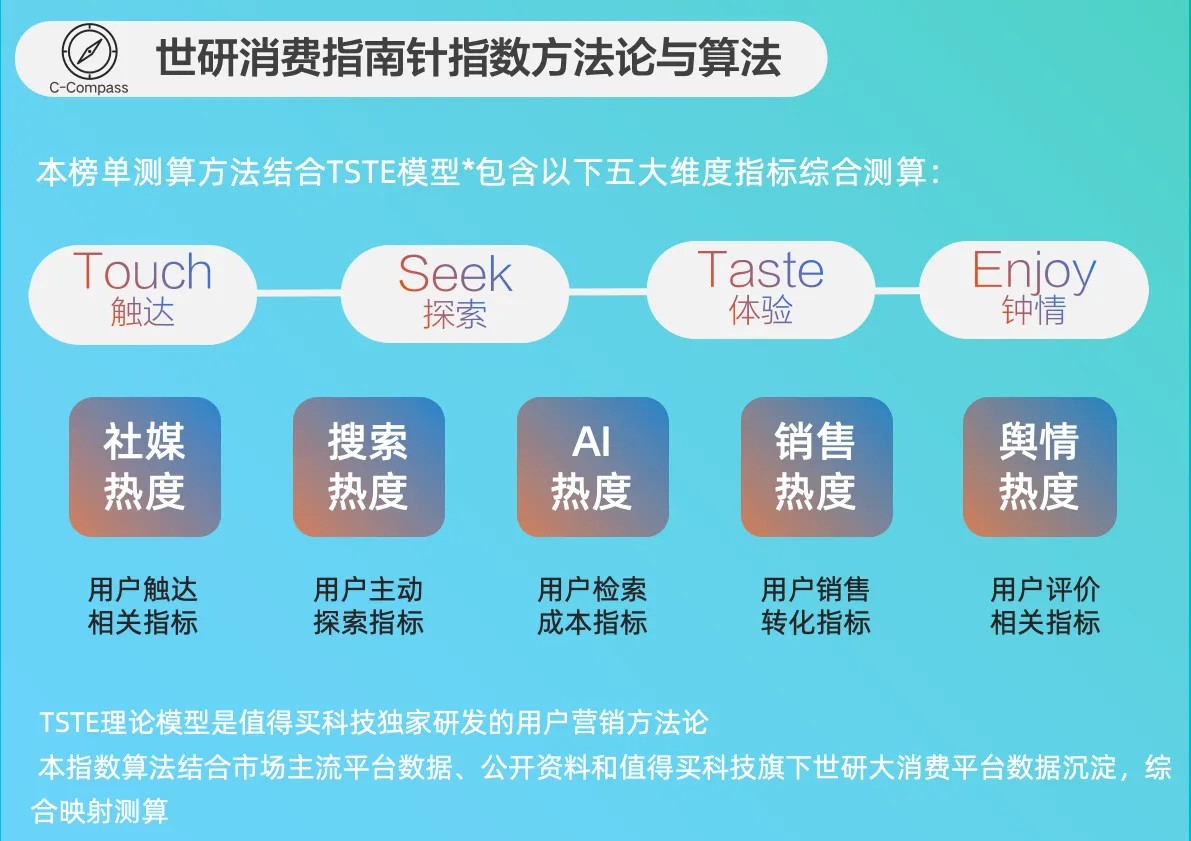

The Shiyan Consumption Compass Series Index Report is a consumption index evaluation system independently developed by Shiyan Index. This series includes major lists such as the "Brand Consumption Popularity Index List", the "Industry Consumption Heat Index List", the "Product Consumption Wave Index List", the "Consumption Popular Event List", and extended list reports for corresponding scopes. It aims to objectively and truly present the trend characteristics of the consumption world through index evaluation, help industries and brand owners continuously track consumption market trends, provide references for enterprise operations, and enhance comprehensive business competitiveness.

The Shiyan Consumption Compass Series Index List continuously monitors the following industries:

12 major industries in total, including 3C digital products, footwear, clothing and accessories, food and fresh produce, household appliances, sports and outdoor products, beauty and cleaning products, mother and baby products, home decoration, automobile consumption, toys, models and musical instruments, pet products, and medical and health products.

Image source: Shiyan Big Consumption Index

Disclaimer

This list is independently compiled by Shiyan Index. The views, conclusions, and suggestions in the list are for reference only and do not represent any specific investment advice or decision - making basis.

The calculation of the list data combines public data from mainstream platforms and data precipitation from the Shiyan Big Consumption Platform under the ownership of Zhidemai Technology. We have taken reasonable measures to ensure the reliability and accuracy of the provided data as much as possible, but we cannot rule out partial errors or deviations due to the limitations of the data itself. In addition, some data in this report have not been formally audited by an independent third - party auditing institution, so there may be unidentified errors or omissions. It is especially reminded that the market situation may change at any time, so the predictions, analyses, and conclusions in the report may differ from the actual situation.

Any third - party names, brands, or products mentioned in the report are for illustration purposes only and do not constitute recognition or recommendation of them. Any mention of these third - parties should not be regarded as an endorsement or recommendation in any form. The copyright of the report belongs to Zhidemai Technology Group and Shiyan Index. It shall not be reproduced or distributed without permission. Zhidemai Technology Group and Shiyan Index shall not bear any legal liability for any losses or damages caused by the use of the information in this report.