Among the leading real estate developers, which one acquired the least land?

In the first half of the year, the top 100 real estate enterprises in terms of land acquisition spent a total of 506.55 billion yuan in the land auction market, a year-on-year increase of 33.3%, showing a rare positive growth since 2022.

However, the year-on-year increase in the amount was achieved by putting a large number of high-quality land parcels in the core areas of various cities on the market. If calculated by the transaction area of residential land, the transaction area of residential land in 300 cities counted by the China Index Academy continued to shrink.

At the same time, real estate enterprises are further focusing on key first - and second - tier cities, especially several popular cities such as Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou, and Chengdu.

In the future, the foundation of the real estate market lies in the top 20 - 30 cities. In the first half of the year, the land transfer fees of the top 20 cities accounted for more than 65% of the national total, while the sum of the other cities only accounted for one - third.

For real estate enterprises, the "battlefield" of the real estate market has become smaller, and direct confrontation in the land markets of these cities is inevitable.

On the one hand, the intensifying competition among leading real estate enterprises is the main reason for the frequent increase in the premium rate of high - quality land parcels. The consequence is that the cost of real estate projects for enterprises is getting higher and higher.

On the other hand, real estate enterprises with weaker "capital + operation" capabilities will soon be squeezed out of the first echelon. What enables real estate enterprises to outperform is no longer the explosive power in a certain year, but the continuous capital endurance and product upgrading capabilities.

It is worth noting that the median equity land acquisition amount of the top 100 real estate enterprises is only about 2 billion yuan, and the equity land acquisition amount of the top - ranked enterprise has reached 14.8 times that of the 30th - ranked enterprise. Now and in the future, there are only about 20 real estate enterprises with the ability to comprehensively develop in multiple urban agglomerations. The situation of blooming in multiple popular cities across the country has nothing to do with 80% of the enterprises.

01 Who is Making Efforts

The top 10 real estate enterprises in terms of equity land acquisition amount in the first half of the year are Poly Developments and Holdings Group Co., Ltd., China Overseas Land & Investment Limited, Greentown China Holdings Limited, C&D Real Estate Group Co., Ltd., Binjiang Group Co., Ltd., China Resources Land Limited, China Jinmao Holdings Group Limited, China Merchants Shekou Industrial Zone Holdings Co., Ltd., Poly Property Group Co., Ltd., and Yuexiu Property Co., Ltd.

China Overseas Land & Investment Limited ranked first in land acquisition last year, but in the first half of this year, it was replaced by Poly Developments and Holdings Group Co., Ltd.

Top 10 Real Estate Enterprises in Terms of Equity Land Acquisition Amount and Area in the First Half of 2025

Two real estate platforms under Poly Group both entered the top ten. In order to maintain its first - place position in terms of sales volume in the industry, it continues to charge forward.

In the four major metropolitan areas, Poly Developments and Holdings Group Co., Ltd. has made key investments, especially in the Yangtze River Delta, where the new - housing market performed better in the first half of this year, and the Beijing - Tianjin - Hebei region centered on Beijing. The land acquisition amount in the first half of this year has far exceeded the whole of last year.

Land Acquisition Situation of Poly Developments and Holdings Group Co., Ltd. in Various Regions in the First Half of 2025

Another real estate enterprise that is obviously accelerating land acquisition is China Jinmao Holdings Group Limited.

In the first half of 2025, China Jinmao spent 26.1 billion yuan in the land market. In contrast, it only spent 18.7 billion yuan on land acquisition throughout last year.

On June 27th, China Jinmao acquired land in three cities, Chengdu, Hangzhou, and Hefei, simultaneously, with a total land price reaching 5.144 billion yuan. Among them, the premium rate of the plot GS1004 - 9 - 2 in the former Canal New City Unit in Hangzhou was as high as 55.91%.

From the perspective of the newly - added land value, it better reflects China Jinmao's eagerness to make progress. Its total newly - added land value reached 74.9 billion yuan, even surpassing China Overseas Land & Investment Limited.

In recent years, China Jinmao once fell out of the 100 - billion - yuan camp, and its industry ranking dropped to the 13th place, becoming the first central - state - owned enterprise to be eliminated from the leading camp.

Now, China Jinmao has finally climbed out of the trough. Since this year, China Jinmao has taken a series of major actions. First, it changed its leadership, and then it drastically adjusted its organizational structure, simplifying the "headquarters - region - city" model to a two - level management model of "headquarters - area". The positions of the main leaders of the North China Region, East China Region, South China Region, Central China Region, and Southwest Region were all removed for management adjustment. At the same time, it streamlined the city - level companies and focused on key areas.

After going light this year, it has begun to accelerate again in terms of land acquisition and marketing. As an enterprise with product - strength accumulation, if China Jinmao can give full play to its potential, its future performance ranking will definitely rise.

Total Newly - Added Land Value of the Top 10 Real Estate Enterprises in Land Acquisition in the First Half of 2025

Another real estate enterprise that frequently made headlines for land acquisition in the first half of the year is C&D Real Estate Group Co., Ltd. Its land acquisition intensity in the first half of the year reached 64.22%, second only to China Jinmao and Greentown China in the leading camp.

