Marketing Observation | What Was Said in the WeChat Open Class 2025?

Text | Wang Yuchan

Editor | Qiao Qian

On January 9, the 2025 WeChat Open Class continued the tradition of "not being public" that was revised last year. Once again, a small meeting for industry insiders was held behind closed doors, without inviting the media or opening a live broadcast.

However, based on the photos sent back by the on-site audience, we still learned some core information announced by the WeChat team. In this open class, the focus was on explaining the relationship between the WeChat Mini Store, Mini Programs, and Service Accounts planned by the WeChat team, as well as the updates at the e-commerce infrastructure level. The recently popular "Send Gifts" feature also occupied a considerable amount of space in the open class and is expected to officially debut during the upcoming Spring Festival.

The WeChat lecturer announced that The GMV scale of the WeChat Mini Store in 2024 increased by 1.92 times, the number of orders increased by 2.25 times, the number of products in active sales increased by 3.83 times, the GPM increased by 1.5 times, and the number of merchants in active sales per month increased by 1.7 times. Apparel and home furnishings, fresh food, jade and cultural playthings, personal care and beauty products, education and training, mother and baby toys, books, audio and video, etc. are the dominant categories that are growing rapidly on the Video Account currently.

The proportion of users over 25 years old on the Video Account is as high as 97.7%, and the proportion of women is 63%. Users from first-tier and new first-tier cities account for 32%, second and third-tier cities account for 40%, and fourth, fifth, and sixth-tier cities and overseas account for 28%. It can be concluded that the core user group of the Video Account is adult women from second and third-tier cities.

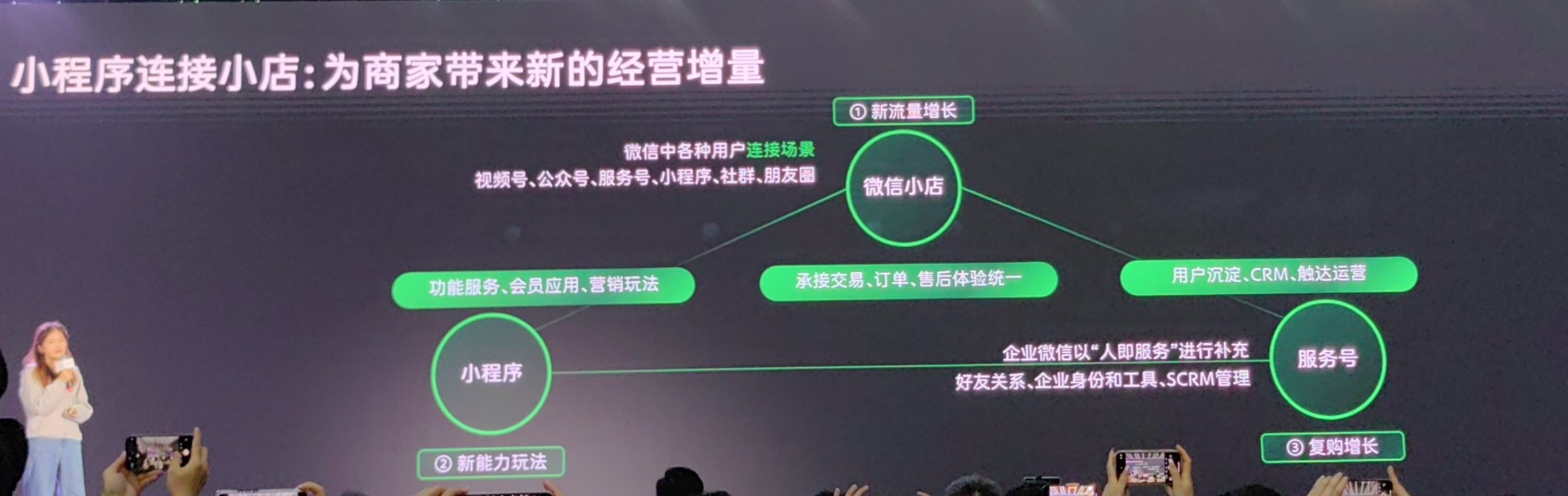

In terms of commercialization, a very clear message conveyed in this open class is that the WeChat Mini Store should cooperate well with other atomic components of WeChat (Mini Programs, Service Accounts, Communities, Search, etc.) to build an e-commerce ecosystem within WeChat rather than relying only on the Video Account and live streaming channels.

WeChat Open Class PPT

The Trinity of Mini Programs, Mini Stores, and Service Accounts

The WeChat Open Class has spent a lot of effort introducing that Mini Programs should cooperate well with the WeChat Mini Store.

In the third quarter of 2024, the transaction volume of Mini Programs exceeded 2 trillion yuan, with a year-on-year growth of more than ten percentage points. Although the results are good, many Mini Program merchants are worried about how the future Mini Program store system will coexist with the WeChat Mini Store system based on the Video Account.

According to the planning of the WeChat team, in the WeChat e-commerce system, the WeChat Mini Store, Mini Programs, and Service Accounts will form a "trinity" system. The WeChat Mini Store undertakes the integration of transactions, orders, and after-sales experiences; Mini Programs are responsible for providing functional services, membership systems, and marketing gameplay; Service Accounts are responsible for user sedimentation and repeat purchases, etc.

In this system, Mini Programs are like brand official websites. Users learn about the brand and are reached by marketing activities here, then place orders in the WeChat Mini Store, and become fans in the Service Accounts. The lecturer of the open class said that this set of models will bring new traffic and high repeat purchases, ultimately achieving the "business increment" of merchants.