In Hangzhou, Chengdu, and Chongqing, C&D Real Estate successively won three land kings, becoming the new "land - king harvester". Among them, the premium rate of the land parcel in Hangzhou reached 115.39%, and the floor price reached 88,000 yuan per square meter.

Actually, C&D Real Estate started to accelerate land acquisition five years ago. From 2020 to the first half of this year, its ranking in the industry in terms of equity land acquisition amount was 13th, 10th, 4th, 4th, 5th, and 4th respectively, and it has been stably ranked among the top 5 in the industry in the past four years.

C&D Real Estate's style has also influenced Xiangyu Real Estate and Guomao Real Estate, which are also part of the "three - swordmen" of Xiamen state - owned assets.

The land acquisition - to - sales ratio of Xiangyu Real Estate in the first half of this year was as high as 79.45%. It used 80% of its sales revenue for land acquisition, and its investment intensity far exceeded that of the first - echelon enterprises. The land acquisition - to - sales ratio of Guomao Real Estate also reached 56.81%.

After the large - scale retreat of private "Fujian - based" real estate enterprises such as Shimao Group, CIFI Group, Zhongjun Group, Sunshine City Group, and Taihe Group, C&D Real Estate, Xiangyu Real Estate, and Guomao Real Estate have taken over the baton and aggressively entered the real estate circles of Shanghai and Beijing.

02 Who is Shrinking

Daring to boldly acquire land usually sends two signals: first, the enterprise has sufficient working capital and the ability to invest; second, the enterprise has the willingness and goal to boost performance and is willing to take risks to exchange money for growth.

On the contrary, real estate enterprises that acquire less land either have financial conditions that do not support it, such as Vanke, or have made investment mistakes before and are now adjusting their pace, such as Huafa Group.

In the first half of 2025, the equity land acquisition amount of Huafa Co., Ltd. was only 2 billion yuan, and its land acquisition - to - sales ratio was in single digits, which was out of place among the top 10 enterprises.

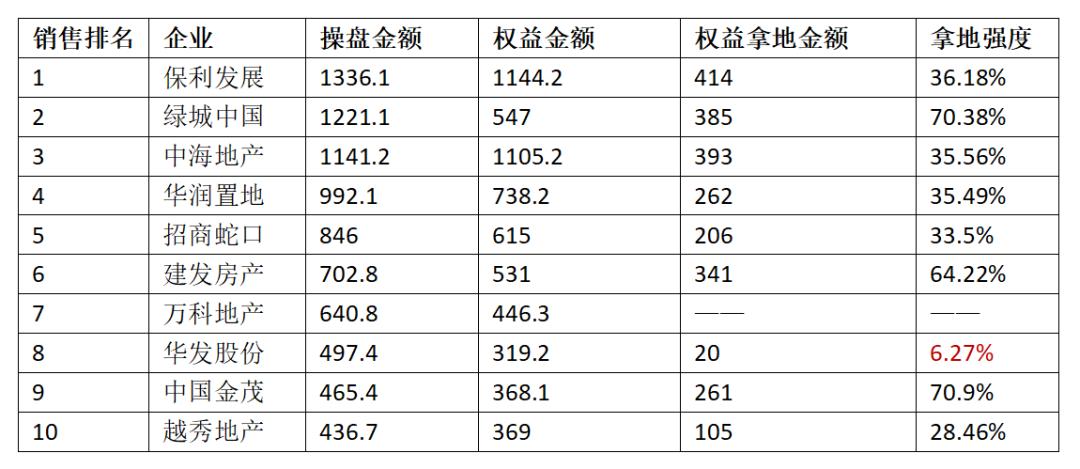

Sales and Land Acquisition Situations of the Top 10 Real Estate Enterprises in the First Half of 2025

Actually, Huafa started to "step on the brakes" in the land market last year, only acquiring a few land parcels sporadically in the outer areas of Shanghai and Xi'an. Its total land acquisition amount even failed to rank among the top 100 in the industry.

Huafa was most aggressive in 2022 and 2023. Its equity land acquisition amounts in these two years were 29.9 billion yuan and 28 billion yuan respectively, directly ranking 10th in the industry.

Among them, Huafa focused on Shanghai. In 2022, it invested 21.909 billion yuan in Shanghai, accounting for 73.3% of its annual total land acquisition amount; in 2023, it invested another 12.3 billion yuan in Shanghai, outperforming China Overseas Land & Investment Limited and Poly Developments and Holdings Group Co., Ltd.

But then Huafa faded out of the land market. According to industry insiders' analysis, the main reason is that Huafa acquired the wrong land. For example, the sales of two projects of Huafa, Huafa Guanlan Peninsula in Zhoupu, Pudong, and Huafa Haishang Duhui in Dongjing, Songjiang, were not smooth. For the projects with relatively good sales, such as Suhe Century, Huafa Four Seasons Peninsula in Zhuanqiao, Minhang, Peninsula Huating, and Gumei Huafu, their reputations collapsed one after another, and the brand image was affected.