The combination of Mini Programs and the WeChat Mini Store solves the problem that Mini Program merchants lack channels to acquire new customers, and also solves the problem that the WeChat Mini Store lacks a brand homepage.

In order to make it easier for merchants to achieve interconnection, WeChat has also helped merchants reduce the development difficulty: Merchants do not need to develop a Mini Program mall additionally, and they can directly implement the mall on the Mini Program through the Mini Store component; moreover, the store is unified within WeChat and managed uniformly. When merchants need to adjust the price of a certain product, they only need to operate with one click to modify it within the entire WeChat server, improving the operational efficiency of merchants.

WeChat Open Class PPT

"Send Gifts" Will Also Benefit Offline Stores

On December 19, the WeChat team began the gray-scale internal test of the "Send Gifts" feature. At that time, 36Kr wrote that, "For merchants, the emergence of the gift-giving function is a significant benefit. For the WeChat platform, this may be a genius invention that can rival the 'WeChat Red Packet'."

The lecturer of the open class said, "The outside world has exaggerated the 'Send Gifts' feature beyond our perception. This feature will still continue to be iterated and developed, and it is not clear what changes will occur in the future." But its appearance has obviously made competitors feel uneasy - Taobao and Douyin quickly followed up with the gift-giving feature.

The lecturer said that the impact of "Send Gifts" on merchants is not only to increase sales, but also to help merchants reduce promotion costs based on the gift-giving behavior of social relationships. Moreover, because only products with qualified quality can be spread through the social relationship chain, it is a valuable virtuous cycle. "If all merchants are committed to this, the ecology of WeChat transactions will definitely undergo huge changes," the lecturer said.

In the open class, two exciting new gameplay of the "Send Gifts" feature that will be launched next were also demonstrated: "Merchant Gift Goodies" and "Offline Scan Code to Send Gifts".

Regarding "Merchant Gift Goodies", it means that merchants can make exclusive "page decorations" for gift-related products in the WeChat Mini Store, and can also customize stickers and custom package cards to make the entire gift-giving process more delicate and thoughtful - it sounds like the significance of the "Red Packet Cover" to the WeChat Red Packet product.

"Offline Scan Code to Send Gifts" benefits offline merchants, allowing offline customers to directly send gifts to WeChat friends online by scanning the QR code presented by the store. It can be said that it adds a new entrance and new scenario to the "Send Gifts" feature, and also brings a new sales channel to offline merchants.

Support Third-Party Alliance Delivery Agencies to Improve Promoter Delivery

It was particularly mentioned in the open class that merchants can sell their products through third-party alliance delivery agencies in the form of product cards and live broadcasts, showing the support of the WeChat official for the delivery agencies.

The WeChat team announced that in order to support the delivery alliance, the platform does not draw the delivery commission of the alliance delivery personnel; for the platform technical service fee generated by the alliance promoter delivery personnel channel, the platform draws 1% and returns 0.4% traffic vouchers.

In December 2024, the "Promoter Delivery" capability of WeChat was launched, which can be understood as the "WeChat Version of Taobao Customer". For WeChat, the platform's greatest resource is precisely the users' social relationship resources, and the greatest advantage of WeChat e-commerce is e-commerce based on social relationships. Therefore, "Promoter Delivery" is also a function that merchants have been looking forward to for a long time. In WeChat, promoters can display products in the form of native product cards without the need for "secret codes" or off-site jumps, which will indeed give consumers a better experience.

The WeChat team also announced the platform's improvement plan for this function in the open class: In January this year, the sharing of live broadcast rooms and short video attributions of influencers will be improved, store coupons will be opened, and gift-giving gameplay will be combined with the Spring Festival scenario; in February this year, the sharing of the live broadcast rooms and short videos of the store and other delivery capabilities will be shared, and marketing gameplay such as influencer coupons and agency coupons will be supported.

Lowering the Threshold for Merchants, WeChat Seems Ready to Face the Boom

When we talk about WeChat e-commerce, a word that is often used is "restraint", which is reflected in the platform's strict review standards, high deposit requirements, and the not-so-close connection between the official operation and merchants. It is widely believed that this is because the WeChat team is not ready to face the soaring difficulty brought about by the commercialization boom, so it is deliberately slowing down.

But today, WeChat seems to be ready. In the open class, the WeChat team announced that it will lower the threshold for merchants: 1. Open as many categories as possible; 2. Reduce the deposit amount; 3. 0-yuan deposit.

First, 391 third-level categories have been adjusted from "directional access" and "temporarily not open" to open categories, and 26 first-level categories including apparel and underwear, luggage and leather goods, agricultural materials and horticulture, etc. have simplified the settlement rules, significantly lowering the threshold for merchants to enter;

Secondly, the deposit amount for 25 categories such as jewelry and accessories, underwear, and women's clothing has been reduced, with the maximum reduction reaching 50%;

Finally, the current 0-yuan deposit has covered more categories, and it will continue to cover in the future.

An internal source from Tencent disclosed to 36Kr that the group has very strong confidence in the performance of WeChat e-commerce in 2025. In the past year, due to the impact of the macro economy, many e-commerce platforms have experienced a decline in sales, but the Video Account still has the advantage of a low base. Liu Chiping, President of Tencent, said in the Q2 2024 earnings call, "Compared with other short-video platforms, in terms of the growth of total merchandise transaction volume, we have not shown a slowdown. The main reason is that compared with our competitors, our e-commerce transaction volume is actually very small and there is still huge room for growth. "