This year, Huafa experienced a major personnel upheaval. Core executives such as Li Guangning, Zhang Chi, Yu Weiguo, Zhang Yan, and Luo Bin collectively left the company, and the company entered an adjustment period and had no time to focus on other things in the short term.

Normally, it is normal for the land acquisition amount to be one - third of the sales amount. If it is lower than this value, it indicates that the current land acquisition intensity is relatively low.

In the first half of this year, in addition to Huafa and Vanke, the land acquisition intensity of Yuexiu Property was also lower than 30%. However, Yuexiu has relatively strong operation capabilities. The ratio of its equity newly - added land value to total newly - added land value in the first half of the year reached about 1:2.5. It can leverage higher sales through product strength by "minority - stake operation".

Generally speaking, except for some special cases, the positions and strategies of leading enterprises have been relatively stable, and their land acquisition intensities are generally high. Most of the real estate market cakes in key first - and second - tier cities have been divided up by them.

As the first - echelon real estate enterprises continue to acquire land with high intensity, it may be the second - and third - echelon real estate enterprises that will be squeezed in the future. They will gradually shrink from their previous national layouts to a few major cities or even retreat to a certain region.

03 Who is at Risk of Falling Behind

In the real estate industry, the biggest variable in the future lies in the enterprises currently ranked 11th - 20th.

Nearly half of the enterprises in this ranking have had operational problems before, and their performance has declined. For example, Country Garden, Sunac China Holdings Limited, Greenland Holdings Group Co., Ltd., and Gemdale Corporation.

There are also enterprises that have invested large amounts of funds in the land market in recent years but have not been able to stabilize in the first echelon due to the fierce competition for the leading positions in the industry. For example, Binjiang Group.

The situations of the real estate enterprises ranked 11th - 20th are very different, showing three distinct levels:

- High - intensity land acquisition (Binjiang Group, Poly Property Group Co., Ltd.). The total sales revenue of Binjiang Group in the first half of the year was 43.16 billion yuan, and its equity land acquisition amount was 31.3 billion yuan. The land acquisition - to - sales ratio reached 72.5%, exceeding that of all the top 10 real estate enterprises.

- Normal land acquisition (China Railway Construction Real Estate Group Co., Ltd., China Construction Yipin Group Co., Ltd.). Including China Construction Zhidi, China Construction Dongfu, and China Construction Jiuhe under the China Construction System, they will all be the most powerful competitors in the 11th - 20th ranking in the industry in the future.

- Low - intensity land acquisition (Longfor Group, Power Construction Real Estate Group Co., Ltd., etc.). For these enterprises, with strong competitors in front and pursuers behind (China Construction System, Xiangyu Real Estate, Guomao Real Estate), they face great pressure to maintain their rankings and are likely to gradually fall behind.

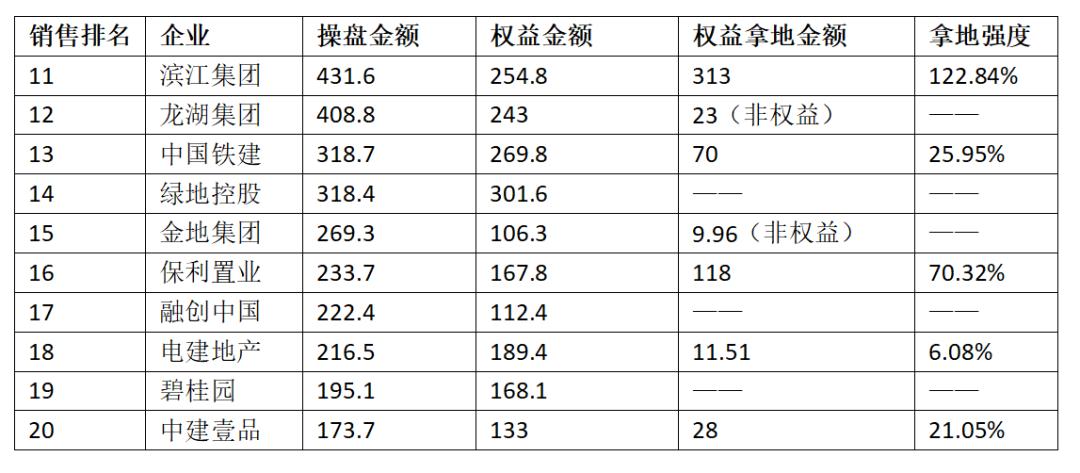

Sales and Land Acquisition Situations of the Top 11 - 20 Real Estate Enterprises in the First Half of 2025

Real estate enterprises that acquire less land at present will face greater sales pressure in the future. Only by seizing the right opportunity to acquire land can they stay in the game and survive until the next cycle.

Another set of data from the China Index Academy shows that in the first half of 2025, among the samples of 20 representative real estate enterprises, the contribution rate of the sales performance in first - tier cities increased by 9.0 percentage points year - on - year to 40.0%, and second - tier cities contributed 47.8% of the sales performance. The combined contribution rate of the two reached 87.8%.

As the